Research and development in multiple sclerosis (MS)

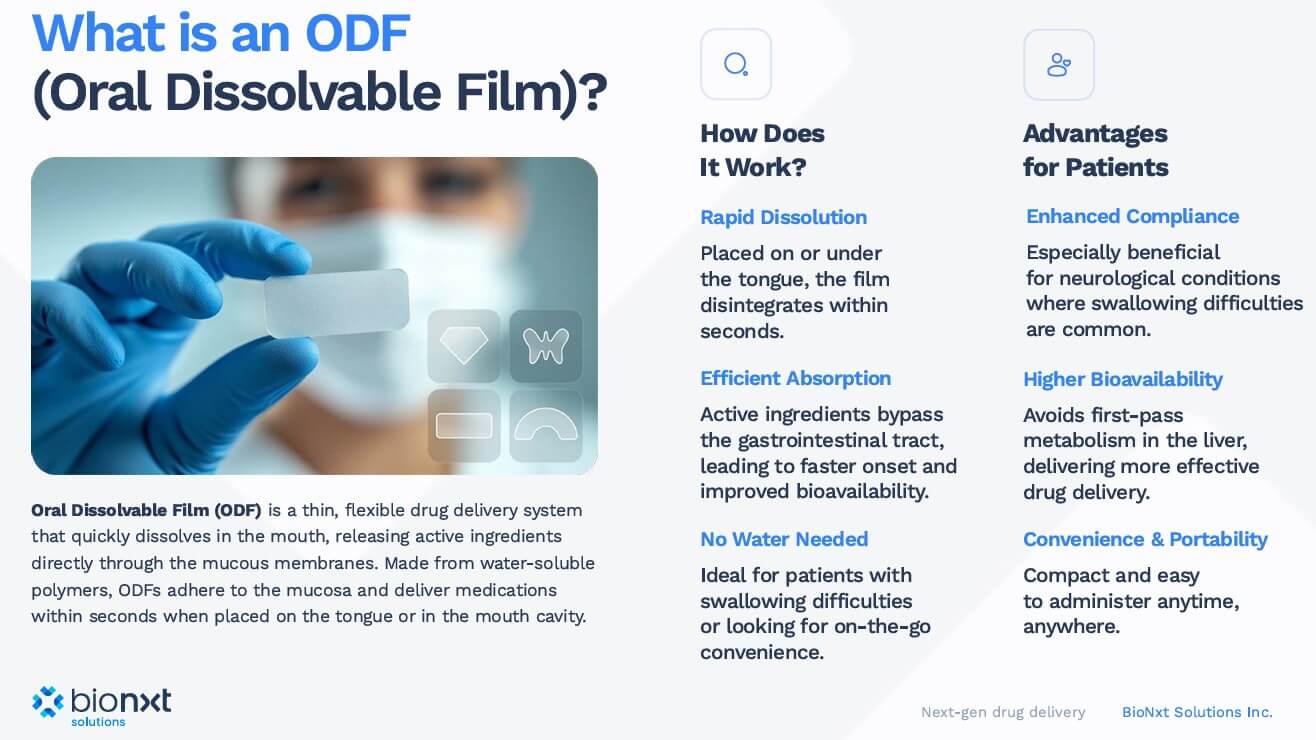

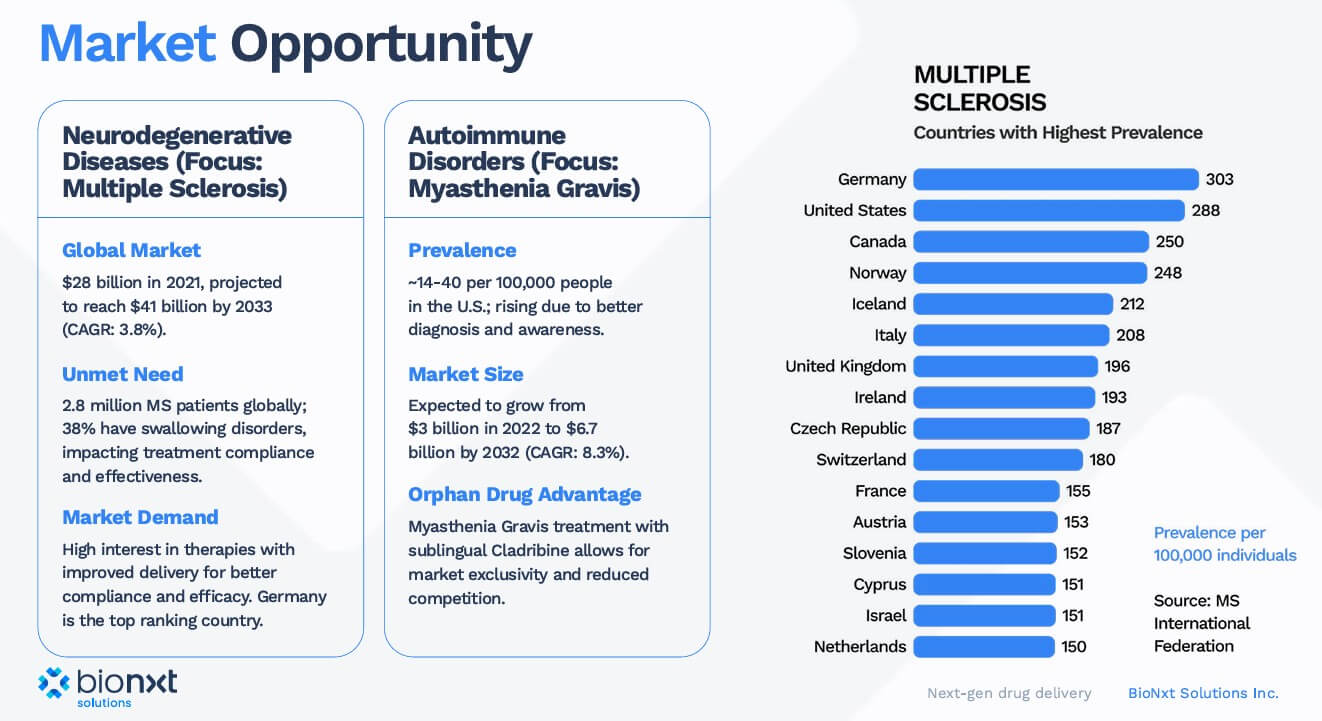

BioNxt Solutions (TSX-V: BNXT; WKN: A3D1K3; ISIN: CA0909741062) is an innovative life sciences company specializing in next-generation drug delivery technologies. The focus is on diagnostic screening systems and the development of pharmaceutical agents. The Company's proprietary platforms target key therapeutic areas, including autoimmune diseases, neurological disorders, and longevity. With research and development activities in North America and Europe, BioNxt is driving regulatory approvals and commercialization, with a focus on European markets. The leading development program in the portfolio is the Company's sublingual cladribine product for the treatment of multiple sclerosis (MS). Things could really take off in 2025 with a production partner. The developers at BioNxt expect that their in-house Cladribine product will offer a significant advantage over the tablet form for patients suffering from dysphagia (difficulty swallowing). This is a market worth billions!

A research hub in Germany

Further progress has been made in the choice of location. The Company is relocating its R&D activities to the innovative Gen-Plus Contract Research and Development Organization (CRDO) in Munich, Germany, where it commenced operations on March 1, 2025. The new laboratory environment offers BioNxt access to cutting-edge technologies and strategic scientific collaboration opportunities in Europe's biotech hub. Management expects the Company's ongoing projects to accelerate rapidly, particularly in the areas of drug delivery systems, therapeutics for neurodegenerative diseases, and next-generation biomedical technologies. Access to state-of-the-art equipment and analytical tools will enhance BioNxt's ability to develop innovative solutions and optimize its research results.

Protection through patent applications

BioNxt provided an update at the end of February on several key milestones for the next 90 days, including the filing of patents at the national level, the completion of a human bioequivalence study for its leading multiple sclerosis (MS) drug, and the development of its longevity and anti-aging product. It is also confirmed that all national patent applications under the Patent Cooperation Treaty (PCT) have been concluded in the most important jurisdictions. The Company's national applications are based on the positive international examination report issued by the European Patent Office (EPO) in Q3 2024 for the sublingual administration of cancer drugs to treat autoimmune neurodegenerative diseases such as MS.

The pipeline is promising

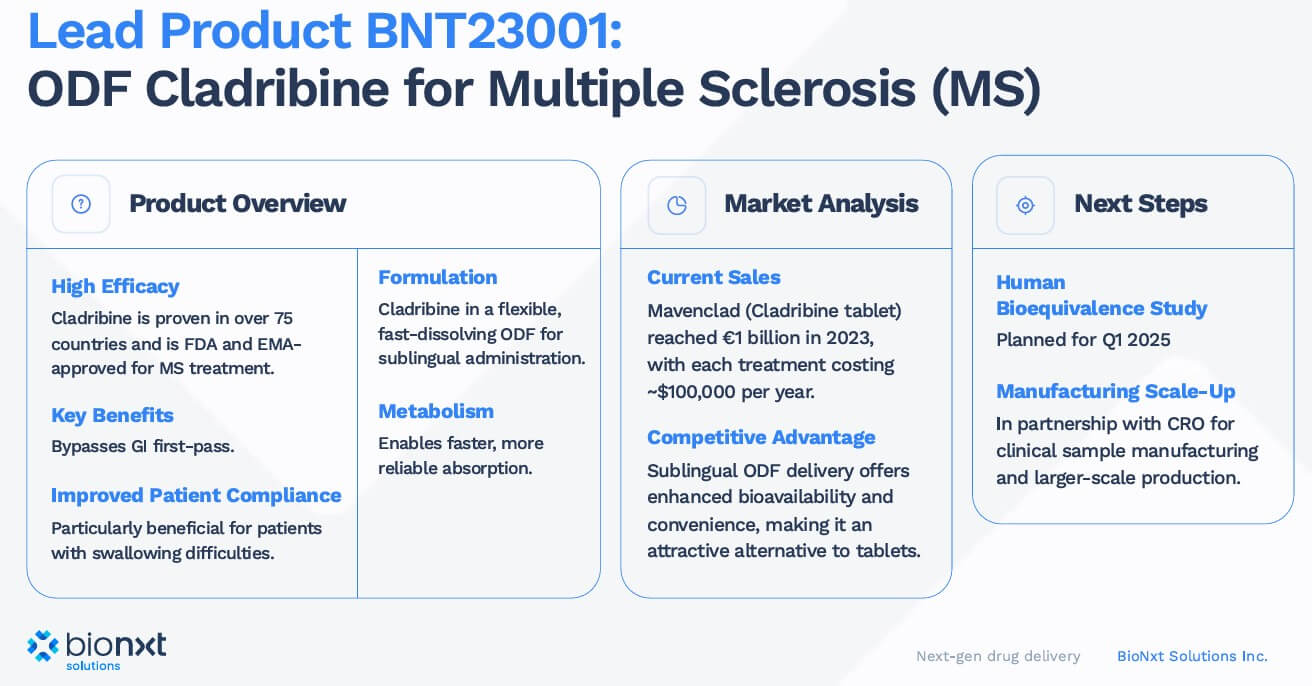

BioNxt Solutions is using its proprietary platform to focus on improving the applications of drugs for autoimmune and neurological disorders. In particular, patients with swallowing difficulties (dysphagia) are target clients of the Company, as the development significantly facilitates the previously problematic drug intake in these patients. The sublingual cladribine product, developed in-house, is used for this purpose. This active ingredient is absorbed through the oral mucosa and, in addition to avoiding the usual tablet form of administration, offers the advantage of improved absorption of the active ingredient, especially in multiple sclerosis (MS) patients. Approximately 2.3 million people worldwide suffer from MS, and companies like Merck KGaA generate annual revenues of EUR 1 billion or more with their tablets. However, MS patients often have difficulty swallowing, and BioNxt Solutions' innovation can solve this serious problem. Bioequivalence studies in humans are expected to confirm that the active ingredients can be absorbed much faster through the oral mucosa.

BioNxt's lead product, BNT23001, is a proprietary sublingual thin-film formulation of cladribine for the treatment of MS. Preclinical studies, as reported in internal research data and third-party evaluations, have shown high absorption rates and bioequivalence to existing oral therapies. The first clinical study is planned to start in Q2/Q3. The bioequivalence study is relatively short and is expected to be completed in less than 30 days. The successful completion of the bioequivalence study is an important milestone and a proof of concept for the lead product and the broader pipeline of sublingual products for treating autoimmune diseases.

In the coming quarter, BioNxt also plans to enter the rapidly growing anti-aging sector, which, according to Statista, is expected to reach a volume of USD 93 billion by 2027. To secure a substantial piece of the pie, the Company is developing suitable thin-film preparations and enteric-coated tablets with pharmaceutical ingredients that have been shown to slow ovarian aging, prolong fertility, and promote healthy aging in the early stages. The preparations are being developed in the German subsidiary Vektor Pharma TF GmbH, a manufacturer and developer of pharmaceuticals with over a decade of experience in non-invasive drug delivery systems.

Market size for anti-aging by 2027.

If the same principle that is currently being tested in MS patients can be transferred to other fields of application, things are likely to move quickly in the course of the year. BioNxt has strengthened its team in recent months, taking on two operational managers, Dr. Florian Sahr (Head of Project Management) and Dr. Wolfgang Wagner (Head of Research & Development). Dr. Oleksandr Zabudkin was also recruited from Ukraine. He will be responsible for business development in the future. The Company aims to improve healthcare through precise, patient-centered solutions that will increase the success of therapies worldwide.

Conclusion and outlook: Strong growth expected

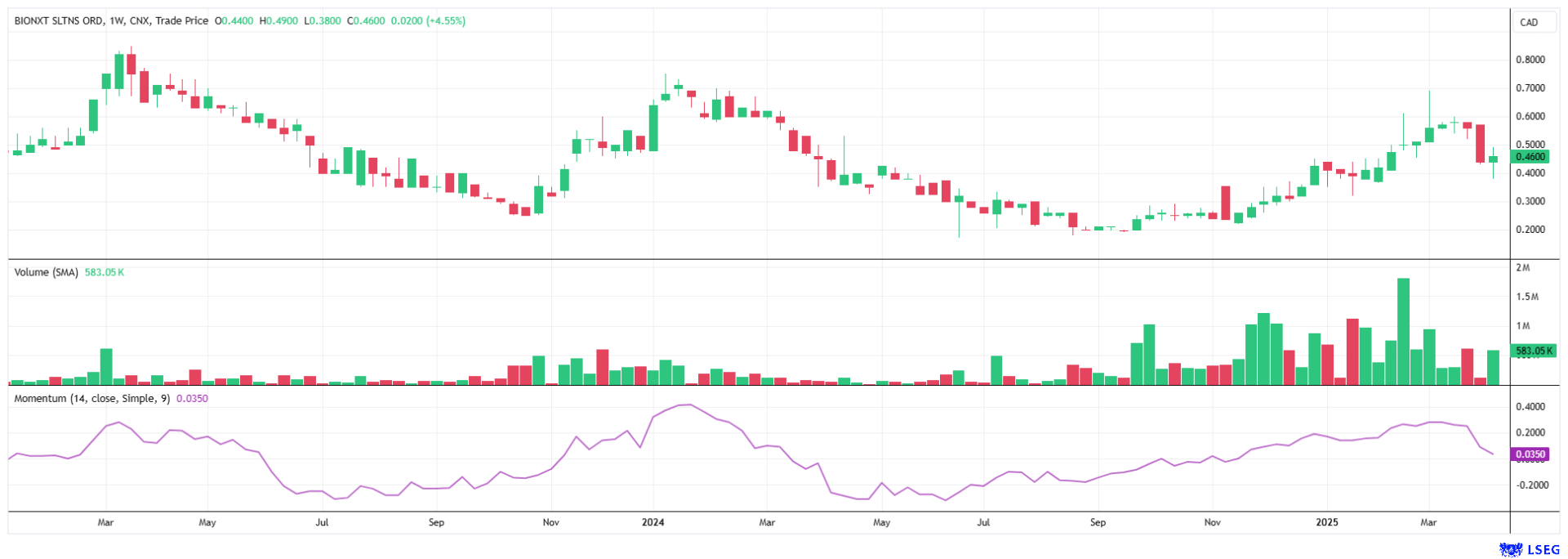

BioNxt is a biotech company operating in several growth areas. The current longevity and anti-aging programs represent another strategic and diversified investment in a large and rapidly growing global market. In recent weeks, convertible loans of CAD 2.5 million were placed to finance the projects. This is a good instrument for further growth because if the strike price is exceeded, the loans are converted into shares, and the Company no longer has any debts to pay.

Interest in BioNxt shares has been reawakened, and with rising trading volumes, it is possible that the EUR 1 mark could be crossed quickly - previous highs were well above EUR 2. Risk-conscious investors are betting on further progress and an imminent market launch. Given the historical volatility, the current level presents an attractive entry point! With ongoing advancements in its core business and expansion into a new billion-dollar market, BioNxt is becoming increasingly attractive as a takeover candidate. It would not be surprising if a major player entered the arena.