Green hydrogen is coming

The German government has adopted the National Hydrogen Strategy in 2022. It aims to make green hydrogen marketable and enable its industrial production, transportability and usability. Green hydrogen is central to achieving the Paris climate protection targets: With its help, it is possible to transform Germany's largest greenhouse gas emitters in a climate-friendly way and, at the same time, strengthen Germany as a technology location. This is the theory of the Berlin-based "Energiewende" working group.

The most important area of application is industry: green hydrogen is the only way to make certain processes in the chemical industry climate-friendly and also the most sensible way to replace coal in the steel industry. In addition, hydrogen can fire a wide range of furnaces as an alternative fuel. Green hydrogen can be used as a fuel in transportation - especially where electrification is not practical or possible. Together with CO2, it can also be converted into other climate-friendly fuels, which will include powering trucks, ships and aircraft. The new fuel can be converted into electricity and heat with the help of fuel cells. In this way, fluctuations in the power grid can be balanced out, and houses can be heated and supplied with electricity. This is an important starting point for the "Habeck Heating Policy 2024".

The global Hydrogen Council corporate initiative estimates that the share of climate-neutral produced hydrogen in final energy demand will increase from currently 2% to 18% in 2025. Europe is to become climate-neutral by 2050 and save at least 55% of greenhouse gases by 2030 compared to 1990. The "Fit for 55" package has further tightened EU legislation.

ThyssenKrupp is in on the action

The Uhde Chlorine Engineers electrolyzer business will be rebranded in 2022: Under the name ThyssenKrupp Nucera, the supplier of systems for green hydrogen production plans to usher in "a new era". At its Capital Markets Day at the Company's headquarters in Essen, Germany, on January 13, 2022, ThyssenKrupp unveiled the new brand identity, as well as the Company's business model and growth strategy. In alkaline water electrolysis (AWE) for the production of green hydrogen, ThyssenKrupp Nucera is building on its decades of experience in chlor-alkali electrolysis and aims to support its customers on the road to climate neutrality. The name Nucera is a combination of "new", "UCE", and "era" and symbolizes the dawn of a new era of innovation, transformation and green energy. ThyssenKrupp AG is currently examining how best to develop the hydrogen business. The IPO is currently the preferred choice and could become a reality as early as this summer.

Focus on the IPO of H2 subsidiary Nucera

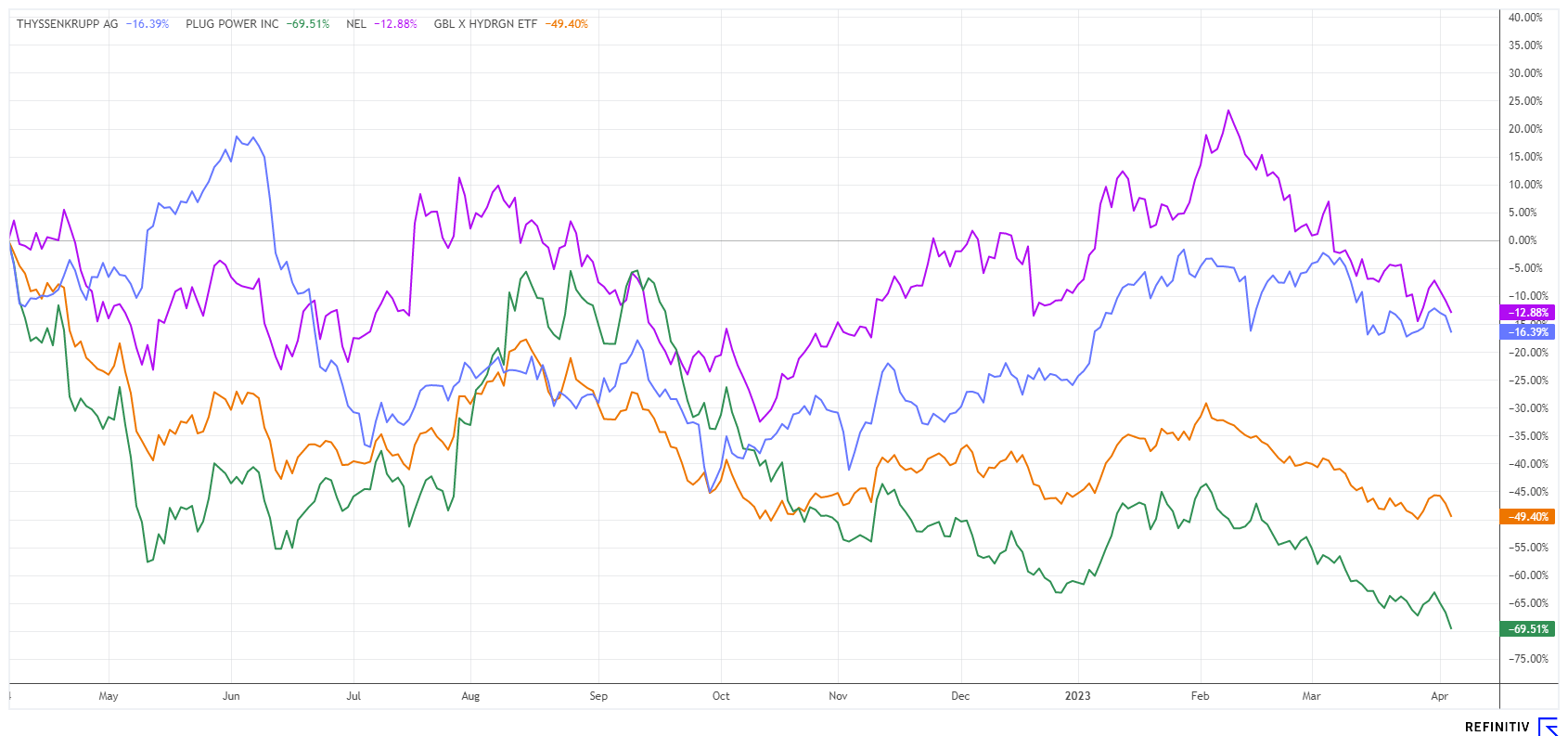

ThyssenKrupp could bring Nucera to the stock market as early as June if the market continues to cooperate until then. Currently, the mood is surprisingly good, except for the hydrogen sector, which is struggling immensely. At present, skepticism prevails that rapid industrial infrastructure for hydrogen applications can be created. The IPO plans have been known for quite some time, but a date has yet to be set. However, there can be no more procrastination because the project is important for ThyssenKrupp and Germany as a business location. But it will require huge investments in technology and research, which, due to a lack of public funding, can only be financed via the capital markets.

There are many speculations about the possible valuation of Nucera, ranging from EUR 2 billion to EUR 5 billion. Analysts take a positive view of the fact that ThyssenKrupp will retain a majority stake after the IPO. The issue of new shares is expected to generate proceeds of up to EUR1.2 billion. A positive aspect of the stock market debut would in any case be the media attention and the new avenue for future refinancing via equity and debt capital. Investors in Germany would also get their first chance to invest in a major hydrogen player. Due to its capitalization, the stock would be able to enter the MDAX right away.

The strategic challenges are great

ThyssenKrupp CEO Martina Merz is currently in a difficult position. The workforce is rebelling, and the capital market is reluctant to let the stock soar. Since last fall, there has been little movement in the Group, and the concept of a "Group of Companies" - the key vision for the industrial group - has so far not been particularly successful. In the first quarter, there was a decline in orders of almost 1.2 billion to only EUR 9.18 billion. Turnover, however, held steady at just under EUR 9 billion. The coming quarters should be better again.

Under pressure from exploding raw material costs, EBIT in Q1 slumped 33%.

The bottom line was a 33% drop in adjusted EBIT to EUR 254 million from EUR 378 million. Management blames the poor environment for the declines. Experts, on the other hand, see the unresolved intentions regarding the steel division as the biggest obstacle, as it supplies system-critical sectors such as the auto, defence and mechanical engineering industries. Steelmaking is a highly cyclical, capital-intensive business with strong fluctuations from year to year. All the more reason for the stock market to doubt the seriousness of alleged interested parties such as financial investor CVC Capital Partners, Brazilian competitor CSN, India's Jindal or potential investors from the Czech Republic or Qatar. So far, many rumours, but no deal.

Conclusion: The skeptics still outnumber the investors

In the current year 2023, ThyssenKrupp stock is up 17%. That is roughly the same as the DAX return. In the prior year, the stock was down 48%, and the market priced in corresponding risks on the energy and raw materials side with heavy discounts. These negative factors are currently easing significantly, giving the Group breathing room, although pension obligations of EUR 3 billion continue to weigh on the balance sheet. Slight optimism is warranted for 2023 and 2024, as the order situation should improve again due to rising public budgets for the fight against climate change. Analysts at the Refinitiv Eikon platform estimate 2023 sales of EUR 36.2 billion and adjusted EBIT of EUR 869 million. Earnings per share are expected to reach EUR 0.58 after EUR 1.82. In the previous year, the profit included special proceeds from sales of company shares. Currently, the MDAX stock is valued at a market capitalization of only EUR 4.0 billion.

The consensus view of the 13 analysts surveyed by Refinitiv Eikon on ThyssenKrupp AG is neutral to positive. The average 12-month target price is EUR 9.03 - a potential upside of 32%. From a chart perspective, the price should not fall below EUR 6.25 to underpin the positive turnaround of recent weeks. The risk profile of ThyssenKrupp stock is high due to the large cyclicality of the business model and is only suitable for long-term investors. For re-entry into the DAX, the market capitalization would have to increase by 100%.

The update is based on the initial report 03/2022.