Sonora – A historic place for gold and silver

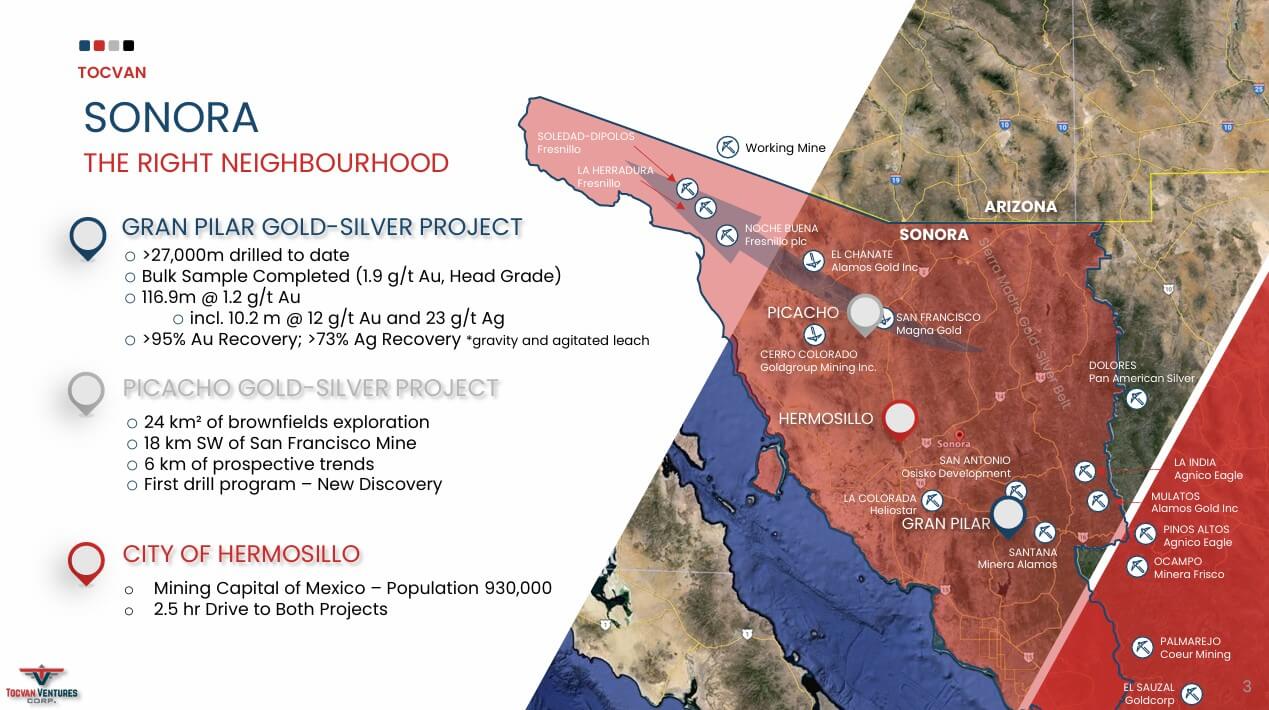

Sonora is the most well-known state in Mexico when it comes to the mining industry in the Central American country. The tradition of gold and silver mining dates back to the time of Spanish colonization. As early as the 18th century, particularly between 1783 and 1790, the Tarasca mine was known as a major producer of gold and silver. In modern times, Sonora continues to play a leading role in Mexico's precious metals production. In 2023, Sonora was Mexico's largest gold producer, contributing nearly a quarter of the country's gold output. Mexico itself remains the world's largest silver producer. In 2023, the country produced 6,400 tons of silver, accounting for about 25% of global silver production. Several well-known mining companies are active in the region, including Fresnillo, Pan American, Heliostar, and Minera Alamos.

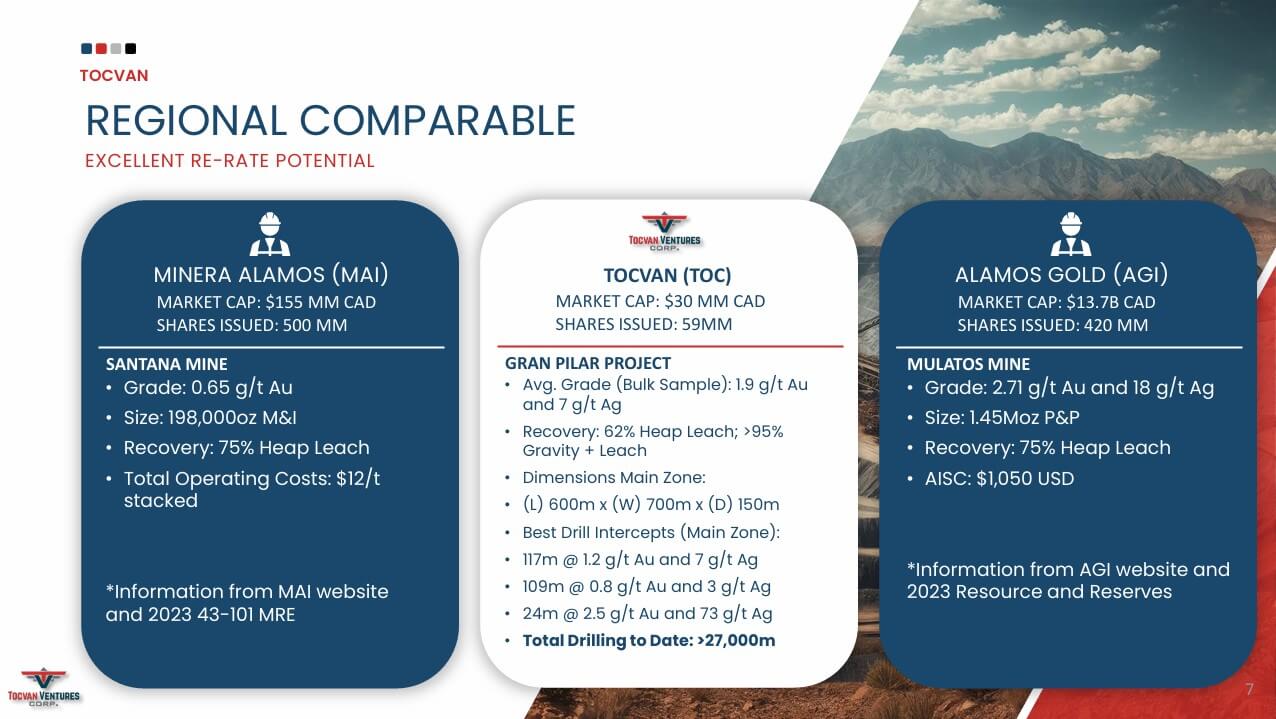

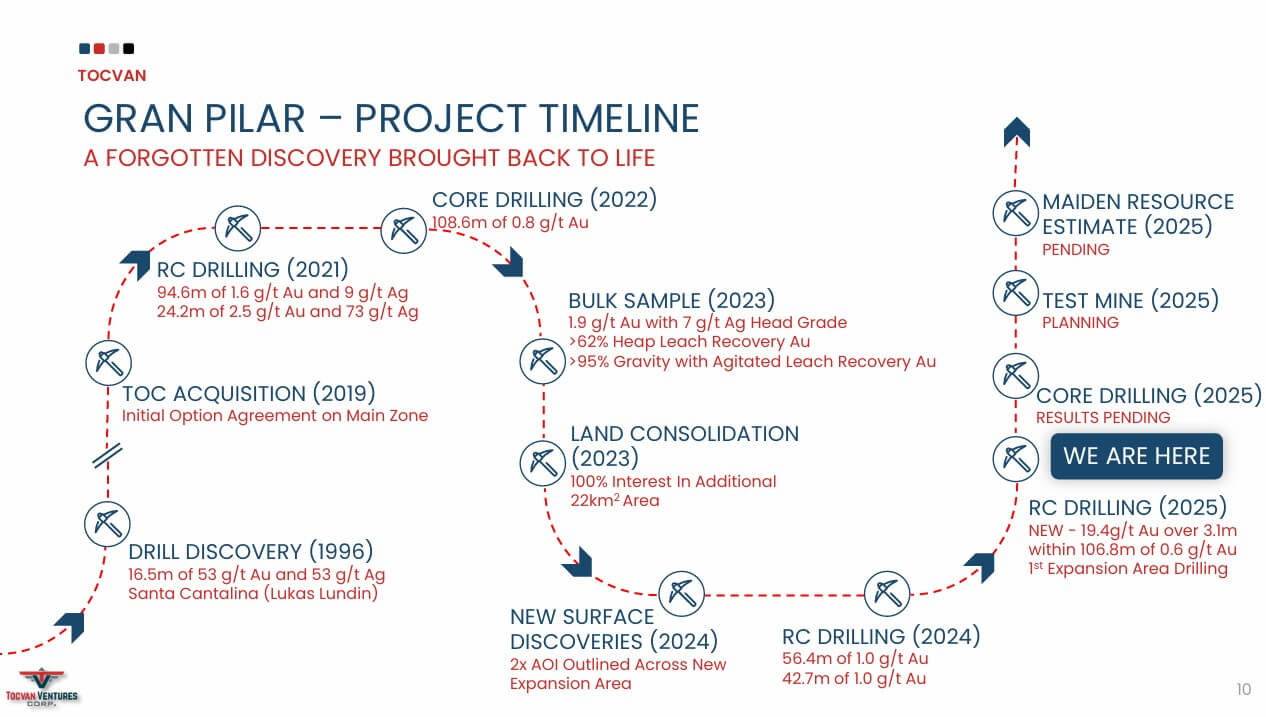

These parameters provide a small hedge against inflationary spikes and highly volatile metal prices. According to the latest NI 43-101 reports, the local producers at the San Antonio, La Colorada, and San Francisco properties operate at grades of 0.4 to slightly over 1.0 g/t Au, with recovery rates varying between 50 and 90%. Tocvan Ventures has now completed 27,000 meters of drilling at its Gran Pilar project. The highlights include 116.9 meters @ 1.2 g/t Au, including 10.2 meters @ 12 g/t Au and 23 g/t Ag, placing them at the top of the range, with excellent recoveries of more than 95% for gold and 73% for silver.

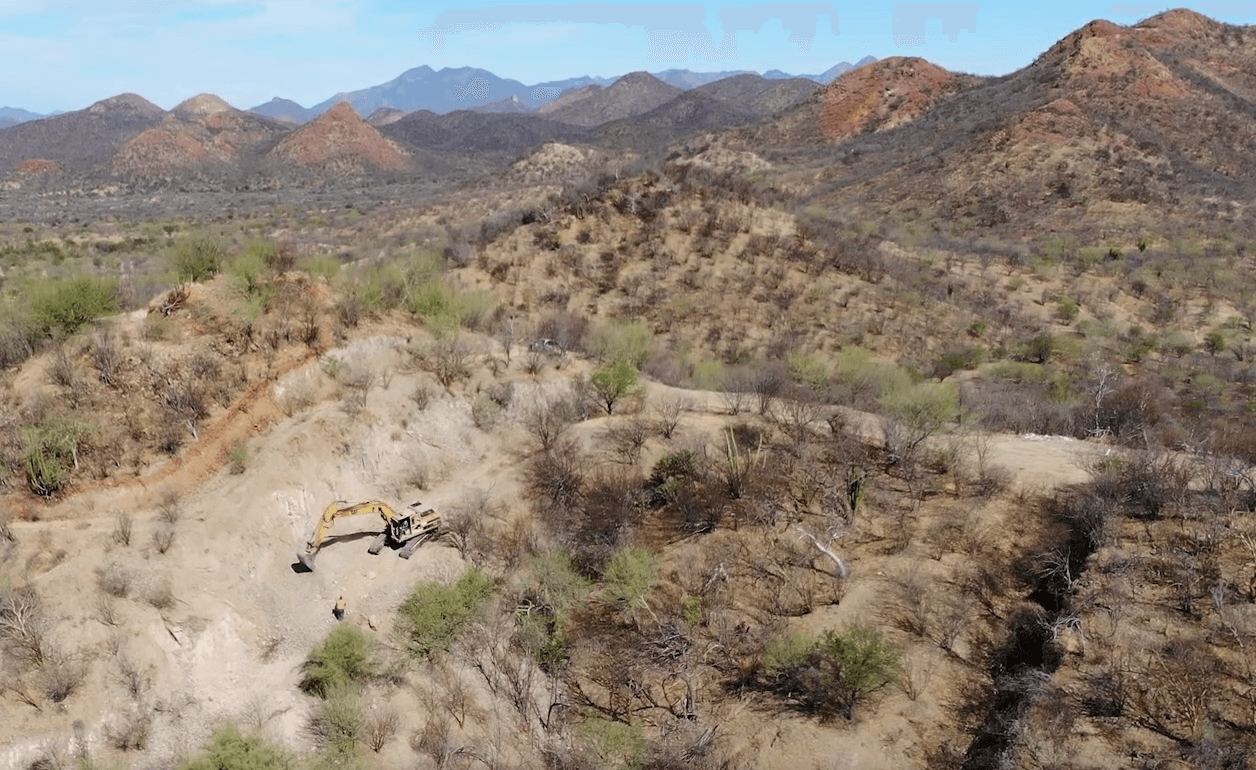

The work is facilitated by an excellent infrastructure that allows full access. Pilar is located 130 km southeast of Hermosillo, the capital of Sonora. The project site near the town of Suaqui Grande can be reached in just 150 minutes on a mostly paved road. The El Picacho concession is located approximately 145 km north of Hermosillo and can be reached within 2 hours. The long mining history in Sonora has led to a settlement of industry experts, enabling the rapid development of mines. A mineral resource estimate is now expected in the fall. A subsequent mine permit is expected before the end of 2025.

Recent results are convincing across the board

Tocvan Ventures has released the most recent core drilling results at the Gran Pilar gold-silver project. Ten core holes totaling 1,167.5 meters were completed earlier this year within the Main zone, 51% of which is owned by Colibri Resource Corp. Today's results include 21.6 g/t gold, 209 g/t silver, and 6.7% lead across 3.0 meters, and 2.8 g/t Au, 38 g/t AG, and 2.3% zinc across 3.8 meters within a broader anomalous zone averaging 1.2 g/t gold from surface to a vertical depth of 64.9 meters (JES-25-108).

Large nuggets are also found here.

The drill hole highlights that it is located 300 m east of the Main zone trend, in alignment with the North Hill trend, marking the first discovery of high-grade gold mineralization along the southern end of this corridor. The high-grade mineralization appears to be in a highly fractured, near-surface fault zone with associated quartz veining. Given its proximity to the surface, this area will be targeted in future trenching to further evaluate the extent of the high-grade mineralization for potential feed to a pilot mine. In addition, drill hole JES-25-107, 100 m east of the Main zone, returned the best values to date from the eastern flank of the Main zone. Core logging indicates that the hole has intersected a major fault zone that separates the mineralization encountered in previous drilling (JES-22-53 and JES-24-79). The results for the remaining three drill holes testing the outer extent of mineralization are still pending. They should be available in the coming weeks.

"Core drilling has just returned the highest-grade intercept outside of the Main zone, located 300 m away on an emerging trend," commented CEO Brodie Sutherland. "The best part is that it is only a few metres below surface, allowing us to easily penetrate the area with the trenching planned in the next phase of exploration. This provides us with another area where we can find mineralization for potential pilot mine material. Trends like the North Hill are still largely untested and suggest that other areas throughout the expansion area show considerable potential for high-grade gold and silver. We look forward to continuing drilling throughout the expansion area to begin exploring additional resource potential."

Conclusion: One of the best silver values on the stock market

The low number of Tocvan shares outstanding, totaling 58.9 million, remains a strong point. The Company's coffers are well-stocked following the latest capital measure. In addition, CEO Sutherland expects up to 23.2 million warrants, 80% of which are in the money, to be exercised in the near future due to the good share price performance. In addition, there are still 4.7 million options in circulation, which are also exercisable. The project's solid progress is expected to be reflected in the share price in the coming months. Currently, the number of publications is very high, with investors eagerly awaiting the completion of the preparatory work for the resource estimate.

With an 86% price increase in the last 12 months, the stock is already showing initial reactions to the strong project progress. Tocvan's stock is in the top third of the best performers compared to other Mexican silver stocks. Key catalysts include the latest drilling results and the mineral resource estimate expected for the second half of the year. At the same time, the Company expects to receive a mining license. The current market capitalization of CAD 44.8 million has now reached a level that should catch the attention of local major players.

Precious metals have already got off to a good start in 2025 and are currently at the top of the performance list. Gold, for example, has now clearly broken out with a high of USD 3,134, and silver is also firmly back in focus at its 5-year high of around USD 36. Tocvan is making good progress at the Gran Pilar concession area. After the current consolidation, this should quickly bring the share price back up to its old levels of over CAD 1.50. The stock is highly liquid and trades over 700,000 shares on good days. It is listed in Canada and Germany and is well known within the sector.

Tocvan Ventures CEO Brodie Sutherland explains in his latest interview with Lyndsay Malchuk the recent results and the project developments for the coming months.

The update follows the initial report 09/2022