It has only been about two weeks since the conference, hosted by JP Morgan in San Francisco around companies in the healthcare and pharma sectors, moved share prices. As the Wall Street Journal reports, a gaping hole has opened up between pharmaceutical companies and biotechs over the past year: on the one hand, there are large pharma companies with high valuations and bulging war chests, and on the other, innovative biotechs that primarily need capital to develop the next blockbusters. According to the Wall Street Journal, this gap may now be closing.

Big pharma under pressure - acquisition targets urgently sought

made clear by pharma companies during the last industry conference

The reason lies, among other things, in the planned Inflation Reduction Act in the US, which will enable negotiations on drug prices and could put pressure on the revenue streams of big companies. In response, more and more major industry players are looking to partner with biotech companies - capital is something most big players have plenty of on hand. During the conference in San Francisco, three companies - AstraZeneca, Ipsen and Chiesi - each inked deals worth billions of euros. On February 7, Immuno-Oncology 360° will begin in New York, another conference that aims to bring together representatives from business and the biotech sector with a focus on cancer. Participants include almost all relevant representatives of immuno-oncology, the promising company Defence Therapeutics, and investment companies, banks, venture capitalists and analysts.

In addition to the professional exchange during the conference, above all the direct line to decision-makers from the New York financial scene could be important for Defence Therapeutics. In addition to additional investor interest, strategically important contacts could also arise for Defence Therapeutics. At the stage Defence Therapeutics is currently in, comparable companies had dared to step onto the Nasdaq in order to be even more interesting for potential investors. A listing on a renowned trading venue usually brings additional interest from analysts and investors.

Cancer cure: possible already in animals

Defence Therapeutics is a biotech company that has developed a platform approach around its patented Accum™ drug enhancer, from which several promising product pipelines are currently emerging. Before the end of 2023, Defence Therapeutics plans to launch Phase 1 studies around mRNA vaccines against various types of cancer, to establish a vaccine candidate against the HP virus, and to investigate a potentized version of its highly flexible Accum™ drug enhancer under the AccuTOX™ label as a chemotherapeutic agent, also in a Phase 1 study. The market potential around all activities amounts to more than USD 100 billion. Details can be found in the report published two weeks ago.

Defence Therapeutics recently announced details on the efficacy of its vaccine candidate A1 against skin cancer. The vaccine uses a variant of Accum™ that reprograms mesenchymal stromal cells ("MSCs") to behave like antigen-presenting cells. In experiments on animals, a synergistic effect was achieved in combination with the immune checkpoint inhibitor anti-PD-1, which ultimately led to the majority of solid tumour-bearing animals surviving and in some cases, even rejecting the tumours. Overall, Defence Therapeutics reported a cure rate of 60%. But how should this figure be evaluated?

Scientists point out that absolute numbers are difficult to evaluate regardless of details about the tumour model chosen. Sébastien Plouffe, CEO of Defence Therapeutics, sheds light: "The animal model used for this study is a melanoma, which is the same type of cancer that we will treat in our Phase I study. The antigens used for this study are non-biased and come from the lysate of B16 melanoma cells to ensure that we cover all the different neoantigens. Regarding the cure rate, it is important to keep in mind that these are animal models and can only give an example of the efficacy of the treatment. It is important to remember that tumours are heterogeneous and each immune response is different in different individuals," the CEO said. Translated to humans, he said, cure rates of up to 60% are possible, but so is a delay in tumour growth that can buy patients life. The latter is already considered a success with current cancer drugs and can, for example, favour approval by authorities.

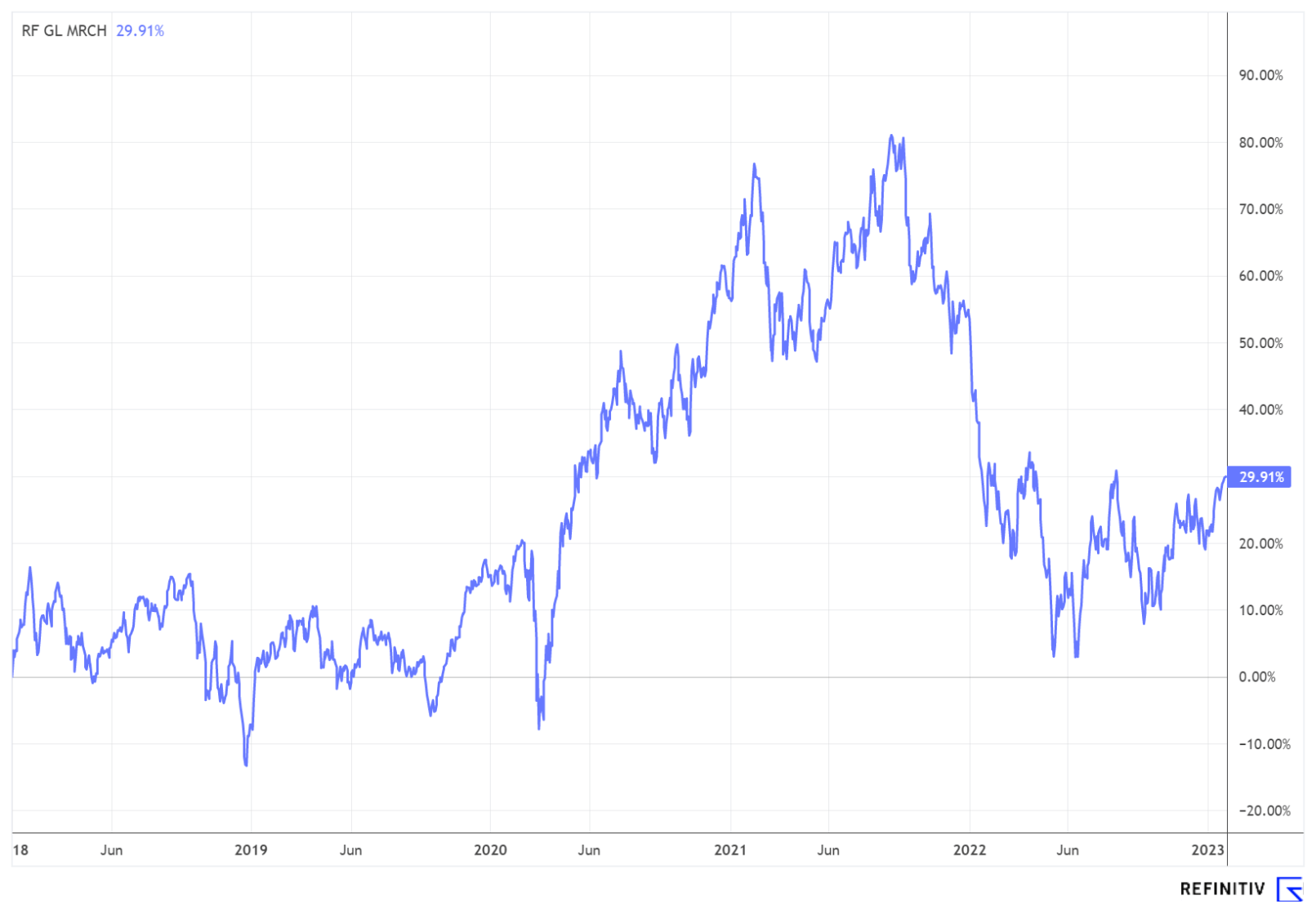

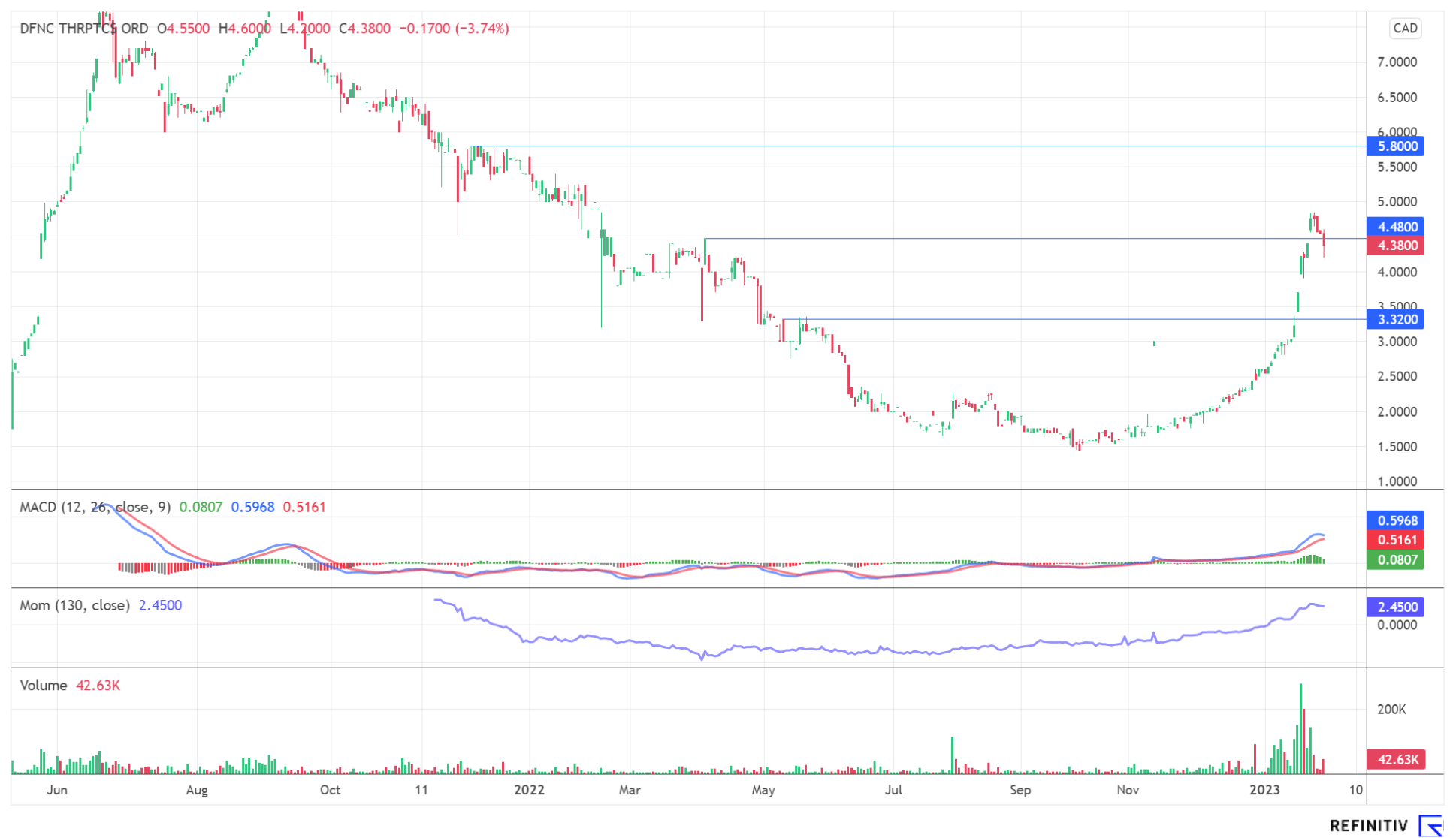

Where is the journey heading? The share with relative strength

The Defence Therapeutics share has developed extremely dynamically over the past few weeks and is showing great relative strength after price gains of around 50% in just a few weeks. The current consolidation can serve as a springboard for price gains if the news flow continues. The development chart of the share shows short-term potential up to CAD 5.80. Even new record highs beyond the CAD 8 mark are possible - provided there is a tailwind from the industry.

Interim conclusion: Many things fit together here

According to market researchers, all Defence Therapeutics' business areas offer this potential by 2030

Defence Therapeutics is making progress operationally. Interim results on the efficacy of the vaccine candidate A1 against skin cancer recently showed an efficacy of 60% in animals. With these impressions and its versatile technology portfolio, Defence Therapeutics can attract attention during the upcoming Immuno-Oncology 360° conference at the beginning of February, to which investors and industry experts are invited. The Company is giving two presentations and is represented with a stand in New York.

Although the share has consolidated recently, the value still shows solid relative strength. As the entire biotech sector is currently in an exciting phase, the Defence Therapeutics share could also experience tailwinds from its sector. The stock remains speculative, but product range, outlook and timing appear promising. Experienced investors can still have a lot of fun with Defence Therapeutics. Given the promising product pipeline and the current valuation, it cannot be ruled out that the Company will soon aim for the Nasdaq. For potential investors, a listing on a renowned trading venue is often a prerequisite for investment.

The update is based on the initial Report 12/2021