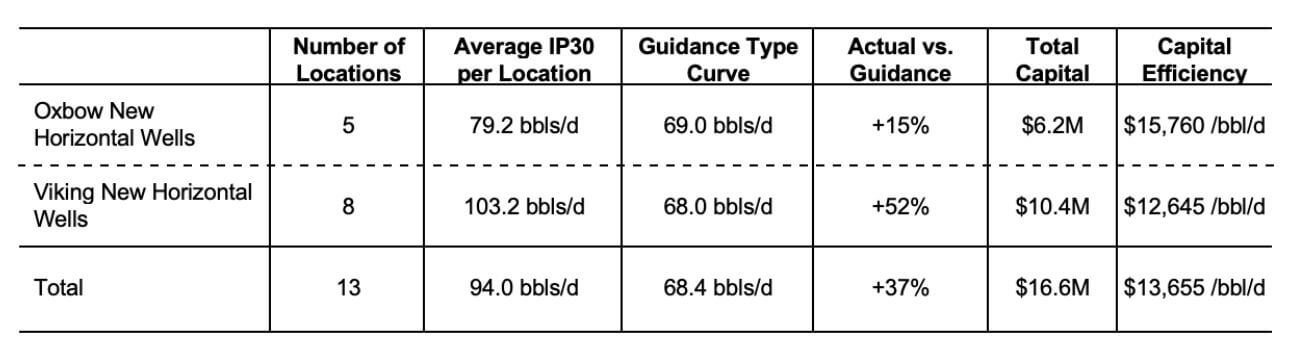

13 New drilling sites come online

The day before yesterday, Saturn Oil & Gas Inc. released the latest results from its recent drilling activities on the Oxbow and Viking properties. Saturn drilled 5 horizontal Oxbow wells in the first quarter of 2023 with an average 30-day production (IP30) of approximately 79.2 bbls/day per well, which is 15% above the Company's expected type curves for Oxbow wells. The average capital cost incurred for each well drilled was within the budgeted CAD 1.25 million per location.

13 production locations were brought online in the first quarter with a total production rate of over 1,200 barrels/day

The highlight of the Q1 drilling program was the 101/11-21-006-05W2 well, which targeted the Frobisher light oil in the Oxbow Asset and achieved an average IP30 rate of 149 bbl/day. The Weir Hill 11-21 well was a follow-up to a strong 2022 production well and is an encouraging result for further development of the Weir Hill light oil reservoir in the second half of 2023.

"The first quarter was a great start to Saturn's 2023 capital program with the successful drilling of 13 horizontal wells in Saskatchewan, which have all now been put into production," commented Justin Kaufmann, Chief Development Officer. "The successes of the 2022 drilling campaign have led Saturn to focus on repeatable development opportunities in its best-performing oil pools in Saskatchewan, which is now being reflected in the excellent initial production results for 2023."

Saturn continues to have great success with its Viking development program and has drilled and completed 8 horizontal Viking wells in 2023. Viking wells in the first quarter achieved an average IP30 rate of 103.2 bbls/day, which is approximately 52% above the Company's expected type curves for Viking wells. Average capital costs incurred per Viking well were within the budgeted CAD 1.3 million per location.

Details of the new Sustainability Report (ESG Update)

The current release of the first sustainability report is aligned with the guidelines of the Task Force on Climate-related Financial Disclosures ("TCFD"). One of the highlights of the ESG focus is the investment of CAD 14.2 million in the reclamation of former operating lands, including the decommissioning of 129 wells. The sustainability report details Saturn's commitment to minimizing its environmental footprint, including other projects the Company is undertaking in 2023 to reduce current CO2 emissions from existing manufacturing facilities by approximately 36% to 47%. Saturn places a strong emphasis on working with the surrounding communities. It supports several non-profit organizations and initiatives, including KidSport, Children's Cottage Society, Alberta, and the Carlyle & District Food Bank, Saskatchewan.

Production curtailments from Alberta wildfires

Management advises that the ongoing wildfires are impacting operations in Alberta. Approximately 10,000 Boe/day (60% oil and NGLs) of production has been temporarily curtailed as of May 4, 2023. The Company is not aware of any significant damage or loss to company-owned or third-party infrastructure. Production will resume as soon as the currently shut-down third-party infrastructure can be brought back online. In western Canada, however, wildfires are currently expanding - despite isolated rain showers and falling temperatures. Authorities are talking about more than 375,000 hectares of burned land. Nearly 30,000 people have been evacuated so far.

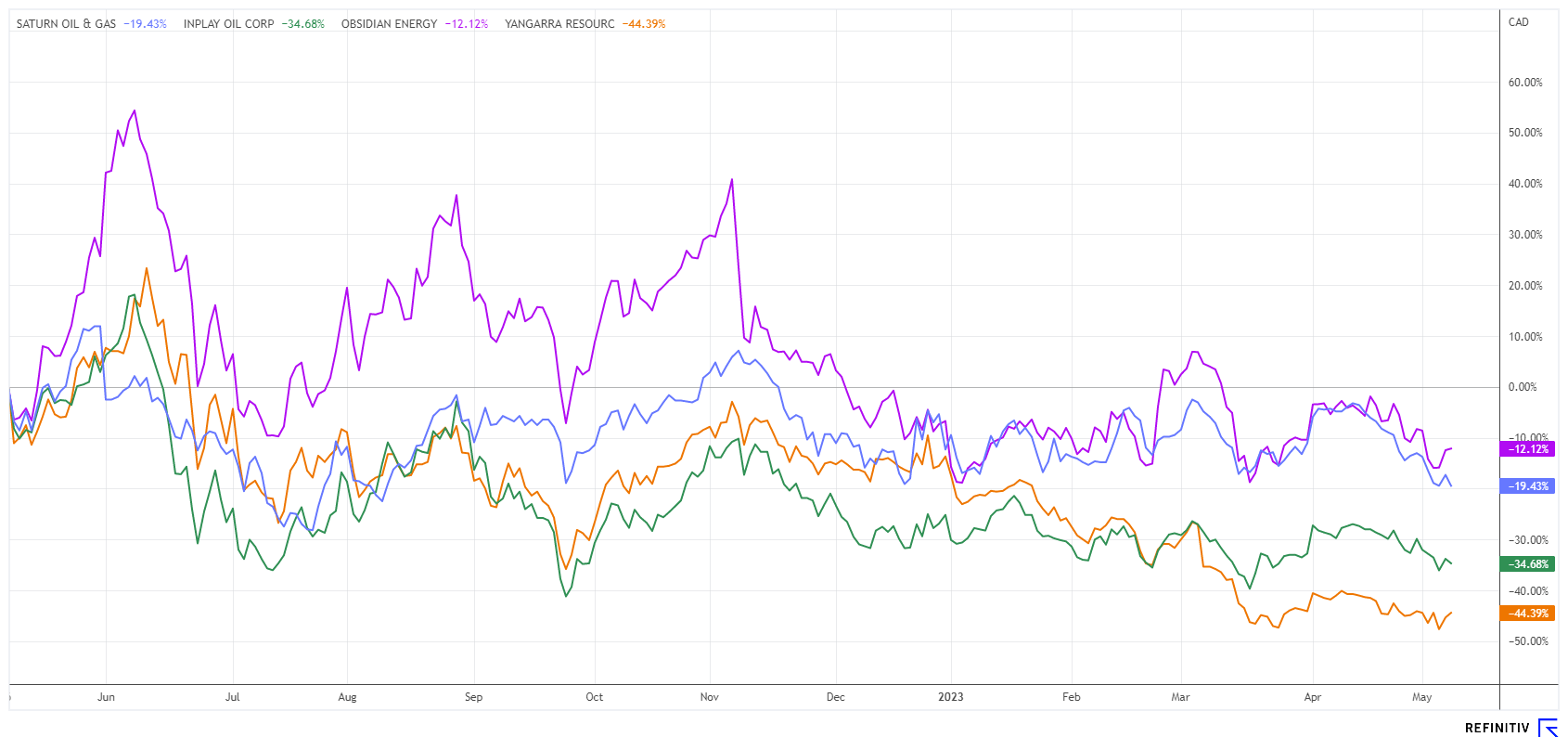

Interim conclusion: Low valuation in peer group comparison

The chart comparison shows a level playing field in the mid-sized Canadian oil producers sector. Nevertheless, Saturn Oil & Gas was able to slightly outperform its peer group in recent weeks, while oil prices in WTI continued to fall slightly from USD 82 to USD 73.

Fundamentally, Saturn is currently trading at an EV/adj EBITDA ratio of about 1.3. If one sets the factor to the industry average of 5, then a fair value per share of around CAD 8.50 to CAD 10.00 would be appropriate from today's perspective.

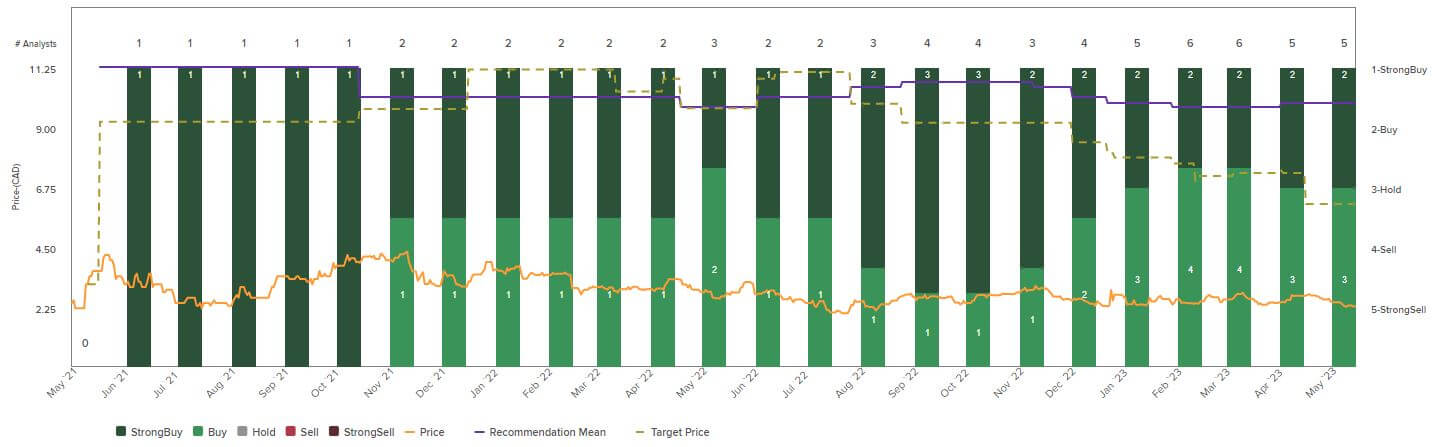

The price expectations of analysts on the Refinitiv Eikon platform currently range between CAD 4.75 and CAD 7.50 on a 12-month horizon. The price targets are between 100 and 250% above the last prices of CAD 2.25. The currently falling oil price could be an obstacle to closing the valuation gap at a factor of 5 times EV/adj EBITDA. The Company can continue to improve its value through increased drilling investments. Alberta wildfires are currently putting some downward pressure on production and cash flow, but they are not impacting the oil reserve valuation.

Scheduling Note: Saturn Oil & Gas is expected to release first quarter 2023 financial results on Tuesday, May 16, 2023, after market close and will host a webcast on Wednesday, May 17, 2023, at 6:00 pm CET. Attendees can access the live webcast via this link. A webcast recording will subsequently be available on the Company's website.

Prior to that on May 10, Saturn Oil & Gas will be presenting at the 7th International Investment Forum (IIF). Investors will have the opportunity to examine the valuation and business performance and gain insights into the background.

The update is based on our initial Report 11/21