Globex Mining Enterprises: Commodities from A to Z

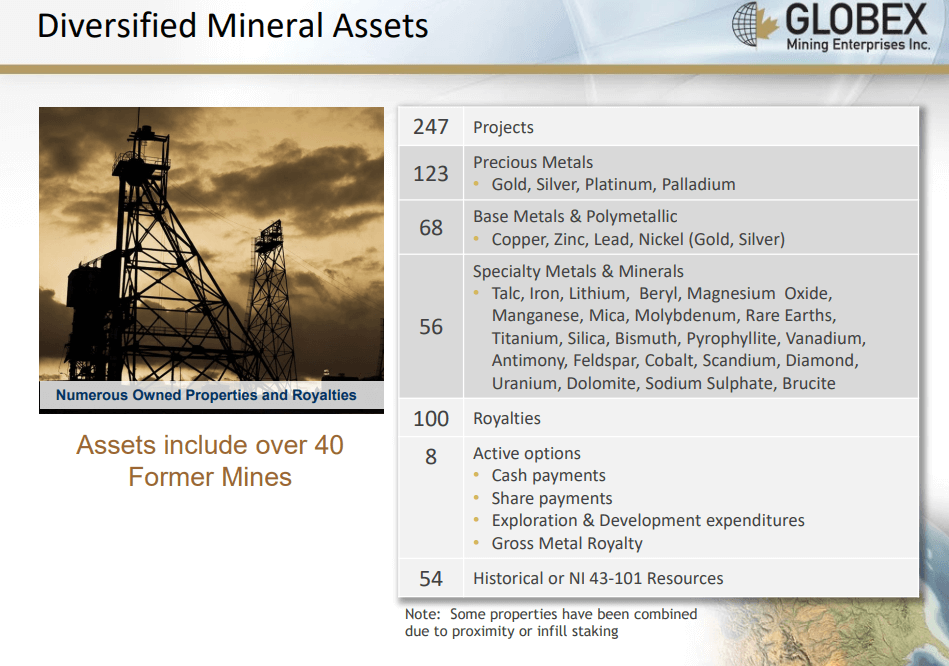

In the exploration sector, there are companies that explore only a handful of properties and let their investors finance them from one drilling section to the next. However, some multi-explorers acquire a large number of claims with little money and explore them through option agreements with local partners. In addition, there is a corresponding license fee (net smelter royalty), which is due when production begins on the mining property. Globex Mining Enterprises, based in Quebec, describes itself as a "mineral property bank" due to its many properties and various commodities. The portfolio now includes 247 projects in the current year. This means that the prospects for benefiting from the rising sentiment for gold & silver and selected industrial metals are excellent. Instead of significant single-project risk, the investor acquires over 200 opportunities in a promising stock market segment with one GMX share. The asset management concept of "do not put all your eggs in one basket" is optimally implemented with Globex Mining.

The deal flow is high

CEO Jack Stoch has been in this business since the 1980s, and the industry veteran is still constantly developing his network today. The Company's primary goal is not the investment-heavy development of a mining operation but rather the optimization and maintenance of broadly diversified properties.

Broad diversification in precious metals, non-ferrous metals, polymetals, specialty metals, and rare minerals. 100 royalties and some options.

Globex Mining currently reports new boron results from its partner Radisson Mining Resources Inc., specifically for the portion of the Kewagama Gold Mine for which Globex Mining receives a 2% net smelter royalty. High-grade gold mineralization ranging from 6.40 to 9.70 g/t was found over approximately 4 m of the mine. In the other zones around the Pontiac Sediments, 0.84 to 1.11 g/t AU were identified. As stated by Radisson, all drill cores from this campaign are NQ-size. Assays were performed on the sawn half cores with the second half retained for future reference.

Partner Brunswick Exploration Inc. also reports further significant Li2O intersections on Globex's Lac Escale (Mirage Project) license areas in the Eeyou Istchee (James Bay) region of Quebec. Intersections of up to 1.55% lithium oxide (Li2O) over 93.45 m and 1.05% Li2O over 34.05 m were encountered. As is standard practice at Brunswick, all drill core samples were taken under the supervision of BRW staff and contractors. The drill core was then transported by helicopter and truck from the drilling platform to the core logging facility in Val-d'Or.

Sentiment for precious metals improving gradually

The year 2024 could turn out to be a good year for commodities. Partner drilling programs could be continued in many properties under the recently improved refinancing conditions. There are signs, especially in North America, that sentiment could now improve for several years to come. Added to this are the major geopolitical uncertainties worldwide. They are drawing investors' attention to secure jurisdictions. Commodity experts see precious metal prices on a strong upward trend towards USD 2,500 for gold and USD 50 for silver after a 3-year consolidation. With this price outlook, Globex's current portfolio would have to experience an appreciation of 200 to 300%.

Interim conclusion: the starting position is now better than ever

While the spot prices of precious metals have already reached positive territory in the last six months, both large and small mining companies are only at the beginning of a longer upswing. One reason for the reluctance of market participants is the cost explosion in the entire sector, which has caused the exploration and production prices of precious metals to rise by around 20 to 30%. However, market sentiment is currently in upward mode. Globex Mining traditionally has its costs under control because it acts as an asset manager and does not conduct drilling itself. This initially incurs no costs, and if a project is successful, Globex either receives option income or generates royalties.

The GMX share has recently recovered from its lows of around CAD 0.60, with market capitalization rising from CAD 36 million to the current CAD 54 million within six months. The share price is currently fluctuating between CAD 0.90 and CAD 1.00 with good turnover. The share price is supported by a constant deal flow, continued option income and new royalty deals. In addition, the Company had CAD 24.6 million in available funds and valued company shares as of December 31, 2023. With these resources, Jack Stoch can make the most of the opportunities that arise in the current year. GMX shares should continue to outperform the resources sector due to the large number of high-quality projects, the high diversification across the entire commodities sector and the prospect of promising deals. The share reached CAD 1.70 in the last bull cycle. This level now appears to be within reach again. Collect!

The update follows the initial report 11/2022.