Gigantic market potential

The market volume for stationary grid storage is almost unstoppable due to the demand expected in the future. It is expected to grow by around 28% per year in the coming years. The global battery energy storage systems market is expected to explode from USD 4.4 billion in 2022 to USD 15.1 billion in 2027. It is also forecast to grow from 20 GW in 2020 to over 3,000 GW by 2050.

In this context, the revolutionary CERENERGY batteries, which represent an innovation compared to existing technologies, could set a new standard, as the benefits are clearly evident. CERENERGY batteries are non-flammable and therefore fire and explosion-proof, have a life span of more than 15 years and operate in extremely cold and hot climates. The battery technology uses boiled salt and small amounts of nickel. In addition, neither lithium, cobalt, graphite, nor copper are required and thus function independently of critical supply shortages and price increases of raw materials. The manufacturing costs of CERENERGY batteries are also expected to be about 40% lower than those of comparable lithium-ion batteries, according to Fraunhofer.

Clear advantages

To develop the CERENERGY project, Altech Batteries GmbH was founded with the Australian partner Altech Batteries (share: 56.25%) and the Fraunhofer Institute for Ceramic Technologies and Systems IKTS (share: 25%), the leading battery institute in Germany. The joint venture, in which the Heidelberg-based company holds an 18.75% stake, is focused on industrially producing and commercially marketing a sodium-aluminum oxide solid-state battery. The revolutionary batteries are to be produced at Altech's Schwarze Pumpe site in Saxony, Germany. The plant is expected to have an initial annual production capacity of 100-MWh, corresponding to an initial standardized production line that can then be quickly scaled up. According to the Company, detailed planning for this line and further scaling is currently being implemented. It is expected to be completed with the detailed economic feasibility study before the end of the third quarter of the current fiscal year.

Stationary energy storage systems for regenerative energy sources such as wind, solar and hydro have been identified as the target market for CERENERGY batteries. In addition, the technology could be used as a temporary storage solution for the generation of green hydrogen and CO2 reduction in steel production and cement manufacture.

Silicon as a lever

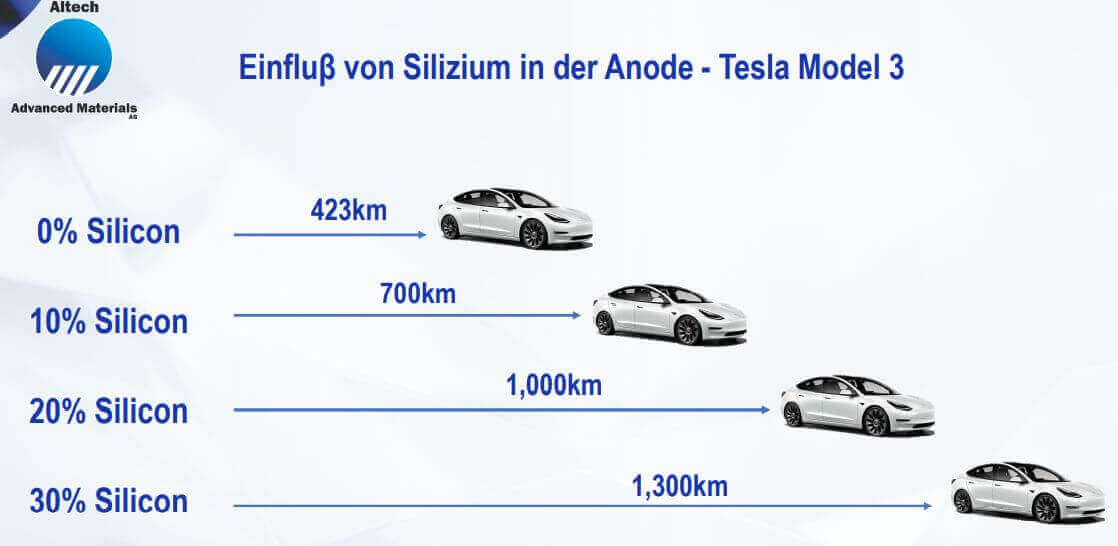

Silumina Anodes, the second innovation, which is also being driven forward with technology partner Altech Batteries Ltd. and in which Altech Advanced Materials owns 25%, has no less potential. Here, batteries are provided with a special nano-coating of high-purity aluminum oxide and an enrichment of silicon, which is intended to prevent the deposition of lithium particles on the electrodes. A loss of capacity, as seen in lithium-ion batteries, is hugely reduced with the coating method. In addition, laboratory tests have shown performance increases of over 30% in lithium-ion batteries using the Silumina Anodes technology.

In addition to the significantly increased energy capacity, improved energy density, chargeability and lifetime with increased safety were also achieved. The significantly increased energy density lowers storage costs and thus reduces battery cost per charge capacity. Silicon can store ten times more energy than the commonly used graphite, making it one of the most promising anode materials for future development and application in electromobility and lithium-ion batteries.

The result of the pre-feasibility study for the planned ceramic coating plant for anode composite material in Schwarze Pumpe, south of Cottbus, showed clear potential. The project's pre-tax net present value (NPV) was around EUR 420 million. Assuming full capacity utilization of 10,000t p.a. at the production facility still to be built, this would result in an EBITDA of EUR 52.00 million.

Interim conclusion

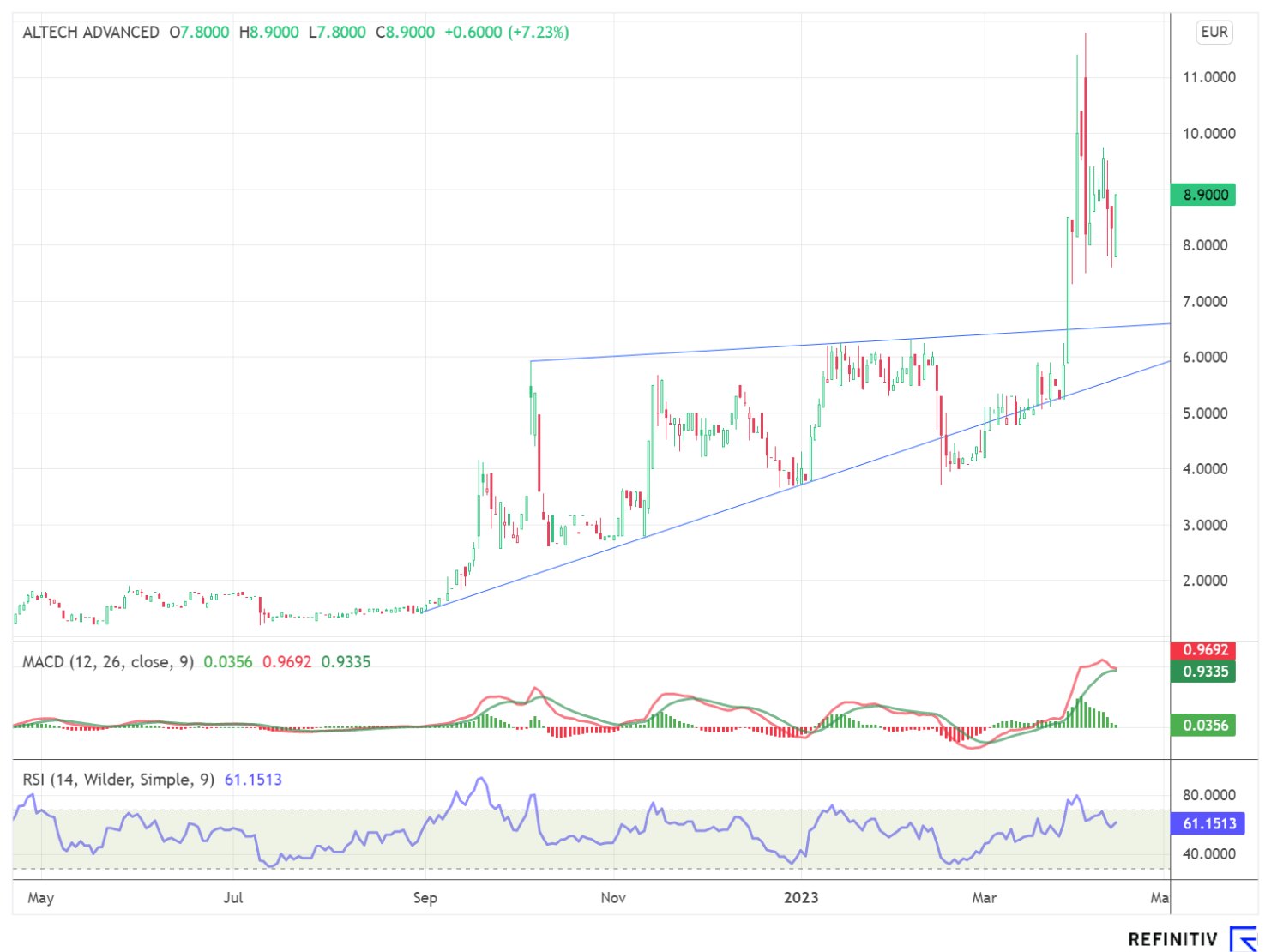

Altech Advanced Materials could be the new innovation driver,"Made in Germany". Both the novel Silumina Anodes coating technology and the CERENERGY battery storage technology, which is being developed together with the Fraunhofer Institute for Ceramic Technologies and Systems, have enormous potential. Altech Advanced Materials currently has a stock market value of EUR 62.86 million. Due to the price fireworks of the past weeks, the share is in consolidation. However, should the start of the pilot plant go ahead as planned, this should boost the share again. As an interested market participant, however, the value should be limited when buying due to its market narrowness.

The update is based on the initial report 02/2022