When it comes to tungsten, Almonty looks like a changing of the guard for China

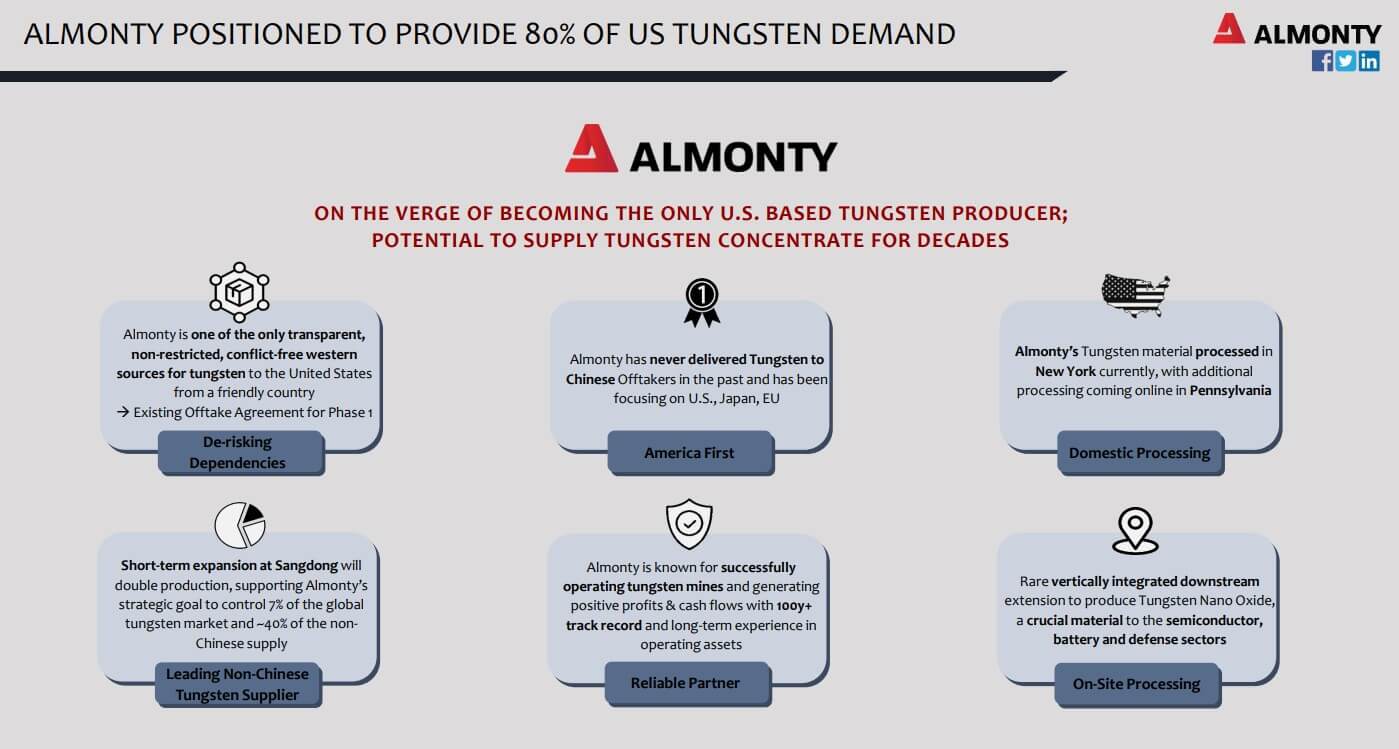

The Western world is facing a raw materials crisis with geopolitical implications. Around 70% of the most important critical metals are found in China. China has now drastically tightened its export controls on critical minerals, with strategically important metals such as gallium, germanium, antimony, and, most recently, tungsten being particularly affected. These raw materials are indispensable for the defense industry, semiconductor production, and high-tech manufacturing. China dominates the entire supply chain for many of these raw materials, from mining to processing and refining. For some metals, like gallium and graphite, China's share of the global market is over 80–90%. Countries such as the US, Germany, Japan, and South Korea are particularly affected, as they need these metals for semiconductors, batteries, chips, lasers, fibre optics, wind turbines, and electric vehicles. Relying on hope is a risky strategy - the final implementation of China's export policies may depend on upcoming talks between Trump and Xi Jinping in Beijing. There is still hope that the interests of the West will not be sidelined entirely and that there will not yet be any rationing. Almonty Industries (WKN: A1JSSD | ISIN: CA0203981034 | Ticker symbol: ALI) is already positioned to fill the emerging gap in 2025.

The US Congress applauds

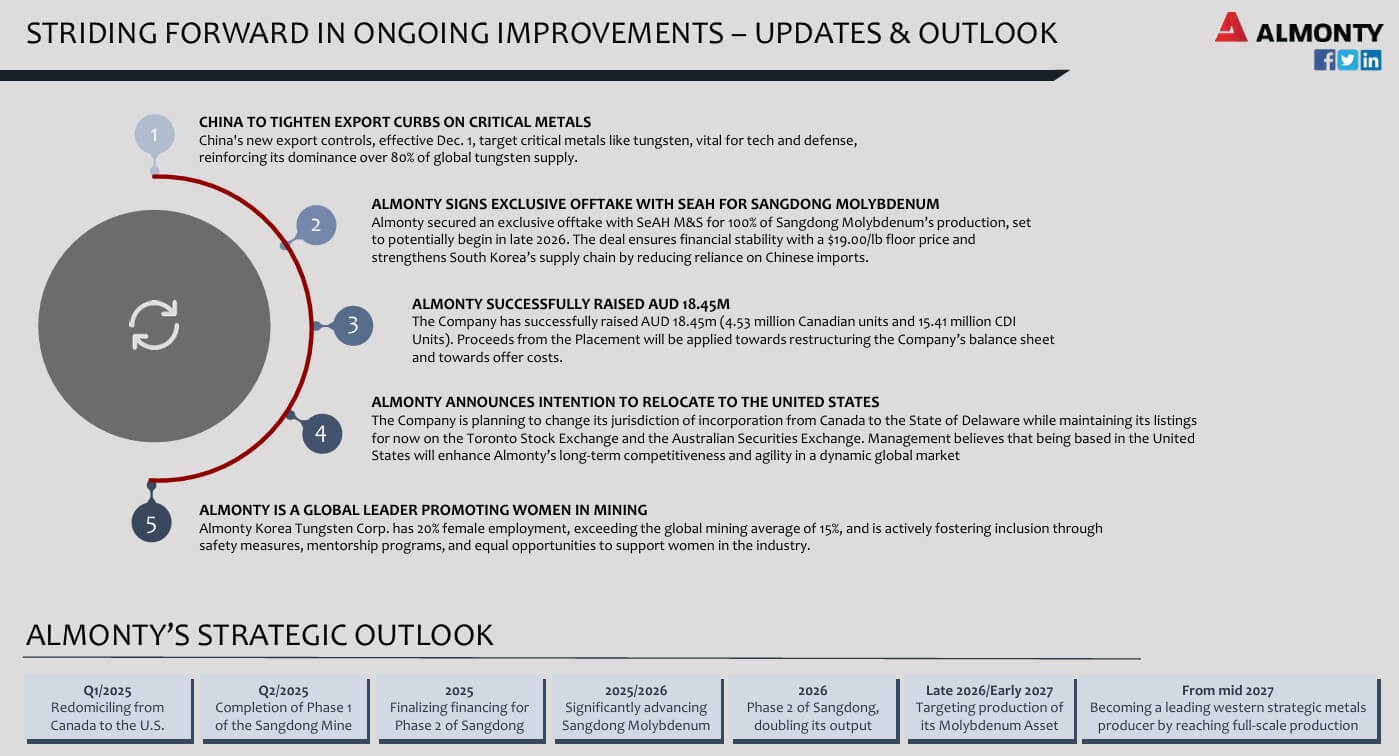

It was a good day for CEO Lewis Black. On June 9, Almonty Industries received an official letter from the chairman and ranking member of the US House of Representatives Select Committee on Strategic Competition between the United States and the Chinese Communist Party. The letter highlights Almonty's strategic importance to the United States, which seeks to secure its supply chains for critical minerals in the face of growing geopolitical tensions. The committee particularly recognized the importance of Almonty's Sangdong mine in South Korea, which is expected to become the largest tungsten producer outside of China. It is equally pleased about the planned relocation of the Company's headquarters to the US, which will make Almonty the only US company producing tungsten concentrates on a commercial scale. The Committee also expressed interest in further cooperation with Almonty, with a focus on potential collaboration to support the US defense industry, including supply chain integration with US defense companies and potential additions to national defense stockpiles.

CEO and President Lewis Black commented: "This recognition by leading members of the US Congress confirms that Almonty's Sangdong project is far more than a commercial venture – it is a strategic infrastructure asset that is critical to the security and resilience of the supply chains of the US and its allies. As we prepare to relocate our corporate headquarters to the United States, we aim to be more than just a supplier. We are positioning Almonty as a trusted partner for the reshoring and relocation of critical mineral capacity at a time when geopolitical constraints require greater transparency, reliability, and control by allies. We are fully aligned with US national security priorities and remain focused on delivering long-term value to our shareholders."

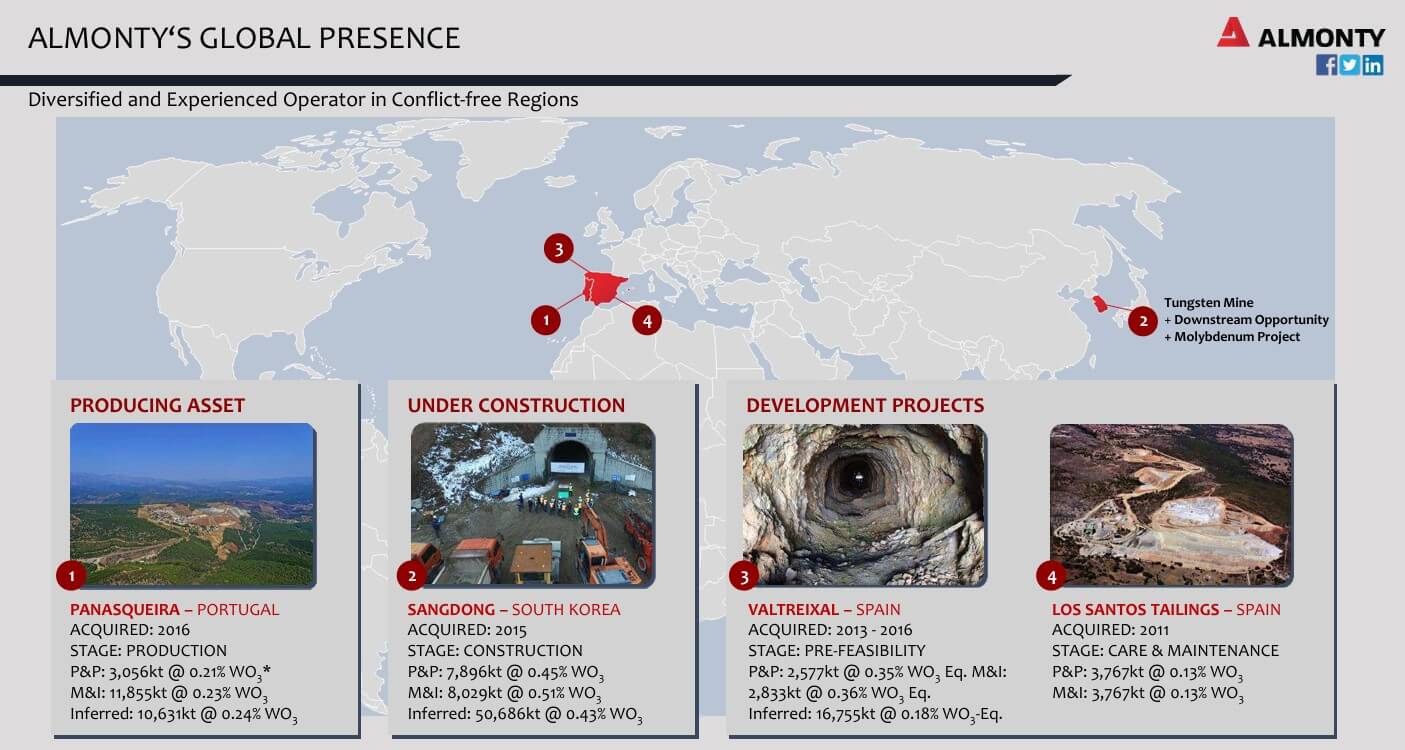

Ramp-up at Sangdong sets tungsten capital machine in motion

Almonty is nearing completion of its processing facilities at the Sangdong Mine, with initial production planned for 2025. With no commercial tungsten production in the United States since 2015, the upcoming market entry is expected to significantly strengthen the resilience of the US supply chain for a mineral that is critical to ammunition, aerospace, and other high-performance defense applications. With the Sangdong mine in South Korea soon to begin production, the Company is in a unique position: once operational, it will be one of the largest sources of tungsten outside China and will be able to cover up to 40% of non-Chinese global production. The mine has a life span of over 90 years, and the rock has an exceptionally high tungsten content.

“Almonty will start with an initial production of 2,300 tons and aim for an output of 4,600 tons after 12 months.”

This is good news, and not just for the US. It dispels any doubts about the effectiveness and mood within NATO, as sourcing European companies via a US-based raw materials company is feasible even with strict customs agreements. In addition, Almonty already has a purchase agreement with the Austrian Plansee Group and, with its strong shareholder Deutsche Rohstoff AG, has enough EU clout to secure supplies from South Korea. One example illustrates the pressure on trade: According to Martin Hotwagner of Steel & Metals Market Research in Austria, every vehicle contains an average of around 300 grams of tungsten – most of which is lost during recycling. The result: declining stocks, rising prices, and increasing pressure to act in the US, Europe, and Japan. As stocks dwindle, he expects Western companies to run out of tungsten over the summer. Governments are alarmed and are urgently seeking alternatives – and have now come across Almonty Industries.

New price target from GBC Research

On June 10, 2025, GBC published an update to its analysis. Analysts Matthias Greiffenberger and Cosmin Filker now estimate revenues for the coming year 2026 at CAD 153.8 million instead of CAD 123.5 million. By 2027, this figure is expected to grow to CAD 314.9 million, up from the previous CAD 252.9 million. This means the current market capitalization of just under CAD 930 million corresponds to only 3.3 times the revenues projected for 2027. Comparable raw material suppliers are valued significantly higher (see MP Materials in the following chapter). The analysts conclude with a new 12-month price target of CAD 5.50, representing a potential upside of 66%. The enterprise value/sales ratio (EV/Sales) of 3.45 in 2027 also appears remarkably low. Corresponding earnings forecasts bring the P/E ratio down to below 5. All of this is still within the tangible horizon of 48 months, making value generation over a short time frame particularly transparent. Click here for the original study from April and the latest update.

Sphene Capital analyst Peter Thilo Hasler already updated his calculations in April and sees considerable potential: He raised his price target for Almonty from CAD 3.21 to CAD 5.20. The Munich-based expert expects significant revenues of over CAD 192 million and EBIT of CAD 69.4 million as soon as operations start in 2026. The bottom line is that net income of CAD 46.8 million or CAD 0.19 per share should be achievable. Based on today's price of CAD 3.25, the share would currently be valued at a 2026 P/E ratio of 17. Given the high market momentum, this ratio could even exceed 30. The metrics speak for themselves.

Valuation multiples are growing in line with expectations

Tungsten, molybdenum, and rare earths are among the most critical materials. The example of MP Materials Corp in the US shows how the global shortage can affect company valuations. With the Mountain Pass project in California, the Company owns the largest rare earth property in the Western world. Revenue is estimated at around USD 265 million for last year, up from USD 73 million in 2019. Analysts on the LSEG platform believe that revenues could rise to around USD 796 million by 2028. MP Materials is valued at just under USD 4.6 billion, around seven times the current value of Almonty Industries. Of course, the companies' revenues will develop differently, as the availability of metals is determined by the global market. However, Almonty Industries' starting position shows a significantly lower valuation compared to its US competitor. Its listing on the NASDAQ offers a perfect set-up for upcoming peer group comparisons. Almonty can score big here!

Conclusion: A significant revaluation is imminent

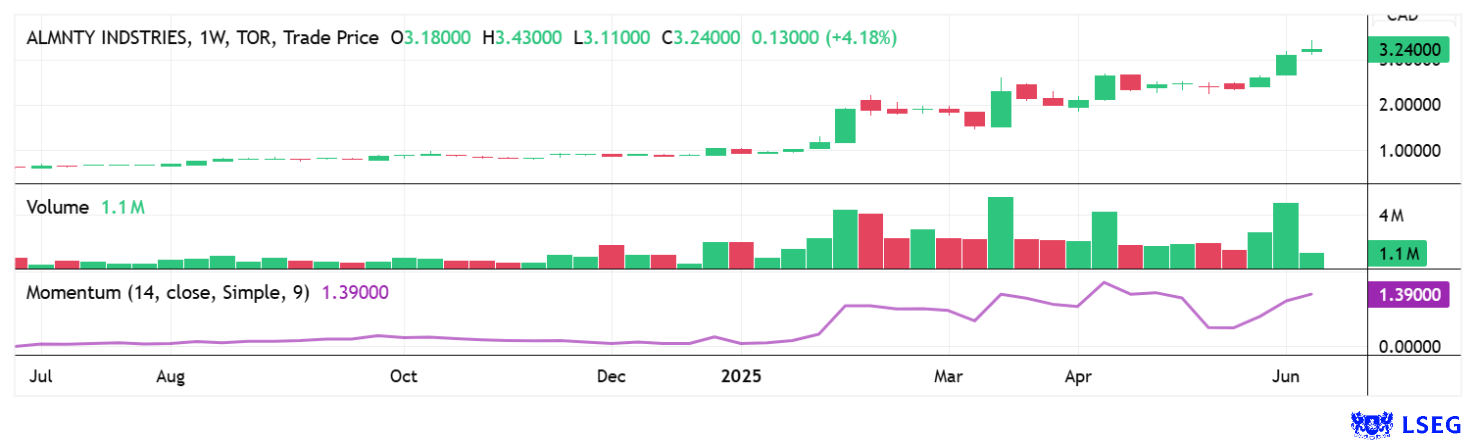

Western security of supply is colliding with the powerhouse that is China. Anyone still wasting time reminiscing about the good old days is barking up the wrong tree! International interests require geographical diversification and security. The EU knows all too well what happens to prices when 60% of energy supplies are cut off overnight due to sanctions. For Almonty, this means a new strategic positioning and a clear claim to a revaluation. This is already impressively reflected in the 12-month chart. The US listing appears to be a done deal, opening the door to a whole new universe of investors and a shift in perspective.

The price development offers a rare opportunity. What seems to have gone unnoticed for years must now happen in a relatively short period of time. China's restrictions on metal exports, the US initiative to secure critical metals, and the consistent delivery of the predicted steps make CEO Lewis Black a rock star on the trading floor. With large trading volumes of more than 3 million shares in Canada and Germany, the price is constantly rising. Yesterday's high of CAD 3.43 confirms our analysis of the last few months. There are currently no reasons to believe that there will be any significant consolidation. Therefore, those who have not invested will have to accept the increased valuation if they want to participate in the story. The commodity remains in short supply!

This update is based on our initial report report 12/2021.