Everything on track

The next decisive step towards commercialization is imminent. From the end of March, conditional on approval by the Vehicle Certification Agency, the UK's vehicle licensing authority for road transport in the UK, test drives are to be carried out with customers in real-world use on the road. There has been enormous interest in the two Generation I light commercial vehicles. A total of 15 major fleet operators have signed up to participate as part of the UK's Aggregated Hydrogen Freight Consortium. In doing so, the test drives give commercial operators in industries such as food and express delivery, utilities, and roadside assistance the opportunity to test electric vehicles with hydrogen-powered fuel cells alongside their existing fleets and compare different technologies.

Ballard Power with dress rehearsal

Before the maturity testing begins on real road conditions, one of the premium partners, Ballard Power, which alongside AVL, has been involved in developing the hydrogen-powered LCVs from the start, tested them at AVL Powertrain's technical centre in Basildon. The first-generation vans, for which the MAN eTGE serves as a so-called "donor vehicle," are equipped with the latest generation of Ballard FCgen-LCS fuel cells, which are expected to give the vehicles a range of over 500 km. The two prototypes are still undergoing vehicle evaluation and mileage measurement to optimize the vehicles' efficiency. The data collected will allow First Hydrogen to more accurately calculate fuel consumption and vehicle range under various driving conditions, which will be incorporated into future vehicle development. Importantly for the testing fleet companies, data on total cost of ownership can also be analyzed as a result.

Generation II on the way

In parallel with testing the two Generation I prototypes, which serve as proofs of concept and whose data and feedback will be incorporated into the design and construction for further development, work is already underway to develop Generation II. With the EDAG Group as a design partner, another market leader has been won. EDAG is the world's largest independent service provider for the international mobility industry. Initial silhouette images and front and rear views have already been released. The Generation II vehicles, which will be available with either fuel cell or battery electric propulsion, are modular in design and can be adapted to operational use for express delivery, grocery stores, construction and utility work or emergency services as needed.

The sketch above shows the overall shape of the vehicle in greater detail, highlighting some of the van's technical advantages. In addition to the vertical taillights and the brand's signature daytime running lights, which were unveiled earlier this year, the new illustrations show the aerodynamic body. Also visible are the solid and dynamic fenders and the large radiator grille with First Hydrogen branding, intended to provide the necessary ventilation for the fuel cell at the front of the vehicle.

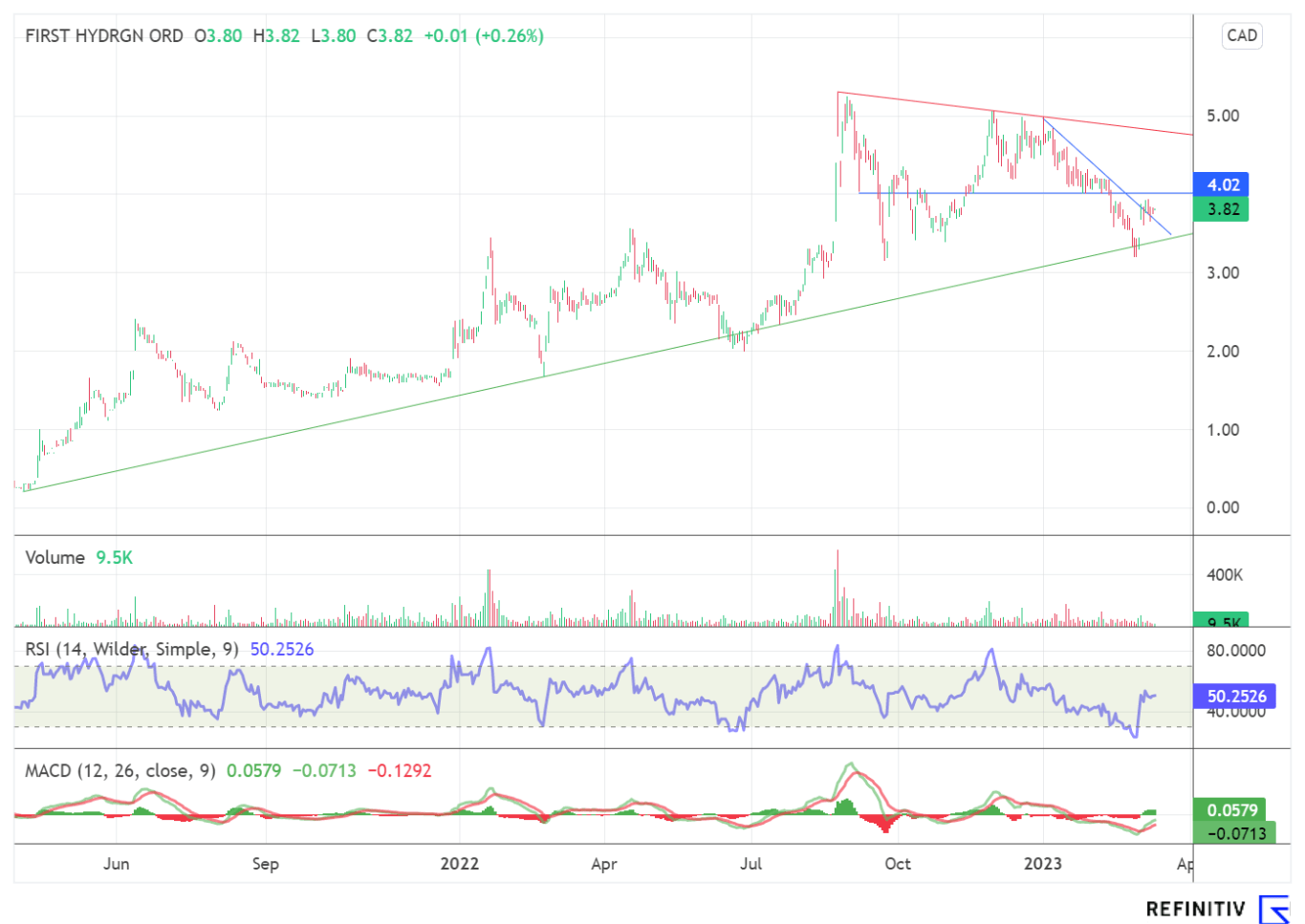

Chart picture brightens significantly

After a consolidation phase that has lasted since the beginning of January, the First Hydrogen share was able to successfully defend the upward trend formed since May 2021 at CAD 3.35 and, in the countermovement, even overcome the short-term downward trend that has existed since the end of the year at currently CAD 3.70. In addition, the trend-following indicator MACD was able to generate a buy signal on a low basis. The relative strength indicator is still in the neutral range, so there should still be further air to the upside. In addition to the vertical resistance at CAD 4.02, the next target is the downward trend at CAD 4.81, formed in August.

Interim conclusion

First Hydrogen remains well on track and is expected to begin road testing the two Generation I vehicles in late March. In addition, design work on the next generation is already underway. In parallel, the Canadians are pushing their "Hydrogen-as-a-Service" model, which is intended to cover the entire value chain in the hydrogen sector. Here, a joint venture has been established with FEV Consulting GmbH to develop a prototype for a customized refuelling system for the hydrogen mobility market. Furthermore, the Company, which currently has a market capitalization of CAD 189.21 million, plans to produce and distribute green hydrogen in-house in North America, Europe and the UK.

The update is based on the initial report 07/2022