25,988 BOE - The numbers are getting better and better

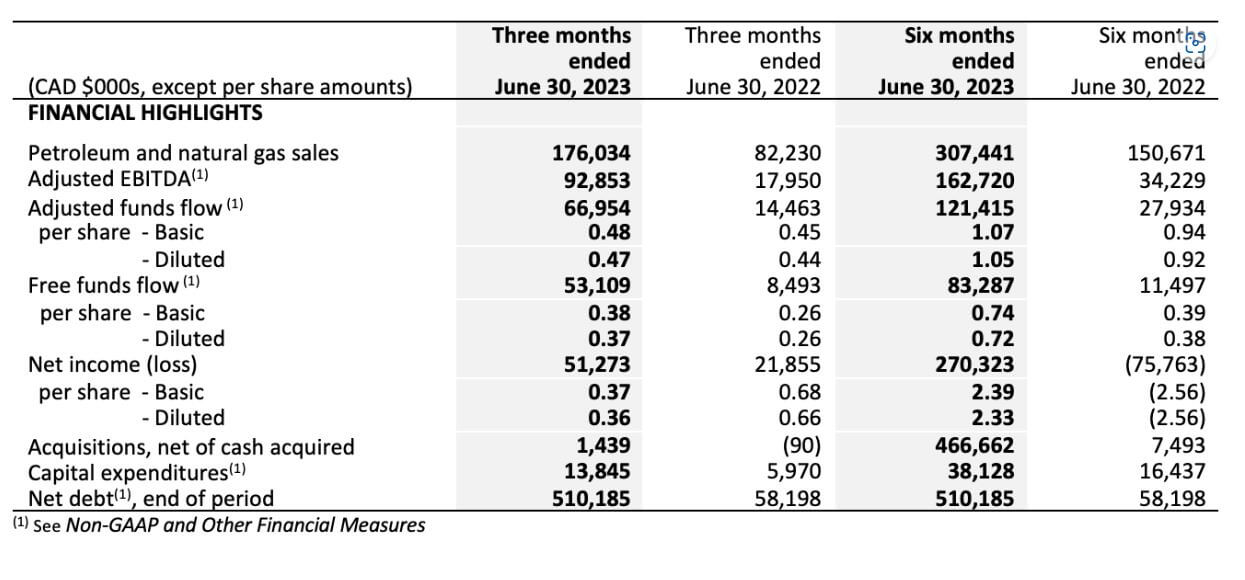

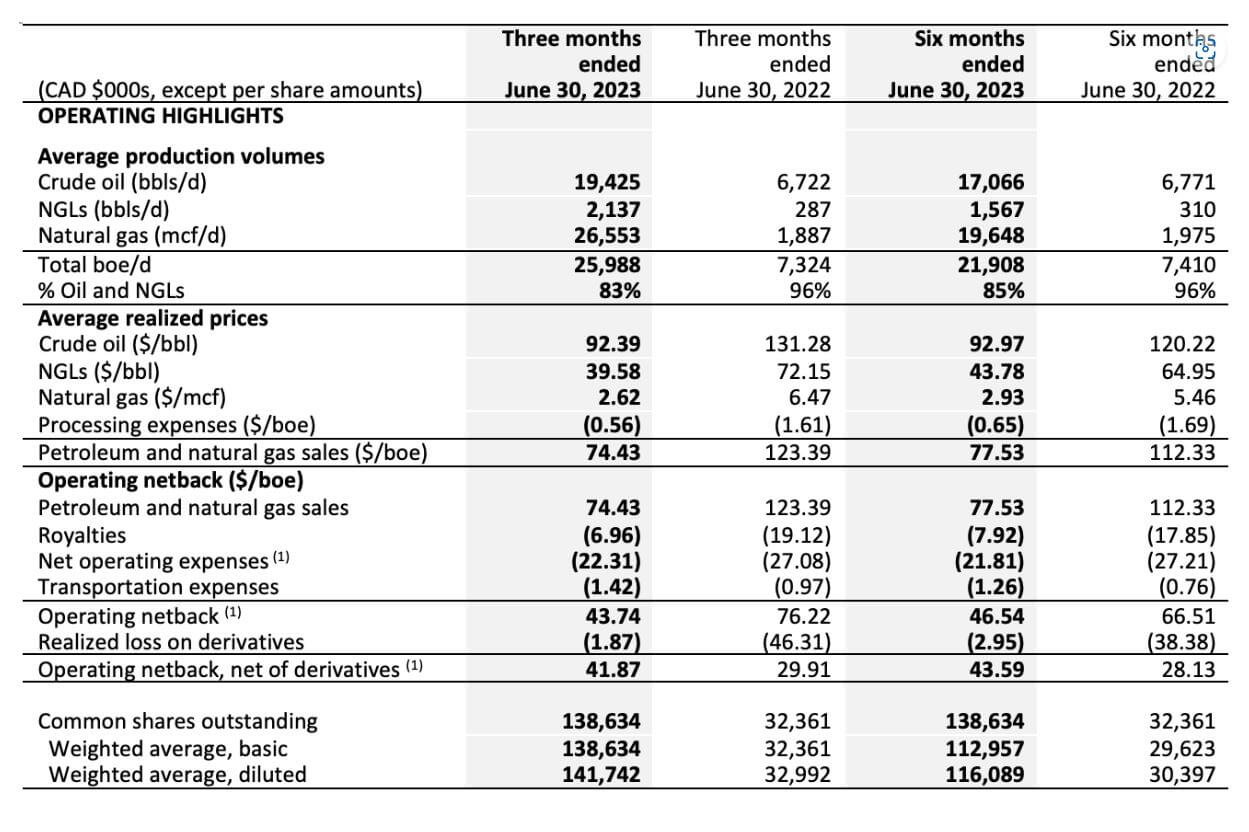

Saturn Oil & Gas can boast another production increase. Following the integration of the latest acquisition, "Ridgeback," the quarterly production is displaying its best performance. And this, despite the oil price experiencing setbacks due to the economic conditions and severe wildfires in Alberta that forced the shutdown of some properties. **The fires have now been extinguished, and production is reaching new dimensions with more than 25,000 BOE per day (BOE = barrel of oil equivalent, including gas components). The figures for the completed 2nd quarter of 2023 were surprisingly good: a renewed record quarterly production averaging 25,988 compared to 7,324 BOE/day in Q2 2022 resulted in quarterly oil and gas revenues of CAD 176.0 million compared to CAD 82.2 million in Q2 2022 and CAD 131.4 million in Q1 2023.

**Operationally, Saturn increased its value per barrel from CAD 29.91 to CAD 41.87, while year-to-date oil prices corrected from USD 108.41 to USD 73.75.

barrels in oil equivalent/day is the new production mark for an average day

The 2nd quarter of 2022 is an exceptional quarter for oil price development with the invasion of Russian troops into Ukraine. Here, top prices of USD 125 per barrel WTI could be observed. Under current economic conditions, WTI oil prices should be expected to range between USD 70 and 85. On the earnings side, this resulted in an increase in Saturn's adjusted EBITDA from CAD 18.0 million to CAD 92.9 million, with adjusted cash flow reaching CAD 67.0 million or CAD 0.48 (basic) per share. With seven new wells, Saturn invested a full CAD 13.8 million, achieving a 100% hit rate. Free cash flow increased significantly from CAD 8.5 million in the previous year to CAD 53.1 million, a remarkable 524% increase due to acquisitions.

Q2 and H1 2023 financials at a glance:

Saturn continues to make significant progress in integrating Ridgeback Resources Inc. to become an important energy producer in Western Canada. Annual production will nearly quadruple YOY. In recognition of the increased scale of the Company's operations, Saturn has been listed on the Toronto Stock Exchange since June 2023. The Company's production in Alberta was temporarily impacted by wildfires and associated third-party infrastructure outages, resulting in a curtailment of production of approximately 2,300 BOE/day (56% oil and NGLs) during the quarter. Currently, 100% of curtailed production is back on stream, and there has been no material damage to Saturn's infrastructure or facilities. With strong free cash flows in excess of CAD 50 million per quarter, Saturn is able to consistently reduce its debt of approximately CAD 510 million. The Company made a principal payment of CAD 51.5 million in the past quarter.

An overview of the production figures for Q2 and H1 2023:

More drilling targets using new technology

Saturn's drilling program for the 2nd half of 2023 is already underway. One rig each is expected to be in operation in Alberta and Saskatchewan by the end of 2023. The Company plans to drill up to 25 wells in the Oxbow area in H2 2023. The Oxbow development is expected to include drilling in the Bakken formations for light oil using a new hydraulic well stimulation technology ("OHML", Open Hole Multi-Lateral Well). OHML is a newly developed drilling technology that is already having great success in the Bakken formations in southeast Saskatchewan. Its use can increase estimated total light oil recovery and improve development economics. The Bakken formation is a well-defined resource area where Saturn has over 350 identified locations in close proximity to the Company's infrastructure and an operated gas processing plant. In addition to the ongoing drilling program, Saturn plans to drill up to two additional ERH wells targeting Cardium light oil in the West Pembina area in 2023. Supplemented by up to four ERH wells targeting Montney light oil in the Kaybob area of the Northern Alberta Asset. It is therefore expected that Saturn will already be able to report further increases to daily production in the coming quarters.

Interim conclusion: On the way to a revaluation

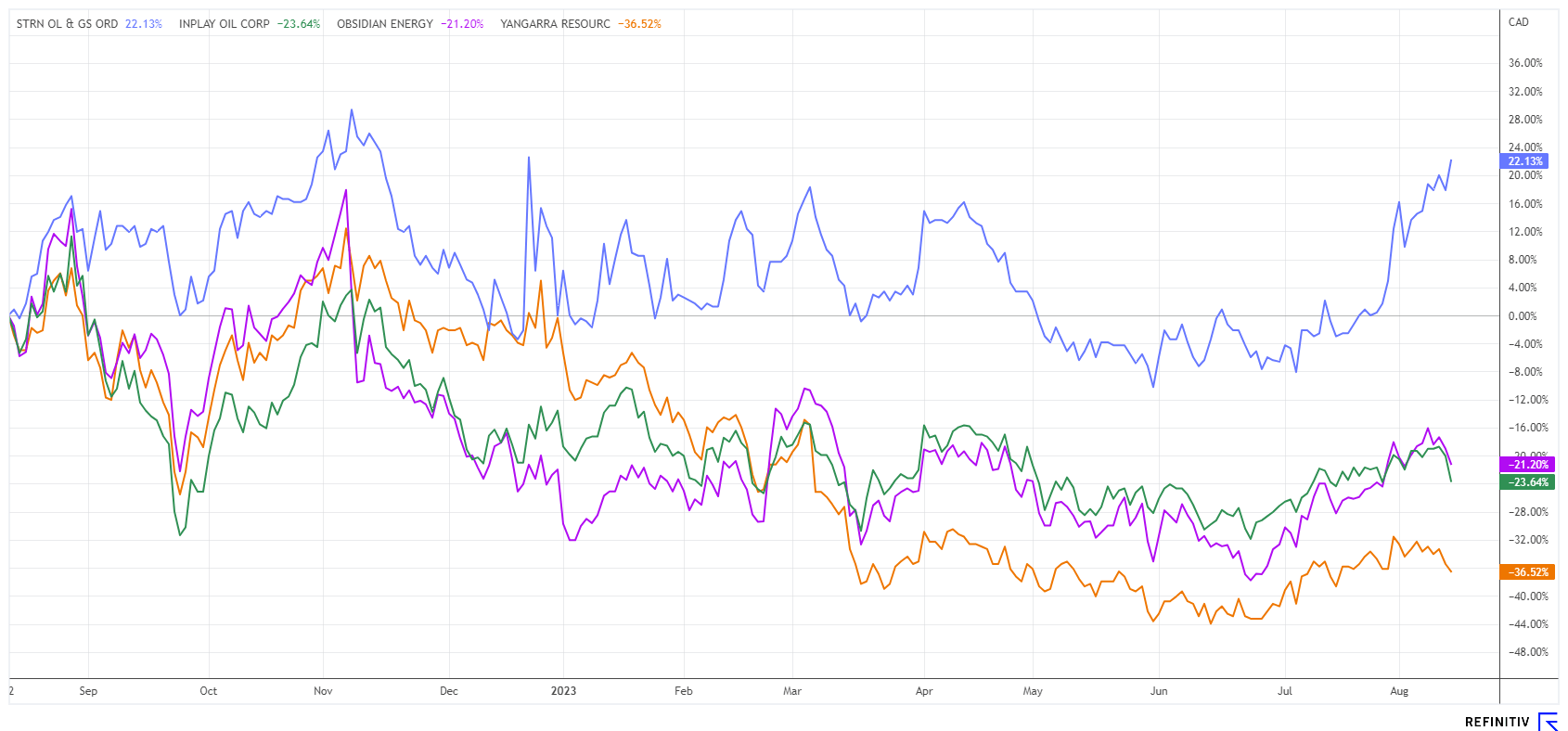

A chart comparison shows that Saturn is now clearly outperforming its Canadian competitors. The valuation gap that emerged after the large M&A transactions now appears to be dissipating in a short period of time. Over the past 12 months, the SOIL share price has outperformed its peer group by up to 50%. Due to the current high momentum in the ramp-up of production, it is likely that the gap can even be widened.

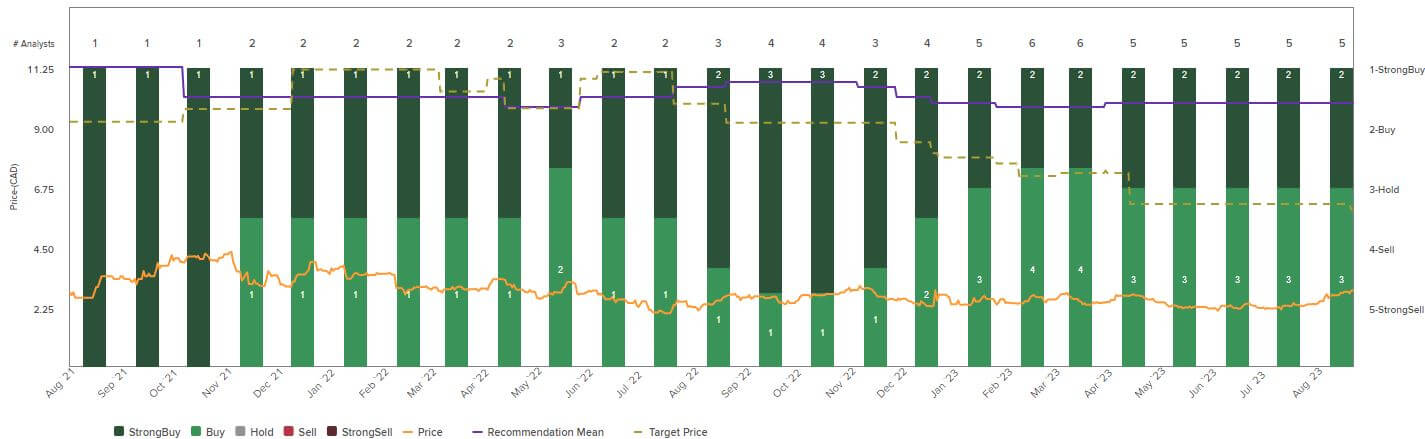

Fundamentally, Saturn is currently trading at an estimated 2023 EV/adj EBITDA ratio of about 1.2. With a median industry valuation of 4.5, a fair value per share of about CAD 9.00 to CAD 11.00 would be expected from today's perspective. Most recently, the major investor GMT Capital increased its stake in Saturn Oil & Gas to 24.91%. Interest from institutional investors now seems evident due to the Company's new size.

The price expectations of analysts on the Refinitiv Eikon platform currently still range between CAD 4.75 and CAD 6.50 on a 12-month horizon. This means the current price of SOIL shares is still far from its fair price target. However, the recent price momentum indicates that the hurdle at CAD 2.80 can be overcome sustainably. Chart analysis also gives the share further room to move upwards, provided that the CAD 2.50 line is not breached downwards again. The Company can continue to achieve a brightening of the value through increased drilling investments and the use of modern technologies. The recently expired 30.54 million warrants and options are no longer contributing to dilution. The intrinsic value per share thus increases significantly.

Note: A detailed presentation on the Financial results for the 2nd quarter of 2023 can be found here. A spoken version can be accessed at this link: Q3 webcast recording. On October 10, 2023, Saturn Oil & Gas will present at the International Investment Forum. The release of Q3 figures will take place on November 29, 2023.

The update follows our initial report 11/21