Energy demand growing dramatically

In order to achieve the global climate goal of limiting global warming to less than 2 degrees Celsius, Germany wants to become greenhouse-neutral by 2045. This is to be achieved with an accelerated expansion of renewable energies from currently 48.5% to then 100% in electricity generation and the complete abandonment of fossil energy sources. 1 The share of nuclear energy for electricity generation in the Federal Republic was only 6.0% in the first half of 2022 and is to be driven to zero in the near future by the planned closure of the last three active nuclear reactors. In contrast, the major industrialized nations do not share the German government's renunciation of climate-neutral nuclear energy; on the contrary. Here, the trend is clearly toward constructing new, ultra-modern reactors and is being massively subsidized by politicians. In Canada, for example, the government announced it would provide CAD 970 million in funding to develop a grid-scale small modular reactor, a new nuclear technology being promoted as a central part of the country's plans to reduce emissions. 2 US President Joe Biden is similarly combating the energy crisis, putting forward a USD 4.3 billion plan to support the uranium sector in the US and minimize dependence on Russia, in addition to tax incentives.

| Country | Reactors operable | Reactors under constructio/planned | Uranium required in tons | Share of nuclear electricity/total electricity, as of 12/2021 |

|---|---|---|---|---|

| Germany | 3 | 0 | 521 | 11,9% |

| USA | 92 | 5 | 17.587 | 19,6% |

| China | 54 | 69 | 9.563 | 5,0% |

| Japan | 33 | 3 | 1.396 | 7,2% |

| France | 56 | 1 | 8.233 | 69,0% |

| India | 22 | 20 | 977 | 3,2% |

| Russia | 37 | 28 | 5.925 | 20,0% |

Nuclear energy existential

The international community sees an urgent need to make electricity generation carbon-free to protect people and the planet from the dangers of air pollution and climate change. In this regard, meeting the significant increase in electricity demand, which according to the International Energy Agency, will grow from about 25,000 TWh to 40,000 TWh between 2020 and 2050 3

, is a Herculean task. In order to meet this with sustainable energies, nuclear energy is essential in addition to the expansion of wind and solar energy. For example, experts predict a tripling of nuclear power by 2050 to provide up to 25% of electricity as part of a clean and reliable low-carbon mix. According to the OECD Nuclear Energy Agency, a mix that relies primarily on nuclear energy is also the most cost-effective option for meeting the decarbonization target of 50 g CO2 per kWh.

Looking at the IEA's World Energy Outlook 2018, electricity costs in China from onshore wind, solar PV, and offshore wind are 16%, 50%, and 140% higher than nuclear, respectively.

Cheap, safe, and the gummy bear

Of course, many remember the horrific events from Three Mile Island in 1976, Chernobyl in 1986, and Fukushima in 2011. But the technology has advanced significantly in recent decades to provide a much higher level of nuclear safety and is considered the safest source in the world in 2023 compared to both fossil and renewable energy sources. Thus, at 0.04 per TWh of energy produced, uranium has the lowest mortality rate of all energy sources and is well ahead of wind (0.15 TWh), solar (0.44 TWh), oil (36 TWh) and coal with a high 161 TWh.4

Nuclear power is the "ideal way" to deal with climate change.

Another advantage is the low land requirement. Although nuclear power produces enormous amounts of carbon-free electricity, it generates more on significantly less land than any other source. For example, an average 1,000-MW nuclear power plant in the US requires about 2.6 sq km to operate. To produce the same amount of electricity, wind turbines require 360 times more land area, and photovoltaic systems take up 75 times more space. 5 To visually imagine this, it would take more than 3 million solar panels to produce the same amount of electricity as a typical commercial reactor or more than 430 wind turbines.

Furthermore, due to the high energy density of the uranium required, a uranium fuel pellet the size of a gummy bear generates as much energy as 1t of coal, 149 gallons of oil, or 481.38 cubic meters of natural gas.

6

Because of the pervasive availability of nuclear energy, Microsoft founder Bill Gates also sees the future of nuclear energy as bright. The visionary wrote on his blog in 2018: "Nuclear power is ideal for addressing climate change because it is the only carbon-free, scalable energy source available 24 hours a day. The problems of today's reactors, such as accident risk, can be solved through innovation," he wrote, adding that the US "is uniquely suited to create these advances with its world-class scientists, entrepreneurs and investment capital." 7

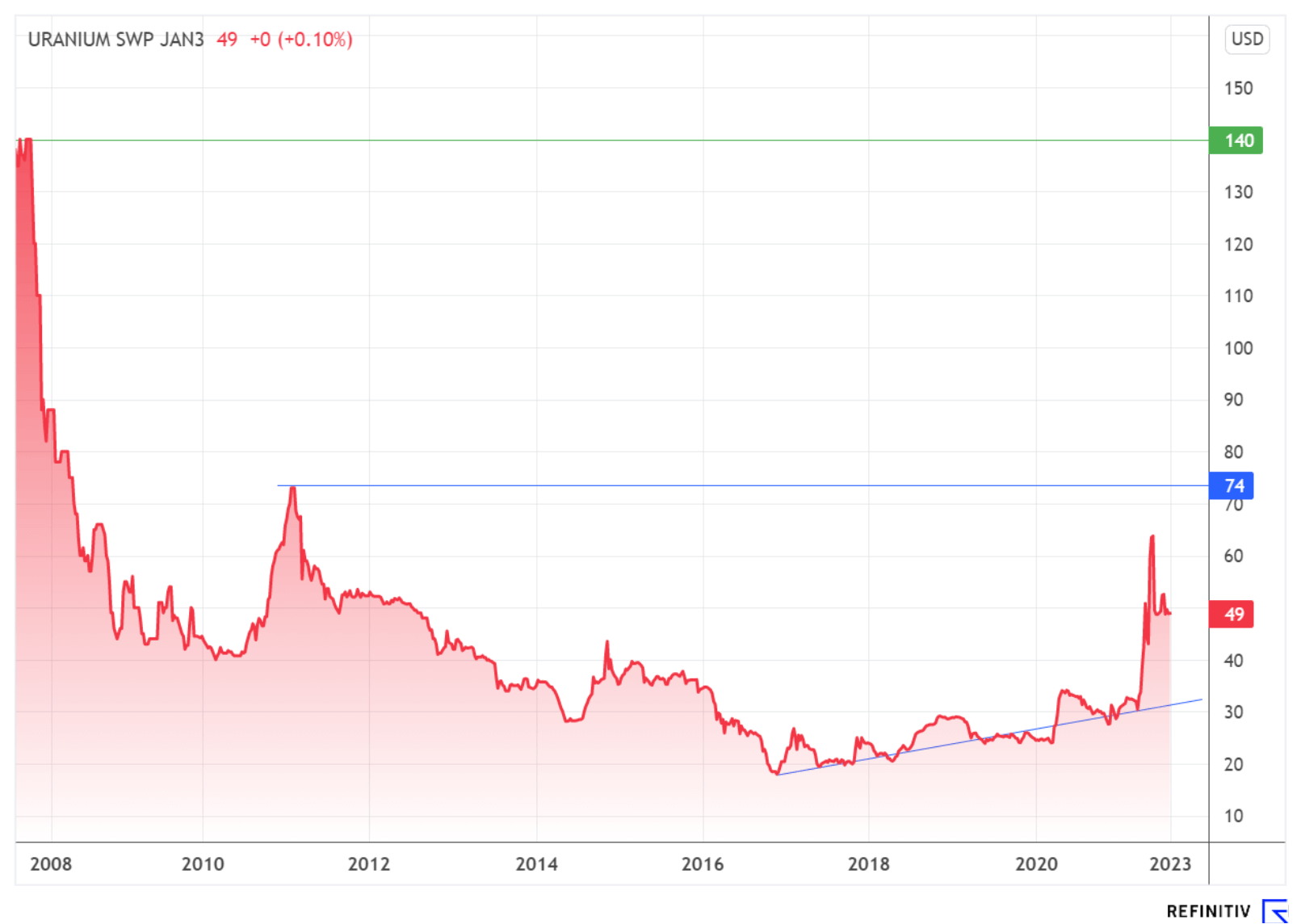

Uranium in long-running bear market

Despite the expected increase in global electricity demand and the commitment of major industrialized nations to build new reactors, the price of uranium has been in a bear market for years, beginning with the Fukushima nuclear disaster. The global shift away from nuclear power and a shutdown of many reactors after 2011 caused many uranium producers to shut down or close their mines due to profitability. The result was a landslide in the price of uranium from $140/pound in 2008 to below $18/pound in early 2018. Since then, the price of uranium oxide has formed a floor, more than tripling in the interim to $64/pound due to the escalating conflict in Ukraine and currently hovering around the $50/pound range.

However, since the start of the war of aggression and the looming energy crisis, there has been a hello wake-up effect in the Western world, which should ensure a turnaround not only in the uranium market. The primary goal of Western governments is now to minimize their dependence on Russia or China. And especially in the procurement of uranium oxide, the US dependence on countries like Kazakhstan or Russia is enormous. While the United States purchased more than 45 million pounds of uranium in 2021, making it the world's largest consumer, domestic production was a tiny 21,000 pounds of uranium oxide U3O8. Thus, domestic production is not even remotely sufficient to meet the country's needs for nuclear power plants. Based on data from the World Nuclear Association, the largest imports came from Kazakhstan (35%), Canada (15%), Australia (14%), Russia (14%) and Namibia (7%). 8

Thus, revitalization of the domestic uranium industry is urgently needed and has national and energy security implications. The Inflation Reduction Act is designed to boost the domestic uranium industry. In addition, the program includes support for existing nuclear power plants, advanced nuclear energy projects, and advanced nuclear fuel development. In addition, the US Department of Energy's 2022 budget received a record $1.85 billion for the Office of Nuclear Energy.

Bank of America expects uranium spot prices to return to $70/lb by 2023 due to growing support for nuclear energy and tight supply. 9

Positive signs in the market

The primary beneficiaries of the government programs are mainly domestic uranium producers such as Cameco, Fission Uranium or exploration companies like Oberon Uranium. Cameco, one of the largest uranium producers in the world, sent a clear positive signal to the market with the resumption of production at the McArthur River mine. Production was suspended for approximately four years beginning in January 2018 due to continued weakness in the global uranium market. Following an announcement in February after a four-year hiatus due to improving market conditions, President and CEO of Cameco, Tim Gitzel, commented as follows: "Market conditions have continued to improve since the announcement of the planned restart, with growing geopolitical uncertainty heightening energy security concerns around the world and the ongoing global emphasis on decarbonization and electrification only gaining momentum." 10

the best place to find a particular resource is where you have a proven production history.

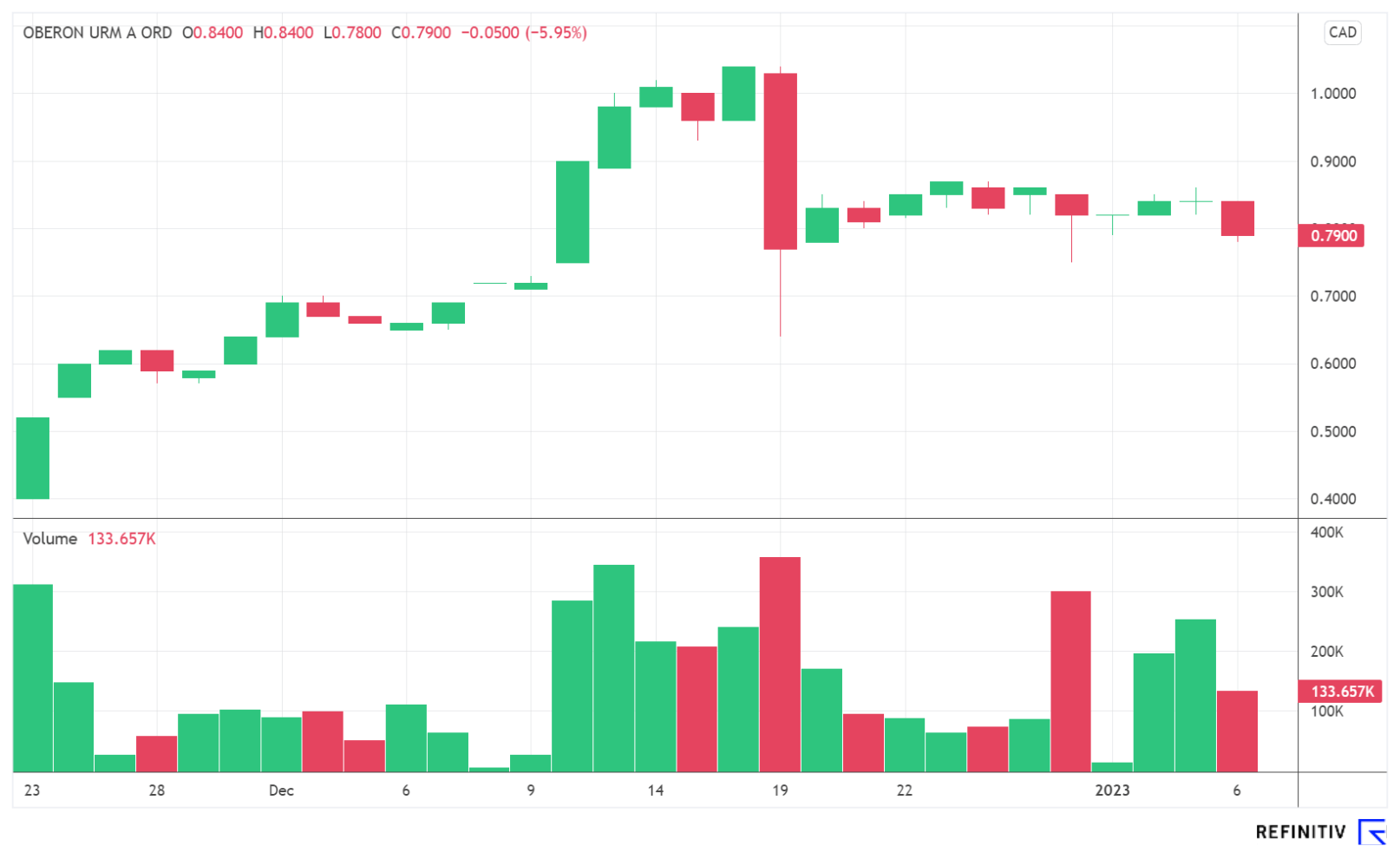

The second tier is booming

Second-tier companies are gaining significant attention from both industrial and private investors. Fission 3.0, a uranium project development company focused on projects in the Athabasca Basin in Saskatchewan, more than quintupled its share price within four weeks following successful drilling results, lifting its market capitalization to CAD 126.16 million. On the southern rim of the Athabasca Basin, stock market newcomer Oberon Uranium also owns a 100% interest in the Element 92 property, but the Canadians' main project is the past-producing Lucky Boy Mine in Arizona, which should offer significant upside potential.

Prepared for the upswing

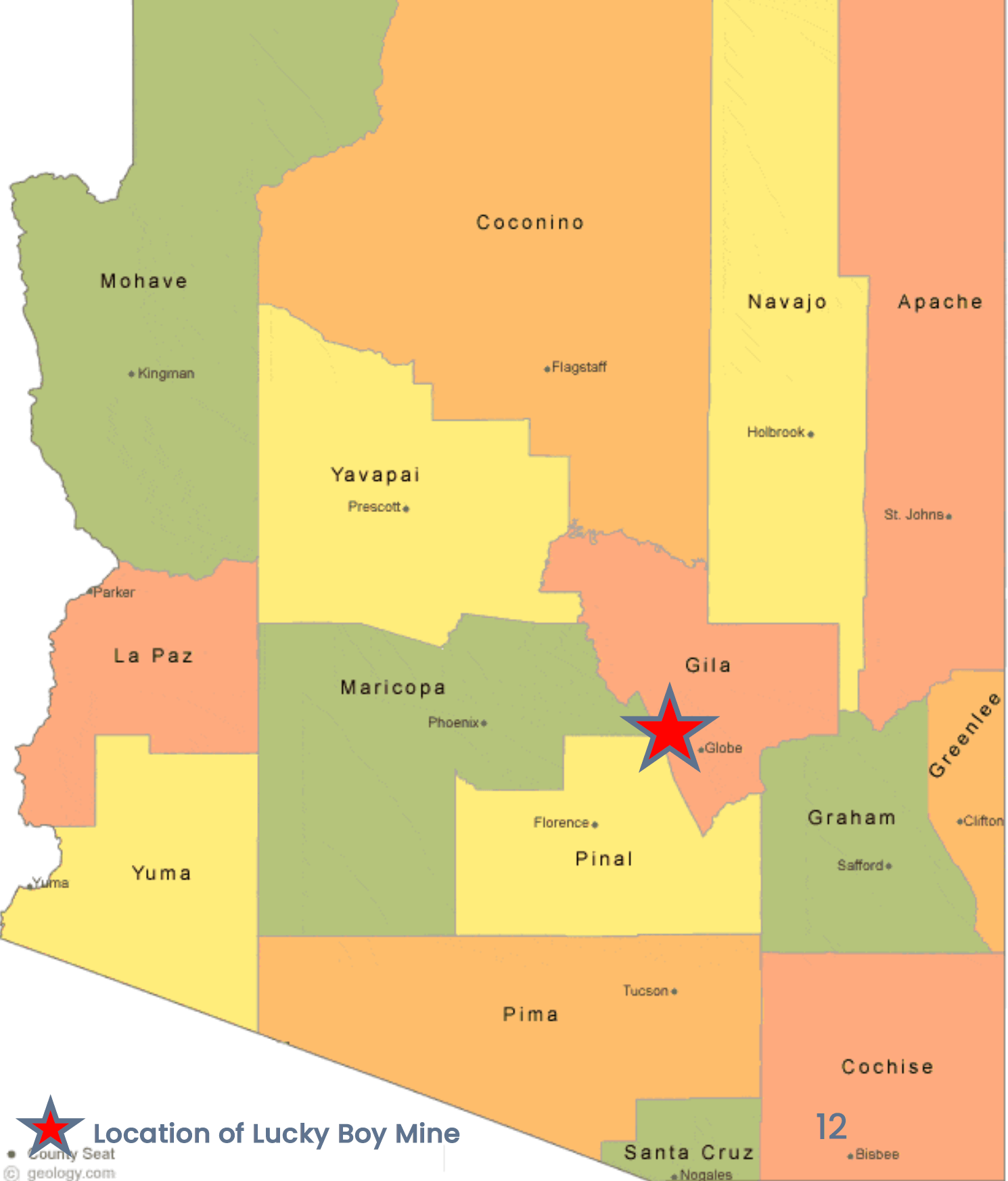

Compared to its peer group, Vancouver-based and still relatively unknown Oberon Uranium is still moderately valued with a market capitalization of CAD 19.04 million, especially in view of the fact that the flagship Lucky Boy project has already proven its productivity in two phases in the past. For example, a total of 2,336 tonnes of ore with an average grade of 0.17% uranium oxide (U308) was reportedly proven in several tests as early as the 1950s. Work in the 1970s included an open pit mine and a fully operational leach recovery system. This set the stage for using in situ recovery when the mining process resumes. This uranium recovery method has proven economic advantages and minimal environmental impact.

Oberon Uranium holds a 100% option on the Lucky Boy Claims, but management intends to draw this in a timely manner with a final condition precedent. Given the potential at hand, this also makes sense in order to secure the project definitively. With world-class infrastructure, the approximately 110-hectare property is located in what is known as the Dripping Spring Quartzite. This mountain formation hosts nearly all of Arizona's uranium deposits and has geological characteristics similar to the Colorado Plateau. In addition, a lease of the adjacent property of approximately the same size is planned, with mining rights already applied for.

Beyond the borders

A radiometric survey was completed last spring with a total of 208 readings that confirmed the presence of uranium beyond the limits of past production and showed anomalous values. This indicates that uranium mineralization may extend beyond areas marked by historic mining sites. The next steps are a geophysical study beyond the original production limits, enabling Oberon Uranium to overlay the radiometric survey and confirm the drill targets. If the results are positive, the Company could start drilling in the first quarter. In any event, a continuous news flow should be in place over the next few weeks. The experienced management is already planning to start production in 2024.

In addition to the prospective Lucky Boy project, the Canadians own a 100% interest in the Element 92 property on the southern edge of the Athabasca Basin in Saskatchewan, Canada, as mentioned above. The Athabasca Basin hosts some of the world's most prolific uranium mines, including Cameco's high-grade McArthur River uranium mine, grading 16.5% U3O8 after accounting for dilution, which was responsible for more than 14% of global supply prior to the production freeze. The project comprises a single mineral concession in Saskatchewan covering 5,961 hectares. Oberon holds a 100% interest in the claim. The concession area has been the subject of industry and government uranium exploration surveys since the late 1960s and 1970s, usually as part of much larger regional programs.

Oberon Uranium's CEO believes the company is well prepared: "Oberon Uranium Corp." is in a strong position to fully realize the potential of its assets. Both of the Company's projects are in secure jurisdictions in Canada and the United States. With increasing government support for the industry, the Company will benefit most from its Luck Boy project, which has a history of production."

Tight market

Compared to other companies in the sector, the number of shares is small, with 24.1 million shares outstanding. Add to that 3,497,500 warrants that can be converted into shares and 27,180 options, and you have a fully diluted share count of 27,622,180 shares. In addition, of the fully diluted shares, approximately 12 million are held by related parties or employees. Oberon Uranium has only been listed on the Canadian Securities Exchange and in Frankfurt since November 23, 2022. If news flow continues to be positive in terms of new results, the undiscovered stock could see disproportionate share price movements due to market tightness.

Highlights

- Governments push nuclear energy to meet climate targets

- Revival of past-producing Lucky Boy project

- Rising demand for uranium due to climate targets, growing energy demand and major policy changes

- Increasing acceptance of nuclear energy as a positive ESG investment

- Oberon Uranium with two prospective properties

- Low free float

Uranium market facing a turning point

After a 10-year bear market, the uranium sector is at an inflection point. Strong tailwinds reviving the nuclear sector are supported by aggressive climate targets, growing energy demand and major policy changes. In this regard, with its two promising projects, Oberon Uranium is well positioned for a sustained increase in the uranium price. However, despite the high potential, it should not be forgotten that the stock is a young exploration company with corresponding risks and high opportunities.