Canadian biotech company XPhyto recently reported positive in vivo results of a Rotigotine transdermal patch for the treatment of Parkinson's disease. Rotigotine is an active pharmaceutical ingredient already approved in Europe and the United States for treating Parkinson's disease and restless legs syndrome (RLS). When the active ingredient is administered orally, bioavailability is low and continuous drug delivery is difficult. For this reason, Rotigotine can be used as a once-daily transdermal patch, which delivers the drug continuously through the skin and thus ensures a consistent effect for relieving both neurological disorders.

Market entry of Parkinson's disease patches possible in as little as 12 to 24 months

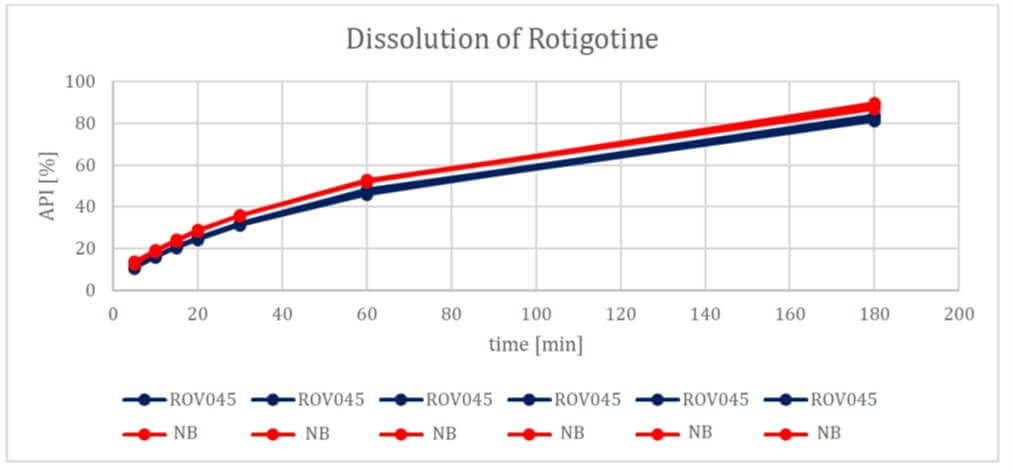

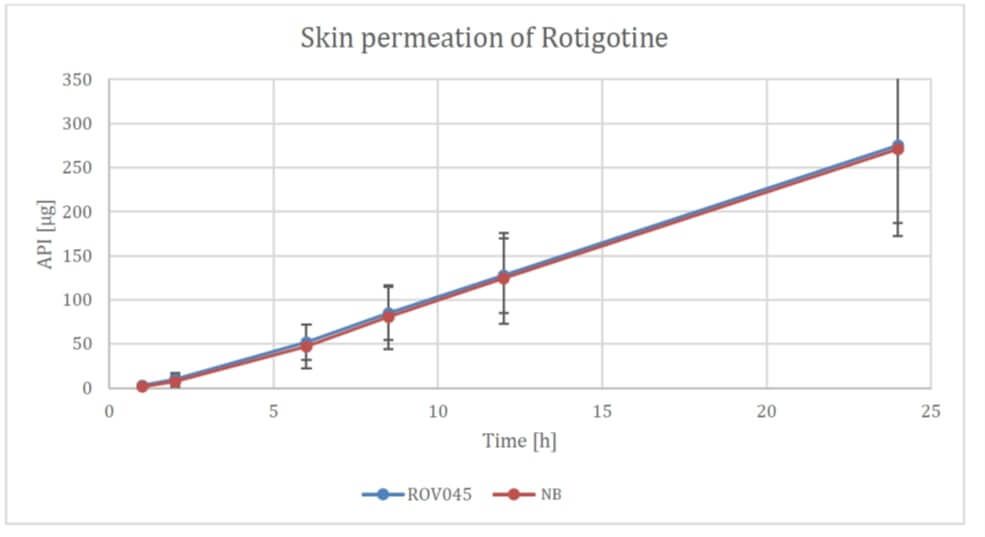

XPhyto's latest study compared an active ingredient patch currently on the market from a well-known brand with an in-house development from XPhyto's subsidiary Vektor Pharma TF GmbH, based in Biberach, Baden-Württemberg. In particular, the penetration of the skin and the dissolution behavior of the active ingredient were investigated. While the former test criterion did not reveal any significant differences between the two products, the solubility of Rotigotine still showed small differences in favor of the branded product. For XPhyto, the results nevertheless exceeded expectations. The Company expects to move its Rotigotine patch into an in vivo study. Such studies, which in the positive case result in a market entry, usually last between 6 and 12 months.

Rotigotine is standard medication - and a multi-million market

XPhyto's Rotigotine solution is the only publicly known alternative to date to the drug known by the trade name Neupro. The patch is typically used as the sole active treatment, particularly in the early stages of the disease. Later, it is often administered in combination with L-dopa. The active ingredient Rotigotine thus covers several stages of Parkinson's disease or restless legs syndrome. According to Wissen Market Research, total global sales of Rotigotine patches was USD 518 million in 2021. By 2030, analysts expect sales to increase to USD 760 million.

If XPhyto succeeds in gaining share in this market, the Rotigotine patches could help the Company achieve an operational breakthrough. "The studies to date around our Rotigotine product are very encouraging, and we are confident we can continue to optimize the patches," XPhyto CEO Hugh Rogers told researchanalyst.com. "Ahead of the CPHI conference in Frankfurt starting on November 1st, there is already a lot of interest in our interim results from potential partners."

One step further: Agreement with US company around diagnostic products

While potential partnerships are being explored in the area of dosage forms, XPhyto is already one step ahead with its diagnostics division. Earlier this month, the Company signed a non-binding letter of intent with a US company to collaborate in the area of thin-film screening tests. Specifically, this is to involve manufacturing, sales, and also research and development. The partner company, which cannot yet be named, has manufacturing capabilities that meet the requirements of the US Food and Drug Administration as well as more than 50 years of experience. The two companies are currently evaluating what a concrete collaboration could look like and how the respective business areas could fit together in concrete terms.

Fighting opioid epidemic in the US - Oral health takes center stage

XPhyto's diagnostics business comprises several oral health-related products, including tests to detect stomatitis, periodontitis and peri-implantitis. It is here that tie-ups to the lucrative US market could emerge. In the summer, the US Food and Drug Administration warned of the indirect health consequences of opioid addiction in the United States. Estimates suggest that between 6.7 and 7.6 million people in the United States suffered from opioid use disorder in 2019 alone. As if these numbers were not frightening enough, this summer, it was revealed that medications for addiction, such as buprenorphine, can result in oral diseases as a side effect. Specifically, this involves tooth decay and other infections that can ultimately lead to tooth loss. Because XPhyto's tests around inflammatory diseases of the mouth are easy to use and provide reliable results, there could be a large market for them, particularly in the US. Insurance companies are likely to have a keen interest in proactively countering costly treatments, including implants, through timely prophylaxis.

Bottom line: Big steps toward market readiness

After the shares of XPhyto had formed a course low in late summer, the price is now stabilizing and is even leaving the weak summer months behind. The reason for this bottom formation is probably the fact that the Company has made significant progress in two of its three business areas. In the diagnostics division, there is already a non-binding letter of intent with a US company. Here, the special situation surrounding the opioid crisis could be a catalyst for rising quotations. Market researchers also believe that there is potential, independent of this special situation: with its biosensor products, the Company is positioning itself in the global markets for biosensors and oral health, which, according to Global Market Insights, could reach a volume of USD 43.6 and USD 44.5 billion, respectively, by 2028.

In the dosage form space, XPhyto is reaching a potential multi-million market with its Rotigotine patches. XPhyto's platform approach also enables the Company to respond to new developments in the healthcare market. Furthermore, positive spill-over effects of recent developments on the Company's third pillar cannot be ruled out: Psychedelics are gaining importance in the fight against mental illness, especially in North America. As recently as September, XPhyto filed a family of new patents in this context. Stocks around psychoactive agents have received a lot of attention in North America in recent days.

The update follows our initial Report 12/2021.