Background at a glance

XPhyto Therapeutics Corp. is a German-Canadian biotech company focused on next-generation drug formulations, diagnostics and novel pharmaceutical agents. These include precise transdermal and orally dissolvable drug formulations, rapid and cost-effective testing for infectious diseases and oral health, and standardization of new pharmaceutical agents for neurological applications, including psychedelic compounds and cannabinoids. The company has research and development sites in North America and Europe, with an operational focus in Germany. The focus is on regulatory approval and commercialization of medical products for European markets. For example, the company plans to launch its own rapid PCR tests in the coming weeks and months. With results within 25 minutes, the company hopes to convince customers in the near future. Corresponding studies are underway in parallel with talks with interested parties. Furthermore, XPhyto is researching innovative drug delivery forms, such as patches and self-dissolving active ingredient films for application in the mouth. The goals here are fewer side effects, easier handling for patients, and lower drug manufacturing costs. Studies on efficacy are also underway here. Wholly speculative is the area of psychedelics. The company, founded in 2017, is following in the footsteps of Christian Angermayer and Peter Thiel and aims to combat illnesses such as depression with mescaline and psilocybin.

The business segments

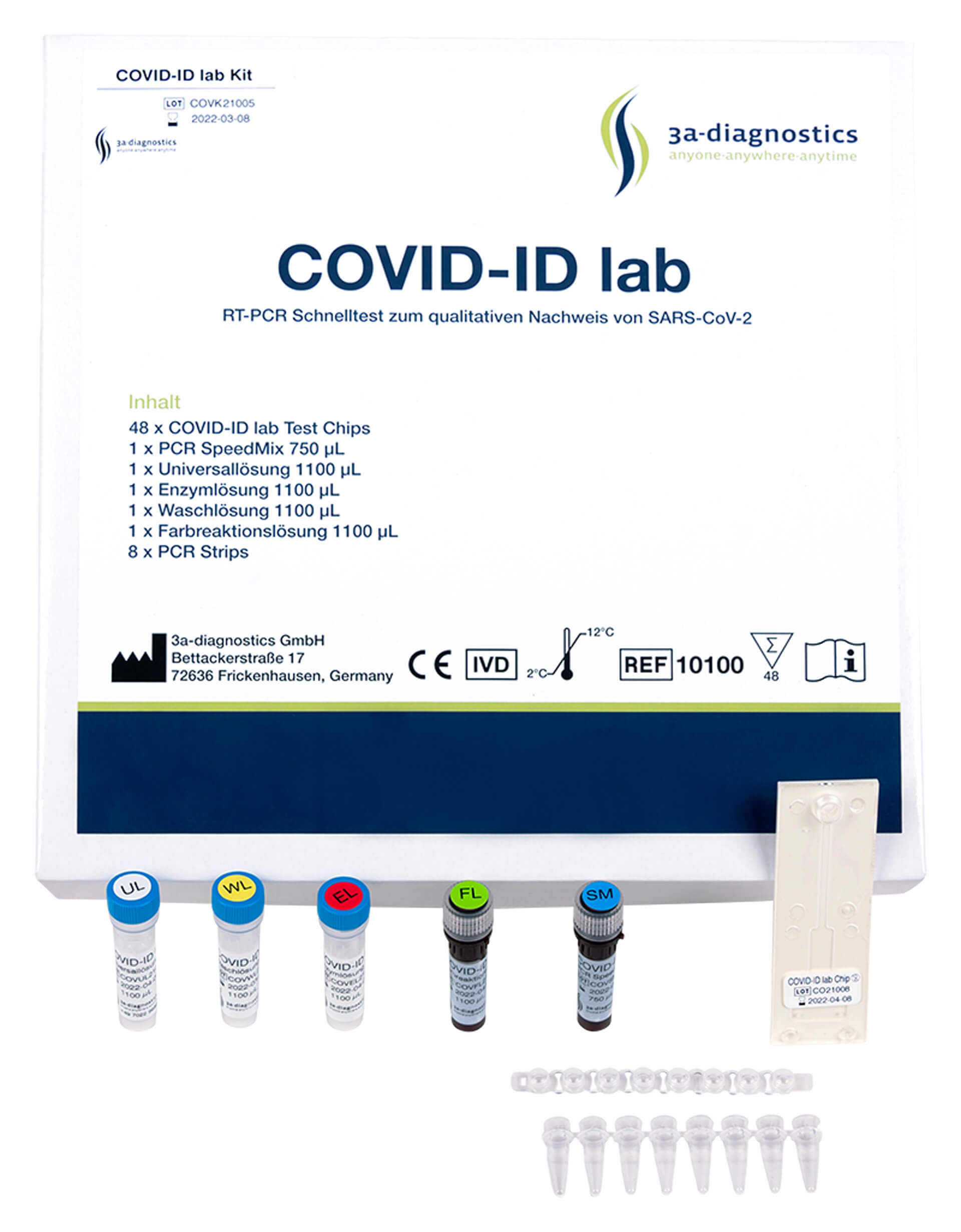

Looking at the details, three main business areas can be identified: Diagnosis, Drugs, and Dosage Forms. In the area of diagnostics, the company is currently focusing on a special form of PCR test to detect Covid-19, which can be performed on-site and offers results in as little as 25 minutes. As XPhyto has several subsidiaries in Germany, there are growth opportunities, particularly in the European market. In the drug discovery area, XPhyto is researching psychoactive substances such as mescaline and psilocybin and their use against mental illness. In the area of active ingredient carriers, everything revolves around innovative dosage forms that are intended to either provide manufacturers of drugs with cost advantages or enable better bioavailability of active ingredients.1

Investments in Germany

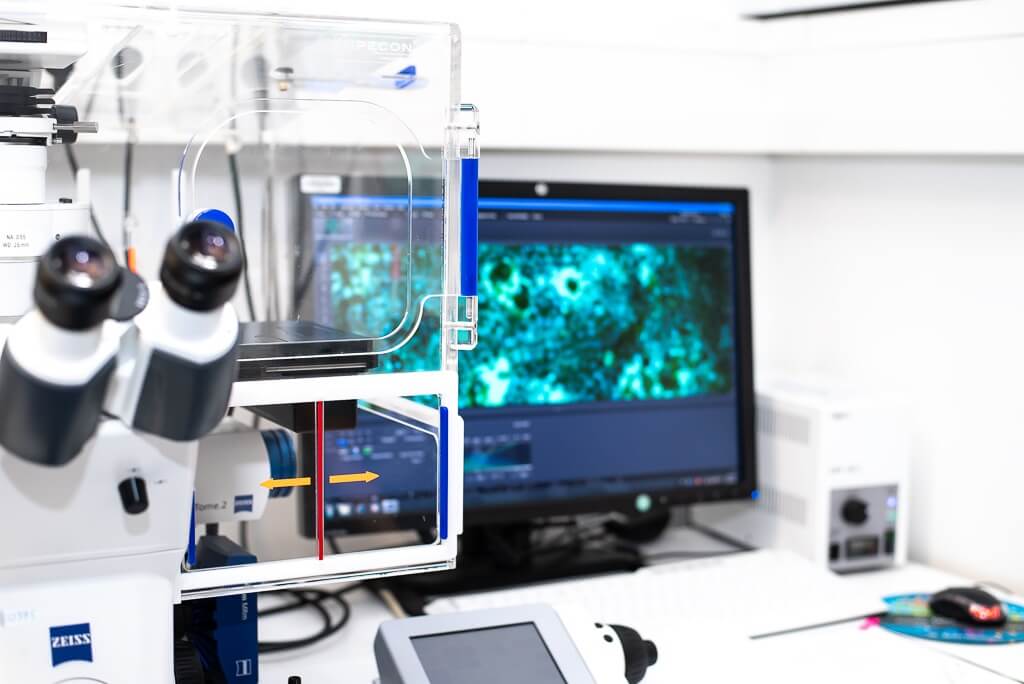

The company has an agile set-up and organizes platforms that enable business scalability within critical medical applications. XPhyto operates in Canada and Germany and is the owner of the German company Vektor Pharma TF GmbH. In the field of research and development, XPhyto cooperates with the Canadian University of Alberta. There was previously a contract with the Swabian company 3a-diagnostics for the exchange of technology related to biosensors; the company was most recently acquired by XPhyto. The technology of 3a-diagnostics GmbH is used, among other things, to implement its own PCR test with results within 25 minutes. XPhyto recently raised capital, among other things, to add the company to its portfolio.2

Market timing and opportunities

XPhyto operates in three areas whose markets have entirely different maturities. While the business with psychedelic drugs, for example, is dependent on approvals and the extent to which active ingredients, such as mescaline, will be approved for the therapy of mental illnesses in the respective regions of the world remains open, there are already intact markets for innovative dosage forms and also biosensors as well as other diagnostic methods.

Diagnostics - multi-billion market

Market size for diagnostics in 2020 in Germany alone.

The pandemic, in particular, has set the market for antigen and PCR tests in motion and created new use cases. According to the German Diagnostics Industry Association, the market volume for corresponding diagnostics in 2020 was EUR 2.7 billion. Of this, EUR 2.39 billion was for so-called reagents and EUR 356.7 million for equipment and service. The bulk of the reagents business, EUR 875.7 million, is in the field of infectious immunology.3

XPhyto is also active here with its rapid PCR test. Given the continued need for testing and the certainty that ideally vaccinated individuals should also be tested regularly, the market is expected to grow even faster in 2021 and 2022.

XPhyto points out that the company's rapid PCR test can speed up many procedures and expedite a return to normal life with a higher level of safety. The company cites rapid PCR testing in airports, which provides reliable results before passengers have left the airport, as typical use cases. Such tests could also be used outside schools and universities or for hospital admissions, providing greater safety thanks to greater accuracy compared to rapid antigen tests. XPhyto's testing technology carries the CE mark and is approved for sale within the EU.

In addition to tests for the detection of Covid-19, XPhyto is also working with 3a-diagnostics GmbH on other biosensors that can diagnose viral and bacterial infections. These include diseases such as certain inflammations in the oral cavity (peri-implantitis, periodontitis and stomatitis) as well as scarlet fever and influenza. For the size of the market, the company points to the dental services market, for example, which is expected to reach USD 698.8 billion by 2030, according to Precedence Research.4

Innovative dosage forms in demand

No precise market data are available for innovative dosage forms. However, research pointed out years ago that innovative compounds from genomics and biotechnology also require the development of innovative dosage forms. As an analysis by Technical Insights, a division of Frost & Sullivan, showed back in 2005, numerous benefits can result from innovations in dosage forms. Examples include simplified handling, fewer side effects and lower costs.

XPhyto is addressing this point and, in addition to active ingredient patches, has also developed self-dissolving active ingredient films that release active ingredients sublingually, i.e. under the tongue. All dosage forms were developed by XPhyto's German subsidiary Vektor Pharma.

Psychedelics and their potential

By 2028, the global market for drugs to treat depression is expected to develop this annual size.

The third pillar of XPhyto is the market for psychoactive substances. While representatives of the German healthcare system are critical of substances such as THC, psilocybin or even mescaline, the trend in North America has long been moving in a different direction. There, star investors such as Bruce Linton and Peter Thiel are creating hype around psychedelic substances. Studies indicate that they can be used to treat various mental illnesses - provided the dose and quality are right.

If it becomes established that psychoactive substances are effective against mental illnesses, suppliers of these products can hope for high demand. Market researchers such as Data Bridge are already forecasting that the market for the treatment of various forms of depression could grow to a volume of USD 14.3 billion worldwide by 2028. The market share in North America, Europe, Asia-Pacific and South America is expected to be roughly equal in each case. 5

With business relationships in North America and Europe, XPhyto may be well- positioned to take advantage of this projected market development. Primarily, the company works with the active ingredients psilocybin and mescaline.

Cards are reshuffled

XPhyto's business is unique because of the makeup of its different business units. However, in 2022, management sees the greatest growth potential in diagnostics. A look at the competitive environment shows where XPhyto could be headed in the coming years, for example, the Korean company SD Biosensor, which claims to be the world's number 1 in the field of diagnostics. Here, however, the founder's story was somewhat different. SD Biosensor was only founded in 2010 and went public in the summer of 2021. Today, its market capitalization is just under EUR 4 billion. SD Biosensor is characterized by high margins - the EBITDA margin expected by the market for 2021 is 48.9%. 6

Studies are imminent

SD Biosensor's expected EBITDA margin in 2021

XPhyto is also striving for efficiency in the field of diagnostics and emphasizes the platform idea: "We want to position XPhyto as a leading manufacturer of biosensors and combine the technology of our partner 3a with thin-film technology. That will create a platform from which we can build various solutions around rapid and cost-effective testing procedures" explains Hugh Rogers, CEO of XPhyto to researchanalyst.com. According to the company, numerous clinical test series for the PCR tests will be launched in the coming weeks and months, promising results within 1-2 weeks with a high probability of direct orders.

Rapid PCR tests are in vogue

XPhyto is also conducting studies in the coming months in the area of innovative dosage forms and the use of psychedelics as medications, which can scientifically document the advantages of the respective technology. XPhyto expects these studies to provide catalysts for new business. In particular, the rapid PCR tests are expected to help the company achieve a breakthrough. As XPhyto points out, the market for such tests has recently gained considerable momentum: "The testing business is booming, and there is already a trend towards rapid PCR tests. Demand is very high", Rogers emphasizes.

Early listing as an opportunity

There are highly different approaches to the right financial setup in the biotech industry. While companies such as SD Biosensor are doing good business today with the big players in the industry, such as Roche, such partnerships are, of course, still pending at XPhyto. However, SD Biosensor, for example, was not listed on the stock market in its early phase between 2010 and 2021 and was able to quietly build a business. XPhyto, which was listed on the capital market early on, is looking for investors on the open market in the early stages of its business development. One could also say that the company is putting a lot on one card and exposing itself early to the agile capital market. Risk and opportunity with possible momentum included.

However, the extent to which such an early investment opportunity can promise success for investors naturally depends heavily on the outcome of the outstanding clinical trials. It is not uncommon for biotechs to conduct research for years without any earnings to show for it. If success is foreseeable, institutional investors who accompanied the company at an early stage often cash out - for the majority of investors, the crumbs of the cake then remain.

A good signal is when the biotech keeps receiving fresh funds. In view of the upcoming clinical test series in all areas, some of which are being carried out directly in cooperation with potential customers, XPhyto could now be on the verge of a significant upturn in business. Most recently, the company managed to complete a CAD 7 million capital raising. The primary objective of this measure was to fully acquire 3a-diagnostics GmbH and to initiate new business, the statement said.

SWOT - a brief overview

Strengths

- Three promising business areas (diagnostics, dosage forms and psychedelics)

- Rapid PCR test as growth driver

- Already listed on the stock exchange in early company phase

- Capital increase recently successfully completed

- Platform approach

Weaknesses

- Decisive studies still pending

Opportunities

- Strong demand for Covid-19 test solutions

- Potential around diagnosis of oral diseases and innovative dosage forms

Risks

- Competition from Asia

- Market maturity of products not yet conclusively proven in some cases

Conclusion and outlook

XPhyto is a biotech company operating in three growth areas. The diagnostics business is very promising in light of the pandemic. XPhyto is also promisingly positioned in the diagnosis of other diseases, such as oral diseases, like periodontitis or scarlet fever and flu. The extent of the potential will be shown by clinical trials in the coming weeks and months, on which some customer orders may directly depend. The business with alternative dosage forms will also be demonstrated in the coming months in the form of clinical trials and has the potential to prevent application errors on the part of patients and save costs in the manufacture of medicines. With the business field around drugs and psychedelics, XPhyto walks on the paths of numerous star investors like Peter Thiel and Christian Angermayer. While this topic has not yet struck a chord with physicians and decision-makers in the healthcare sector in Germany, people in North America are more open-minded. As XPhyto is present in both regions, the company can push this speculative business field within a constructive environment.

The coming weeks and months will be critical for XPhyto. If the company succeeds in acquiring customers and further developing the individual business areas, figures will soon be available that can be used as the basis for an even better assessment of the company's future growth. Until then, XPhyto remains a speculative stock with great blue sky potential.