Innovative dosage forms: It's not just the dose that matters

Although XPhyto is a Canadian company, there are several points of reference to Germany. Two of Xphyto's most important business units are based in the Federal Republic of Germany. Vektor Pharma TF GmbH is based in Uttenweiler in Baden-Württemberg and is responsible for innovative dosage forms. Specifically, this involves patches or small plates with active ingredients that are placed under the tongue. Alternative dosage forms are about achieving the same or better efficacy with fewer active ingredients. This has the potential for lower side effects and decreasing costs. Currently, Vektor Pharma is working on dosage forms for the treatment of epilepsy and Parkinson's disease.** Recently, XPhyto reported that the division offered opportunities for rapid market approvals due to lower regulatory risks. Once pilot or pivotal studies are planned, XPhyto will report.

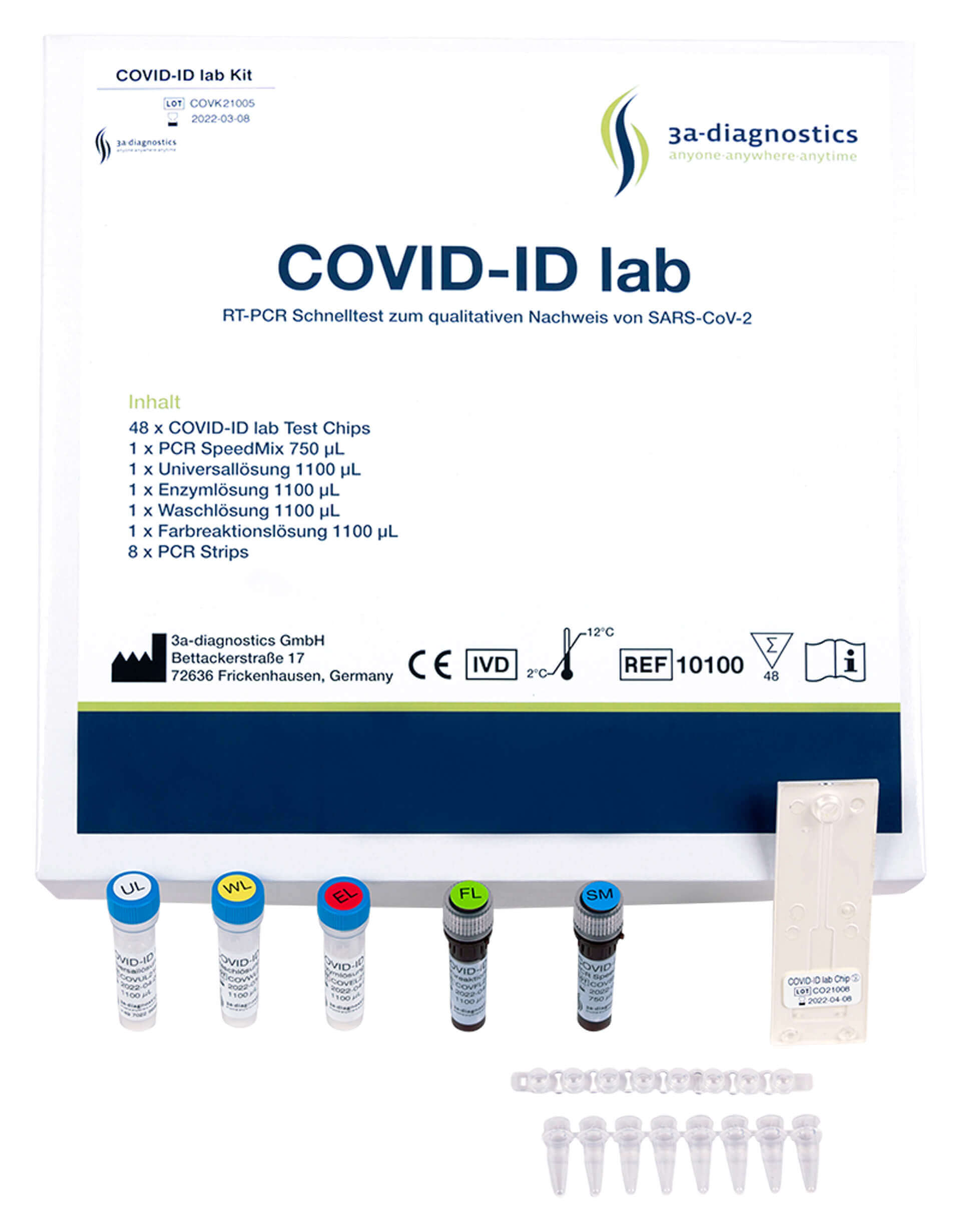

XPhyto's second major business segment also stems from the acquisition of a pharmaceutical company based in Baden-Württemberg, Germany. 3a-diagnostics GmbH is now 100% owned by XPhyto and focuses on the field of diagnostics. As already highlighted in detail in our comprehensive portrait (Report 12/2021), the diagnostics market in 2020 was worth EUR 2.7 billion in Germany alone - and this despite the fact that rapid tests for corona infections only came onto the market in the course of that year. Meanwhile, the market is likely to have grown further.

Diagnostics business picks up speed for XPhyto

In addition to products for the detection of oral diseases and influenza, XPhyto also offers Corona rapid tests in PCR quality. In this way, a high degree of certainty can be established within 25 minutes as to whether or not a person has a corona infection. Comparable rapid antigen tests are significantly less reliable and are currently causing a stir with false results. Under the umbrella of XPhyto, 3a-diagnostics GmbH is pursuing the goal of changing the diagnostics and rapid test market with proprietary technologies in a contemporary and rapidly growing sub-segment of the diagnostics industry. As recently as early February, XPhyto entered into an agreement with testing centers and pharmacies in Bamberg, Germany, for the supply of laboratory supplies and technical training of personnel.

"This is just one of many direct sales contracts we are currently pursuing in Germany, in addition to a number of European and global distribution agreements under review. It is a result of the combined efforts of 3a and Vektor staff in providing high-level training capabilities", commented Roland Spleiss, Head of Business Development at XPhyto, on the deal.

Psychedelic agents - more than just a hype topic

XPhyto's third business area is deliberately not based in Germany: psychedelic active ingredients still have a somewhat disreputable connotation in Europe, especially in Germany. But the drugs that can induce states of intoxication hold out the hope for the treatment of mental illnesses such as depression. Xphyto also wants to fight addiction or trauma-related stress disorders and is researching mescaline, among other things, for this purpose. XPhyto takes a multi-pronged approach to psychedelic medicine that includes GMP compound synthesis, proprietary delivery systems, development of new psychedelic analogs and their clinical validation. Thus, XPhyto acts as a complete provider around psychedelics and can offer investors everything from a single source. Although the third business area must be considered highly speculative in view of the regulatory risks, XPhyto can be considered promising due to the synergy effects, for example with the area of alternative dosage forms. Its subsidiary Vektor Pharma TF GmbH offers, among other things, patches that deliver active ingredients slowly and continuously over 24 hours. Such a dosage form could also make sense in the field of psychedelics, for example, when patients are to receive a continuous medication.

Interim conclusion: XPhyto is a biotech company with three exciting business segments. While the areas of diagnostics and innovative dosage forms can be described as conservative, the activities around psychedelic agents must be considered innovative and speculative at the same time. Even though small companies always need to show proof-of-concept before the market rewards efforts, XPhyto seems to be well on its way to doing so. **Following further updates on the business, the market is likely to continue re-rating the stock that has been slowly taking shape for several weeks now.