ChatGPT reaches the mainstream

No, artificial intelligence is not new. As early as the year 1956, the term, translated in English as Artificial Intelligence or AI, was coined by John McCarthy on the occasion of a meeting at Dartmouth College in the US state of New Hampshire, which is considered the official starting shot of academic research in this future sector. Here 10 scientists met to philosophize about computers that should be capable of more than stubbornly calculating numbers and were convinced that human intelligence, as well as basic learning, could be simulated by machines.

users reached ChatGPT in the first two months after launch.

In 1966, the first chatbot saw the light of day before AI made its entry into medicine six years later with the "MYCIN" system. Exactly twenty years later, the computer finally learned to speak, and the program "NETtalk" was thus the forerunner of today's popular voice services SIRI, Alexa and Microsoft's "Cortana". 1

Since the launch of the Chatbot ChatGPT 3.5 on November 30, 2022, when it was made freely available to the public, the topic has finally reached the mainstream. In the process, the growth of the groundbreaking Internet application broke all records. Just two months after launch, the user base topped 100 million, according to a study by UBS, a major Swiss bank, and continued to grow in the first month of 2023 with an onslaught of 13 million unique users per day. By comparison, the global video community TikTok, at 9 months, and Facebook subsidiary Instagram, at 30 months, were moving at a snail's pace to break the 100 million barrier.

Infinite expanses

The fact that the use of artificial intelligence is still in its infancy should become increasingly clear to everyone due to the multitude of applications and massive cross-industry growth. For example, Huawei Technologies' Chief Strategy Marketing Officer William Xu saw breakthrough developments coming to industry, business, and society as early as 2018 in the published strategy paper 2 . In the past 120 years, the industrial, electrical, and information technology revolutions led to three major breakthroughs in human civilization and increased productivity that could not have been achieved in thousands of years.

The annual spending on AI-centered systems is expected to grow to over USD 300 billion between 2022 and 2026.

Now the world is at another inflection point in the fourth revolution based on information and communications technology and driven by artificial intelligence. The new smart world will be one in which all things are connected and intelligent. Key technologies such as 5G, cloud, video, the Internet of Things, and AI will converge and evolve together, which is expected to create enormous value. Huawei projects that there should be 40 billion smart devices and 100 billion electronic connections by 2025. Annual storage of the data generated from these could be as much as 180 billion terabytes, a twenty-fold increase compared to 2020. Moreover, 86% of global enterprises will adopt AI, and data usage rates are expected to reach 80%. Such exponential growth in data produced is naturally driving the market for AI significantly.

According to the International Data Corporation (IDC), the world's leading provider of market intelligence for the information technology, telecommunications, and consumer technology markets, projects that global spending on artificial intelligence, including software, hardware, and services for AI-centric systems, will reach USD 154 billion in 2023, representing a 26.9% YOY increase. The progressive integration of AI into a wide range of products is expected to lead to an annual growth rate of 27.0% over the forecast period 2022-2026, with spending on AI-centric systems expected to exceed USD 300 billion in 2026. 3

Many systems in one

In the next few years, C3.ai, a company founded in 2009 by Thomas Siebel and Patricia House that specializes in providing AI systems for businesses, should benefit from the rising spending. It has spent 14 years researching and creating an AI engine with more than 40 cross-industry and cross-domain applications that enable customers to create workflow-optimizing software systems that can be rapidly integrated into operations and run on all major public cloud infrastructures as well as customers' on-premises servers and processors. In total, the AI specialist offers five families of software solutions.

it is expected to move into positive earnings on a non-GAAP basis, according to management.

The core technology, the C3.ai platform, is the comprehensive application and development environment that can rapidly deploy AI applications of any type for enterprises. Using the conceptual models of all elements makes rapid implementation possible for developers instead of writing complex programming codes to define, control and integrate the many data and microservice components required to make them interact.

C3.ai Applications, in turn, includes a large and growing portfolio of industry- and application-specific pre-built AI applications that guarantee immediate installation into customer systems. The code-free Ex Machina solution ensures secure access to analyzable data and enables analysts without data science training to perform tasks such as creating, configuring and training AI models. The fourth area, C3.ai CRM, is a collection of fully AI-enabled CRM solutions that collects data from CRM systems, other enterprise systems and external data sources to accurately forecast, cross-sell recommendations and other AI-powered sales, marketing and service processes. Finally, C3.ai Data Vision unifies data from multiple systems to provide complete data analysis in visual form. The interaction of the turnkey systems on one unit is thus the unique selling point of the innovative technology company from Redwood City in California.

Cluster risks and declining revenues

Revenues were previously generated by the Software-as-a-Service company with a monthly subscription model. This resulted in recurring revenue of a strong 86%, according to figures for the third quarter ended January 31, 2023. However, the pricing model is set to change to a consumption-based model in the future, meaning customers will only pay for the features they need. A total of 236 clients across all industries, including global players such as Shell, Eni, Baker Hughes and even the US Department of Defense, use the various services offered by the US company. However, there is a high cluster risk in the revenue distribution. For example, C3.ai generates 71.8% from the oil and gas sector, with another 15.7% coming from aerospace. The remaining 12.5% is shared by sectors such as energy, high-tech and financial services. 4

The figures for the third quarter were, once again, as is the rule rather than the exception for innovative research and development companies, characterized by high operating losses. These were USD 71.19 million on revenues of USD 66.67 million. It was also disappointing that this was around 5% lower than revenues in the same quarter last year. For the full year, C3.ai is projecting revenues of USD 265.42 million, which equates to a price-to-sales ratio of 7.45 at the current price. Net loss is expected to be USD 279.22 million, according to Reuters Refinitv estimates. With improvement in the economy and increasing demand for AI solutions, Siebel sees the Company's 2024 profitability on a non-GAAP basis. It also expects positive cash flow in 2025. On a GAAP basis, however, as seen in the estimates, C3.ai is expected to continue to operate at a loss for years to come. Somewhat reassuring, therefore, is the still comfortable cash position, which stood at USD 789.8 million at the end of January.

| Year | 2021/2022 | 2022/2023e | 2023/2024e | 2024/2025e |

|---|---|---|---|---|

| Sales | 252.76 | 265.42 | 317.16 | 382.72 |

| Pre-Tax Profit | -191.28 | -275.15 | -218.85 | - |

| Net Income | -192.07 | -279.22 | -264.66 | -230.30 |

| Earnings per Share | -1.84 | -2.54 | -2.27 | -1.85 |

| Price to Sales | 7.83 | 7.45 | 6.24 | 5.17 |

Do it again, Tom!

The fact that founder and CEO Thomas Siebel has already experienced a lot and has an impressive resume to show for it likely prompted many investors to invest in the innovative company. The technology veteran was the founder and CEO of the eponymous CRM software company Siebel Systems, which merged with Oracle in 2006. With the former SVP of Engineering and CTO at Siebel Systems, Edward Abbo, and Houman Behzadi, Siebel hoisted two former companions into the executive suite of C3.ai to rewrite the success story once again. A glance at the shareholder structure shows that the name has charisma. The Vanguard Group is the largest shareholder with a share of 8.39%, followed by the oil service company Baker Hughes with 7.96%. Following behind are Thomas Siebel with 5.92% and the world's largest asset manager, Blackrock, with 4.31%.

Headwind from all sides

Despite the illustrious circle of shareholders, the Company has been feeling massive headwinds in recent weeks. The accusation by short seller Kerrisdale Capital that C3.ai had "serious accounting problems" led to a 26% one-day loss in early April. 5 . According to Sahm Adrangi, Chief Investment Officer of Kerrisdale, C3.ai uses "a very aggressive accounting to inflate its income statement, meet sell-side revenue and certain profit estimates, and conceal a significant deterioration in underlying operations." Adrangi wrote this in a letter to Deloitte & Touche LLP, C3.ai's auditor. In addition, Kerrisdale criticized C3.ai for accounting for the cost of producing custom software as research and development costs rather than cost of sales to increase profit margins. He said this is part of the accounting practices C3.ai uses to portray itself as a high-margin company in the Software-as-a-Service business rather than one based on lower-margin consulting.

In an interview with Bloomberg Radio, CEO Thomas Siebel denied the allegations and cautioned that the letter "does not possess a single word of truth". In any case, the last word in this process does not seem to have been spoken yet.

Class action lawsuit filed

As if this were not enough, a https://www.bgandg.com/ai1 caption: class action has been filed against C3.ai, which investors who own or owned shares in the period between March 2, 2022, and April 3, 2023, can join. The class action seeks to recover damages from the defendants for alleged violations of the Securities Act. Thus, it is alleged that throughout the Class Period, C3.ai made false and misleading statements about the Company's business, operations and compliance policies. It is also alleged to have engaged in improper accounting practices, resulting in the Company's public statements being materially false and misleading at all relevant times.

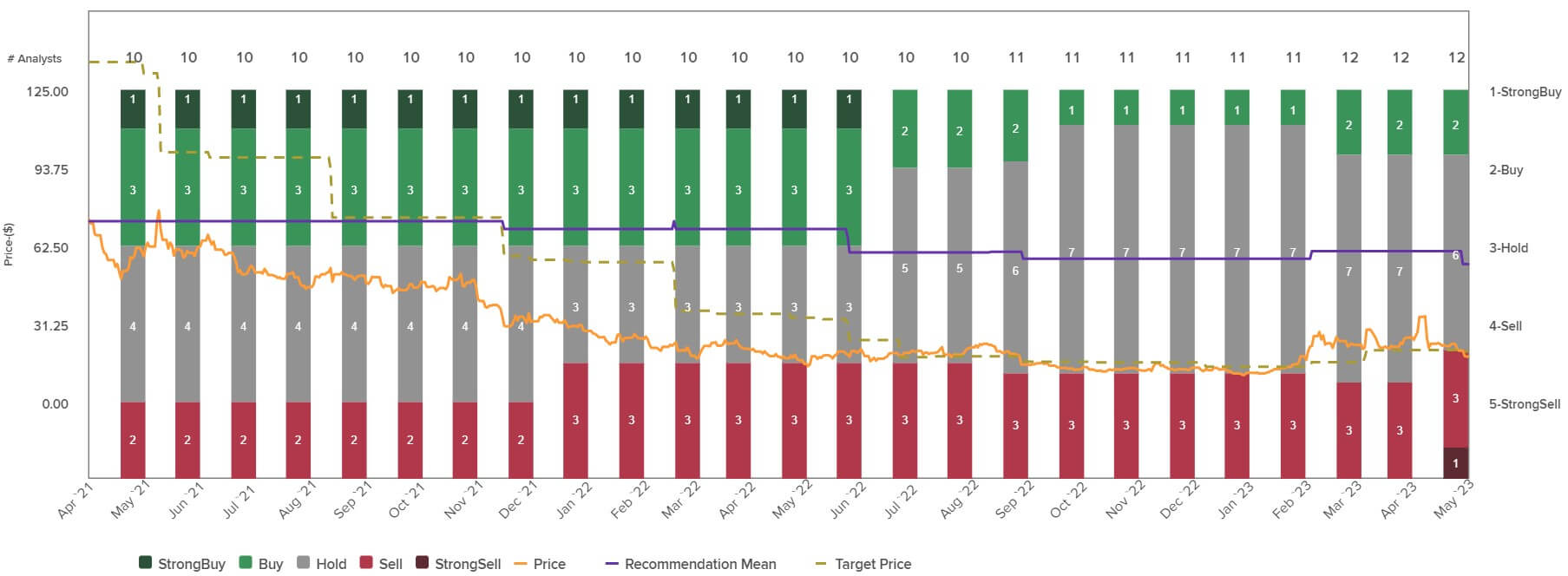

Analysts give thumbs down

There are also currently mainly negative voices from analysts. Wolfe Research, for example, downgraded the securities of the AI company from "marketperform" to "underperform". The price target was lowered to USD 14.00. According to Refinitiv, a total of 12 analysts currently rate the Company. The average price target is USD 18.50, close to the current price level.

SWOT analysis

Strengths

- Highly scalable business model

- High recurring revenues

- Experienced management with track record

- Solid financial position with approximately USD 790 million in cash reserves at the end of Q3

Weaknesses

- High burn rate

- Approximately 80% of revenues from one industry (oil and gas)

- Stagnating revenues

Opportunities

- Expansion of portfolio to additional industries

- Increasing industry investment in AI

- Acquisition by a larger player

Threats

- Competitive market environment

- Macroeconomic risks

- Dilution of shareholders through major corporate actions

Chart image severely tarnished

After a brilliant price increase of 217% since the beginning of the year to an interim high of USD 34.68, the above-mentioned negative influences were followed by a real sell-off under high volume. Currently, the price is at USD 17.60 only just above its 200-day line, which is still slightly rising at USD 17.34 and acts as support. If it falls below, the next sell signal will be generated. Weak support is offered at USD 14.97. After that, the way would be clear to the annual low at USD 10.16. If the turbulence and accusations continue, a further break of this mark is not unlikely. A fall into the single-digit range and thus a new all-time low could therefore make far lower prices possible. On the upside, however, a sustained break of the downtrend formed since March at USD 20.36 would positively impact the chart.

A question of faith

Due to the success of the chatbot chatGPT, artificial intelligence has finally arrived in the mainstream. Experts see dramatic growth in the coming years. C3.ai has a unique selling point due to its developed platform. However, the Company is still heavily loss-making, and the last quarter even saw a decline in revenue compared to the previous year's third quarter. However, with the experienced technology veteran Thomas Siebel at the helm, C3.ai could be steered in the right direction. In our view, a takeover by a larger technology group would not be unlikely. From a chart technical perspective, there is still further downward potential, so a possible investment is currently more than speculation.