The previous year pulverized

Last year was a year of records for the "Build Your Dream" company. This is impressively shown by the preliminary business figures, which reflect explosive profit growth. The Shenzhen-based technology company expects net profit to be between EUR 2.19 billion and EUR 2.33 billion, representing growth of 425.4% to 458.3% YOY. Revenues grew by around 94%, from EUR 29.61 billion to EUR 57.54 billion. That significantly beat analyst average forecasts, which, according to Bloomberg, were for a net income of just EUR 1.81 billion and revenues of EUR 54.80 billion.

The Company's full-year deliveries rose 209% to 1.86 million vehicles despite the COVID situation in China and increasing competition. This included 911,140 battery-electric and 946,239 plug-in hybrid vehicles, according to statistics from the China Association of Automobile Manufacturers. In comparison, sales of battery-only vehicles totaled 710,865, with BYD's market share rising from 18% to 30.9% YOY in the Middle Kingdom. To narrow the gap with BYD, Tesla has been focusing on price cuts since the beginning of the year, which could trigger a price war in the Chinese market.

Significant increase in weak January

Compared to the previous month, sales figures in January slumped by a good 35%, but this was due to the typical seasonal weakness. It was compounded this year by the fact that government incentives for purchasing electric vehicles in China expired at the end of 2022, so many willing buyers brought forward their decision. Here, BYD posted a record month with 235,197 vehicles sold, up 150% from the same period last year.

In total, BYD sold 150,164 passenger vehicles in the first month of the new fiscal year, including 71,338 electric vehicles and 78,826 plug-in hybrid vehicles. Compared to January 2022, sales increased significantly by 62%. Chinese peer group sales fell by around 40% in the first month of the year. For example, Nio, XPeng and Li Auto together sold only around 29,000 units.

Further growth forecast

The China Association of Automobile Manufacturers (CAAM) expects strong growth of 35% to around 9 million units for alternative drive vehicles in 2023, but the end of subsidies could slow the increases of recent years. This circumstance is also included in the valuation of the analyst firm CMB International Global Markets. The experts assume sales of 2.46 million units for BYD in fiscal year 2023. That would mean an increase of 31%, which should even exceed the average growth of the NEV industry in China, which is 27%. Accordingly, net profit would be EUR 2.59 billion. However, the cancellation of subsidies would leave the Chinese market leader with a net profit of only EUR 973, compared to EUR 1123 in fiscal 2022, per unit sold, according to analyst estimates.

Expansion into attractive sales markets planned

In addition to expanding its product range, BYD also wants to grow by expanding into additional countries. For example, the first car dealership in Japan was inaugurated at the end of January. At least another 100 stores are to follow by 2025. There are also plans to push into the rapidly growing Indian market, the fourth-largest automotive market. The ambitious goal here is to capture around 40% of the EV market by 2030. BYD has so far invested USD 200 million in its electronics and automotive factories in India. The automaker is currently assembling vehicles at a plant in the southern city of Chennai. If demand increases in the next two to three years, the Company will consider adding more production facilities. With more workers and double shifts, the Chennai plant could produce 50,000 units annually, the Company said.

Manufacturing of BYD models could also take place in Germany in the future. Thus, according to media reports, Ford is negotiating with the Chinese automaker about a sale of the plant in Saarlouis. However, the talks are still at an early stage. The plant in Saarlouis currently produces the "Ford Focus", but production is scheduled to cease in 2025.

Interim conclusion

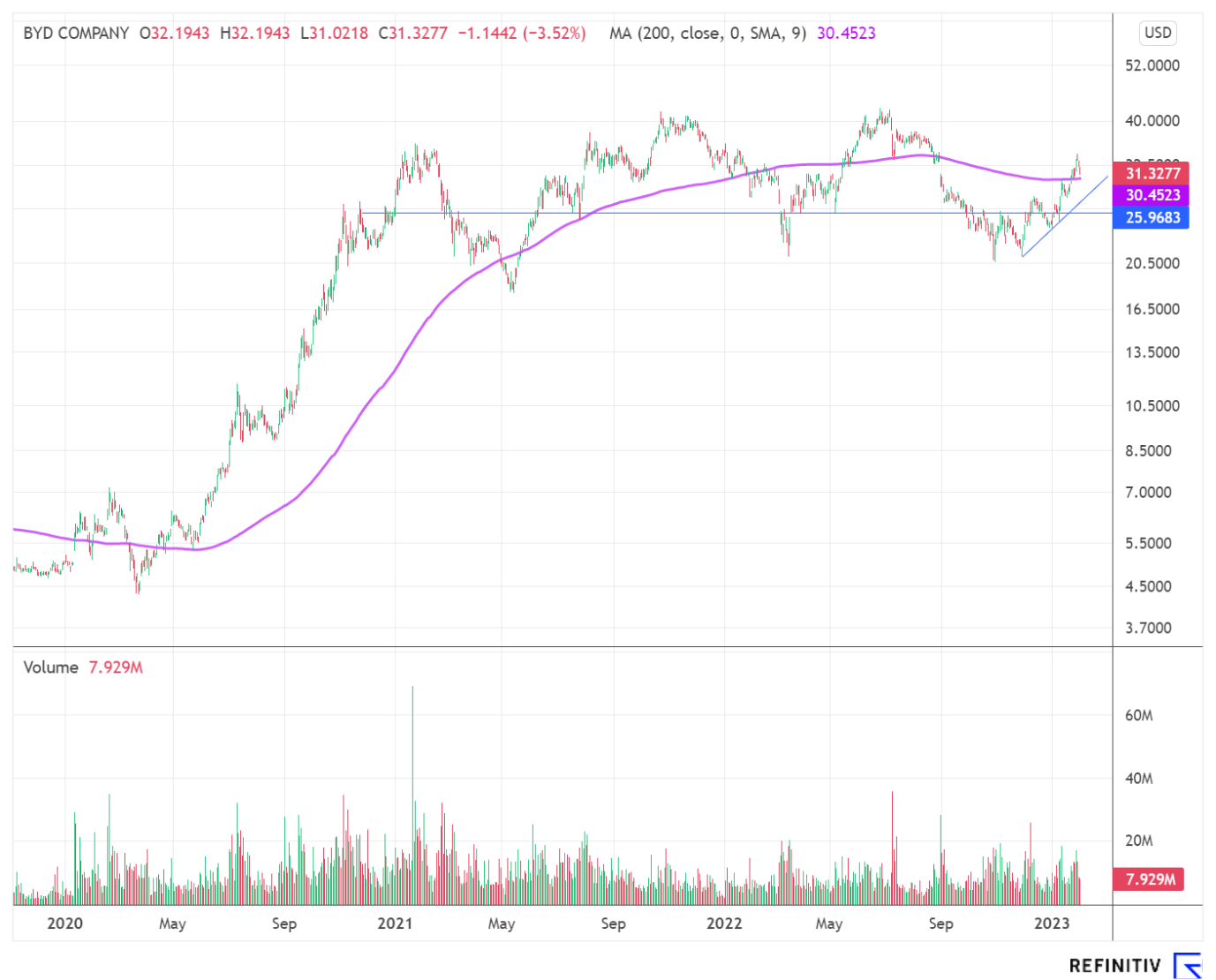

After solid growth in the past fiscal year, analysts predict BYD should continue to grow faster than the overall market at over 30% in 2023 and further expand its market leadership in China. However, both the cancellation of subsidies by the government and price cuts by competitor Tesla are putting pressure on margins. From a chart perspective, the BYD share is in a correction after the strong increase of 58% since the end of November, which could lead the price back to the uptrend at around EUR 28.

The update is based on the initial Report 07/2022