Breaking news: Option to acquire the Tiegba Gold Project

The news flow for Canadian explorer Desert Gold (WKN: A14X09 | ISIN: CA25039N4084 | Ticker symbol: QXR2 | TSX-V: DAU) could hardly be better right now. With the recent signing of an option agreement with Flower Holdings SARLU to acquire a 90% interest in the Tiegba Gold Project, the Company - currently valued at only CAD 19 million - is taking the next steps in its expansion. The seller is Flower, a private company based in Abidjan, Ivory Coast. The signing of the option agreement for this unexplored project represents a major milestone for Desert Gold, as it adds another highly promising zone to the Company's portfolio. After a lengthy period of inactivity, Desert Gold is now successfully transitioning into a regionally diversified gold exploration and development company in West Africa. The story is really gaining momentum!

Highlights of the expansion into the Ivory Coast

The Tiegba Project is located in the Ivory Coast, one of the region's most progressive and investor-friendly jurisdictions. In recent years, this West African country has become an increasingly attractive destination for investors in the gold sector. One of the main reasons for this is the country's geological composition: it is located in the Biriman greenstone belt, one of the most resource-rich zones in West Africa, home to numerous large gold deposits. In contrast to neighboring countries such as Ghana, however, Côte d'Ivoire is still relatively unexplored, offering scope for new discoveries and significant growth potential.

In addition, there is significantly improved political stability and a reform-oriented, investor-friendly government that has created favorable tax conditions and transparent licensing procedures. The country has also invested in infrastructure, particularly in road construction and energy supply, which is crucial in remote exploration areas. Operating costs for mines are relatively low due to low wages and favorable conditions, which further increases the country's attractiveness. A clear increase in gold production is already evident, from around 12 tons in 2010 to over 48 tons in 2023. With companies such as Barrick Mining, Endeavour Mining, and Perseus Mining, several international industry giants are already active in the country, reflecting the industry's confidence in the local conditions. Overall, Côte d'Ivoire combines geological opportunities with growth-friendly economic policies, positioning itself as one of Africa's most exciting gold markets.

Desert Gold (WKN: A14X09 | ISIN: CA25039N4084 | Ticker symbol: QXR2 | TSX-V: DAU)

- Côte d'Ivoire is emerging as an up-and-coming gold producer in West Africa

- Stable political situation and mining-friendly jurisdiction

- Rapid approvals for new projects

- Excellent infrastructure with many paved roads

- Underexplored areas offer high exploration potential

- Significant recent discoveries with newly developed mines, such as the Koné project by Montage Gold

- A 297 km2 strategic land package in the Tier 1 Birimian orogenic gold belt

- Significant interest from Tier 1 producers such as Barrick Mining, Endeavour Mining, Allied Gold, and Perseus Mining

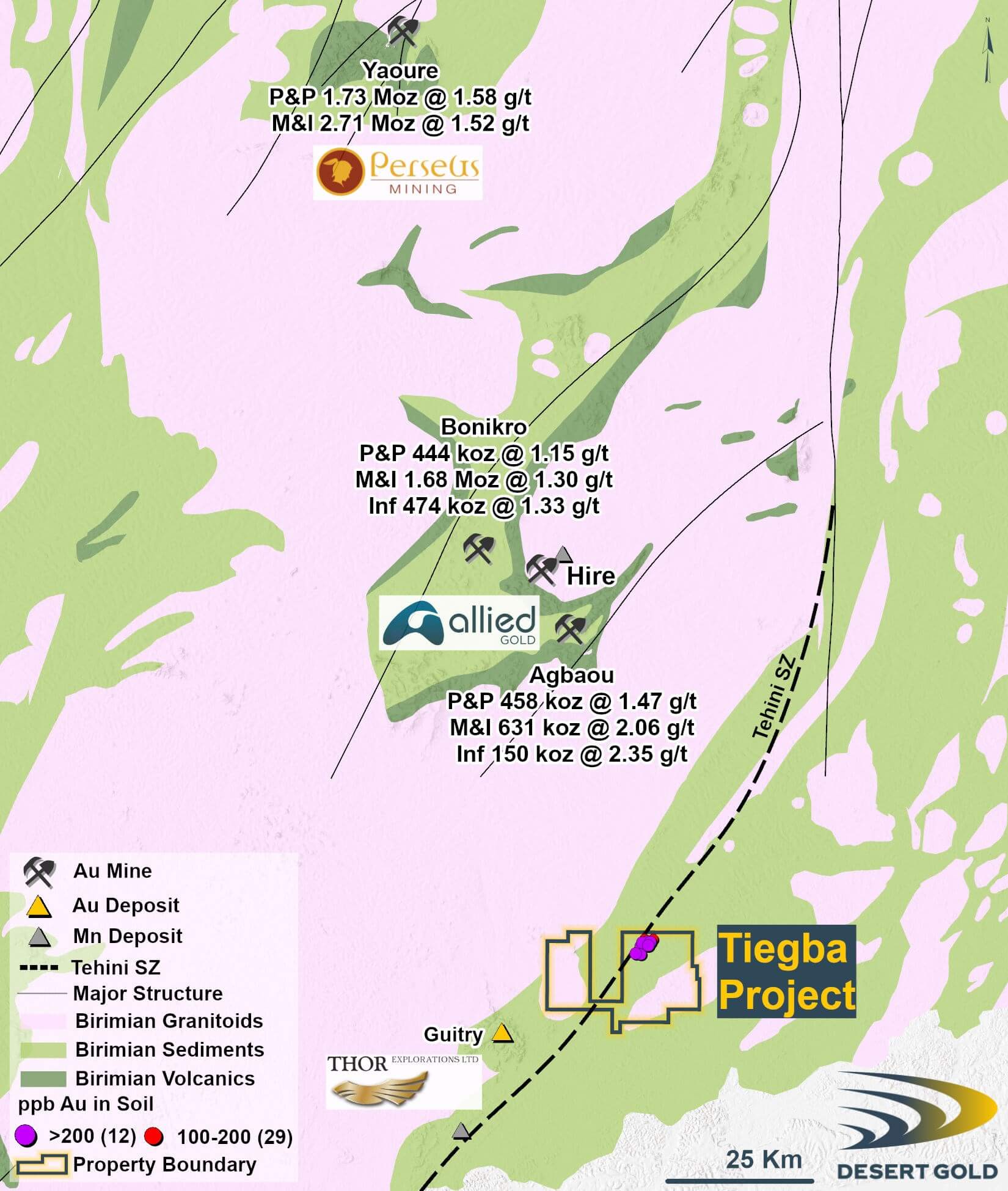

- Located near multi-million-ounce deposits, including Agbaou (Allied Gold Corp), Bonikro/Hire (Allied Gold Corp) and Yaouré (Perseus Mining Ltd)

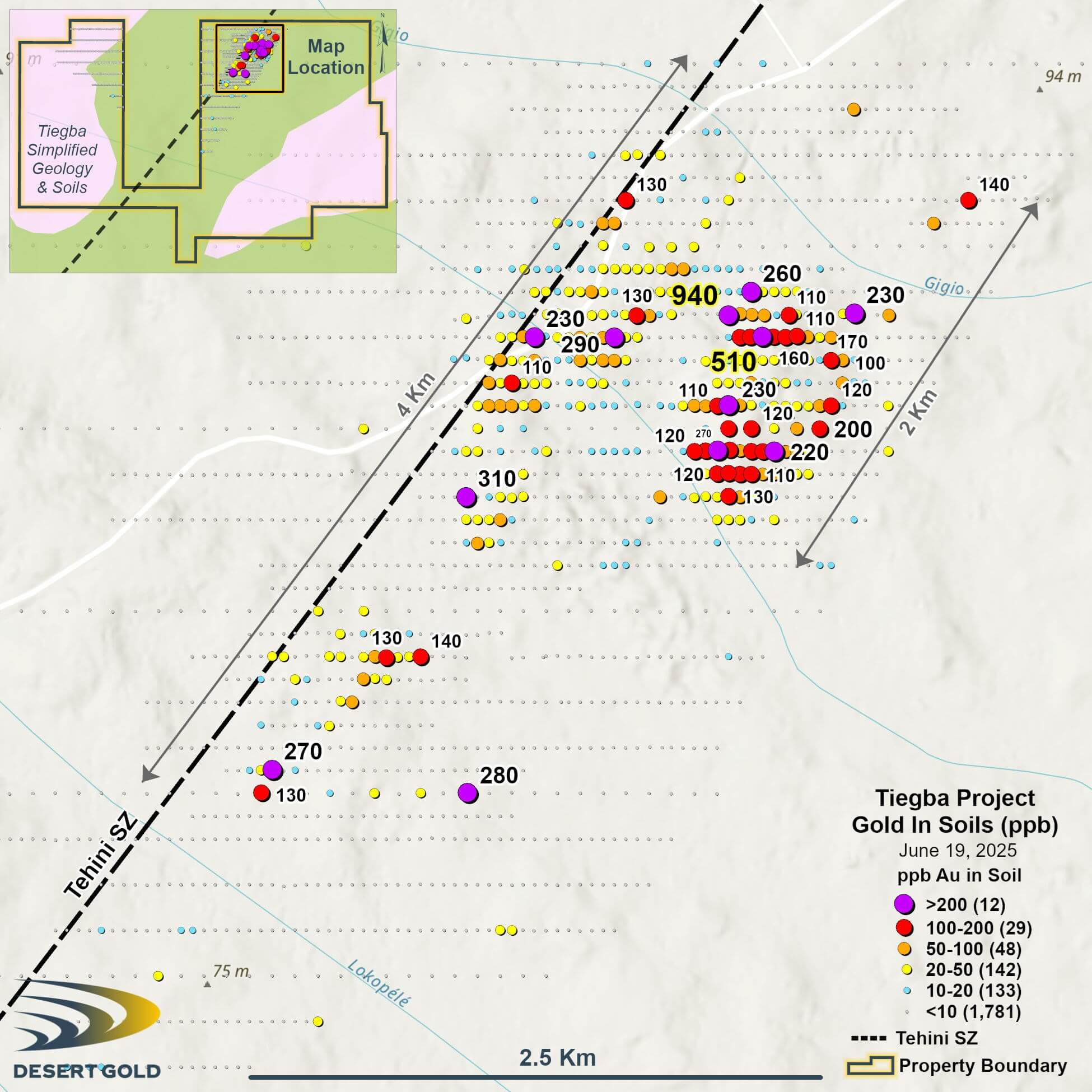

- 4.2 km by 2.1 km anomalous gold-in-soil trend along a large regional structure (Tehini shear zone)

First steps in new territory

The project hosts multiple parallel mineralization trends with values exceeding 900 ppb gold, including 89 samples above 50 ppb gold, 29 samples between 100 and 200 ppb gold, and 12 samples above 200 ppb gold. Despite impressive surface results, no drill testing has been conducted at Tiegba to date. The Company's site visit confirmed the gold anomalies as in-situ. The upcoming exploration program is now focused on rapidly defining drill targets. It consists of infill and expanded soil grids, as well as airborne magnetic and IP surveys across the entire property. This will be supplemented by targeted trenching, geological mapping, and prospecting. The next few weeks should be exciting, with a good news flow expected.

Jared Scharf, CEO of Desert Gold, commented: "The completion of the Tiegba option agreement represents an important milestone in the Company's diversification into a regional player in West Africa. In the spring, our technical team evaluated a dozen projects covering more than 1,000 km2 in the region. Tiegba ticks all the boxes. We look forward to advancing the property's significant and impressive gold discoveries into drill-ready targets."

Option agreement with Flower with good framework data

As part of the overall package, Desert Gold will pay Flower a total of USD 450,000 over the 3-year agreement term. USD 150,000 was paid upon signing the agreement, with the balance payable in two equal installments on the first anniversary of the agreement and upon renewal of the initial permit. The payments will also result in the issuance of an additional 1,500,000 common shares to Flower in three equal tranches, with the new shares subject to the TSX-V's statutory hold periods. Upon completion of the cash and share payments to Flower, Desert Gold will have fulfilled the terms of the agreement and will receive a 90% interest in the Tiegba license. Flower's 10% interest will be held at no cost until the feasibility study for the mine is completed. Thereafter, standard pro-rata dilution terms will apply to Flower. The seller retains a 1% net smelter royalty (NSR) on the ore produced from the Tiegba license. Desert Gold retains a right of first refusal (ROFR) on the sale of Flower's NSR and/or 10% minority interest. During the initial option period of three years, Desert Gold will be responsible for maintaining Tiegba's permits and fulfilling all obligations under the laws of Côte d'Ivoire. Desert Gold will assume operational control of the Tiegba project upon completion of the transaction with Flower. An extension of the agreement is anticipated.

Information about the Tiegba Project

The Tiegba project is located approximately 188 km west of the capital, Abidjan, and covers an area of 296.9 km² in the previously little-explored Tehini greenstone belt. The Tehini belt extends northward to Burkina Faso, where it hosts large gold deposits such as Houndé (5.2 million ounces of gold) and Mana (2.3 million ounces of gold). An important aspect is the northwestern extension of the Tiegba project towards the Bonikro Agbaou gold complex and the Yaouré gold mine (see Figure 2 below):

- Agbaou Deposit

Proven and probable reserves (9.49 Mt @ 1.50 g/t = 458 thousand ounces)

Proven and probable (9.33 Mt @ 2.10 g/t = 631 thousand ounces)

- Boniko & Hire Deposits

Proven and probable reserves (11.98 Mt @ 1.15 g/t = 444 thousand ounces)

Proven and probable (40.21 Mt @ 1.30 g/t = 1.68 million ounces)

- Yaoure

Proven and probable reserves (35.2 Mt @ 1.53 g/t = 1.73 million ounces)

Proven and inferred (55.6 Mt @ 1.52 g/t = 2.7 million ounces)

The Tiegba project is part of the Paleoproterozoic Birimian Terrane, which is manifested in a northeast-trending volcanic sequence of sedimentary rocks with syn- to late-tectonic granitoid characteristics, typical of gold-bearing greenstone belts in West Africa. The local geology of the project bears strong similarities to the Bonikro-Agbaou gold district. Notably, calc-alkaline intrusive structures have been mapped along the eastern and western margins of the license area. These intrusions are considered favorable host rocks for gold mineralization, particularly along their contacts with highly deformed structural corridors and at the intersection with quartz vein networks. These geological structures represent high-priority targets for further exploration work.

Historical geochemical soil data, originally collected by Newcrest Mining Limited, identified a significant north-northwest trending gold-in-soil anomaly approximately 4.2 km long in the Tiegba Project area. The highest gold values exceed 900 ppb gold. These values in soil samples are well above typical values for Birimian greenstone belts. The anomalies appear to be spatially related to the Tehini shear zone, a significant regional structure crossing the property. This mineralization corridor has also proven productive on adjacent ground and is currently being developed by Thor Explorations Ltd.

Desert Gold site visit

As part of Desert Gold's initial due diligence, the technical team conducted a site visit in March 2025 to assess the prospects of the Tiegba permit area. Field observations confirmed elevated soil anomalies consistent with sub-surface outcrops of the bedrock and transition zones with rock fragments and disseminated quartz. These structures support the interpretation of an in-situ source of mineralization, with a geochemical anomaly originating from primary dissemination processes.

250% upside expected: GBC analysts must now evaluate Mali and Ivory Coast

Desert Gold's prospects were already evaluated by German GBC Investment Research in mid-2024. Top analyst Matthias Greiffenberger shows in his (report) that the gold companies acquired in the Kenieba region over the past ten years have reported an average of 1.81 million ounces of gold and generated a price of approximately USD 66.00 per ounce in the ground for the sellers or shareholders. The Company's SMSZ project in Mali has already reported 1.08 million ounces of gold with a grade of 1.14 g/t. Operational estimates indicate that the heap leach mine in Barani East will produce 15,000 to 20,000 ounces of gold per year and have a life span of over ten years based on current oxide resources. Assuming a gold price of USD 2,300 per ounce, the expert had already anticipated annual revenues of around USD 40 million, but the gold price is now a good USD 1,000 higher. The combined assets in Mali alone, using low average prices, were valued at CAD 97.6 million, which, based on the current number of shares of just under 240 million, corresponds to approximately CAD 0.41 per share. We therefore expect an updated version of the study to include the Tiegba Gold Project, reflecting the corresponding upside potential!

CONCLUSION: A giant step for Desert Gold

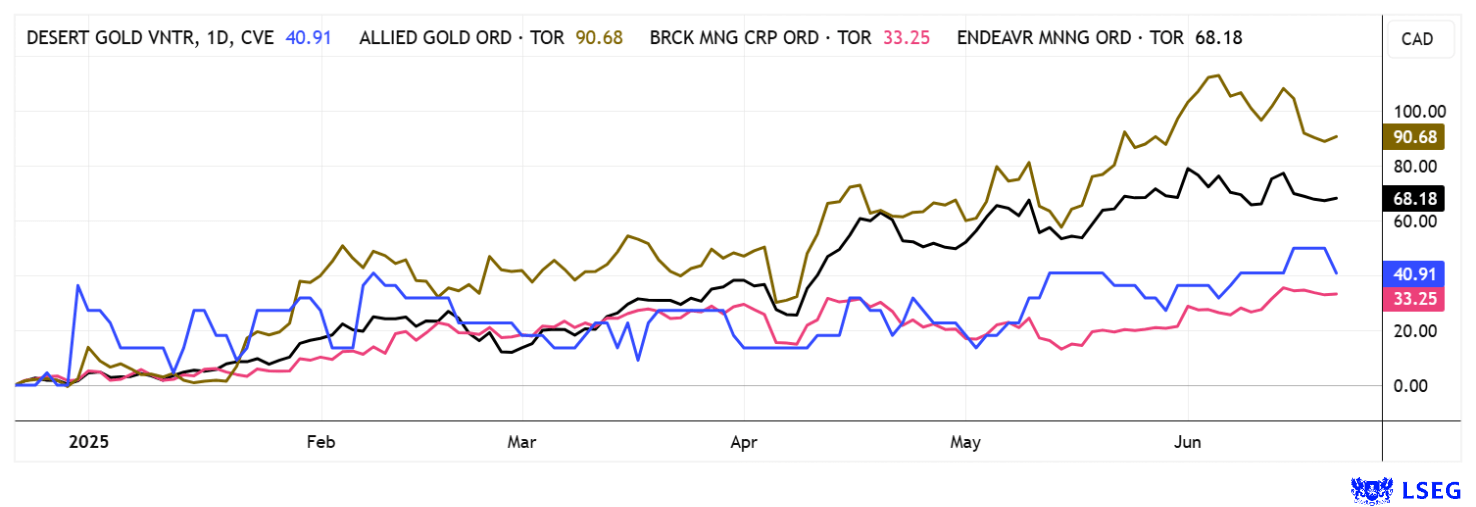

The gold investment market is currently distorted. While the futures exchanges in London and Chicago are calculating different settlement prices in some cases, the physical market is increasingly coming into focus. Central banks around the world have increased their reserves by more than 1,000 tons of gold in 2024. While producers are steadily gaining in value, developers and juniors remain incredibly undervalued. Billion-dollar corporations are already bustling in Côte d'Ivoire. They have recognized the potential and are looking for more properties. The valuations are impressive: Barrick Mining (EUR 31.1 billion), Endeavour Mining (EUR 6.4 billion), and Allied Gold (EUR 1.4 million). With two properties and the prospect of tripling its resources, Desert Gold, with 251.36 million shares, is currently valued at just EUR 12.5 million. With a solid PEA scheduled for the coming weeks and a mine start in Mali on the horizon, Desert Gold's stock is now clearly moving into the spotlight for speculative investors.

With yesterday's announcement, the share price is just below its one-year high of CAD 0.085. From a technical perspective, Desert Gold (WKN: A14X09 | ISIN: CA25039N4084 | Ticker symbol: QXR2 | TSX-V: DAU) is now showing an interesting formation after a prolonged sideways phase, which points to an upward breakout. The share capital is currently widely dispersed. Around 45% of all shares are held by management and insiders, with California-based Merk Investments holding around 7% and mining legend Ross Beaty also on board with around 3%. Investment companies such as Deutsche Bank, JP Morgan, Goldman Sachs, and BoA recently adjusted their precious metal forecasts to between USD 3,100 and USD 3,700. With the current setup, Desert Gold (DAU) shares could multiply rapidly!**

This update is based on our initial report report 11/21.