Energy transition, high-tech & armaments - tungsten remains in demand

The climate debate is taking up an increasingly large share of the political discussion in 2023. After years of hanging fire over nuclear power, the last 3 nuclear power plants in Germany were now shut down in mid-April. This increases efficiency pressure in industry, and important metals must remain available for energy renewal. For its part, the EU wants clear strategic agreements on how the procurement of rare metals will proceed and which countries can be considered stable partners for a secure supply of raw materials. Almonty Industries is ideally positioned in the tungsten sector with its properties in Spain, Portugal and South Korea.

Tungsten is extremely heat resistant and its melting point of 3,422 degrees Celsius is even higher than the performance of an electric arc furnace.

In the current geopolitical environment, it is clear that supply risks are now greater than ever. For some time now, tungsten has been considered a next-generation battery material, as the metal can replace the controversial cobalt. Asian manufacturers such as BYD also hope to increase charging performance, endurance and safety by increasing the proportion of tungsten in the sought-after traction batteries. Tungsten is capable of significantly increasing the energy density of the batteries. This allows EV batteries to be created on a smaller scale, saving space and weight simultaneously. In the robotics industry, tungsten carbide cutting tools are used for machining various materials, including metals and plastics, due to their exceptional hardness and wear resistance. If developments in the automotive and high-tech sectors continue as expected, tungsten demand could go through the roof. Currently, however, far too little material is available in the addressable portion of world markets.

Mine construction in South Korea enters final phase

Almonty is already producing approximately 78,000 metric tons of tungsten trioxide from the Panasqueira mine in Portugal. This is generating more than CAD 20 million in gross revenues per year. Both projects in Spain are in further permitting stages. They will commence European supply in the coming years. Very close to production start-up is the AKT tungsten project through subsidiary Woulfe Mining Corp. The deposit was discovered in 1916 but had to be closed in 1994 due to low tungsten prices. Almonty acquired the Sangdong mine in 2015 and is now bringing it back into production.

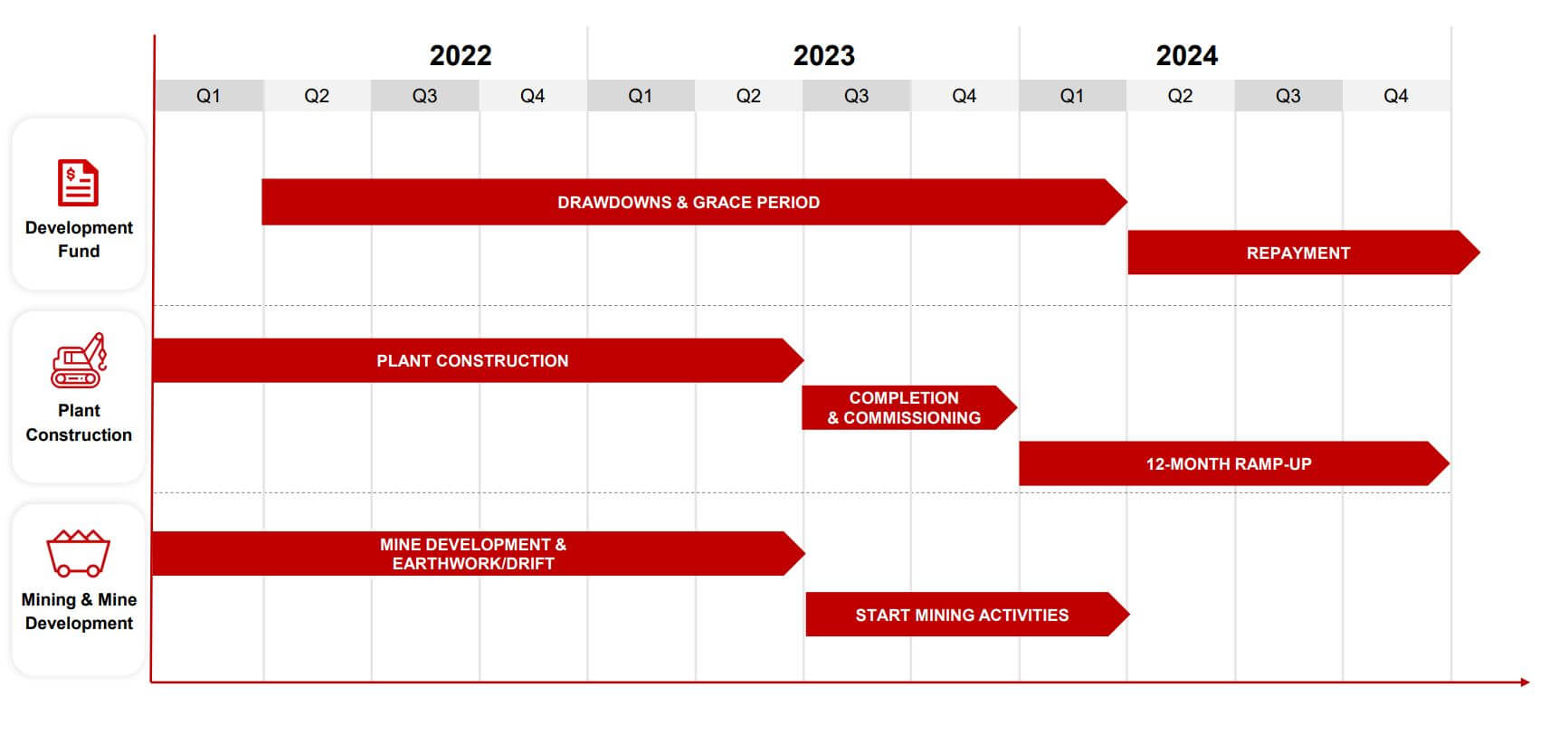

The mine expansion in South Korea is partially funded through a loan from KfW-IPEX Bank and totals USD 75.1 million. Disbursement is based on project progress; as of early April 2023, Almonty has now drawn USD 32.3 million of the committed amount. The Austrian export credit agency Oesterreichische Kontrollbank (OeKB) has guaranteed the loan. Almonty has completed a scoping study for the downstream nano-tungsten trioxide processing plant at Seok Moon, 28 km away. It is currently in another application process with the German Development Bank to finance the processing plant after KfW signed a letter of intent for up to USD 50 million in January 2022. It is now important that the mine construction be completed as planned in 2023, as tungsten trioxide from Seok Moon is already expected to be on the market in early 2024.

Figures for 2022 in line with expectations

Almonty Industries achieved gross sales of CAD 24,796 million in 2022, but the sharp depreciation of the US dollar against the Canadian dollar resulted in currency losses of CAD 2.9 million. Combined with financing costs of CAD 3.83 million, the net loss increased to CAD 14.49 million, or CAD 0.07 per share, for the period ended.

Lewis Black, CEO of Almonty, commented: "While operations at our Panasqueira mine in Portugal continues to show income and positive EBITDA from mining operations with a 9-fold increase in EBITDA compared to 2021 and a disciplined management of costs during some extraordinary inflationary events, the Company recorded a non-cash unrealized foreign exchange loss of CAD 2.9 million during the year as a result of an 8.5% fluctuation in the relative exchange rate between the US dollar and the Canadian dollar. In addition, there was a non-cash charge for share-based payments of CAD 3.8 million directly related to the successful closing of the KfW financing."

For 2023, analyst firm Sphene Capital estimates revenue of CAD 60.9 million and net income after tax of CAD 5.8 million. This estimate assumes that the start of production in Sangdong can still be implemented in 2023. Repayments on the loans taken out will not start until the mine has been commissioned.

Further financing steps successfully completed

In order to strengthen its equity base, Almonty placed 2.5 million Chess Depository Interests (CDI) with gross proceeds of CAD 2.0 million at the beginning of April. The securities were subscribed by institutional investors who wanted to further increase their shareholding in Almonty. Attached to each new share is a warrant entitling the holder to purchase one additional share at a price of CAD 1.25 until December 31, 2024. The capital will be used for working capital, increasing the possibility of further debt financing.

Already at the end of March, Almonty had been able to settle a loan receivable of CAD 3.287 million from Plansee Holding AG by issuing 4.5 million new shares at a settlement price of CAD 0.73. The Plansee Group's stake thus increased to 18.7% of the 223.171 million shares now outstanding.

Update at the 7th International Investment Forum (IIF)

CEO and founder Lewis Black will provide an update on the mine buildup at the 7.International Investment Forum on May 10, 2023 at 4pm (CET).

Conclusion: Clear progress, the goal is in sight

Thanks to the backing of several governments and major industrial companies looking for a reliable source of the rare metal, Almonty Industries is well positioned in the strategic resources market. The Canadians have now taken all the steps to make this important project a success. Mine construction is fully funded and progressing on schedule. Almonty Industries will thus become a core producer of tungsten outside China with the goal of significantly reducing the Western world's dependence on Beijing's plans. We attach great strategic importance to the geographical location, on the one hand in Europe, and on the other hand in South Korea, one of the most advanced Asian states with the battery producers Samsung and Toshiba. With this, Almonty has a significance that cannot be ignored and makes the Company a hot takeover candidate in the long run.

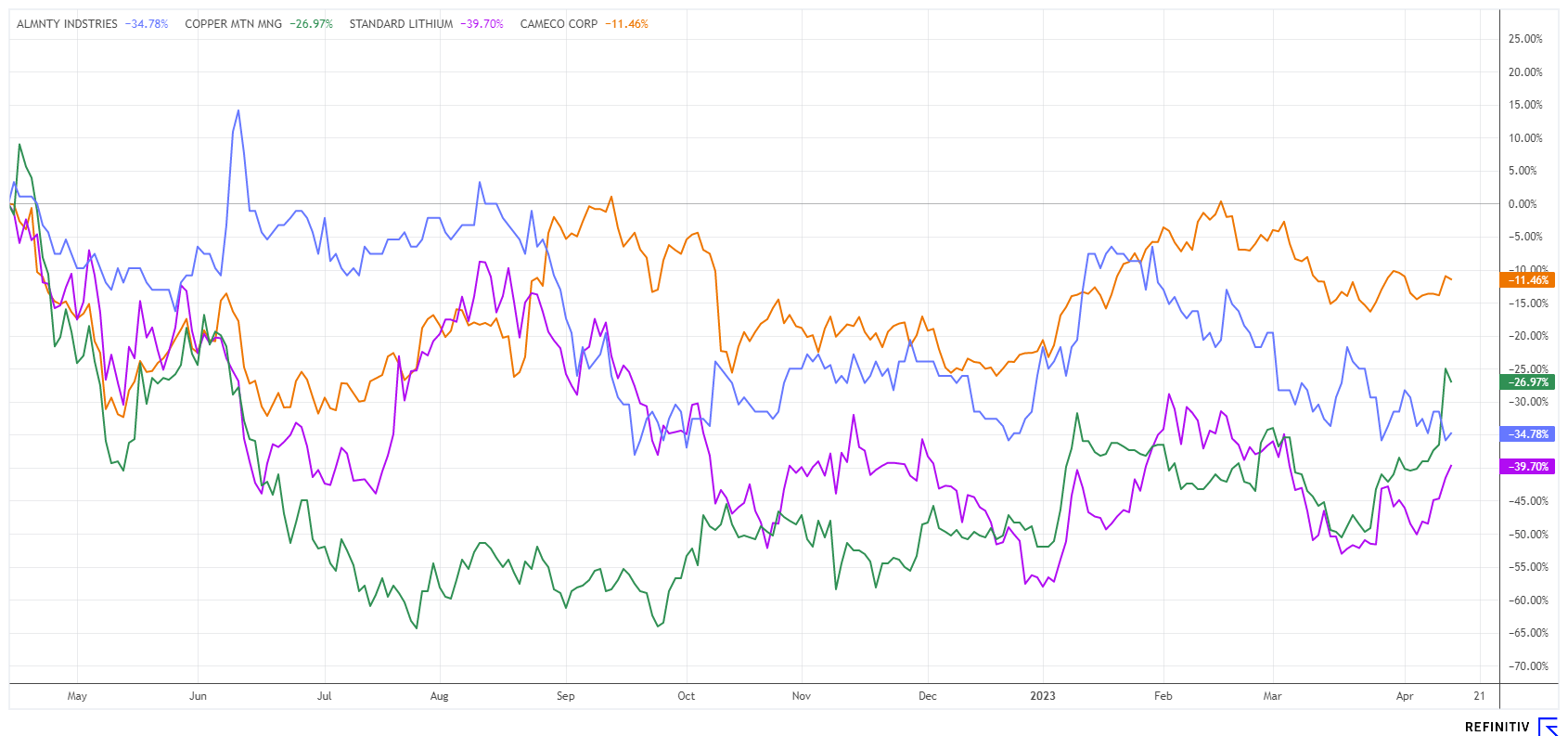

The 12-month price performance of well-known commodity companies such as Cameco, Standard Lithium or Copper Mountain indicates a stronger consolidation of commodity stocks. The Almonty share also corrected by a noticeable 34% in the period under review. The analysts of First Berlin had issued a buy recommendation with a price target of CAD 1.70 in 2022. A confirmation of this evaluation shows up also in the estimate of the experts of Sphene Capital. Here the vote is "buy" with a price target of CAD 1.66. Currently, the share is quoted at a low CAD 0.60, opening up a potential of 166%. A market capitalization of just under CAD 133 million is very low for the bright medium-term prospects for the start of production. With the expected recovery of the commodity markets, the AII share price could rise quickly here.

The update is based on the initial report 12/2021.