Made in Germany in the market of the future

"Germany lacks innovations, the former seal of quality "Made in Germany" no longer exists!" so is the current opinion in society. But far from it, especially in one of the future topics. With the development and production of batteries for electromobility, Germany shows its former steel strength. But the potential game changer comes neither from the automotive giants VW, BMW or Daimler, but from the Heidelberg-based investment company Altech Advanced Materials, founded in 2000 and currently holding a market capitalization of EUR 39.55 million.

On three legs

The Company is not a one-hit-wonder but is broadly diversified with different technologies. On the one hand, Altech stands for high-purity aluminum oxide for industry. This business is being driven forward in Malaysia.

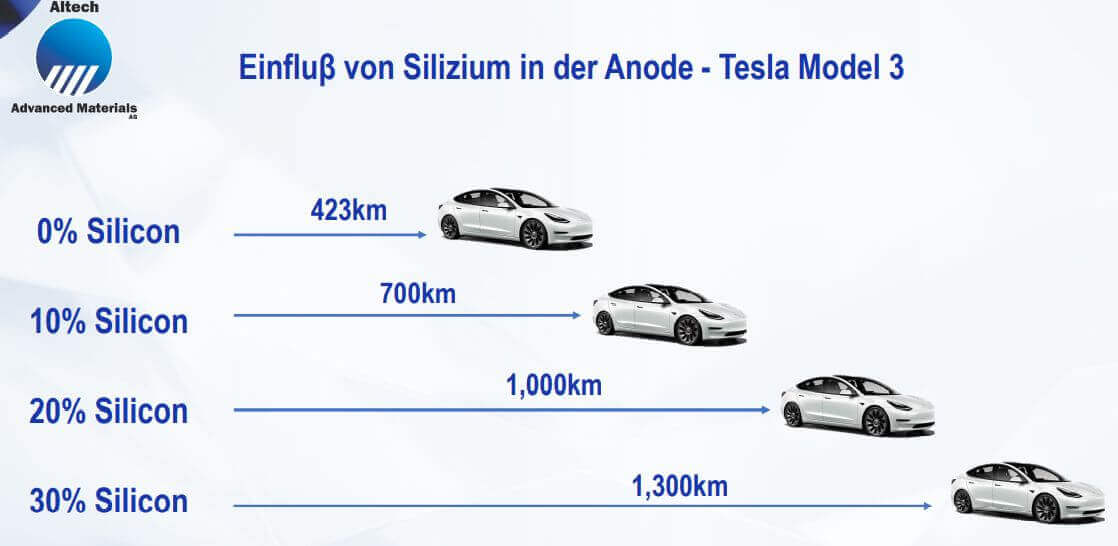

The second business is the application of alumina in the field of high-performance lithium-ion batteries, Silumina Anodes, in which Altech Advanced Materials owns 25% through a joint venture. The remaining 75% is held by the Australian company Altech Chemicals. Here, the novel coating technology has game-changer potential. Batteries are coated with a special nano-coating of high-purity aluminum oxide and an enrichment of silicon, which is intended to prevent the deposition of lithium particles on the electrodes. A loss of capacity, as can currently be observed in lithium-ion batteries, is thus significantly minimized.

This increases the performance of a battery by 15% and even extends its service life by 30%. In addition, further research showed that a doubling of the performance could be achieved with a targeted increase in the silicon content of the anode. The result of the pre-feasibility study for the planned ceramic coating anode composite plant in Schwarze Pumpe south of Cottbus showed clear potential. The project's pre-tax net present value (NPV) was said to be around EUR 420 million. Assuming a planned full capacity utilization of 10,000t p.a. at the production facility still to be built, this would result in EBITDA of EUR 52.00 million. Currently, the stock market value of the Heidelberg-based company is just under EUR 40 million, as mentioned above.

Altech defies supply chains

With regard to blown-up supply chains and scarce raw materials, the second joint venture formed also has game-changer potential. Altech Advanced Materials holds a 25% stake in the newly founded Altech Energy Holdings GmbH, and 75% is held by the listed Australian company Altech Chemicals Ltd. The joint venture, in turn, has now founded the new Altech Battery GmbH with the Fraunhofer Institute for Ceramic Technologies and Systems IKTS, the leading battery institute in Germany. It aims to produce and market a Sodium Alumina Solid State battery (SAS) under the product name CERENERGY.

Years of research work

In this regard, SAS-CERENERGY batteries have enormous advantages over conventional lithium-ion batteries and could replace current technology in the future. CERENERGY batteries are non-flammable and therefore fire- and explosion-proof, have a lifetime of more than 15 years and function in extremely cold and hot climates. The battery technology uses common salt and small amounts of nickel. In addition, neither lithium, cobalt, graphite, nor copper are required and thus function independently of critical supply shortages and price increases of raw materials. The manufacturing costs of CERENERGY batteries are also expected to be around 40% lower than those of comparable lithium-ion batteries, according to Fraunhofer.

The SAS technology to be commercialized has been developed by Fraunhofer IKTS over the past eight years. In the process, the energy capacity was significantly increased, and lower production costs were made possible. SAS batteries have already been successfully tested in terms of capacity in stationary battery modules. Currently, the SAS batteries of IKTS are in the final phase of product testing and are ready for commercialization. The plan here is also to start the first production line with an annual capacity of 100 MWh at the Schwarze Pumpe plant. Long-term plans call for the construction of additional lines up to a gigawatt battery plant.

Interim conclusion

The potential of Altech Advanced Materials could be seen even before the establishment of the new joint venture with the Fraunhofer Institute. The Heidelberg-based company already has a hot iron in the fire with its patented Silumina Anodes coating process. The joint venture between Altech Advanced Materials, Altech Chemicals Ltd and the Fraunhofer Institute for Ceramic Technologies and Systems IKTS now creates a new player that could herald a revolution in the nature of new batteries for the electric vehicle industry. However, it should not be forgotten that the road to mass production is still long and thus, despite great opportunities, there are risks. The next major goal is likely to be the launch of the announced pilot plant.

This update is based on the initial Report 02/2022