Proven cooperation with market leaders

About 18 months ago, the automotive team at First Hydrogen began work with the vision of becoming the leading designer and manufacturer of zero-emission, long-range hydrogen-powered vehicles in the UK, EU and North America. The Canadians used a "best-of strategy" to leverage existing technologies and a proven chassis to gain both time and cost advantages. In addition, Ballard Power and AVL Powertrain Ltd., two global players, were secured for technology, planning and design.

Since then, the partnerships have proven successful, with First Hydrogen successfully meeting the schedule for building the company's first two light commercial vehicles equipped with hydrogen fuel cell stacks. The next stage of development has been achieved with approval by the Vehicle Certification Agency, the UK's vehicle licensing authority for road transport in the UK, excluding Northern Ireland. This will allow potential customers to test the "Utility Vans" on public roads for a period of 24 months from January 2023. There has been tremendous interest from fleet operators in this regard. A total of 14 fleet operators from various sectors have already signed up to take part in the testing.

The mass market is calling

The next milestone is set to be the unveiling of the new next-generation vehicle. For Steve Gill, CEO of Automotive at First Hydrogen Limited, it is clear "our next-generation light commercial vehicles provide a holistic solution for commercial fleet operators who want to be environmentally friendly and cost-effective. We are excited about our new designs and look forward to showcasing them soon."

As with the collaborations with Ballard Power and AVL, the EDAG Group has once again been secured as a design partner, a global player. EDAG is the world's largest independent engineering service provider for the international mobility industry and provides engineering services in the areas of vehicle technology, electrics/electronics and production solutions. First Hydrogen receives support in commercial vehicle development, with the aim of making zero-emission vehicles accessible to fleet managers, thus pushing the door wide open for series production and the mass market.

Hydrogen-powered vehicles suitable for the commercial sector have a much longer range, can carry heavier payloads and can be refuelled much faster than comparable battery-powered vehicles. First Hydrogen's vehicles will also be aerodynamic, durable, advanced and highly functional for the driver, in line with the vehicle's area of use.

Holistic pilot project in Canada

In addition to the series production of the novel utility vans, CEO Balraj Mann's comprehensive goal is to create a holistic product offering of zero-emission light commercial vehicles and green hydrogen with the "Hydrogen-as-a-Service" model. This includes the development of a hydrogen refuelling system and the production and distribution of green hydrogen in the UK, EU and North America.

A pilot project has now been agreed upon with the Canadian city of Shawinigan in the Quebec region for the development of the first ecosystem. First Hydrogen has already conducted site assessments and has now officially begun the process of securing and developing appropriate sites for local production of green hydrogen and assembly of zero-emission First Hydrogen commercial vehicles. First Hydrogen's project plan calls for the production of up to 50 MW of green hydrogen using advanced electrolysis technology and distribution of the hydrogen within the Montreal-Quebec City corridor for use in First Hydrogen's light-duty vehicles, as well as to power other hydrogen-fuelled vehicles and applications in the region. First's vehicles are to be assembled in Shawinigan and distributed throughout North America in combination with its Hydrogen-as-a-Service product offering. The production facility is designed for an annual capacity of 25,000 units.

Interim conclusion

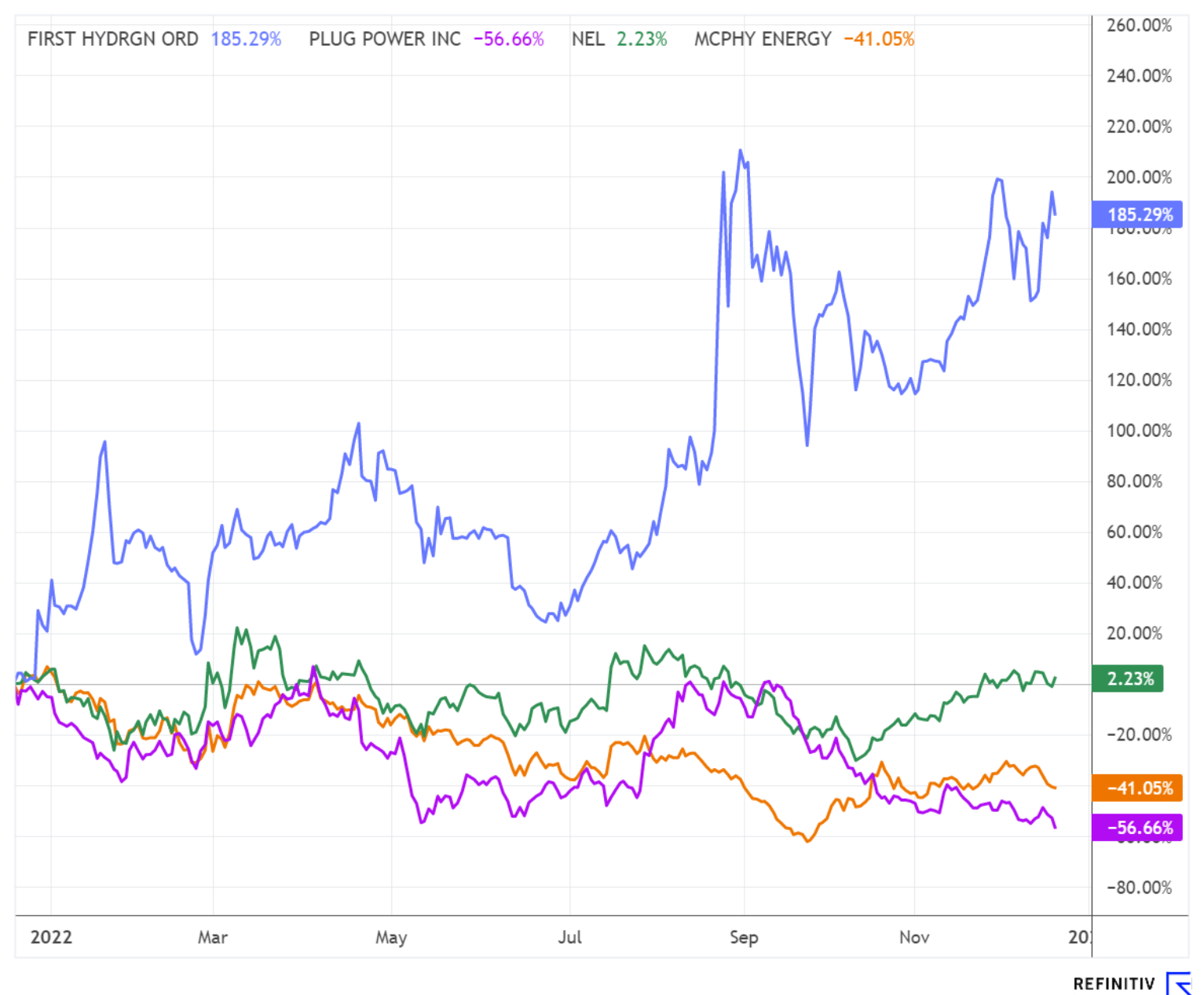

Due to the new partnership with EDAG Group for the development of next-generation commercial vehicles, series production and the entry into the commercial vehicle mass-market is getting closer and closer. In addition, First Hydrogen is positioning itself with its comprehensive "Hydrogen-as-a-Service" model in all areas of the hydrogen sector and will offer customers a complete value chain in the future. With a market capitalization of CAD 233.41 million, First Hydrogen is still moderately valued compared to comparable companies. Proven figures and a business plan for the next few years are still pending. Thus, with regard to further development, there are notable risks in addition to enormous growth opportunities.

The update is based on the Report 07/2022