Strong semiconductor markets boost business

Business is currently running smoothly at chip manufacturer Infineon. The booming semiconductor market and the continued recovery of the automotive markets are driving demand. The change in perspective to e-mobility is also playing an important role. However, the EU's final approval of synthetic fuels is keeping the German combustion engine industry alive and will lead to enormous investment in conversion over the next few years. All of this has to be managed.

The trend towards digitization, accelerated by the Corona pandemic, also ensures excellent prospects in the long term. The automotive industry accounts for the lion's share of Infineon's sales. In 2020/21, the Group felt the consequences of the Corona Crisis in this sector. Modern electronics for accelerating the energy transition and for home office work remain in high demand, and in most fields of application, demand significantly exceeds the supply available today. Infineon sees remaining bottlenecks in those segments where the Group sources chips from contract manufacturers, especially in automotive microcontrollers and IoT products.

Good positioning in global megatrends

The high demand for chips by the automotive industry is expected to continue for a long time due to topics such as electronic drives and driver assistance systems. Infineon also needs to create more capacity for these areas. Suppliers to OEMs have recognized the shortage and recently increased their spending on IT significantly again. Infineon benefits from its focus on global megatrends that will continue to shape the world in the future. These are demographic and social change, the climate and energy transition, and the ever-increasing scarcity of resources. Special topics here are increasing urbanization and the digital transformation of society. The growth areas of energy efficiency, mobility, security, IoT, and Big Data are also derived from these circumstances. In these markets, Infineon focuses on the structural drivers, i.e. areas that will grow disproportionately in the long term due to the abovementioned changes. The success of the last three years proves the adopted innovation strategy right.

Operating performance at the end of the first quarter of 2022/23

Infineon is holding its course in challenging times and closed the first quarter of the current 2023 fiscal year profitably. In particular, the energy turnaround and the expansion of electromobility are ensuring continued high demand for our solutions for industrial and automotive applications. By contrast, demand in the smartphone, PC and data center sectors is declining, in some cases significantly. Group sales of EUR 3.95 billion suffered a 5% decline compared with EUR 4.14 billion in the previous quarter. Revenue decreased slightly in the Automotive (ATV), Industrial Power Control (IPC) and Power & Sensor Systems (PSS) segments, while it increased in the Connected Secure Systems (CSS) segment. The somewhat weaker US dollar compared to the previous quarter resulted in a slightly negative impact on revenue development. Adjusted gross margin nevertheless improved noticeably sequentially from 46.3% to 49.2%, and the much-noted segment result rose to EUR 1.107 billion, corresponding to a margin of 28%.

"Even in a weaker macroeconomic environment, key parts of our business are proving robust."

The bottom line was a profit per share of EUR 0.55. This means that the figures are, in part, significantly above analysts' expectations. On May 4, Infineon reports on the 2nd quarter (FY 30/09/2023). The analyst consensus for earnings per share is EUR 0.581. Due to demand, Infineon strongly raises its forecast for the current 2022/23 fiscal year. Currencies are now also playing along better again. Revenues are expected to increase to at least EUR 15.5 billion; for segment margin, the expectation remains at a cautious 25% and adjusted free cash flow is expected to reach about EUR 1.5 billion. Platform analysts Refinitiv Eikon estimate EBIT of EUR 3.96 billion and EUR 4.07 billion for 2023 and 2024, respectively.Earnings per share for the current year are in an expected range of EUR 2.16 to EUR 2.42, compared to a reported EUR 1.65 from the previous year, nevertheless an increase of 38% in what remains a challenging environment.

Interim conclusion: Analysts are positive

Of 28 current analyst opinions, 22 are positive, and the price targets vary between EUR 28 and EUR 55, averaging EUR 45.95. The average price expectation is thus a further 24% upside. The reason is the gradual stabilization on the supply chain side and the large backlog from the orders of the last 2 years. In the Infineon order book, there was recently a report of EUR 38 billion, more than two annual revenues. Key drivers remain the already mentioned e-mobility and renewables sectors. Deutsche Bank left its rating at "Buy" in April and adjusted the price target from EUR 44 to EUR 47. Analyst Johannes Schaller sees the price environment for "critical" semiconductor products as still favorable. A week earlier, Warburg Research reiterated its Buy recommendation and adjusted the price target upwards from EUR 45 to EUR 48.

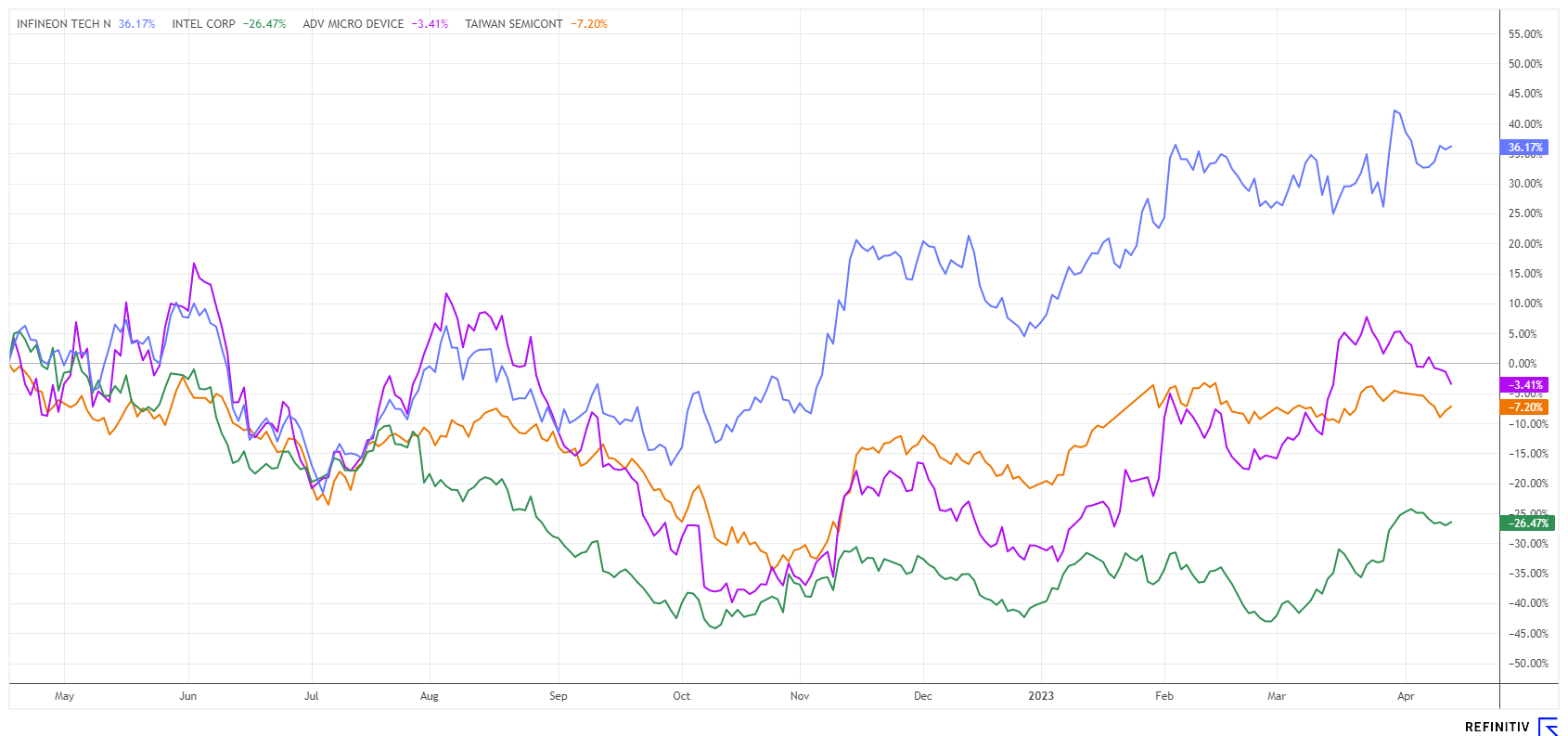

Significant outperformance versus international peer group

The 1-year performance of the Infineon share compared to its peer group in the semiconductor sector looks promising. The Munich-based company has gained 36% since November 2022, while its overseas competitors are running in negative territory. The US manufacturer Intel stands out in stark contrast, down 26% over the same period.

A good risk-reward ratio

Inflation rates have recently fallen back somewhat, and the interest rate level seems to have found equilibrium. This reduces the pressure on the technology sector. Given the slight weakening of the economy, central banks could also lower interest rates in the near future. This would be a good opportunity for the badly battered technology stocks. The Infineon share, which has been performing extremely well since the fall, could climb to new highs in this environment as the business is unusually stable. The all-time high of the IFX share dates from the fall of 2021 at around EUR 43; in the sell-off low of 2022, it went down almost 50% to around EUR 22. The purebred German tech stock is rich in opportunities, but as a DAX stock, historically tends to run with the major NASDAQ cycles. The US technology stock market could, therefore, also generate strong upward momentum for Infineon in the coming months once the consolidation is complete.

The update is based on the initial report 06/2022.