Diversions to the goal

Since last August, a lot has happened at the headquarters of Smartbroker Holding AG, which used to trade under "wallstreet:online". Not only did the name change, but the position of CEO was also filled by a new person. However, "new" is not entirely accurate. Rather, the major shareholder and founder, André Kolbinger, once again took the helm to steer the off-course ship into a safe harbour by August this year at the latest. Then, according to the latest statements by the Company's leader, "Smartbroker 2.0", the most attractive broker in Germany, is to be made available to the general public. Attractive because, on the one hand, the new platform offers all the features as well as the prices of a neobroker, including an Android and iPhone app, and on the other hand, it provides a broad selection of trading venues and investable products, as is only known from established banks and full-service providers.

Transparency is a top priority

Since the largest shareholder with a stake of 54.41% returned to the helm, the planned strategy of building their own broker has been abandoned. The Company is now relying on suitable external partners who offer planning security, both regarding the timely launch of the platform and the cost structure. The custody and clearing account will be managed by Baader Bank, which will also take over several transaction processing functions. The Smartbroker app, which is currently being developed, and the desktop trading interface, which has been redesigned from the ground up, will be combined with securities processing that has been tried and tested by banks for many years. On the operational side, the Smartbroker Group will take over the provision and maintenance of the front end, the digital securities account application process and customer support.

In addition, the Company will, in future, also provide essential parts of the middleware such as security authentication, order preparation, settlement and all other technical execution steps upstream of transaction processing. Currently, the engine room in the capital city is likely to be bustling with activity as the areas of front end, middleware, and securities processing are to be linked. Since the Company has maintained transparent communication with the outside world since the change of management board, one can be optimistic that the announced launch date of August will be met.

Everything on track

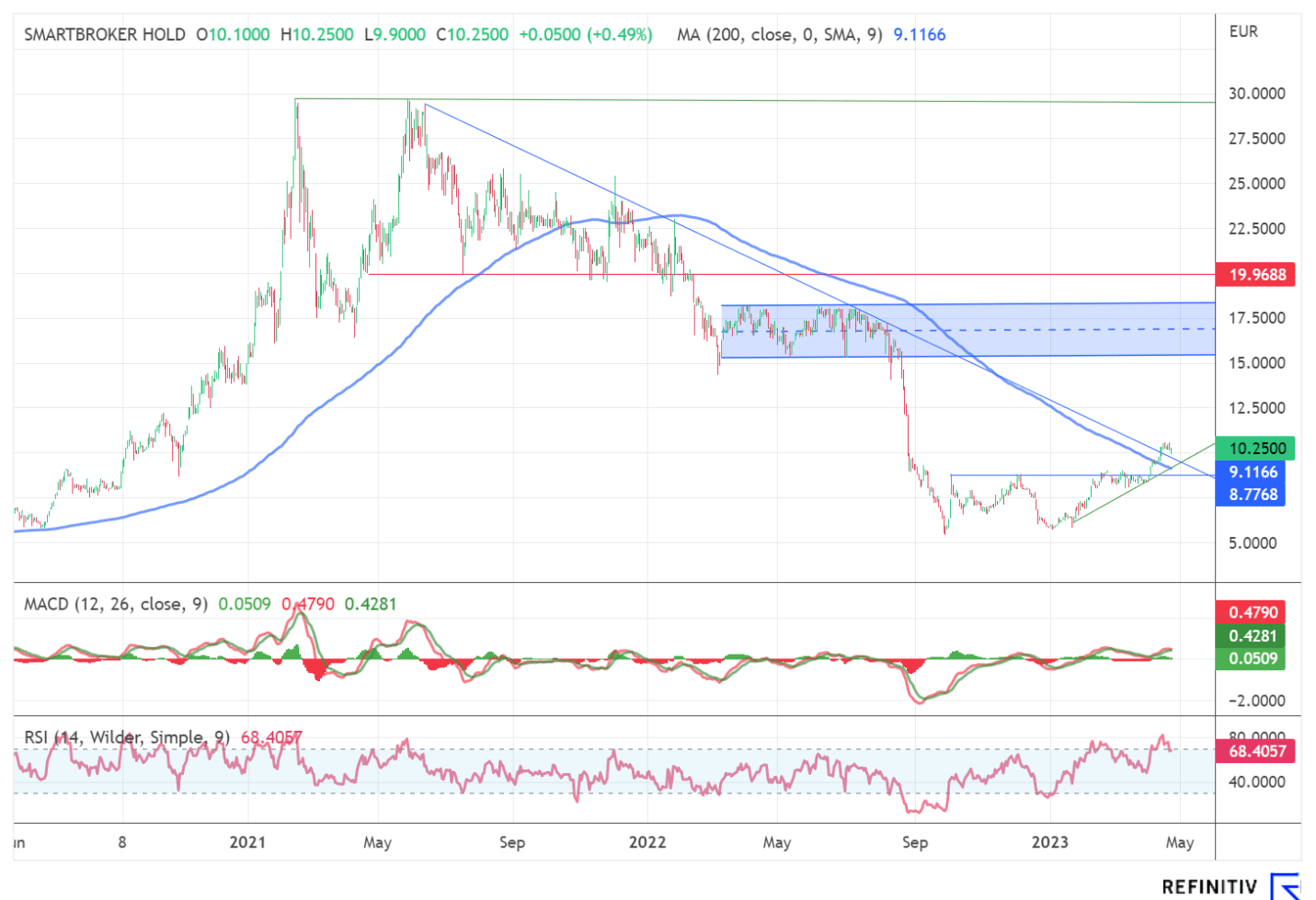

Speaking of open communication. Cleaning up the past at Smartbroker Holding meant special write-offs totalling EUR 13 million and a revenue and profit warning for 2022. Due to the delays concerning "Smartbroker 2.0", the group was able to regain investor confidence, at least in part. This was visible after the announcement of the "bad news", as the share price did not fall further into the bottomless pit. On the contrary, it stabilized we reported after the formation of a double bottom at EUR 5.80. Since then, there has been a performance of 75% to currently EUR 10.25.

Consolidation before the next hype?

From a chart perspective, it would be expected for consolidation to set in after the run-up of the past few weeks. Moreover, investors who missed the first "run" could get a second chance. The share price broke through the downward trend at EUR 10.09 that has been in place since June 2021. However, it is currently showing the first signs of fatigue. The trend-following indicator MACD has already formed negative divergences and is on the verge of generating a sell signal on a daily basis. The RSI is still in the overbought zone, which should move back into the neutral zone due to the sharp recovery rally of the past weeks.

An optimal scenario would be a pullback to the breakout point at EUR 8.77. This is also the area of the still falling 200-day line, which should serve as double support. After a successful test of the mentioned levels and possible positive news regarding the successful launch in August, the next interim target would be the zone of the 2022 established channel between EUR 15.37 and EUR 18.21.

Analysts remain optimistic

This also aligns with the price target of analyst firm GBC AG, who arrived at EUR 17.70 in their discounted cash flow model. The rating is maintained at "buy". Overall, the Augsburg-based analysts continue to see the Smartbroker Group as well positioned to expand its market position in the two business segments, Portal Business and Brokerage. The planned launch of Smartbroker 2.0, including apps and product enhancements, should significantly increase the Company's future growth momentum from the 2024 fiscal year onwards. Due to the high scalability of the brokerage business model, the expected earnings growth should also lead to a disproportionate increase in Group profitability.

Interim conclusion

Due to delays regarding the launch of "Smartbroker 2.0", the share has lost around 70% of its value since July last year. Through a change in strategy, the successful search for new partners as well as open and transparent communication, the executives around CEO and major shareholder André Kolbinger were able to regain the trust of investors. Currently, the crucial phase of linking the frontend, the middleware and the securities processing is likely to proceed. With positive interim reports, we assume this should be reflected positively in the share price. If the launch date in August is met, this should result in significantly higher quotations.

The update is based on the initial report 11/2021