Now that the transformation is complete, it is time to harvest

The Viking acquisition was a quantum leap for Saturn Oil & Gas as it propelled the Company ad hoc from the county league to the association league. The Calgary-based company has acquired a light oil asset in west-central Saskatchewan with new synergistic assets with the Viking acquisition. In scope, this represents a production increase of approximately 4,000 boe/d (~98% light oil and liquids) with intensive cash flow production and over 140 net parcels in the Viking Fairway. With a 250% increase in drilling inventory, the Viking acquisition further expands the size and scope of Saturn's Saskatchewan operations, complementing the Company's core area in the Southeast. Now Saturn has a scalable portfolio of good properties with free cash flow that can be used for both rapid debt reduction and further expansion of drilling activities. Diversification of production greatly improves the Company's financial resilience. The daily production rate now achieved increases by a factor of 50 in just 18 months to a current level of approximately 12,000 boe/d.

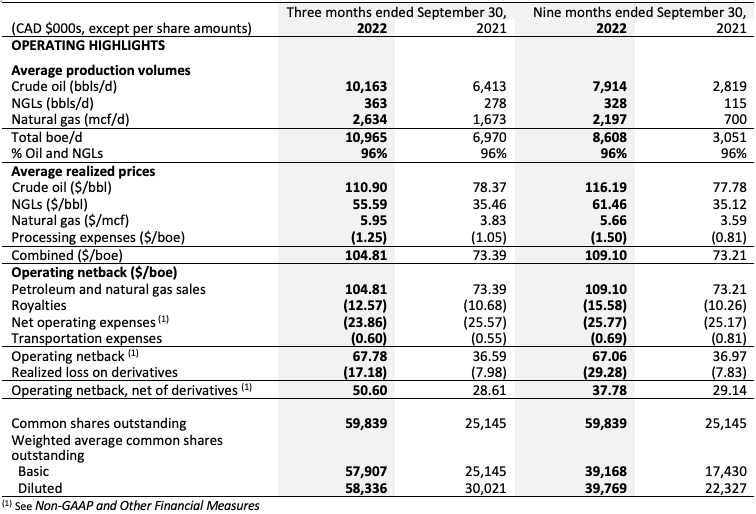

The figures for the third quarter of 2022 can inspire

The highlight of Q3 for Saturn was certainly the closing of the CAD 240 million transaction to acquire the Viking oil fields in southwest Saskatchewan. In addition to approximately CAD 200 million of new debt lines, they were also able to raise CAD 75.2 million in new equity. This enables further refinancing options through the exercise of warrants with a subscription price of CAD 3.20. Theoretically, a further CAD 139.7 million could flow into the Company from 2023 onwards.

Operationally, Saturn was able to convince in the current quarter and catapulted the figures into a new dimension. During the summer, WTI spot prices were quoted between USD 90 and 120, enabling a good 60% of planned production to be sold forward. Saturn will now achieve its planned debt reduction by mid-2024 as a result of these measures. Average production reached 10,965 barrels of oil equivalent per day (boe/d), an increase of 57% compared to 6,970 boe/d in the third quarter of 2021. Revenue thus reached the new record level of CAD 105.7 after CAD 82.2 million in the second quarter, compared to the previous year, the revenue figure thus increased by a full 124%. On an adjusted basis, operating profit also increased correspondingly strongly by 179% to CAD 50.3 million. The operating margin in oil sales developed dynamically to most recently CAD 67.78 per barrel of oil sold. The Company invested CAD 36.8 million in the development of 30 new wells. After deduction of the investments, a cash inflow of CAD 39.8 million remains in the treasury; converted to the new number of shares, this provides CAD 0.69 per share compared to CAD 0.45 a year earlier. Calculated on the fully diluted share, the bottom line is a tidy net profit of CAD 2.87 in the quarter, after 9 months the Company still reaches a full CAD 2.30. The current debt still amounts to approx. CAD 235 million, at the end of the year about CAD 180 million can be forecast with today's oil prices.

"The third quarter of 2022 is the first reporting period to reflect the distinctly positive impact of the Viking acquisition completed on July 6, 2022, in terms of higher netbacks and additional production, resulting in record cash flow for the Company," stated John Jeffrey, CEO of Saturn. "Saturn is in the process of actively developing the newly acquired Viking project with 21 of its recently drilled 27 Viking wells focused on light oil in the new acreage with a 100% success rate."

Operational positioning is gradually improving

With the closing of the Viking acquisition on July 6, 2022, Saturn's business in west-central Saskatchewan has been sustainably scaled up. Operational optimization and incipient economics of scale are sharply lowering overall production costs per barrel. As royalties on the new acreage are significantly lower, net profit margins on each unit produced are also increasing. The trending downward oil price from an average of 108.4 to 91.5 of the benchmark WTI grade had little impact on current operations, as the sales price was still well above management's expectation and is cushioned accordingly by forward sales. Saturn Oil & Gas demonstrates a steady hand in stormy times and benefits from its far-sighted decisions.

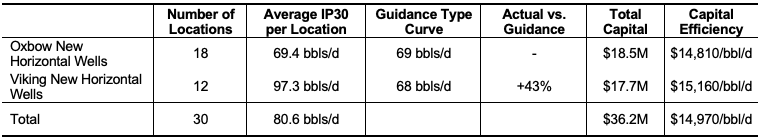

The third quarter of 2022 was the most active drilling period in the fledgling company's history. Saturn developed 29 new horizontal wells for light oil in the core Viking and Oxbow areas with a 100% success rate. As a result, the Canadians remain on track with expected production growth rates even with the new wells and also achieved striking success in developing the Viking region. Compared to last year 2021, development costs increased slightly due to general cost dynamics, but they were more than offset by strong increases in sales prices. The table below provides an overview of the efficiency of newly developed properties:

Interim conclusion: The market is ripe for a revaluation

Saturn Oil & Gas continues to show in the third quarter that it is possible to accelerate the Company's growth once again. From a current production level of 12,000 boe, we assume a further increase in 2023 to an average of 13,400 boe due to the momentum shown. The significant increase in production levels also increases available net cash flow once again, accelerating deleveraging and creating further reserves for investment in organic performance. With forecast capital expenditure of around CAD 115 million, free cash flow should reach a total of over CAD 100 million. This assumes an average WTI price of USD 90 for the coming year. **Even if imponderables are to be expected here from the perspective of an approaching recession, Saturn will achieve a significant debt reduction in 2023/24.

The ever larger production shares, which can be sold freely without hedging, also increase profitability. The forward sale relates to around 60% of production output and is scheduled to decline on a declining basis until mid-2026; the current hedging levels could be carried out at oil prices of CAD 92 to 102 and achieve an average selling price of around USD 80. This ensures that the medium-term deleveraging will work out regardless of the volatile oil price development. If things go well in the meantime, as in the past 3rd quarter, additional proceeds from the optioning even beckon. With the secured USD-based sales, Saturn is currently in a perfect environment.

If one takes the current share price of approx. CAD 3.00 as a benchmark, then an enterprise value of approx. CAD 410 million is calculated, taking into account the borrowed funds. Based on EBITDA after forward sales of approx. CAD 250 million, Saturn Oil & Gas is valued at a factor of 1.6 times EV/adj EBITDA. No comparable company in the industry has such low ratios. It is therefore to be expected that the valuation gap will close in the medium term at a factor of 5 times EV/adj EBITDA. First Berlin consequently rates the stock as "Buy" with a 12-month price target of CAD 7.0.

The update follows our initial report 11/21