Politicians focus on "freedom energies"

For Finance Minister Christian Lindner, renewable energies are "freedom energies." Robert Habeck, Germany's Minister of Economics and Climate Protection, sees the future in non-fossil energy sources: "The real path to energy policy independence is to phase out fossil energies. The sun and the wind do not belong to anyone," Habeck recently commented in an ARD broadcast. Outside Germany, too, both politics and business are focusing on climate change and the use of wind and sun. In addition to photovoltaics and wind energy, hydrogen, which can be used in a variety of ways, is considered a key element.

In order to generate electricity from hydrogen, fuel cell technology is needed. Since hydrogen does not occur in unbound form, it must first be extracted using energy. It is therefore expensive and problematic to produce and transport. Currently, 1kg still costs around EUR 9.50. The solution for a drastic medium-term price reduction lies in the production of green hydrogen. In combination with the expansion of wind and solar energy, Bloomberg NEF expects a drop of 85% in the extraction costs of green hydrogen by 2050, making the gas attractive compared to fossil fuels. However, with the sharp rise in oil and natural gas, green hydrogen is expected to become competitive much sooner.

Plug Power plans big

In the field of fuel cell technology, the US company Plug Power is considered a pioneer and market leader. Founded in 1997, the NASDAQ stock developed into a USD 12 billion corporation without once in the Company's history being in the black. However, this is expected to change drastically in the next few years. As explained in a detailed report, Plug Power plans to reach a revenue target of USD 3 billion in 2025, with a gross margin of 30% and operating income of at least 17%. So far, the Latham, New York-based company is generating significant revenue from its originating "material handling" business. This involves providing hydrogen-powered equipment such as forklifts to Walmart and Amazon and was responsible for 90% of revenues last fiscal year.

Expansion of partnership

Another contract has now been signed with Walmart for the delivery of 20t of green hydrogen for up to 9,500 forklifts at its distribution and fulfillment centers. Walmart has been working with Plug Power for more than a decade to introduce and expand hydrogen fuel cells at its facilities. In 2012, the Company began a pilot project with 50 vehicles, which grew to a fleet of 9,500 vehicles. Now, the retailer is continuing to decarbonize its operations by aiming to use green hydrogen in all of its facilities to make forklift operations more efficient, cleaner, quieter and, most importantly, more sustainable.

Walmart is one of the major customers of fuel cell manufacturer Plug Power, along with Home Depot and Amazon, and has set a goal of becoming carbon neutral by 2040. "Hydrogen is critical to building a more sustainable supply chain, and Plug Power's hydrogen solutions enable us to make further progress," said Jeff Smith, senior director of supply chain maintenance services. "Sourcing green hydrogen can help Walmart move closer to our goal of being emissions-free by 2040."

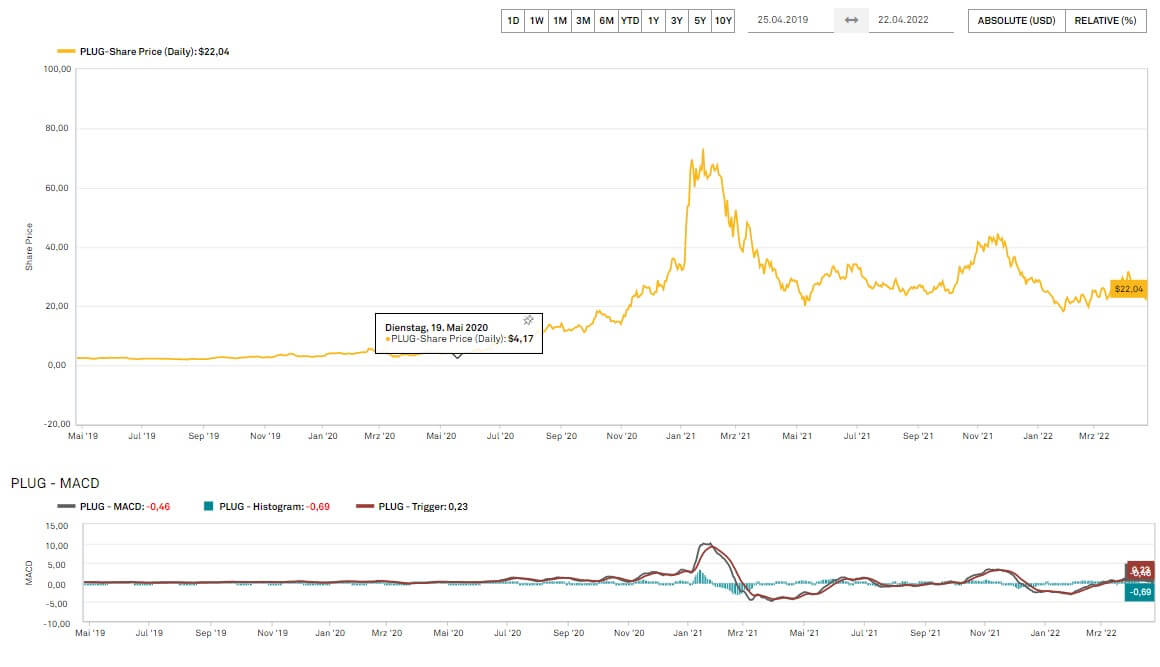

Strong sell-off dampens the mood

The reactions of market participants to the publication of the order were extremely positive. Thus, the Plug Power share price rose to an interim high of USD 28.50, only to be drastically sold off in the wake of general market weakness due to concerns about impending interest rate hikes and uncertainties regarding the Ukraine conflict. The share price is currently quoted at USD 21.75. The value thus fell below the upward trend that had prevailed since December 2018. In addition, clearly negative divergences were formed in the indicators. The next price target is the low for the year at USD 17.51. Should this support not hold, it could go down significantly for the Americans. The next striking resistance area would then only be in the single-digit range. From a fundamental perspective, this decline would be quite understandable. Currently, the price-to-sales ratio of Plug Power is at a high 25. However, in a peer group comparison, shares such as Ballard Power or FuelCell Energy are valued even more ambitiously.

This update is based on our initial report Report 02/22.