Impressive history

One thing must be acknowledged upfront without envy: TeamViewer AG, founded in 2005, is one of the few success stories from the technology sector "Made in Europe " in recent years. The IPO of the Goeppingen-based company, which took place on September 25, 2019, set a new record on the Frankfurt trading floor. Thus, with an issue volume of EUR 2.2 billion, the Group succeeded in becoming the largest German tech IPO since the Infineon IPO in 2000 1 .

defrayed the issue volume at the IPO in September 2019.

The Company, listed on Deutsche Börse's MDAX index, has focused since its founding on cloud-based technologies that enable users to collaborate online and provide remote support globally. These range from remote support of their customers and employees to location-independent control, monitoring and managing equipment or complex machines and instruments, to workflows supported by augmented reality (AR). In total, the highly scalable software has been downloaded worldwide on more than 2.5 billion devices. In addition to the free version for the bulk of private customers, the contract customer base has grown to more than 600,000 customers, regardless of industry or size.

Market environment and opportunities

Corona changes everything

Since the beginning of March 2020, the Goeppingen-based company's business has exploded due to the outbreak of the Corona pandemic. Promulgating lockdowns and moving to home offices and homeschooling, video conferencing, and remote maintenance systems stepped out of the niche and into the mainstream. In March of last year alone, subscribers added monthly tripled, and active devices in relevant markets increased 50% in short order. Overall, management twice increased its set forecasts. Under the balance sheet for the year, billings, which are billed revenues, were EUR 460.4 million, up 44% YOY. The EBITDA margin increased to 57%, corresponding to EBITDA of EUR 261.4 million. The number of subscribers grew by around 25% to 584,000, and clientele in the lucrative key account business exploded threefold to 1,900." 2

Investing in growth

To be able to handle the enormous growth, investments were made both in the workforce and in the global presence. In 2020 alone, the workforce was increased by 500 to 1,200 employees. In the meantime, the Group employs around 1,500 people. A new software development center was also built in Ioannina, Greece. In addition, the management around CEO Oliver Steil issued a clear growth target based on three points. TeamViewer is to become larger by opening up new customer segments, using the solutions in more application fields, and through geographic expansion.

The strategy lies in the greater separation of the Remote-as-a-Service platform into three sub-segments. On the one hand, TeamViewer will continue to offer those IT products that can be used in a standardized manner by SMEs and private individuals. Furthermore, the Managed Enterprise Connectivity area is to be adapted to the special requirements of large companies or critical infrastructure and can be easily integrated into existing corporate IT infrastructures. The third area, Operational Workflow Optimization, is based on forward-looking technologies such as Augmented Reality and the Internet of Things. The goal of establishing a global technology brand and becoming the market leader in enterprise augmented reality solutions should be achieved by expanding the business areas and thus broadening the target market. On the numbers side, the one billion euro mark in billings should fall in 2023 and the adjusted EBITDA margin should remain stable at around 50%.

| in EUR million | 2019 | 2020 | 2021e | 2022e |

|---|---|---|---|---|

| Sales | 390,91 | 455,61 | 501,71 | 580,43 |

| Gross profit | 339,96 | 391,51 | 418,69 | 484,32 |

| EBITDA | 178,36 | 187,36 | 217,54 | 254,83 |

| EBITDA-Margin | 45,71 | 41,12 | 43,36 | 43,90 |

| EBIT | 153,05 | 160,65 | 102,72 | 147,17 |

| EBIT-Margin | 39,22 | 35,26 | 20,48 | 25,36 |

| Adjusted earnings per share (EPS) in EUR | 0,52 | 0,51 | 0,76 | 0,71 |

M&A activities to expand business area

Technologies and strong partners

In addition to organic growth, the Group secured external know-how through several acquisitions. For the first time in the company's history, an acquisition was wrapped up last year with Bremen-based Ubimax, the market leader in augmented reality-based solutions for Industrie 4.0. The software was added to the portfolio a short time later under the TeamViewer Frontline label and works on data glasses to facilitate work in logistics, manufacturing and field service.

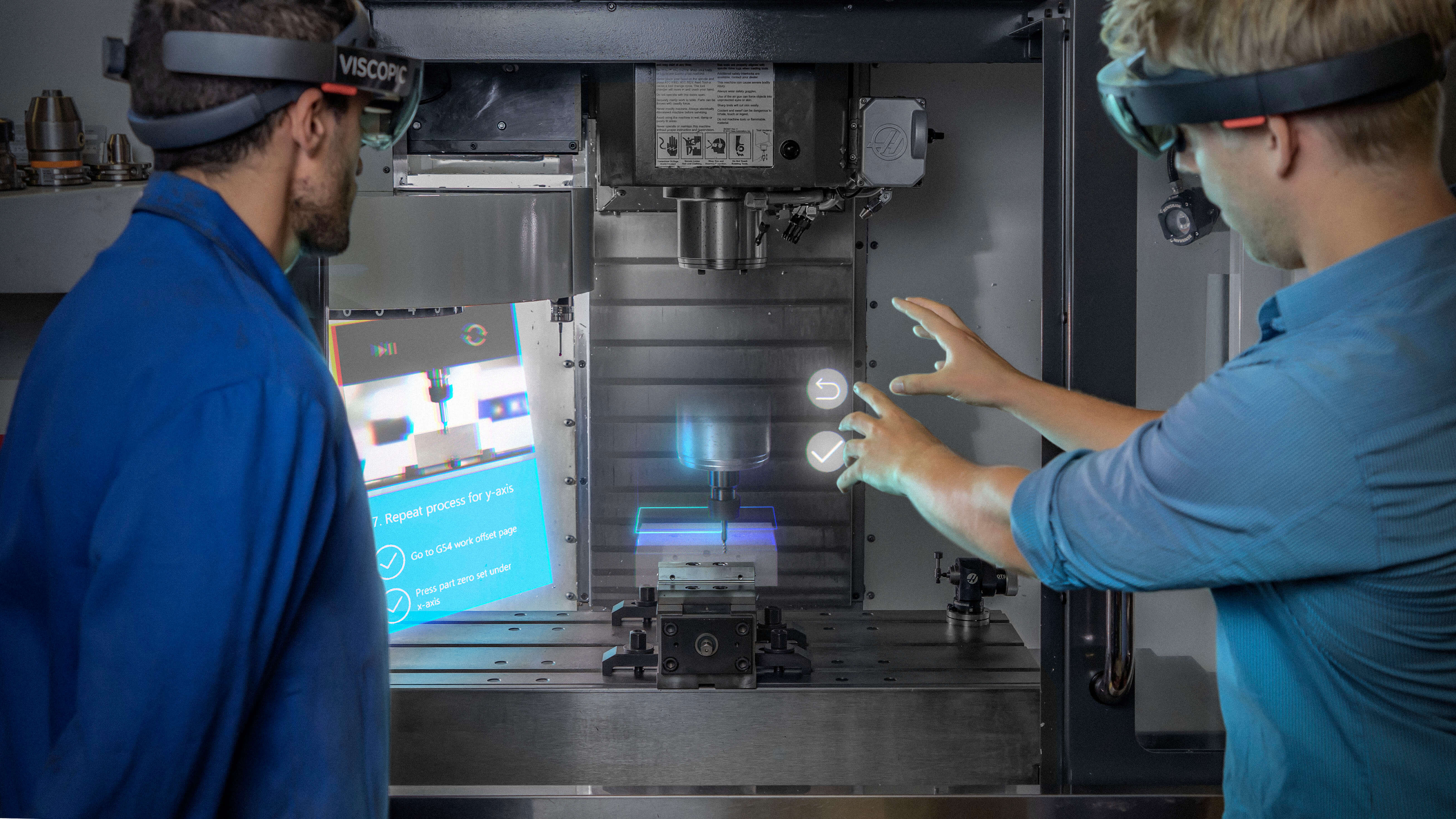

In the current year, the Company secured 100% stakes in three additional innovative technology companies. With the US company Upskill, a specialist for AR-based workflows, and Viscopic, a leading provider of 3D visualization and mixed reality innovations, the augmented reality portfolio was significantly upgraded. Also, under TeamViewer Engage is the third merger of the year. Xaleon is developing customer engagement software designed to improve digital customer interactions in sales and service conversations.

TeamViewer's relevance in the digital ecosystem is already demonstrated by numerous integrations and cooperations with tech giants such as Apple, Microsoft or Google. A new partnership has also been sealed with Google Cloud, with the aim of making TeamViewer's augmented reality (AR) portfolio available on the Google Cloud platform. As part of the cooperation, the two partners will develop and market AR solutions for the Google Cloud, which companies can use to digitize their business processes.

In the home market of Germany, a trendsetting cooperation was concluded with Siemens Healthineers to accelerate digitization in medical technology. The strategic partnership with the software giant SAP could become of enormous importance in the future. On the one hand, the cooperation includes the technical integration of TeamViewer Frontline, an Industry 4.0 solution based on augmented reality (AR), into SAP's offering for asset and service management solutions. Secondly, TeamViewer will be included in the SAP partner program. In addition, further marketing activities are planned. The goal of the two companies is to push the transformation of workplaces and processes in the industrial environment.

SWOT - A brief overview

Strengths

- High brand presence

- Established technology setup

- Expansion of targeted customer segments

- Industry-leading positioning in the augmented reality space

- Global strategic alliances (Microsoft, Google, SAP)

Weaknesses

- High cost structure

- High volatility in service sector

- Peer group with large presence and long history

Opportunities

- Expansion of enterprise business

- Strengthening expansion in the APAC region

- Further expansion of products for optimizing operational processes

- Increasing brand awareness through sports sponsorship

Risks

- Strong competition in the Remote Support product segment

- Declining billings growth

- Declining margins

- Renewed lowering of forecasts

Expenditures, investments - and earnings?

High noon at the announcement

The company plans to fuel its buildup into a global technology brand with two high-profile and costly sports partnerships. A bang for the buck and the first blemish on TeamViewer's share performance so far. Because the partner this time is not the women's handball team of Frischauf Göppingen, but one of the most famous soccer teams in the world, Manchester United. As the new partner and main jersey sponsor of the Red Devils, around EUR 46 million p.a. is to flow from Göppingen to the northwest of England over the next five years.

There is no question that the Red Devils are one of the best-known soccer clubs globally and, with a fan base of over 1.1 billion, one of the top five. That the arrival of superstar Christiano Ronaldo, whose jersey sold around 400,000 copies in the first 12 hours of sales alone, has brought extreme attention to the club is also undeniable. 3

However, at this point it may be asked why a company like TeamViewer takes the high risk of putting 10% of its turnover into such a deal. In addition to the commitment with the Premier League club, a five-year partnership with the Formula 1 and Formula E teams of Mercedes, Mercedes-AMG Petronas Formula 1 and Mercedes-EQ Formula E was also announced.

Christiano Ronaldo jerseys went over the counter with the TeamViewer logo in the first 12 hrs. after sales launch.

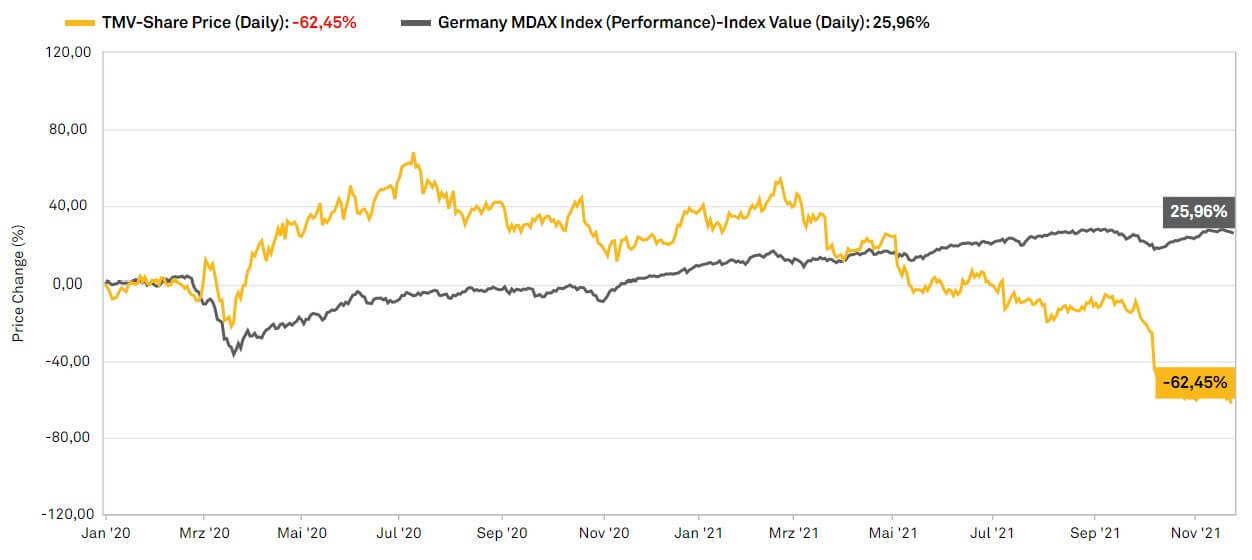

Packed into the adhoc announcement of the partnership with the Manchester club at the end was a forecast reduction for the adjusted EBITDA margin for fiscal 2021 to 49-51% of Billings. A slap in the face for shareholders, who acknowledged the release of the announcement by selling shares. The stock market story surrounding the tech flagship company from Baden-Württemberg had come to an abrupt end - at least for the time being - with a high of EUR 49.64 in mid-February and a market value of almost EUR 10 billion.

Negative run continues - profit warning

The Company's loss of confidence continues. Shareholders then received a further negative climax and confirmation of the distrust in the expensive partnerships on 06.10.2021 with the publication of the preliminary results for the third quarter. Due to lower than expected billings and a higher cost base, the adjusted EBITDA margin was approximately 34% for the third quarter and approximately 48% for the first nine months of 2021.

For the second time this year, the outlook for the full year 2021 had to be capped. According to the new outlook, sales revenues are expected to be between EUR 495 million and EUR 505 million. In contrast, they were previously expected to be at the lower end of the range of EUR 525 million to EUR 540 million. Against the backdrop of the revised outlook for billings growth, the outlook for the adjusted EBITDA margin has also been adjusted from previously 49%-51% to now 44%-46%.

lowered TeamViewer's guidance in 2021. The EBITDA margin was adjusted to 44% to 46%.

Player changes on the field

TeamViewer's situation is similar to that of its sponsoring partner Manchester United. Despite an expensive squad and top-class new arrivals, the English record champion continues to lag behind its aspirations. The coach also had to resign after a series of defeats.

The Goeppingers are also currently tinkering with the formation of a new squad. Despite loud criticism, CEO Oliver Steil may continue to sit on the coach's bench; his contract has been extended until October 2024. On the other hand, CFO Stefan Gaiser, who is leaving the company by mutual agreement when his contract expires in 2022, and Marketing Director Lisa Agona, who was only hired in April, no longer have a future at the MDAX-listed company.

In general, TeamViewer now wants to step on the cost brake. First, in addition to a replacement for the outgoing CFO, another board member with a clear focus on sales should be sought. After the departure of the head of marketing, however, a suitable candidate is now only being sought for the area of finance as well as for marketing. In addition, an experienced manager is to be recruited for the weakening Asian business.

Investor event fizzles out

To mend fences, TeamViewer held the first Capital Markets Day in the Company's history in mid-November to present a "post-Covid action plan." Given the new daily records in the number of infections, this was quite a daring topic. But even this measure could not prevent a further slide in the share price. Instead, most of the points were reminiscent of a basic manual for management consultants.

The most important points were: Over the coming quarters, a betterment program will be put in place that is intended to boost business growth on the one hand, but also stabilize the cost base on the other. For example, a short-term innovation plan for the core TeamViewer product is to be created to improve the user experience. In contrast, there will be a stop in research and development with regard to solutions away from the core products. 4

With the realignment of digital marketing, the Company aims to improve the customer journey. In addition, a stronger focus is to be placed on the enterprise segment. With customer volumes in excess of EUR 10,000, this segment is expected to contribute a significantly higher share of total revenue in the future.

Through its plan of measures and strategy, TeamViewer believes it will meet the current forecast. At the capital market event, the medium-term forecast of annual percentage billings growth in the high tens, percentage revenue growth according to IFRS in the mid-teens, and a recovery of the adjusted EBITDA margin was also announced.

The presentation of the strategy was just as unconvincing to various analysts as it was to investors. Instead, the share price sank to a new all-time low around EUR 12.68. In addition, one of the major shareholders, The Capital Group Companies, reduced its stake from 4.8% to 2.83%.

This is how it could continue

TeamViewer has lost investor confidence in recent months. The sponsorship deal with Manchester United, which is difficult for the Company to manage, squeezes margins and could pose a real problem in terms of profitability for the Goeppingen-based company if the Corona hype continues to die down. Despite a well-performing enterprise business, a further capping of the medium-term forecast is not unlikely.

The company could also be an attractive acquisition target.

On the other hand, TeamViewer, with a market capitalization of just EUR 2.45 billion, with a more than solid base technology and peppered with future technologies, could be an interesting acquisition candidate. Given that the Goeppingen-based company is already cooperating with the Walldorf-based software giant, a takeover by SAP including a stay in Germany would be an obvious option. Such technology is currently still missing from the portfolio of the major corporation.