Intelligent analysis from a bird's eye view

Volatus Aerospace (TSX-V: FLT; WKN: A2JEQU; ISIN: CA92865M1023) is a leading provider of innovative global aviation solutions for reconnaissance flights and cargo transport. With the growing security requirements in recent years, the Company has developed into a highly specialized service provider in the field of airborne inspection, surveillance, and data analysis. With in-depth technological and technical expertise and over 100 years of combined institutional experience in aviation, Volatus offers meaningful solutions to end users from various industries using manned and unmanned aircraft systems (RPAS or drones). The Company has answers to the major challenges facing governments and administrations. Highly sensitive and critical infrastructures have been created in recent decades, requiring significant public investment. These now need to be protected and technically maintained. In the digital age, decision-making processes require a wealth of data that must be collected and evaluated regularly. Volatus has the necessary tools and offers comprehensive training.

Investment Highlights

Volatus Aerospace (WKN: A2JEQU | ISIN: CA92865M1023 | Ticker symbol: FLT)

- Highly specialized aerial data analysis as a unique selling point

- Development into a technical testing authority for critical infrastructure

- Strong growth of the underlying market expected between 20% and 50% per annum

- High security requirements of public sector clients ensure a steady deal flow

- Global rearmament trends create strategic necessities for defense solutions

- High entry barriers due to very high initial investments

- Little competition due to necessary certifications and training requirements

- Significant growth potential through internationalization in the medium term

- Very low market capitalization at around CAD 80 million, given the diverse business opportunities

Focus on critical infrastructure

Canadian company Volatus Aerospace (TSX-V: FLT; WKN: A2JEQU; ISIN: CA92865M1023) was founded in 2018 and specializes in the regular aerial monitoring of critical infrastructure for private and public clients. With extensive sensors and imaging technology, including thermal imaging, the Company is setting new standards in the drone industry and offering innovative solutions for numerous sectors – from the inspection of public infrastructure to precise surveying and monitoring. With state-of-the-art technology and a comprehensive service portfolio, Volatus helps companies increase efficiency, reduce costs, and collect data in real-time. For clients, it is essential to receive timely information about the condition of their infrastructure so that maintenance measures can be planned and carried out in good time. The main customers are currently industrial companies in the oil, gas, and electricity supply sectors that monitor pipelines and power grids - knowledge protects against accidents! Volatus currently achieves a 50:50 revenue mix from hardware and software solutions, with a large proportion also coming from training and consulting. The higher-margin software and services segment is growing at a faster rate.

Greater precision and lower costs through data analysis

Using specially configured drones, aircraft, and helicopters, Volatus Aerospace (TSX-V: FLT; WKN: A2JEQU; ISIN: CA92865M1023) can capture, collect, and analyze all kinds of data from the air in 360 degrees and ultra HD quality. By creating digital twins, even the smallest deviations over time can be detected through sequential recording. This allows conclusions to be drawn about changes over time in the areas under investigation. The business model currently focuses on the oil and gas, energy supply, and transport logistics segments. Already, 1.7 million kilometers of pipelines and 40,000 overland and distribution stations have been inspected, and more than 16,000 remote-controlled transport flights have been carried out. The international presence is expanding from North America to Europe and Africa. The business opportunities are diverse and growing dynamically, as governments worldwide are under pressure to act. Studies show that the partly dilapidated infrastructure in Western industrialized nations can only be kept alive through high levels of private investment.**

Cooperation with drone delivery services such as DroneUp

The rapid transport of perishable, highly sensitive, or time-sensitive goods often cannot be accomplished by road or rail. The ordered goods must reach their destination safely and just in time. With the drone delivery service DroneUp, which is well known in the US, it is now possible to establish a cross-border delivery network. DroneUp brings its US licenses as an approved air carrier and a certified delivery drone system to the partnership, while Volatus contributes its Canadian operating permits (including a dangerous goods license) and operational experience. Large delivery services such as Amazon, DHL, and FedEx have already attracted a great deal of media attention with their drone delivery services, but the establishment of a complete drone logistics system has not yet been successful. The Alphabet project "Wing" already operates autonomous drones in Virginia, Texas, Australia, and Finland. More than 350,000 deliveries have already been made by 2024. With more standardization in regulations and flight safety, many different delivery services will soon jump on the bandwagon.

Artificial intelligence is still in its infancy

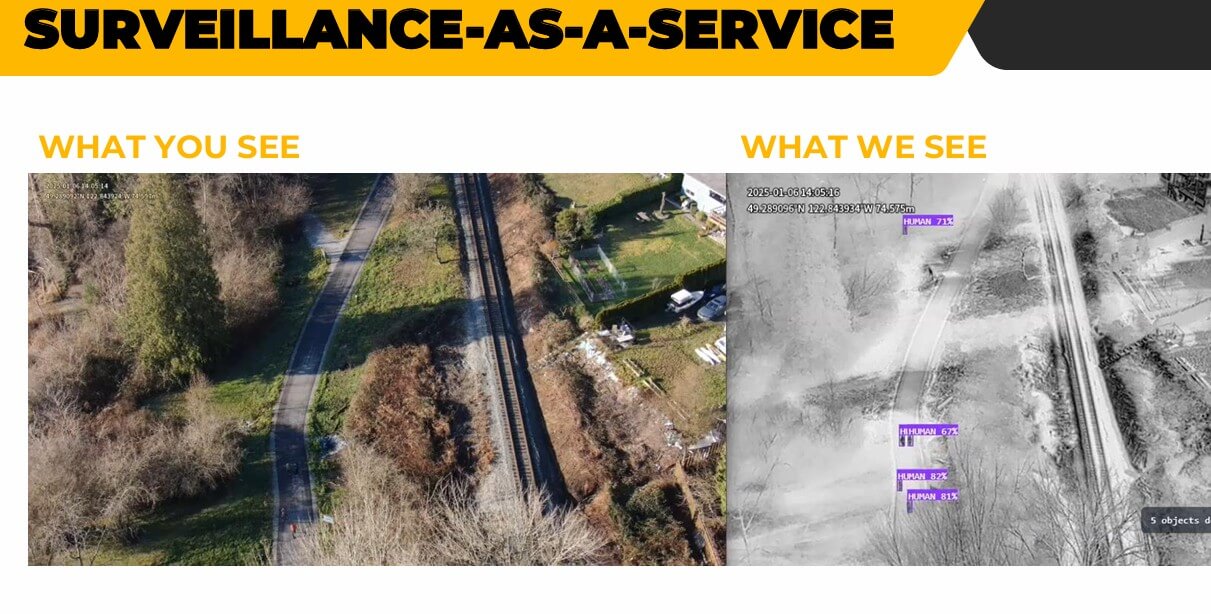

Even though artificial intelligence (AI) is not yet a decisive purchasing factor, CEO and President Glen Lynch is convinced that AI will become an important pillar of Volatus in the future. This is because AI is revolutionizing digital processes in image evaluation and heat detection through automated, precise, and fast analyses. Algorithms are used to recognize recurring patterns, and machine learning enables AI to identify objects in real-time, detect temperature differences, and identify potential hazards. In industrial inspection, this allows the early detection of overheating in machines or electrical systems, preventing costly downtime. In buildings, insulation and heat leaks can be detected to optimize energy efficiency. AI is also becoming increasingly crucial in security monitoring when it comes to reporting unusual temperature patterns, such as identifying emerging fires or simply detecting unauthorized access at an early stage. Ultimately, these digital methods, combined with intelligent analysis models, create new opportunities for military reconnaissance of troop movements and strategic risk minimization on the front lines. The defense sector is still in its infancy, but inquiries are growing exponentially.

The Current environment is becoming a game-changer

The Company's long track record, from its early days as Drone Delivery Canada Corp. in transport logistics to its current success as an aerial data and surveillance specialist, is proving particularly valuable for Volatus shareholders. According to CEO Lynch, the continuous development of drone technology will eventually make the use of aircraft and helicopters obsolete and dramatically reduce costs while improving performance. With its operations center in Toronto, extensive customer consulting services, and rising order volumes, revenue is now poised for significant scaling, which should be followed by a significant increase in profits. Pure hardware sales will decline in favor of high-margin service and technology contracts. The newly launched service packages in the defense sector are a dramatic addition.

Analysis by Ventum Capital: "Buy" with a price target of CAD 0.32

When the Q1 figures were first released, there was initially some disappointment among analysts at Ventum Capital. However, an update was then issued on June 9. It reflects the latest statements by the government in Ottawa to increase military spending by up to CAD 15 billion, potentially raising defense budgets to 2% of GDP within five years. Although NATO's plans are now more ambitious, Volatus has already expanded its business focus to Europe for precisely this reason. Analyst Rob Goff expects Volatus to benefit from the strong solidarity among Western allies and to secure larger military contracts in the future. Volatus has already delivered proof of concept in numerous civilian applications. With the ongoing restructuring of its balance sheet, Volatus has taken a huge step forward. That is why the 2024 figures presented in March prompted Ventum Capital analysts to reiterate their "Buy" rating with a price target of CAD 0.32. The operational turnaround on an EBITDA basis is now expected in the current second quarter of 2025. With a streamlined cost base and a growing number of service-oriented contracts, analyst Rob Goff believes that Volatus is increasingly well positioned within the evolving air infrastructure and government services landscape. Goff expects Volatus to achieve an adjusted EBITDA of CAD 3.9 million on revenue of CAD 45.3 million in fiscal 2025. He forecasts that these figures will improve to an EBITDA of CAD 10.4 million on revenue growth of CAD 67.5 million in fiscal 2026.

Conclusion: The outlook for the coming quarters is encouraging

The recent CAD 3.0 million LIFE equity financing and the conversion of CAD 3.1 million in convertible notes significantly improved balance sheet flexibility and brought pro forma liquidity to just under CAD 4 million. Parallel to these measures, Volatus' share price underwent an extended consolidation phase until May, which has now come to an end due to strong revenue growth and shifting momentum. For several days now, more than 1 million shares have been traded in Canada, with larger investors appearing to position themselves. On German stock exchanges, the volume is also in the hundreds of thousands. After a subdued first quarter in terms of operations, the Company is now clearly gaining momentum in Q2. Under these circumstances, the share price feels like it has been "kissed awake." The positive trend is expected to continue.

In the medium term, Volatus sees increased international partnerships, particularly in the US, Europe, and Africa, as accelerators of its successful business model. The upcoming scaling with new commitments in the defense sector could very quickly lift the Canadian company to a new valuation level. Positioned as a technology company in the critical infrastructure and defense sector, the stock is significantly undervalued compared to peers in the security and defense sector. Ventum's price target currently offers a good 70% upside potential, which could materialize in the short term with the right news flow in the coming weeks.