Strong positioning with partner Cipher Neutron

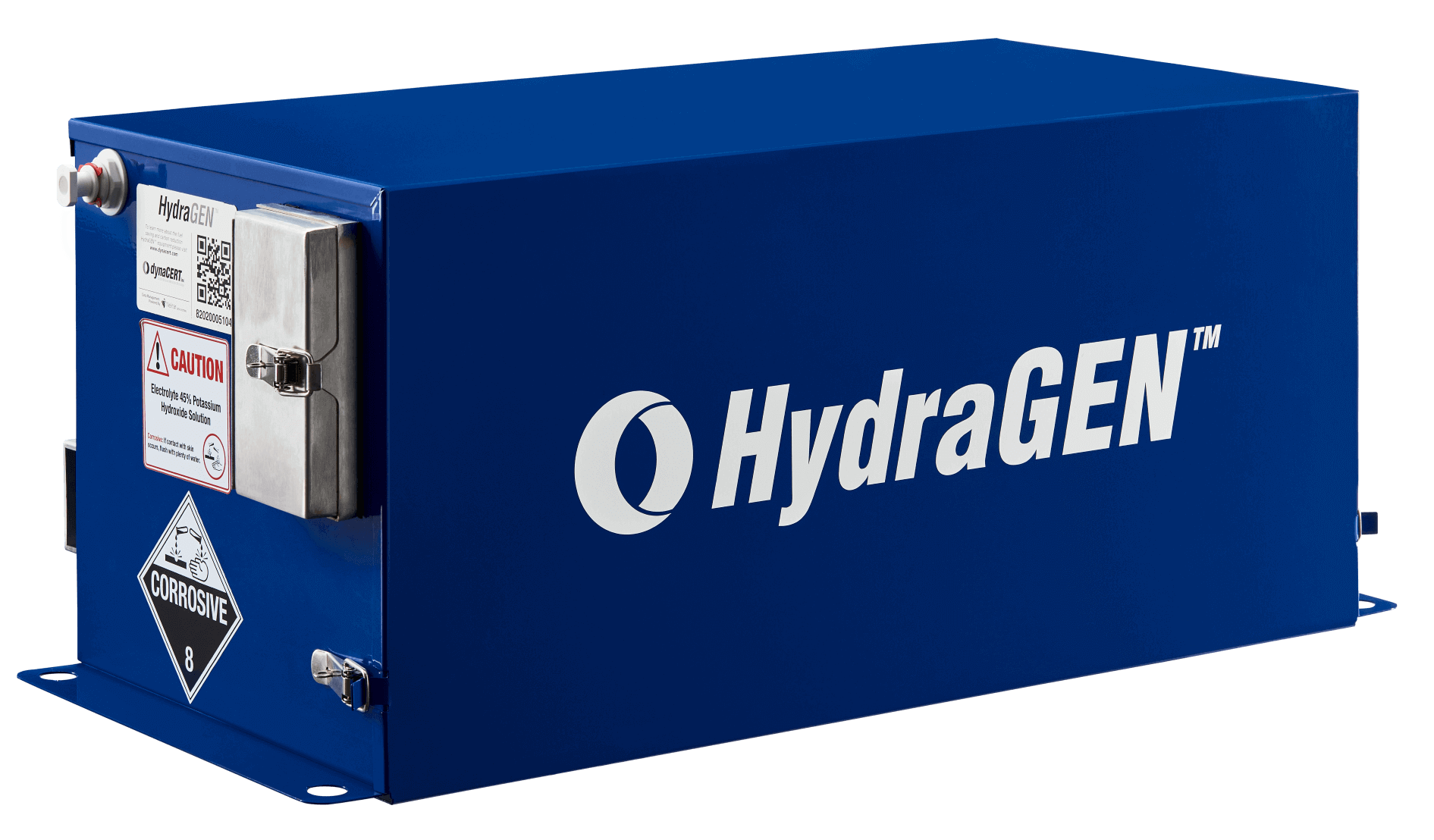

One representative of applied hydrogen technology is the Canadian company dynaCERT. For several years now, the Toronto-based company has been researching technologies that actively use hydrogen to reduce greenhouse gases. Together with its partner Cipher Neutron, it has already landed several important major contracts since summer 2023. In joint projects, for example, they are involved in producing anion electrolysers for green steel production. dynaCERT itself is already supplying a large number of its HydraGEN™ solutions to international transportation and mining companies. The associated fuel savings enable these companies to improve their carbon footprint.

It is now announced that dynaCERT and its partner Cipher Neutron have received the first order for the purchase of its unique electrolysis technology based on anion exchange membranes (AEM). The AEM electrolysers for the production of green hydrogen and reversible fuel cell technology enable the production of hydrogen without the use of platinum group metals (PGMs) such as platinum, iridium and ruthenium. This makes Cipher Neutron's AEM electrolysers one of the most sustainable solutions currently commercially available for the production of large quantities of green hydrogen. Reversible fuel cell technology allows operation in both directions to produce electricity from hydrogen and also hydrogen from water. Reversible fuel cells are an attractive alternative to conventional storage media such as batteries, as they eliminate the need for frequent recharging and reduce long-term maintenance.

Already a big hit at trade fairs

dynaCERT has already exhibited at the IAA Transportation in Hannover in 2022, where the spirit of optimism surrounding hydrogen was palpable. French sales partner IPMD SAS also had a large stand at the Solutrans trade fair for urban logistics and transport. Solutrans is a biennial event organised by the Fédération Française de Carrosserie, which combines innovation and information in the field of heavy commercial vehicles. It took place as an international forum for heavy and light commercial vehicles from November 21 to 25, 2023, in Lyon (France).

According to dynaCERT's distribution partner IPMD SAS, the Solutrans 2023 trade fair marked the official launch of HydraGEN™ technology in France and ended with a very satisfactory result for both dynaCERT and its distribution partner. As the distribution partner explained, the biennial trade fair for industrial and urban vehicle transport is a mobilising event on critical issues in the transport sector, where the main aim is to promote the energy transition. IPMD SAS also pointed out that dynaCERT's HydraGEN™ technology has been very well received by transport companies and mobility professionals in France because it represents a concrete and immediate solution to the energy and ecological transition challenges. In preparation for its market launch in France, HydraGEN™ technology has already been in use by several French transport companies since May 2023 via IPMD SAS, where it is being tested in various vehicles from seven manufacturers: Trucks, public buses, school buses and commercial vehicles.

Enrico Schläpfer, VP of Global Sales at dynaCERT, explains: "The official launch of HydraGEN™ technology at this year's Solutrans in Lyon by IPMD has generated significant interest from the French transport industry and related industry associations. This shows again how important this particular industry's decarbonization can be."

The HydraGEN™ technology is used to reduce pollutant emissions such as CO2, NOx, etc. and thus benefits cities, urban centres and rural areas. The partners are very optimistic about the development of HydraGEN™ technology in France in view of further purchase commitments before and during Solutrans and the installations planned before the end of the year. The next step now involves negotiations with dealers and lorry workshops, which will further strengthen and expand the network of dealers and installation companies. The topic is, therefore, also gaining traction in Europe.

VERRA certification is on its way

For some time now, dynaCERT has been subjecting its technology to a certification process which, once approved, allows carbon reduction certificates to be issued together with technological solutions. These certificates come at a price: each tonne of CO2 emissions saved is currently worth around USD 75 on the international commodity exchanges.

dynaCERT has now announced that it has received the final assessment report from Earthood Services Pvt. Ltd. regarding the methodology for improving the efficiency of fleet vehicles and internal combustion engines. This report was requested by Verra per the stipulated terms and conditions and was delivered by Earthood within the agreed-upon timeframe. It supports the methodology that dynaCERT will use to validate its emission certificates under VERRA's VCS programme. The currently offered HydraGEN™ and HydraLytica™ technologies have been developed to reduce CO2 emissions from diesel engines.

With certification, dynaCERT's products gain significant relevance, especially for public institutions that need to reassess their ESG sustainability parameters annually. The installation of dynaCERT's technologies can have a significant impact on the environmental footprint of the transport companies that commission them.

CEO Jim Payne comments: "On behalf of dynaCERT, I would like to thank Earthood for delivering the assessment report on time, as previously agreed between Verra and ourselves. dynaCERT's work on developing our unique carbon credit capabilities is progressing on schedule and will bring significant benefits to users of our proprietary HydraGEN™ technology and HydraLytica™ technology."

Interim conclusion

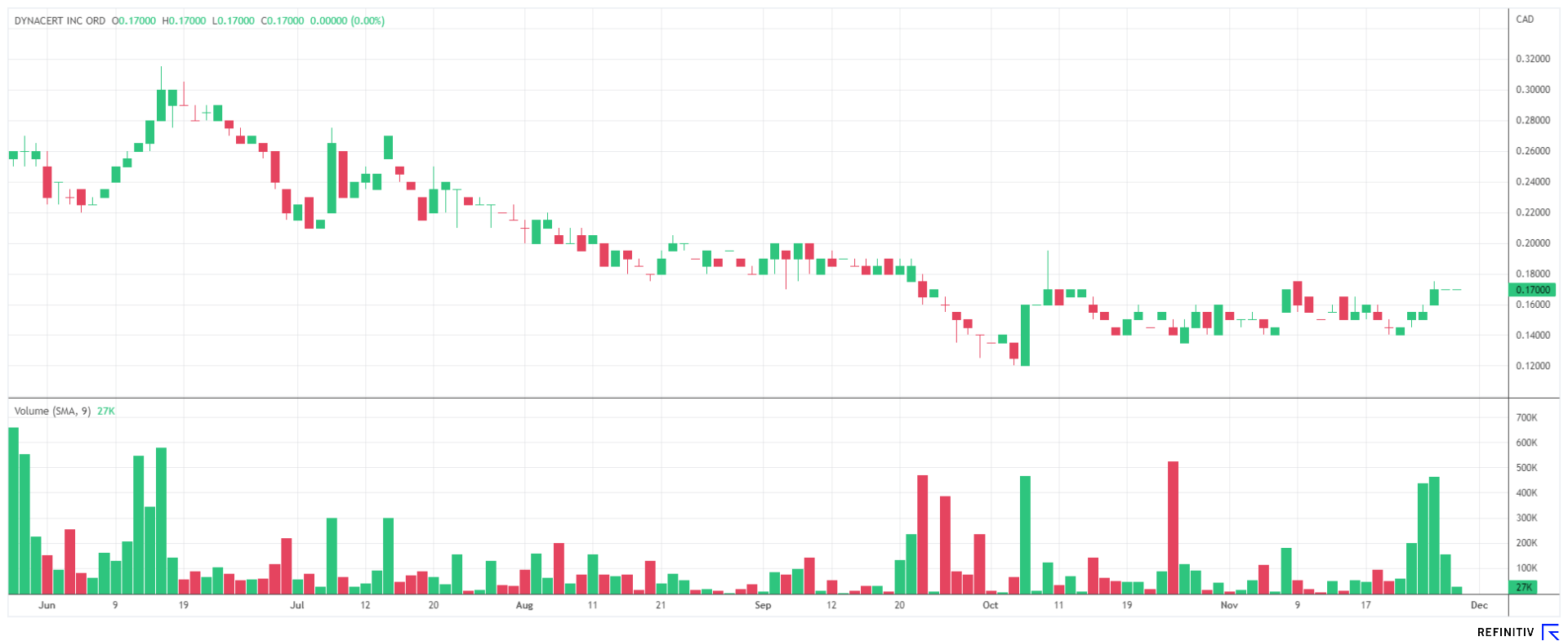

The dynaCERT share is currently trading between CAD 0.15 and 0.18. Investors are currently awaiting certification from VERRA. The management anticipates that the examination for certificate issuance should be completed by the end of the year. Given the wealth of solutions, dynaCERT's market capitalization of CAD 60 million is surprisingly low. This could change in a flash, as sales have picked up noticeably in recent days due to new investor purchases. At the moment of VERRA certification, there should be a significant upward movement as it confirms the medium-term context of the Company. Furthermore, the current valuation represents only a fraction of the investments made in recent years.

CEO Jim Payne will report on the latest developments at dynaCERT on December 5, 2023, as part of the 9th International Investment Forum at 16:30 CET and will be available for questions live. Click here for free registration.

The update is based on the initial report 11/2022