Metallic raw materials in a political bind

The current difficulties in the Suez Canal bring the problems back to the forefront. If supply chains falter, entire industrial sectors are at risk. The Tesla plant in Brandenburg is currently at a standstill because important parts cannot be procured. The situation is not much different for future producers of strategic metals. 65% of today's world market supply of important high-tech metals comes from politically unstable regions. Western industries are, therefore, under pressure to secure positions in secure jurisdictions for medium-term supply. Many states now know that this goal can only be achieved through joint and concerted efforts, as the Western world's dependence on Beijing and Moscow remains a top concern for the mining industry and its consumers.

Mine expansion continues

With 3 mines in Spain and Portugal, the Group's flagship is now located in South Korea. The local tungsten deposit, Almonty Korea Tungsten ("AKT"), formerly known as Sangdong Mine, was a leading tungsten producer globally for over 40 years. After the planned recommissioning in 2024, AKT is expected to become the largest tungsten mine outside China. The expansion of the Panasqueira mine in Portugal is also planned for the first quarter of 2024. This should significantly increase the throughput of raw materials and almost double tungsten production in the medium term. This measure will extend the operating life of the tungsten mine by more than 20 years. Almonty could then achieve an annual tungsten oxide production of 124,000 tons.

Production could double in the medium term.

In this context, it is crucial that the expansion of the Sangdong mine in South Korea goes ahead without friction. A China-Taiwan conflict would be a significant economic burden for the entire region. Nevertheless, South Korea is over 3,000 km away from Taiwan. On completion in 2024, production could already account for 5% of global supply. It is currently estimated that the mine can be operated for over 90 years, and there are also untapped deposits of molybdenum. To date, the Canadian company has received USD 75.1 million in financing from KfW-IPEX-Bank, with further equity to be raised in 2024. It is quite conceivable that there will be initial strategic interests in the final mine development phase. Almonty will operate at significantly higher reference prices while avoiding dilution compared to the current situation. The offtake agreement with the Austrian Plansee Group also represents an important foundation. This contract is based on a minimum price of USD 235 per ton; at historical highs, the price had already exceeded USD 500. Plansee is one of the world's leading tungsten suppliers, with around 11,000 employees and production sites in approximately 50 countries.

New technological concepts focus on tungsten

South Korea is currently the largest per capita consumer of tungsten. Megatrends such as e-mobility, artificial intelligence and metaverse play a decisive role for the Asian country as a counterpart to China, which is regionally superior. Demand for tungsten could also be boosted by the e-car industry. Tungsten is becoming increasingly important in the production of electric vehicle batteries, as it can significantly increase energy density. Niobium-tungsten oxide batteries are already appearing on the industry's future agenda; they have significantly lower charging times and offer a higher power density. Asian manufacturers such as BYD are also promising greater endurance and safety by increasing the proportion of tungsten in the coveted traction batteries. What is often forgotten in times of peace is back on the table in times of war: armaments contain a large amount of the hardening metal tungsten. It reinforces the outer walls of hollow bodies or increases the melting point of alloys. Thanks to the backing of some governments and large industrial companies looking for a reliable source of the rare metal, Almonty Industries is well positioned in the strategic resources market.

Conclusion: Increasing political tensions boost medium-term value

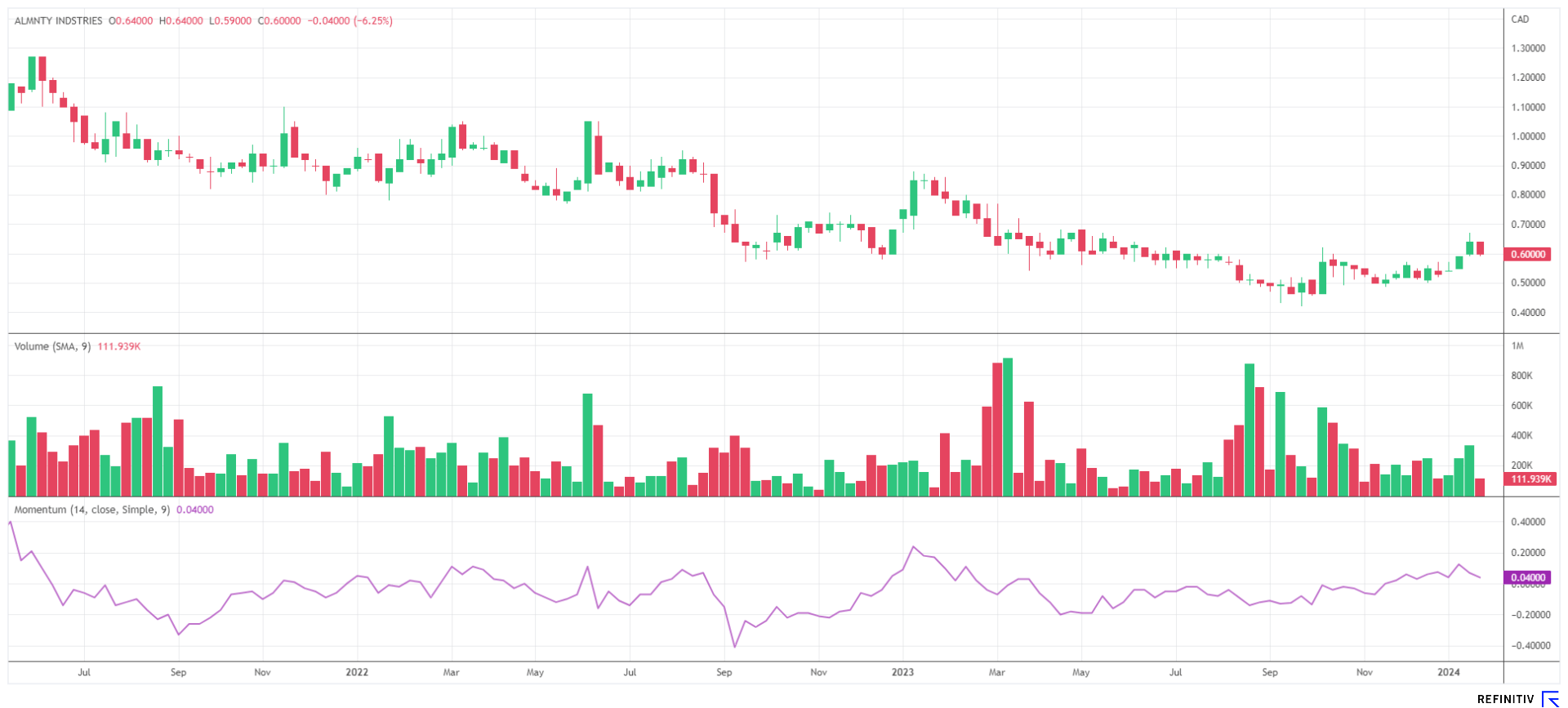

The 16-month chart of the Almonty share reflects the Company's recent past. The producer has long been in the international spotlight, as indicated by the enormous increase in sales. The dual listing in Australia also opened up extensive refinancing opportunities for the Company. It is in the nature of things that all approval procedures take a few extra months, which were not initially considered in the original plan. Such delays create buying opportunities as the underlying scenario does not change. In his public appearances, CEO Lewis Black repeatedly emphasizes that costly mining requires consistency and patience. However, those who reach their goal can expect above-average returns.

The time until the delivery of the first tungsten products is close, so the activity of long-term investors is likely to increase significantly. The knowledge of new sources of supply alone could force larger Western producers to make strategic decisions very quickly. The current market capitalization is just under CAD 160 million, but a fully operational mine will likely be a CAD 500 million asset on the balance sheet. There is, therefore, not much time left for positioning.

The analysts at First Berlin issued a "Buy" recommendation with a price target of CAD 1.70 at the end of 2022; an update is still pending. In May 2023, the experts at Sphene Capital also determined a fair value per share of CAD 1.66. Both analyses are still valid today. With the first news flow on the Sangdong opening, however, there will be a revaluation of the AII share because the cash flows will have to be reassessed.

The update is based on our initial report 12/2021.