High momentum in the gold price shifts focus to juniors

The debt rounds of Western countries are accelerating more and more. Since the suspension of the debt limit in the US alone, US government debt has jumped from USD 32 trillion to around USD 34 trillion in just 6 months. Inflation, which has been on the rise since 2022, peaked at 12% and has recently receded somewhat due to some base effects. Investors looking to protect their assets can no longer ignore investing in precious metals. The average return on gold since 1995 has averaged 7.8% per annum. Even equities could only beat that with optimal timing. The recent momentum in the gold price has brought the long-neglected "junior explorers" back into focus. They concentrate on identifying promising properties that contain future resources for larger mining companies.

Right in the middle of it

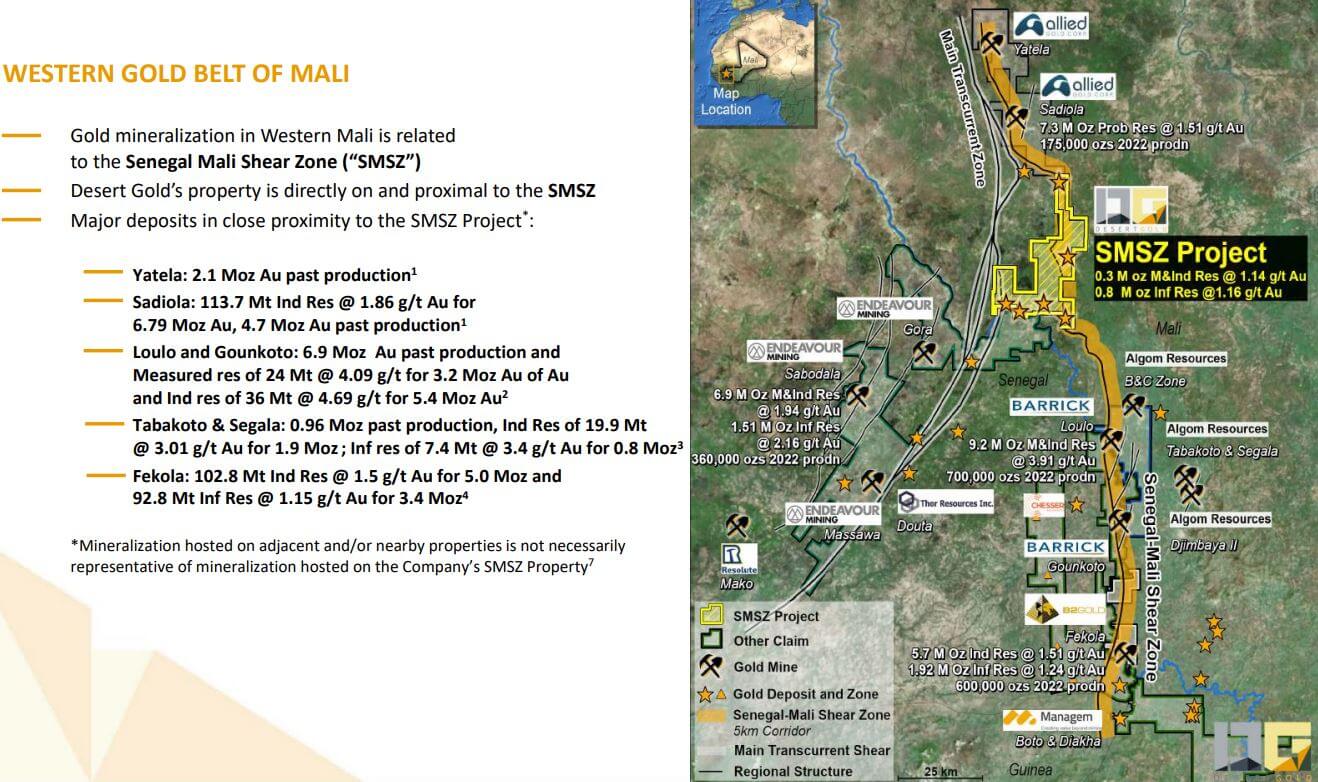

With the SMSZ project in Mali, the Canadian company Desert Gold owns one of the largest non-producing land areas in West Africa. The 440 sq km are located in the immediate vicinity of several producing mines, including Barrick Gold, Allied Gold, Endeavour Mining and B2Gold. Desert has already discovered 24 gold zones in its district, which are to be developed and analyzed for economic grades. For their part, the majors in the neighborhood are constantly searching for mine expansions. Under the new name Allied Gold, the ex-Yamana management has already amassed a portfolio of gold projects with estimated mineral reserves of around 10 million ounces of gold over the last 10 years.

The border zone between Mali and Senegal is blessed with gold. Fortunate are those who place the drill in the right place. So far, Desert Gold has already proven 1.1 million ounces of gold in just 5 zones, and work is now continuing in 19 further zones. Desert Gold is planning approximately 30,000 meters of exploration here for 2024. Not far north of the Desert properties are the reactivated Yatela and Sadiola districts, both under the management of Allied Gold. They have historically produced 6.8 million ounces of gold.

The search continues.

The two projects are considered to be among the most profitable mines in the SMSZ zone. However, the search continues because African producers earn real money above the USD 2,000 spot price. In Mali, gold is close to the surface, which puts the average cost per ounce in the USD 850 range on a sustainable basis. Given the high takeover activity in the region, a drastic appreciation is likely to be on the cards when a neighboring major comes knocking.

Allied Gold's IPO attracts attention

It had been quiet in the gold sector for a long time, but rising inflation and precious metals prices are fueling takeover fantasies worldwide. With the listing of Allied Gold, another precious metals company with a valuation of CAD 875 million, is now on the stock exchange. Allied owns the Sadiola mine and two other projects in Cote d'Ivoire and Ethiopia. B2Gold's Fekola mine is also located in the Senegal-Mali-Shear zone, not far from two other mines owned by industry giant Barrick Gold. The region is highly interesting and may be on the verge of the next consolidation. The Moroccan Managem Group acquired IAMGold at the end of 2022. They acquired their exploration projects in the tri-border of Senegal, Mali and Guinea, also located in the SMSZ. The local Barrick Gold and B2Gold have been inactive recently, but their coffers are full. With declining mine lifespans, they need new properties to maintain their production in the medium term.** This directs attention to Desert Gold, as promising mineralization has already been discovered in the Mogoyafara South and Gourbassi West zones, which will now be identified in more detail in the coming year.

The outlook sounds promising

CEO and President Jared Scharf is confident that 2024 can bring a major game changer, as management is looking at a feasibility study to evaluate gold mining by heap leaching in the Barani East concession area. The preliminary assessment has been very positive, and the aim is to complete the study in the first half of 2024. This would make it possible to start production in the second half of 2025. The Company is currently negotiating with potential strategic partners to fund the pre-feasibility study and mine development. In terms of exploration, Desert Gold aims to conduct targeted work in its Tier 1 exploration zones in 2024 to more than double resources to over 2 million ounces of gold by the end of 2025 and move 50% of these resources from the Inferred to Indicated category. A total of 30,000 meters of drilling are planned. The investment community should soon be able to welcome new investors due to the timely installation of initial production.**

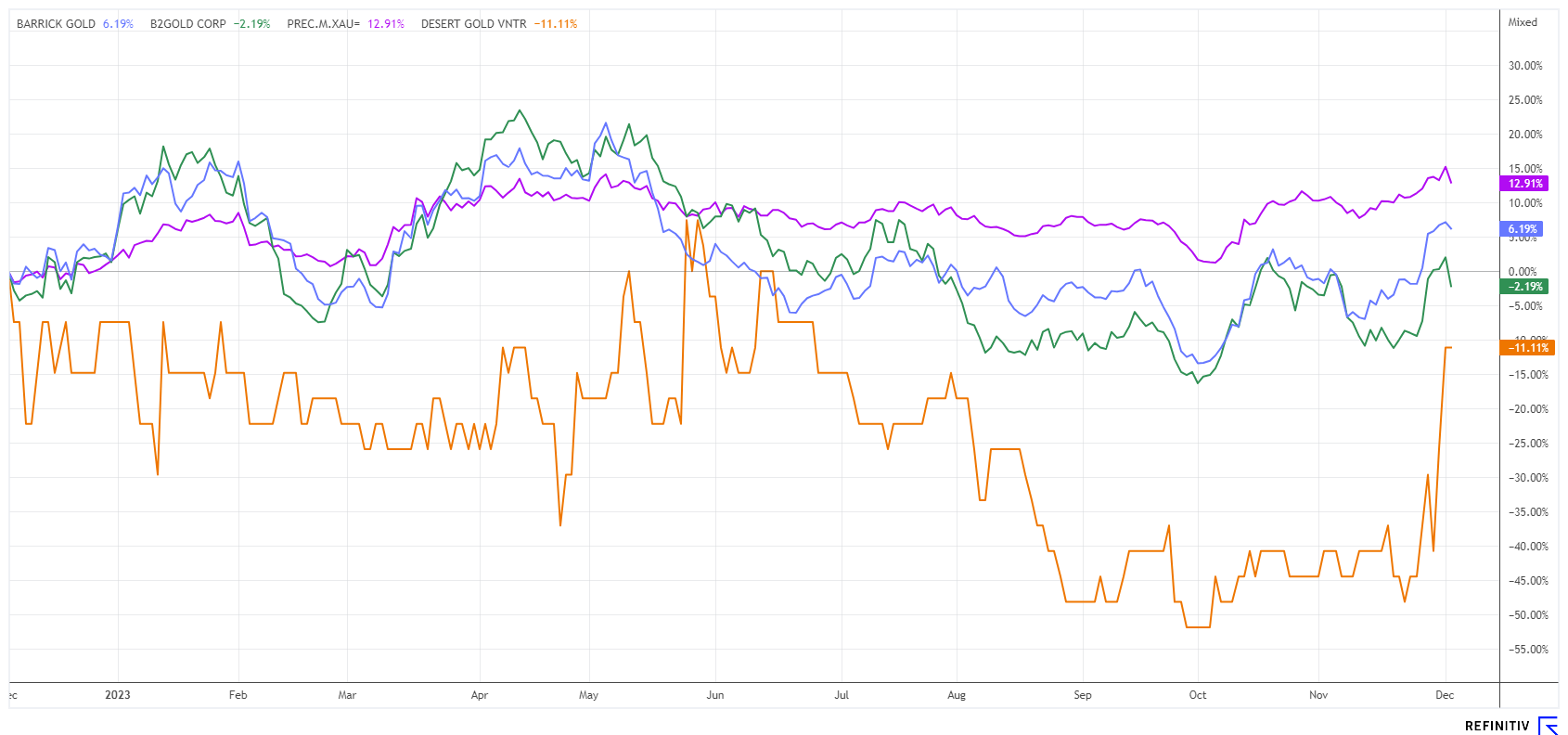

Interim conclusion: Positioned for multiplication

The Desert Gold share has so far only been able to show a sideways movement in 2023, but this is an outstanding performance compared to the peer group of juniors in the gold sector, as the average losses in the sector amount to approx. 50%. Nevertheless, the gold price rose by just under 13% in the SPOT analysis. This is due to the current financing pressure on smaller companies as they have to raise new funds for their exploration in an increased interest rate environment. Only those who deliver excellent drilling results can hope to win the favor of investors. If the first takeover activities make the rounds, junior explorers will very quickly become the focus of investors and will be able to make disproportionately high speculative gains. Time is, therefore, of the essence for Desert Gold, as the potential takeover price increases with every further expansion of resources, should a deal be reached. It is also a good sign that management is not considering further dilution at the current level.

Desert Gold has done well and has not had to raise new money at these low prices. The total number of fully diluted shares is currently 279.5 million, with just under 17 million warrants maturing in 2024 with subscription prices of CAD 0.18 and CAD 0.25, respectively. A good 32 million warrants could still be exercised at CAD 0.08 by December 2025. This provides the management with a good source of financing for the coming year. Should the gold price reach a new high, the high price momentum in Desert Gold will likely continue. Given an upcoming feasibility study, the first production figures for Barani East should be available by mid-2024. Due to the extremely low valuation of CAD 17 million, a possible takeover or interest from larger investors should be anticipated at a significantly higher level.

The update is based on our initial report 11/21.