Figures confirmed

That TeamViewer would close 2022 on a solid note was already known from the preliminary figures published in January. Billings, revenues billed to customers, increased by 16% year-on-year to EUR 634.8 million in fiscal year 2022. Revenue increased 13% to EUR 565.9 million with an EBITDA margin of 42%. Paying customers increased marginally year-on-year from 617,000 to 626,000. Adjusted EBITDA on revenue climbed 9% to EUR 229.8 million, with net profit up 35% to EUR 67.6 million. Earnings per share are not very comparable. Compared to the previous year, this increased from EUR 0.25 to EUR 0.37, which is due to the lower average number of outstanding shares following the repurchase of treasury stock.

Surprisingly optimistic outlook

The team around CEO Oliver Steil continues to be optimistic for the coming year. TeamViewer, therefore, expects demand for its connectivity and workflow solutions to remain high. Thus, despite the ongoing macroeconomic uncertainties, the Goeppingen-based company expects double-digit revenue growth within a range of 10% to 14%, which equates to a range between EUR 620 million and EUR 645 million. The adjusted EBITDA margin is expected to be around the 40% mark. A special effect could be provided by the early exit from the high-dollar sponsorship contract, which offers "significant potential for an increase in margins".

Ronaldo gone, TeamViewer asks for release

The TeamViewer logo still adorns the Manchester United shirt. But that could soon be the end, which should represent a liberation blow for the Goeppingen-based company and have a correspondingly positive impact on profitability. Nevertheless, the question must be seriously asked once again why such a deal with a total volume of EUR 275 million over five years, which is more than any team has ever received for shirt sponsorship, even in England, was able to go through at all for reasons of commercial prudence.

If the contract is terminated, the MDAX-listed company would thus save itself EUR 49 million annually in marketing expenses until 2026, which will lead to a significant increase in margins. A mutually beneficial agreement was already reached at the end of last year, giving Manchester United the option to buy back the rights to the club's main shirt sponsorship. The club confirmed this in a statement and plans to "initiate a focused sales process for a new shirt front partner in a normalized market".

Until a deal is struck with a partner, TeamViewer will continue to feature on the chest of United players as agreed in the contract. Given that the club is playing its best season in years and is firmly in a Champions League position, it is likely that a larger partner will take over at the latest at the start of the new 2023/2024 season. TeamViewer does not want to say goodbye to the big soccer stage altogether. According to the Company's announcement, the role of a global partner is to be assumed thereafter. The costs for this are in the single-digit USD million range.

Reloading in share buybacks

As of December 31, 2022, cash and cash equivalents amounted to EUR 161.0 million. The sharp decline of EUR 389.50 million was attributed to the 2022 share buyback of EUR 300 million (13% of share capital) and debt repayments of EUR 286.1 million net. According to the Company's announcement, the remaining debt volume still amounts to EUR 632.6 million (including lease liabilities). Now a buyback program for a total volume of EUR 150 million or at the current share price level of 5.7% of the outstanding capital, has been announced again, as the steady cash flow generation would enable a rapid debt reduction and a new share buyback program.

Is the bride making herself pretty?

Another reason, which is based on pure speculation on our part, would be the bride making herself pretty for a possible takeover. Various market rumors have already circulated in the past about interest on the part of larger software providers. TeamViewer has been operating a successful strategic cooperation with SAP for some time. In addition to membership in the SAP partner program, the partnership includes the technical integration of TeamViewer Frontline, an Industry 4.0 solution based on augmented reality, into SAP's range of asset and service management solutions. The existing partnership with SAP was expanded in the past fiscal year with additional integrations in SAP solutions.

Interim conclusion

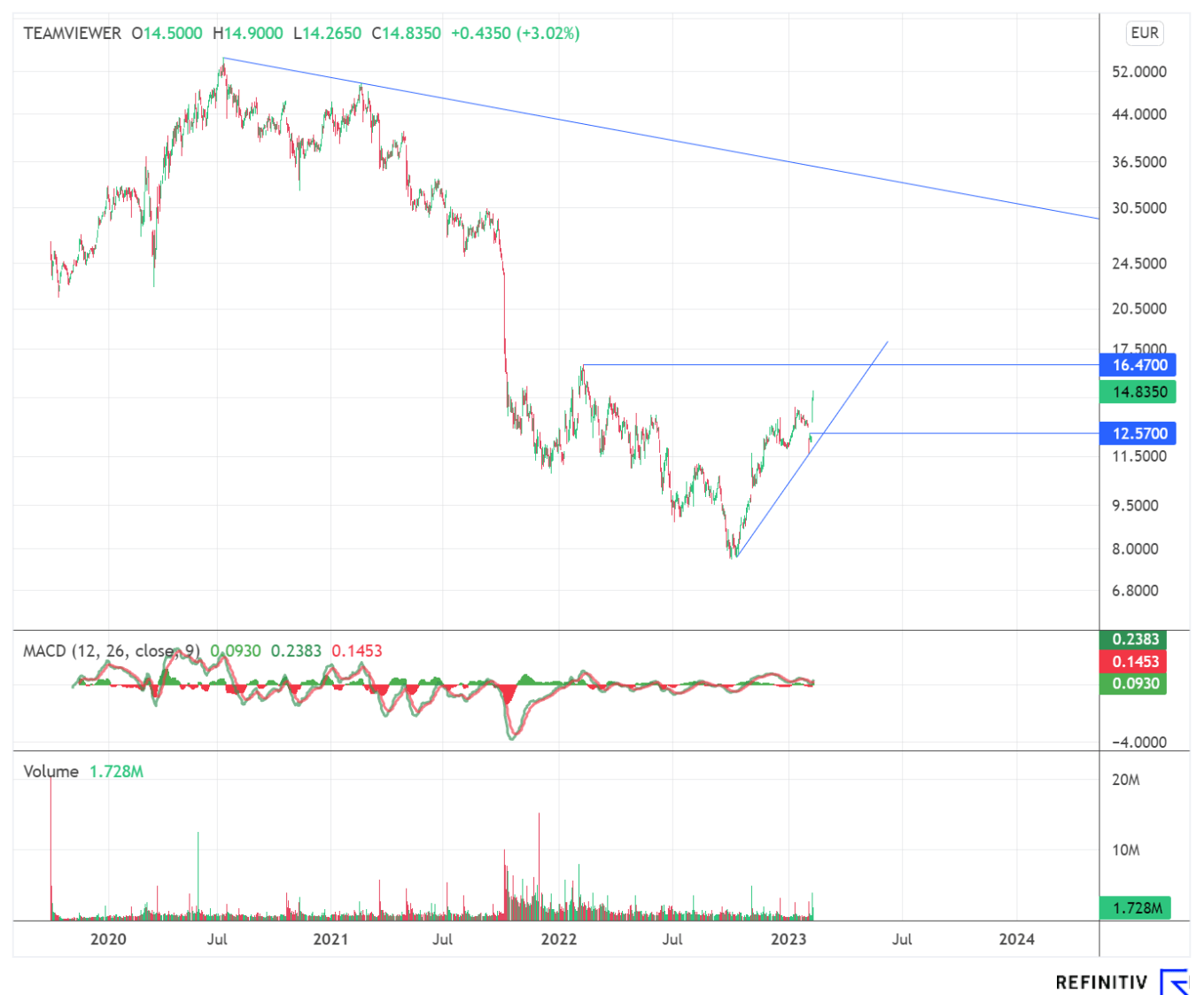

TeamViewer has found a bottom after a weak 2021 and regained confidence in parts through solid annual results. The outlook for 2023 promises further growth, and the fast-growing business with key accounts could contribute a higher share to total revenue. With the elimination of the costly sponsorship contract, margins would increase significantly. Various analyst firms expressed limited optimism. While the US bank JP Morgan raised the price target from EUR 11 to EUR 12, it reiterated its "underweight" investment rating. The British investment bank Barclays is somewhat more optimistic, with an "overweight" rating and a price target increase from EUR 14 to EUR 15.

The update is based on the initial report 11/2021