Conclusion and looking ahead

Since André Kolbinger, the founder of Smartbroker Holding AG, which formerly operated under the name wallstreet-online, retook the helm in the middle of the year, the strategy concerning the launch of the project "Smartbroker 2.0" has been rethought, and the course has been set for a rosy future. The original goal of making Smartbroker independent of external partners and developing it further under its own management was shelved.

With a write-off of EUR 5 million on development costs already capitalised for the originally planned transaction platform, a line was drawn under the ambitious project from a balance sheet perspective as well. In order to complete the development work, management is planning further investments of around EUR 5 million. At the end of September 2022, this was offset by cash holdings of over EUR 28 million. As a result, the project is more than fully financed and no further capital increase is needed. In addition, the portal business continues to generate a high cash flow.

Established partner provides security

The recently announced partnership with Baader Bank, which will take over securities settlement in the future, came as a surprise, but a closer look at the long-term cooperation makes sense. On the one hand, the Unterschleissheim-based bank has many years of experience in brokerage, is currently already working with three competitors, including Scalable Capital, and has already proven its proof of concept as a reliable partner. On the other hand, "Smartbroker 2.0" is docked onto an existing system, which provides plannability as well as legal security. Here, the Berliners provide the front end and essential parts of the middleware, which includes security authentication, order preparation and settlement. This is likely to become important in the future when it comes to docking cooperation partners, such as trading platforms, onto the system.

In order to be perceived as a new broker, the long-awaited launch of a trading app and a trading interface programmed to the latest standards are essential. Also, the new partner offers more organization possibilities, which were not given in the past. Furthermore, customers are to be offered a significantly faster and completely digital securities account opening. The opening of securities accounts for corporate customers, joint and junior securities accounts, and the trading of more than 20 cryptocurrencies will be possible in the future. Thus, "Smartbroker 2.0" appeals to a much broader audience. The introduction of the trading app is also expected to generate significantly higher trading volumes.

Unique selling proposition remains unaffected

What will remain unchanged, according to the Company's management, is the unique selling proposition of the Smartbroker - namely the combination of extremely favourable conditions of a typical neobroker with the broad selection of trading venues and investable products usually only known from established banks and classic brokers. Accordingly, Smartbroker will continue to offer trading in shares, funds, ETFs and bonds from EUR 0. Derivatives are also free of charge in direct trading via the premium partners Morgan Stanley, HSBC, UBS and Vontobel. Customers can choose between all German stock exchanges and 25 foreign trading centres and have access to more than 650 ETFs eligible for savings plans, which can be saved at low cost and to a large extent even free of charge.

Launch in mid-2023

The launch of what Kolbinger calls "Germany's most attractive broker" is firmly in sight for mid-2023. Then the migration of approximately 200,000 existing customers is to take place. Conservatively estimated, the Company expects a bounce rate of 10-15%. There are few reasons why a customer should not migrate. They will receive a powerful app and a significantly larger range of services.

After the launch of "Smartbroker 2.0", new customer acquisition measures are also to be ramped up. By addressing a younger target group with the introduction of the app, acquisitions are to be increasingly distributed on social media platforms. This should reduce the costs of acquiring new customers, as experience shows that advertising prices in social media are cheaper than in classic media. A total of at least 75,000 new customers are planned for 2024, and the operating break-even point should already be reached by then. The planned dovetailing of the portal business with Smartbroker is then also to be tackled after the successful migration of existing customers.

Interim conclusion

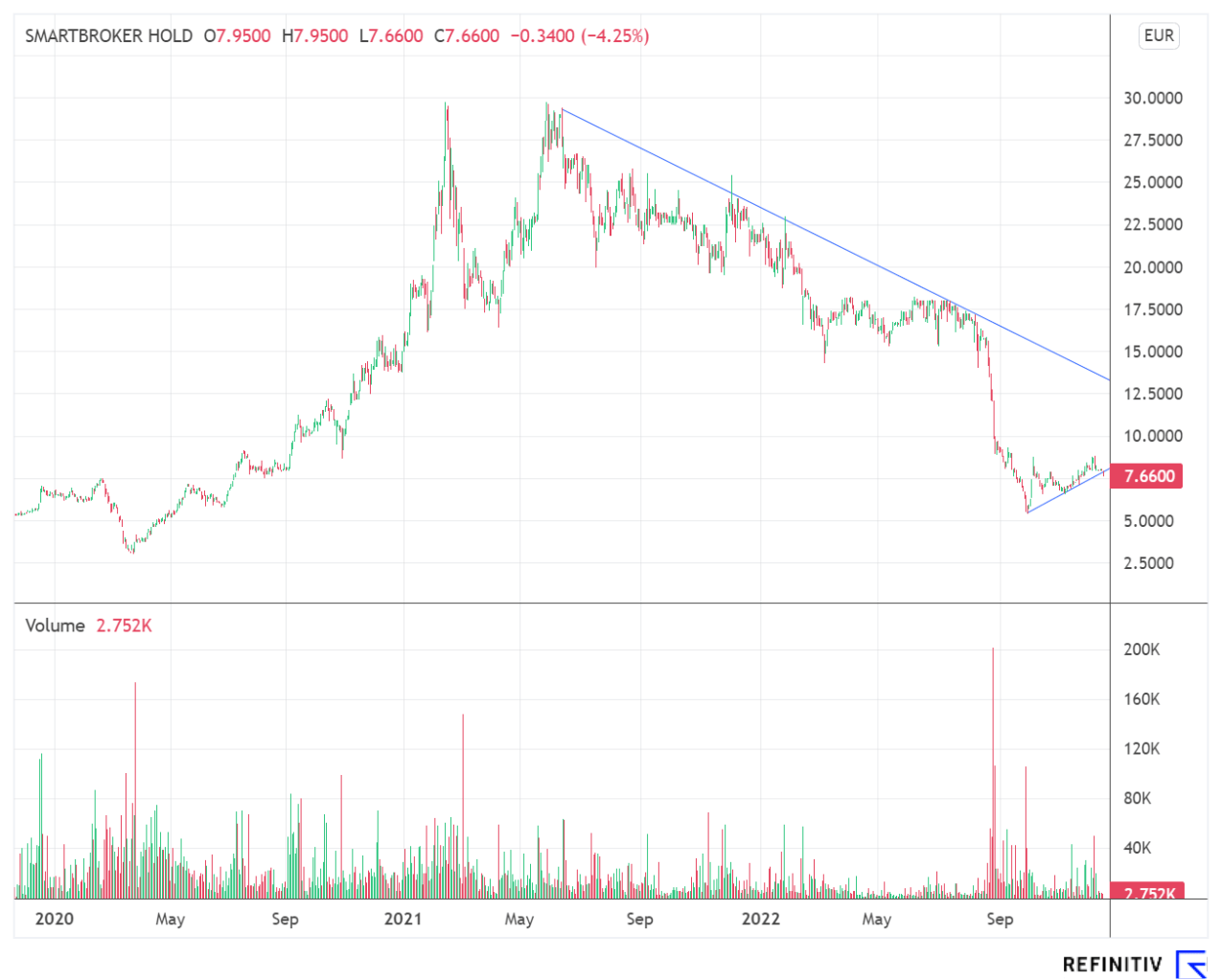

The course is set. The long-term cooperation with Baader Bank provides legal certainty and predictability. The vision of establishing a next generation broker with a unique product selection and, according to the CEO of Smartbroker Holding AG, André Kolbinger, creating "the most attractive broker in Germany", is alive. With around EUR 28 million in its coffers, the Company is optimally financed for further development. The market capitalization of the Berlin-based company is EUR 122.00 million after the price drop.

If the time specifications are met with the relaunch and a modern app, there will be a significant discrepancy in the Company valuation compared to the peer group. Both Scalable Capital, which also cooperates with Baader Bank, and Trade Republic are valued in excess of a billion. After all, Smartbroker is by far the largest neobroker in terms of customer assets under custody with around EUR 8 billion. Thus, a positive development could result in a unique entry opportunity in the long term.

This update is based on our initial report Report 11/2021.