Climate change creates boom in metallic commodities

The EU and North America are currently seen as leading the Greentech wave in the wake of climate engineering renewal. A full USD 2.5 trillion has been budgeted to guide infrastructures through the energy transition. This increases efficiency pressures in the industry, and important metals must remain available for technological renewal.

demand could rise to around 135,000 t by 2032.

For its part, the EU wants clear strategic agreements on how the procurement of rare metals will proceed and which countries can be considered stable partners for a secure supply of raw materials. In the area of tungsten, Almonty Industries is ideally positioned with its properties in Spain, Portugal and South Korea.

An outstanding positioning

With 3 mines in Spain and Portugal, the Group's flagship is now located in South Korea. The Almonty Korea Tungsten ("AKT") tungsten deposit there bore the former name Sangdong Mine and was one of the world's leading tungsten producers for more than 40 years. After the planned recommissioning in 2024, AKT is expected to become the largest tungsten mine outside China. Already during the reactivation phase, the management around Lewis Black was able to conclude a 15-year offtake agreement with the Austrian raw materials conglomerate Plansee Group. Plansee is one of the world's leading tungsten suppliers, with around 11,000 employees and production sites in about 50 countries. The conditions for Almonty are very attractive: A minimum offtake price of USD 235 per metric ton unit (MTU) could be negotiated for a minimum term of 15 years.

Almonty can expect an estimated operating cash flow of at least USD 580 million over the life of the agreement at today's price structures. Yet the agreement covers only about 50% of production, with the remainder available for sale in the market at spot prices. The European high-tech industry, which is affected by supply chain constraints, will be pleased with this additional capacity. Since the Sandong mine is also located only a short distance from the important industrial zones of South Korea, the additional production can be delivered very cost-effectively to the global companies Samsung, Toshiba, Kia and Hyundai. South Korea is so far the largest per capita consumer of tungsten, megatrends such as e-mobility, artificial intelligence and metaverse play a decisive role for the Asian country as a counterpart to the regionally overpowering China.

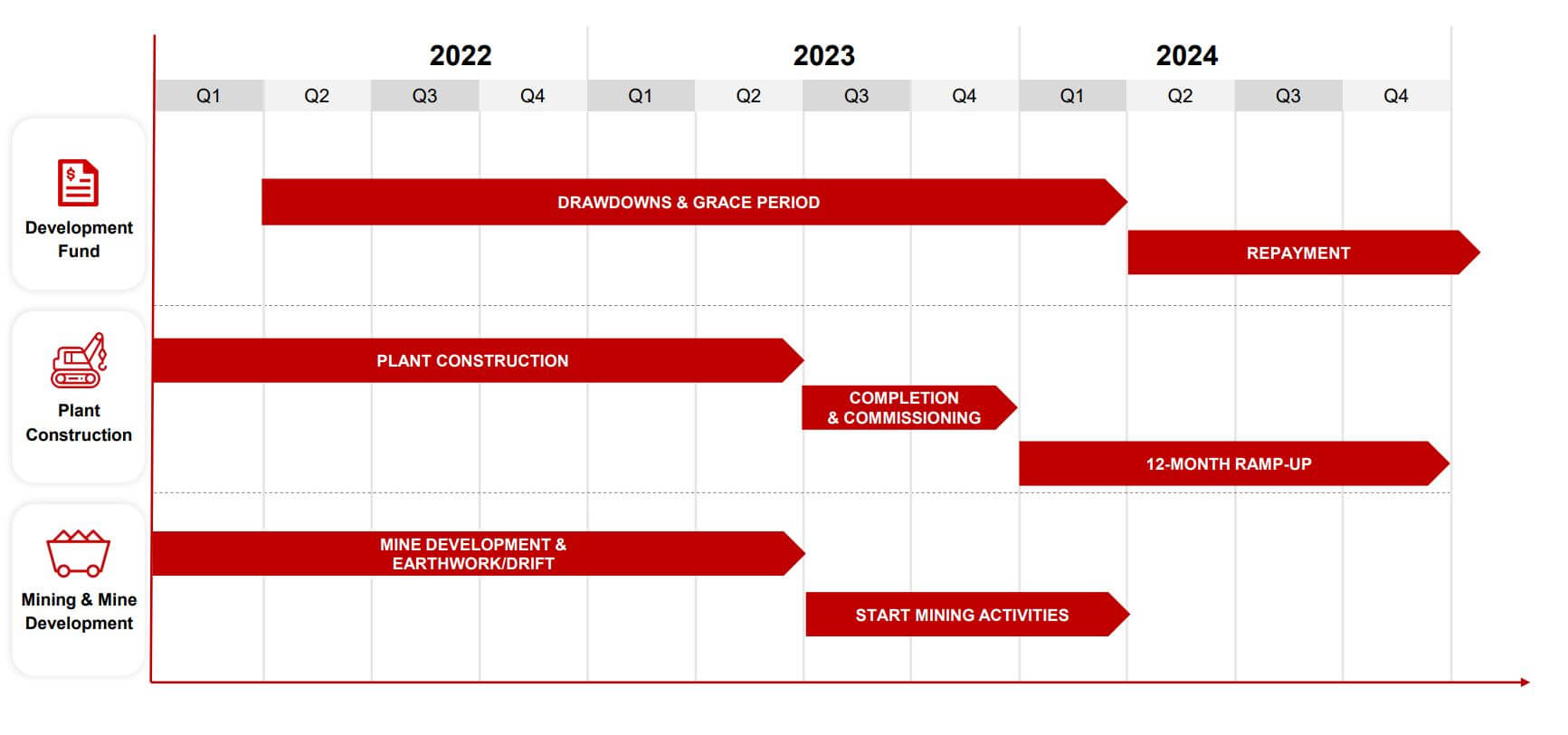

Mine construction is on track to be completed by the end of 2023

Almonty is already mining tungsten trioxide from the Panasqueira mine in Portugal, generating more than CAD 20 million in gross revenues per year. Both projects in Spain are in further approval stages and will contribute to the European supply in the coming years. The planned start in South Korea is now crucial.

Almonty provided an update on the progress of its design work in June 2023. Lewis Black, Chairman and CEO, commented: "We made solid progress on the Sangdong tungsten project in May 2023. The arrival of the Pebble Crusher and Primary Jaw Crusher means that we now have 100% of the Ball Mill and SAG Mill equipment on site. We will complete construction by the end of 2023 and commission the project in the first half of 2024."

Almonty is guided by the highest standards of safety, quality, and environmental sustainability. On-site teams are highly committed and operating on schedule. Disbursements of the KFW financing tranches are also on schedule. The arrival of the essential equipment is now an important milestone for Almonty Korea. The supplier is European partner Metso Outotec. Shipping and erection of the major components are currently taking place. Other equipment also manufactured by Metso Outotec, including ultra-fine screens, apron feeders and flotation tanks, is nearing completion and will soon be shipped from Europe to Sangdong. The startup of the vertically integrated nano-tungsten oxide processing plant will enable Almonty Industries to expand its strategic position in the region significantly. With a potential production capacity of 3,000 to 4,000 t, the global market share from this production facility alone is initially around 5%. This would make Almonty one of the largest suppliers outside China right from the start.

Once the downstream plant is running at 100% capacity from 2026, we could provide up to 30% of non-Chinese tungsten supply, CEO Lewis Black said in his latest presentation at the International Investment Forum in May 2023. There will be an update from the Company at the next IIF on October 10.

Time is of the essence to close the strategic gap

In the current geopolitical environment, it is clear that supply risks are now greater than ever. For some time, tungsten has also been considered a next-generation battery material, as the metal is capable of replacing the controversial cobalt. Asian manufacturers such as BYD also hope to increase charging performance, endurance and safety by increasing the proportion of tungsten in the sought-after traction batteries. Tungsten is capable of significantly increasing the energy density of batteries.

Thanks to the backing of several governments and major industrial companies looking for a reliable source of the rare metal, Almonty Industries is well positioned in the strategic resources market. The Canadians have now taken all the steps to make this important project a success. Mine construction is fully funded and progressing on schedule. Almonty Industries will thus become a core producer of tungsten outside China with the goal of significantly reducing the Western world's dependence on Beijing's plans. Almonty will also make significant progress by supplying South Korean battery manufacturers. Due to the high market dynamics in the e-mobility sector, it is crucial to implement strategic positioning as soon as possible.

Conclusion: Mine launch in sight, share price in wait-and-see mode

The analysts at First Berlin had issued a buy recommendation with a price target of CAD 1.70 at the end of 2022. In May 2023, the experts from Sphene Capital did the math again. The analysts argue as follows: "The expansion of proprietary value creation through the construction of a vertically integrated nano tungsten oxide processing plant to supply the South Korean battery anode and cathode manufacturing industry would unlock additional value creation potential for Almonty and provide the Company with significant earnings growth, which we believe is not yet reflected in the current share price." The current rating is "Buy", with a price target of CAD 1.66.

The 48-month chart of Almonty shares reflects the lengthy and costly mine build-up in South Korea. Over the last 4 years, the share price has fluctuated between CAD 0.50 and CAD 1.40 in a volatile commodity market. Currently, the share can be bought again for around CAD 0.60. A market capitalization of just under CAD 134.5 million is very low in the advanced stage of mine development and currently offers investors a good basis to be part of the market entry for tungsten products in 2024. With high strategic value, Almonty's geographic location is firstly in Europe and secondly in South Korea, one of the most advanced Asian countries with resident battery producers Samsung and Toshiba. Knowledge of new sources of supply alone could force larger, Western producers into strategic decisions very quickly. Almonty Industries should already be on the radar of larger investors due to its low valuation.

The update is based on our initial report 12/2021.