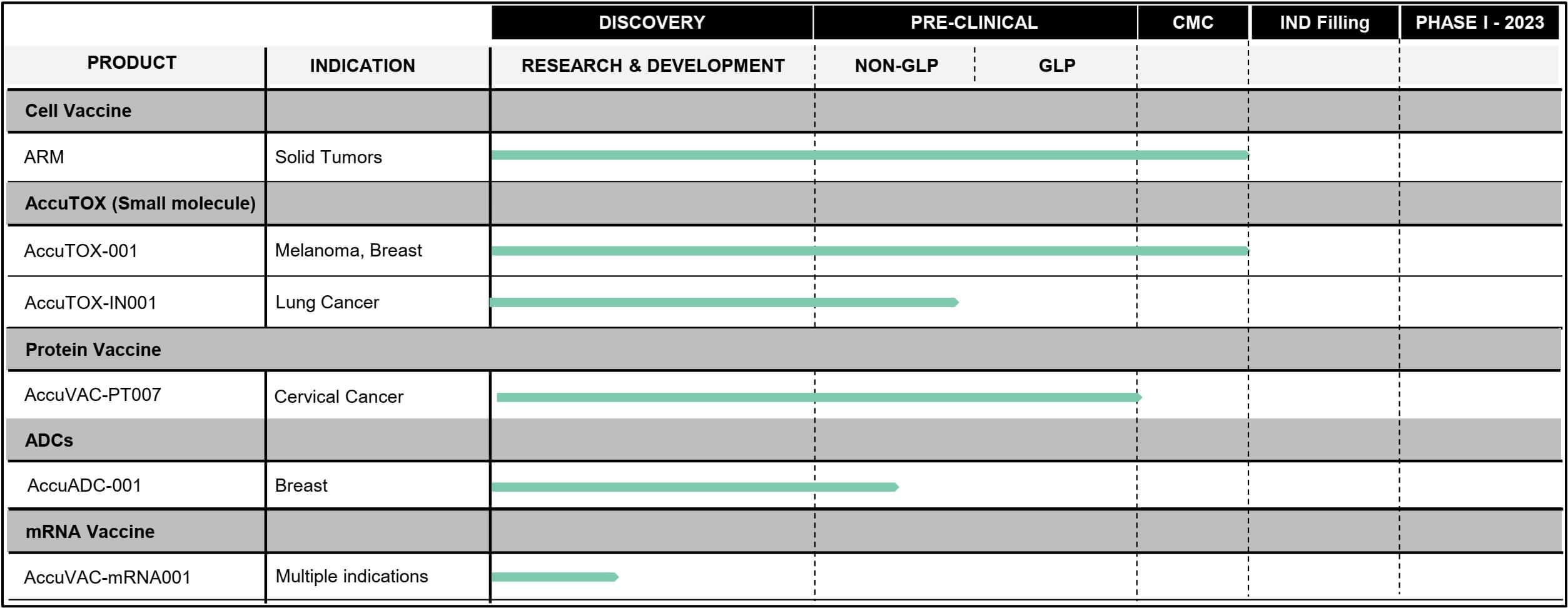

Six projects, one technology: Accum™

the market for vaccines against cancer could grow to USD 7.3 billion by 2027, according to Allied Market Research.

Those who leave a Swiss Army knife in a drawer might forget its functions and not even have it with them when it matters. But those who use their Swiss Army knife regularly, appreciate it - the knife always stays in their pocket. Canadian biotech company Defence Therapeutics has just such a multi-tool on offer in the form of its patented Accum™ technology: From vaccines against cancer to its role as a pure drug enhancer or chemotherapeutic, to a protein-based vaccine against the HP virus or as a supporter of mRNA technology - Accum™ has demonstrated its versatility in recent years. 2023 is shaping up to be a pivotal year for the technology, with multiple clinical trials pending and major pharma companies on the lookout for acquisition targets.

Cell-based vaccine against cancer (ARM)

Thanks to Accum™, Defence Therapeutics succeeded last year in reprogramming innate mesenchymal stromal cells into antigen-presenting cells. As a result, a universal vaccine is emerging that has already been proven to cure lymphoma (cancer of the lymph glands) and melanoma (skin cancer) in animals. There are also synergistic effects when using an anti-PD-1 immune checkpoint blocker. In early 2023, Defence Therapeutics has begun manufacturing this ARM vaccine and plans to start a clinical trial in patients with solid tumors this year.

AccuTOX™ as a chemotherapeutic agent by injection

to USD 326.4 billion are the market expectations for chemotherapeutics through 2027, according to Statista.

Potentiating the drug enhancer Accum™ produces a toxic substance capable of causing cancer cells to die: AccuTOX™. If AccuTOX™ is injected into tumors, several biochemical processes simultaneously lead to cancer cells being damaged and ultimately dying. Defence Therapeutics has most recently completed all preclinical and GLP studies surrounding AccuTOX™ as an injection and is now working with the renowned City of Hope Cancer Clinic in the Los Angeles area to prepare all applications for a Phase I clinical trial in patients with skin cancer.

AccuTOX™ as a chemotherapeutic agent via nasal spray

AccuTOX™ can cause cancer cells to die. The team at Defence Therapeutics wondered whether an

intranasal application for lung cancer might be possible and undertook trials.

the market for lung cancer drugs could grow to USD 55.6 billion by 2030, according to Precedence Research.

To date, Defence Therapeutics has demonstrated that AccuTOX™ is well tolerated by mice at doses of up to three mg/kg body weight, which is approximately one-sixth of the injection dose, and can be administered up to six times over a two-week period. This dosing regimen in mice with lung cancer reduced the number of cancer nodules by over 50% when administered in combination with an anti-PD1 immune checkpoint inhibitor. Further GLP studies are now planned to assess tolerability when using a sprayer. A subsequent Phase I study in humans is also planned. "Because AccuTOX™ has an excellent safety and tolerability profile in patients, it has the potential to become the next generation of anti-cancer drug for a broad range of indications," Defence Therapeutics commented.

Vaccine against the HP virus

The human papillomavirus (HPV) is usually transmitted during sexual contact and can cause cervical cancer, among other things. For years, some vaccines have been available that are suitable for preventing infections. Defence Therapeutics developed the protein-based vaccine

AccuVAC-PT007, which targets the E7 oncoprotein of the HPV virus, thanks to the Accum™ platform.

to USD 12.7 billion, the potential growth of the HPV vaccine market by 2027, according to Fortune Business Insights.

Defence's AccuVAC-PT007 provides complete protection against cervical cancer (prophylactic vaccination) despite numerous challenges. In addition, studies in animals have shown that the vaccine can control cancer growth even when given therapeutically. All GLP studies surrounding Defence Therapeutics' HPV project have been completed. The Company intends to launch its own Phase I trial in 2023 or further develop the project with a partner. Companies currently active in this field include Merck and GSK.

Further develop Accum™ as an antibody-drug conjugate

Antibody-drug conjugates (ADCs) are used to deliver specific drugs into cells. The current field of application for ADCs is often in the treatment of breast cancer.

to over USD 19 billion, the market for ADCs could grow by 2030, according to Grand View Research.

Here, many treatment cycles and high doses are currently required to achieve desired effects. Defence Therapeutics has shown that redesigning these ADCs with Accum™ ingredients can improve the efficacy of commercially available ADCs by more than a hundredfold. Defence is optimizing its formulation and evaluating different variants of Accum™ to find the best combination for optimal efficacy. The goal is to start GLP studies in 2023 to be able to initiate Phase I studies thereafter as well.

Accum™ makes mRNA vaccines better

The mRNA process is considered flexible, fast and inexpensive - COVID-19 vaccines from BioNTech and Moderna were developed based on this technology and are still convincing today. However, unlike other biomolecules, mRNA is sensitive to high acid concentrations and enzymatic reactions, which can directly affect the therapeutic efficacy of mRNA.

In addition, mRNA molecules must reach the cytoplasm, where they can be efficiently translated into complete proteins. This is where Accum™ can provide greater stability and efficacy. Defence is therefore working with a private European company to synthesize an mRNA vaccine coupled with Accum™. In the second quarter of 2023, a small batch of vaccines with different Accum™ variants will compete against an mRNA vaccine without Accum™ in in vivo studies in animals and be analyzed.

Conclusion: multi-tool meets billion-dollar market

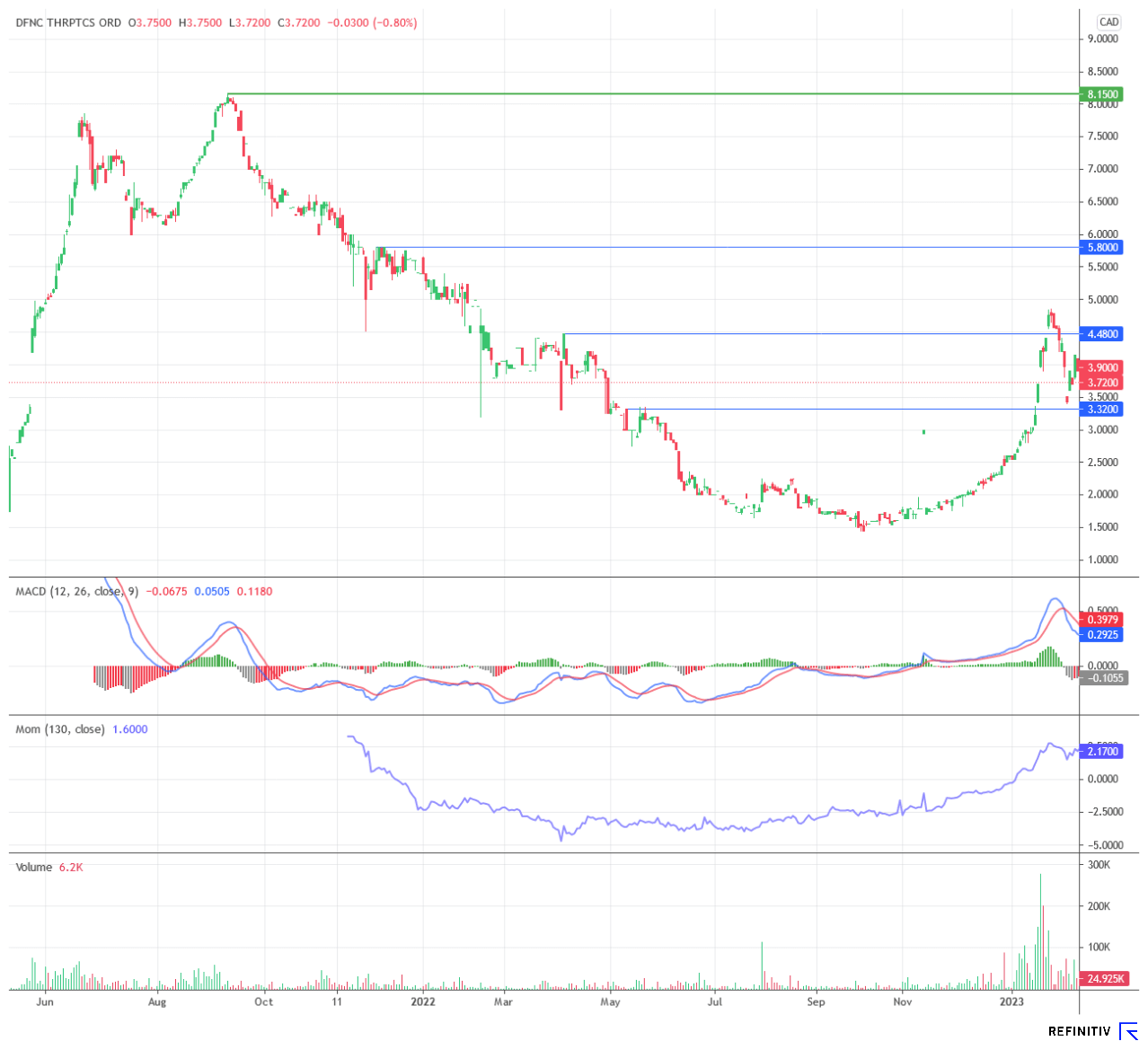

If we add up the market potential that various analysts believe lies dormant in all of Defence Therapeutics' projects, we arrive at more than USD 450 billion by 2030 - leaving any overlaps aside. The Company's market capitalization is currently just over USD 110 million.

experts at ResearchandMarkets estimate the market for mRNA therapy products by 2030.

Given numerous upcoming Phase I trials and the broad use cases of the Accum™ technology, the chances are good that Defence Therapeutics will be able to take a big slice of the growing pie around drug enhancers, cancer drugs, as well as vaccinations in the future.

The comprehensive product portfolio should also make Defence Therapeutics attractive as a potential takeover target for large pharmaceutical groups. As recently as January, three companies AstraZeneca, Ipsen and Chiesi, each wrapped up billion-dollar deals. It has become clear that increasingly flexible companies with platform strategies and a focus on innovative technologies, such as mRNA, are in demand. Since Defence Therapeutics' Accum™ technology, in addition to the six projects mentioned above, is capable of reviving biotech projects that formerly failed due to their high toxicity in Phase I trials, as it allows for lower doses, even further revenue streams from licensing deals are conceivable. It could be worthwhile for large pharmaceutical companies to incorporate Defence Therapeutics' technology into their portfolio - after all, a Swiss army knife is always useful.

The stock jumped in the wake of the general biotech hype in January and has since consolidated at a high level. In the meantime, Defence Therapeutics has presented its projects at the Immuno-Oncology 360° conference in New York, among others, and has found a renowned partner in the City of Hope Hospital in Los Angeles. In 2023, further progress will be made operationally in no less than six areas. The consolidation should have done the share some good. If the mood on the overall market remains positive, Defence Therapeutics could soon take off again.

The update is based on the initial report 12/2021