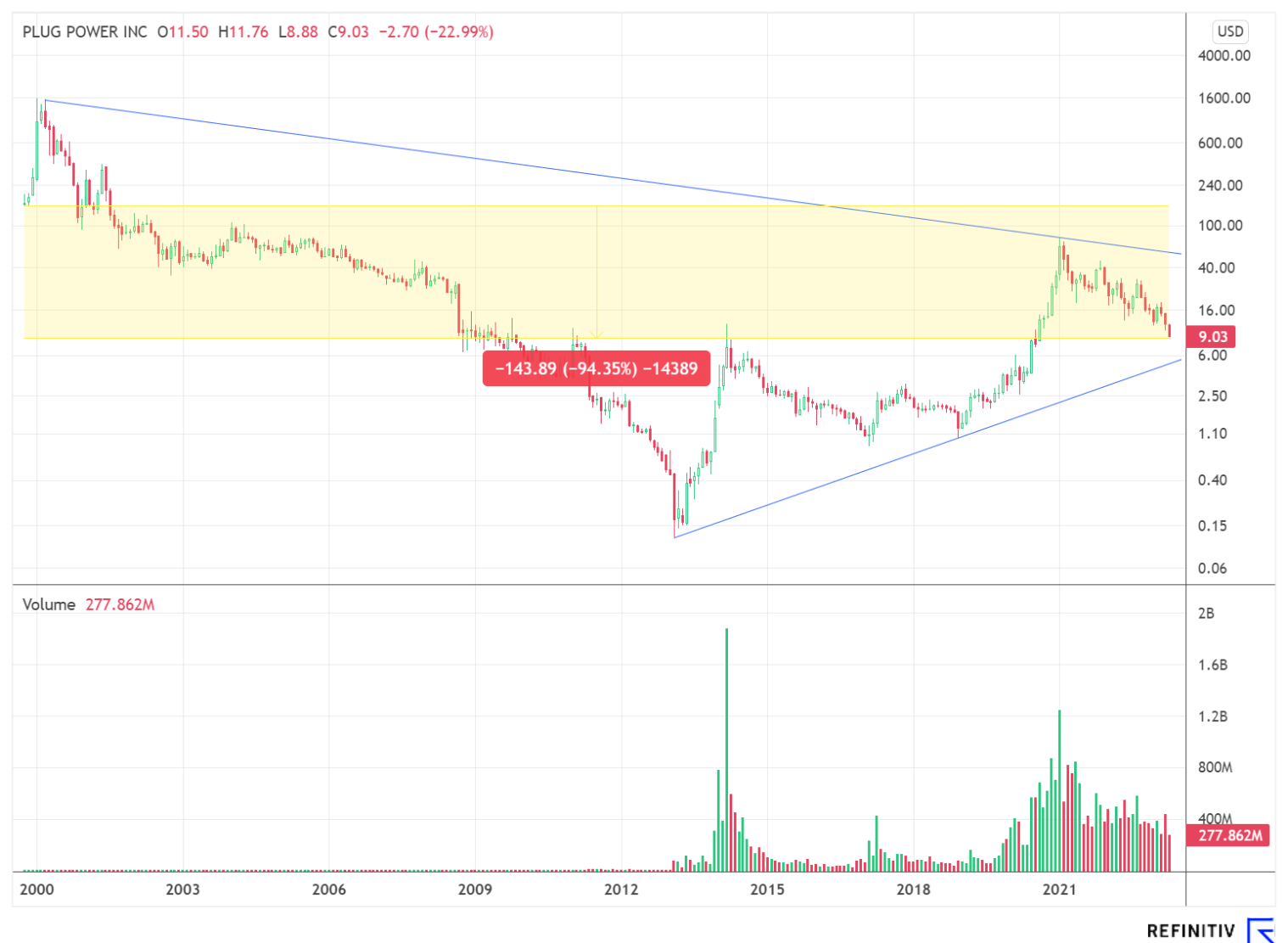

Once to heaven and back

Amazingly, Plug Power has been one of the most hotly debated companies on the capital market for years. The visions of the future are sold perfectly, but disappointed investors have always paid the bill. The share price performance since the IPO in 1999 resembles a disaster with a minus of almost 95%. On the other hand, the number of shares has risen exorbitantly through continuous capital increases, exploding by a factor of 138 compared with the turn of the millennium. We expect a further capital increase and dilution of the existing shareholder structure for the current fiscal year. The development of the hydrogen ecosystem is too capital-intensive, and Plug Power is too slow to even come close to break-even.

Disappointing business performance

The full year 2022 figures were once again marked by disappointment, mainly because several downward revisions were made by Plug Power's CEO Andy Marsh in the months leading up to it. Revenues, where forecasts as recently as October 2022 were USD 900 million to USD 925 million, finally came in at USD 701.4 million. Full-year net income was a negative USD 459.97 million, which equates to earnings per share of negative USD 0.82.

Class action lawsuit filed

With business forecasts revised downward several times, a class action lawsuit has now been filed against Plug Power for securities law violations. The complaint alleges that the defendant made false or misleading statements or failed to disclose throughout the class period between August 9, 2022, and March 1, 2023. Specifically, the hydrogen specialist misrepresented or concealed that it was unable to effectively manage its supply chain and product manufacturing, resulting in lower sales and profit margins. As a result, the defendant's statements about the Company's business, operations, prospects, and ability to manage its supply chain and production lacked a reasonable basis. The lawsuit was filed in the "United States District Court for the District of Delaware."

The Timeline of Misconduct

The complaint mentioned that Plug Power expected to issue a strong business outlook for the remainder of the fiscal year on August 9, 2022, coinciding with the release of its second quarter financial results. In addition, it was stressed that the Company's supply chain was strong, with the Company's CEO Andy Marsh stating that he did not foresee any supply chain issues this year and that the rapidly growing inventory was due to the considerable growth the Company would experience in the second half of 2022. Consistent with this statement, the Company projected 2022 revenues between USD 900 million and USD 925 million, representing approximately 80% YOY growth.

On October 14, a first profit warning already followed, with a revenue correction of 10-15% to USD 845 million. The reasons, according to management, were supply chain issues that would push major projects into 2023. On November 8, 2022, the Company announced its financial results for the third quarter of 2022, disclosing a decline in gross margins and a further increase in inventories. Further downward revisions were made on January 25 on the occasion of a strategy update, but there was no press release on this. Thus the growth in sales in relation to the previous year should amount no longer to 60%, but only 45% to 50%. Plug Power explained here that there were more problems than expected in the manufacture of new products. In addition, supply chain complexity again played a key role. The sad final point was then set on March 1 with the publication of the annual results. The revenue increase was then revised again from the statement made on January 25. It finally amounted to only 40%.

Bombastic outlook

Undeterred by the repeatedly revised forecasts, CEO Andy Marsh is sticking to his estimates for the current fiscal year 2023 and the following years. According to him, the activities in 2022 would form the basis for revenue growth and margin expansion. Thus, revenues are expected to nearly double to USD 1.4 billion in 2023, with a gross margin of 10%. The turnaround in electrolyzer sales is expected to be responsible for this, with the previous order backlog of 2 GW being converted into revenues. In addition, sales of new large-scale stationary plants are expected to grow, with planned installations of over 30 MW in 2023. By 2024, revenues are expected to increase to USD 2.1 billion, with gross margins already at 25%. Thereafter, Plug Power expects annual growth of 50%, equating to revenues of USD 20 billion and a gross margin of 35% in 2030.

Chart image still battered

In our initial report in February 2022, we saw the danger of a significant sell-off at prices around USD 22.00 and set the area around the EUR 8 mark (equivalent to USD 8.77) as a chart target. This was pulverized in yesterday's trading. Nevertheless, the chart continues to be strongly depressed, and the indicators are unlikely to provide much relief in the near future. Our technical analyst Stefan Bode offers a detailed analysis in a short video:

Interim conclusion

The decline in the Plug Power share price continues unabated. Due to the filing of a class action lawsuit accusing the Company of securities law violations, the share reached a new low for the year. Failed forecasts and a share price decline of about 95% since the IPO pave the history of the hydrogen company. Even though the outlook continues to sound euphoric according to the management, we do not believe that there is currently any reason to invest. For the current year, we expect further capital increases and dilution of existing shareholders.