First quarter of 2023 better than expected

A slump in sales hit BASF hard at the start of the year. As a result, sales and profits plummeted in the first quarter. At just under EUR 20 billion, revenues were down more than 13% YOY, as the Russian invasion of Ukraine did not take effect until the middle of the quarter. EBIT adjusted for special items fell by almost a third to just over EUR 1.9 billion. The operating weakness permeated almost all divisions, with only the agricultural sector able to keep its flag flying. The main reason for the poorer earnings performance of the BASF Group was the significantly lower contributions from the Chemicals and Materials segments.

"This amount is more than covered by our free cash flow of EUR 3.3 billion in 2022," said CEO Brudermüller.

Earnings after taxes and non-controlling interests were EUR 1.6 billion, EUR 340 million higher than in the same period of the previous year, but at that time, impairment losses had been recognized on the investment in Wintershall DEA AG. Earnings per share were EUR 1.75, compared with EUR 1.34 in the first quarter of 2022. The Board of Executive Directors and Supervisory Board of BASF SE proposed to yesterday's Annual Meeting of Shareholders a dividend for fiscal year 2022 at the previous year's level of EUR 3.40 per share. In total, BASF will distribute around EUR 3 billion to its shareholders at the beginning of May.

Job cuts in Ludwigshafen, but billion-euro investments in China

The Ludwigshafen-based chemical company BASF is one of the largest suppliers of starting materials for the Greentech industry. Here, substances are produced and mixed with high energy input, important chemical precursors for high-tech manufacturers in the alternative energy and e-mobility sectors. The German group has now started construction of a complex for the production and further processing of acrylic acid at its Verbund site in Zhanjiang in the southern Chinese province of Guangdong. Once completed, Zhanjiang will be BASF's third-largest Verbund site in the world, after Ludwigshafen and Antwerp. Meanwhile, the reduction of capacity in Germany continues. BASF plans to save a total of EUR 500 million per year in central areas outside production from 2025 onwards, primarily affecting 2,600 jobs in Germany. Plant closures and relocations are expected to reduce fixed costs by an additional EUR 200 million.

CEO Dr. Martin Brudermüller not only wants to close one of the two ammonia plants at Europe's largest chemical site because of high energy costs but, much more important, is the end of large, modern TDI production and the thinning out of the European precursor lines for polyamide. All measures will affect "Materials", one of the largest sectors in the Group.

this is how much more BASF had to spend in 2022 due to exploding energy costs.

The reason for this approach is the sharp drop in earnings in the two main plastics-relevant sectors, "Chemicals" and "Materials", which had to absorb additional energy costs of EUR 3.2 billion in 2022. New EU regulations in connection with achieving climate neutrality in 2050 will likely play a role in shifting certain energy-intensive process steps abroad. From a climate perspective, this approach is a global zero-sum game; only in Germany and Europe are valuable jobs lost with such actions. Unfortunately, European location policy is subject to a one-sided climate debate; industrial conglomerates that have been based here for centuries are voting with their feet and successively saying goodbye.

BASF is prospectively divesting Wintershall DEA

Another construction site exists in the oil and gas business. BASF subsidiary Wintershall DEA withdrew from Russia in 2022, causing its parent company to lose billions of euros. The bottom line left BASF with a loss of around EUR 1.4 billion, mainly due to write-downs on Wintershall DEA amounting to EUR 7.3 billion. In January, the Group announced the end of its operations in Russia, which most recently still accounted for 50% of total production. However, the withdrawal is being made more difficult as the Russian government continues to create new hurdles for Western companies that want to leave the country.

"We decided to exit the oil and gas business well before the war. And we are sticking to it," said company CEO Martin Brudermüller at the Annual General Meeting in Mannheim. Management is currently working on various options for the exit, with an IPO of the 70% subsidiary remaining the preferred option, but a sale to investors is also conceivable. Originally, BASF had planned the IPO for the second half of 2020, but the general conditions in the midst of the Corona Crisis were too bad for an appropriate valuation. Today, the value is likely to be significantly below 2020 because operating profit before exploration costs already fell by 14% to EUR 1.14 billion in the first three months of the current year.

Outlook: No gloom despite burdens

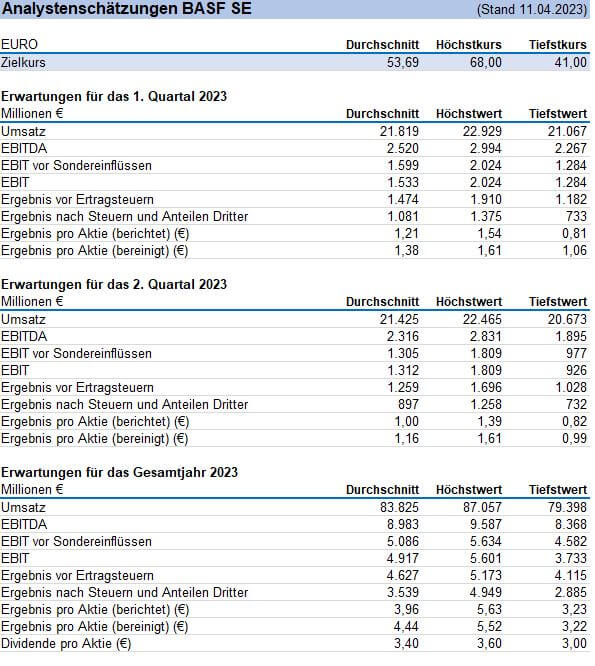

For the current year, BASF management is targeting sales of EUR 84 billion to EUR 87 billion. This is slightly below the previous year, and adjusted EBIT is expected to be EUR 4.8 billion to EUR 5.4 billion - and thus up to 30% lower than in 2022. The greatest burdens will likely be incurred in the first half of the year, as this is when the first adjustments in Ludwigshafen will take effect.

Overall, the analysts polled on the Refinitiv Eikon platform are predominantly positive. Of 27 votes, 22 have identified a buy or neutral rating. Only 4 analysts recommend selling at the level of just under EUR 48. The median 12-month price target is a moderate EUR 54.60. Nevertheless, there are risks from an economic perspective, as the construction industry has come to an almost complete standstill due to high interest rates and energy and procurement prices. The construction of new production capacities in China and the partial closures at the Ludwigshafen site will also have a negative impact on costs for the time being.

Interim summary: First rays of hope discernible

With the onset of the Ukraine crisis in February 2022, the stock market priced the energy risk very strongly into the share price. In 2021, the German chemical group consumed as much gas at the Ludwigshafen site alone as the entire country of Switzerland. In recent months, however, structural improvements on the energy side have emerged, such as BASF having already replaced more than 20% of its gas needs with other energy sources. Furthermore, the demand for chemicals in the current post-Corona phase is such that the world market leader is able to implement appropriate price increases in many operating and auxiliary materials.

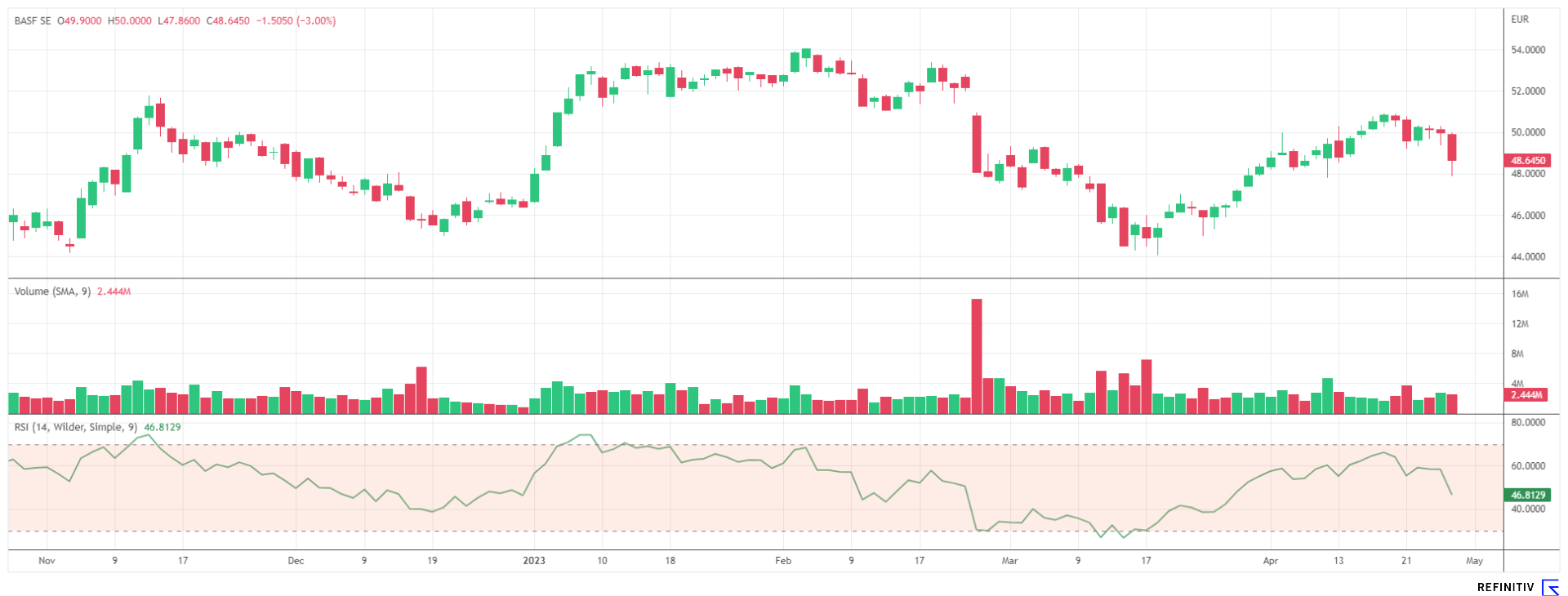

The 9-month price trend of the BASF share shows several technical attempts to exceed the EUR 50 mark. With yesterday's Annual Meeting, the sentiment in the share deteriorated, and the relative strength also decreased noticeably recently. Fundamentally, the stock trades at a 2023 P/E ratio of 10.8 and offers a yield of over 7%. Furthermore, the DAX-listed company trades close to its book value and overall reflects only 60% of forecast sales in the share price. The expansion of locations abroad is progressing steadily and will lead to a significantly lower cost structure in the medium term. Despite currently challenging economic factors, the Ludwigshafen-based company should regain its international strength in the long term.

The update is based on our initial Report 07/2022.