Playing with expectations

It will be exciting when the hydrogen innovator presents its figures for the fourth quarter and the full year 2022 on February 27. A sales and profit warning was already announced by the management around CEO Andy Marsh on January 25, 2023, on the occasion of a strategy update, but an official press release was sought in vain. The Company is very familiar with lowering its ambitious targets. Only in October of last year were sales targets cut from USD 900 million to USD 925 million to USD 845 million. According to Refinitiv, analysts now expect on average revenues of USD 766.82 million, while EBIT is expected to remain clearly in negative territory at minus USD 564.43 million. For earnings per share, most experts expect a minus of USD 1.05.

The Company's leader cited the delayed launch of new products and their impact on the supply chain as reasons for missing annual targets and a weaker fourth quarter. However, the Company did not lose sales but instead shifted them. Accordingly, CEO Andy Marsh still expects revenues of USD 1.4 billion at a gross margin of 10% for the current fiscal year 2023, and USD 5 billion at a gross margin of 30% is already forecast for 2026. For 2030, the marketing specialist is also going out on a limb with huge revenues of USD 20 billion and a gross margin of 35%. Breakeven, as a reminder, no quarterly profit in 25 years, is expected to be achieved on quarterly revenue of USD 600 million and a gross margin of 20%. This quantum leap is in view of the plans for 2024.

The next dilution looms

Plug Power is a polarizing force and has been one of the most discussed companies in various communities worldwide for years. The reasons for this are likely found in the ingeniously sold marketing strategy and less in the business development. Anyone who takes a closer look at the Company should quickly realize that long-term investors have lost over 90% of their capital since the IPO of the share in November 1999. Since the all-time high in March 2000, at USD 1,565 adjusted for capital increases and the subsequent bursting of the dot.com bubble, an investment in the fuel cell pioneer has even amounted to a total loss of capital of around 99%.

In contrast, both the stock market value and the number of shares have exploded. Whereas the number of shares at the time of the initial listing at the end of the last millennium was 4.22 million, this has increased as of today to 582.90 million shares by a factor of 138. The market capitalization, on the other hand, grew only 12-fold from EUR 720.18 million to USD 9.08 billion. A further dilution is likely to occur in 2023 due to the capital-intensive investments if a turnaround does not begin quickly. A look at the cash position speaks volumes. Even though this was still a comfortable USD 1.75 billion as of the end of September 2022, compared to the beginning of the fiscal year, around USD 1.2 billion was again burned.

Dangerous situation

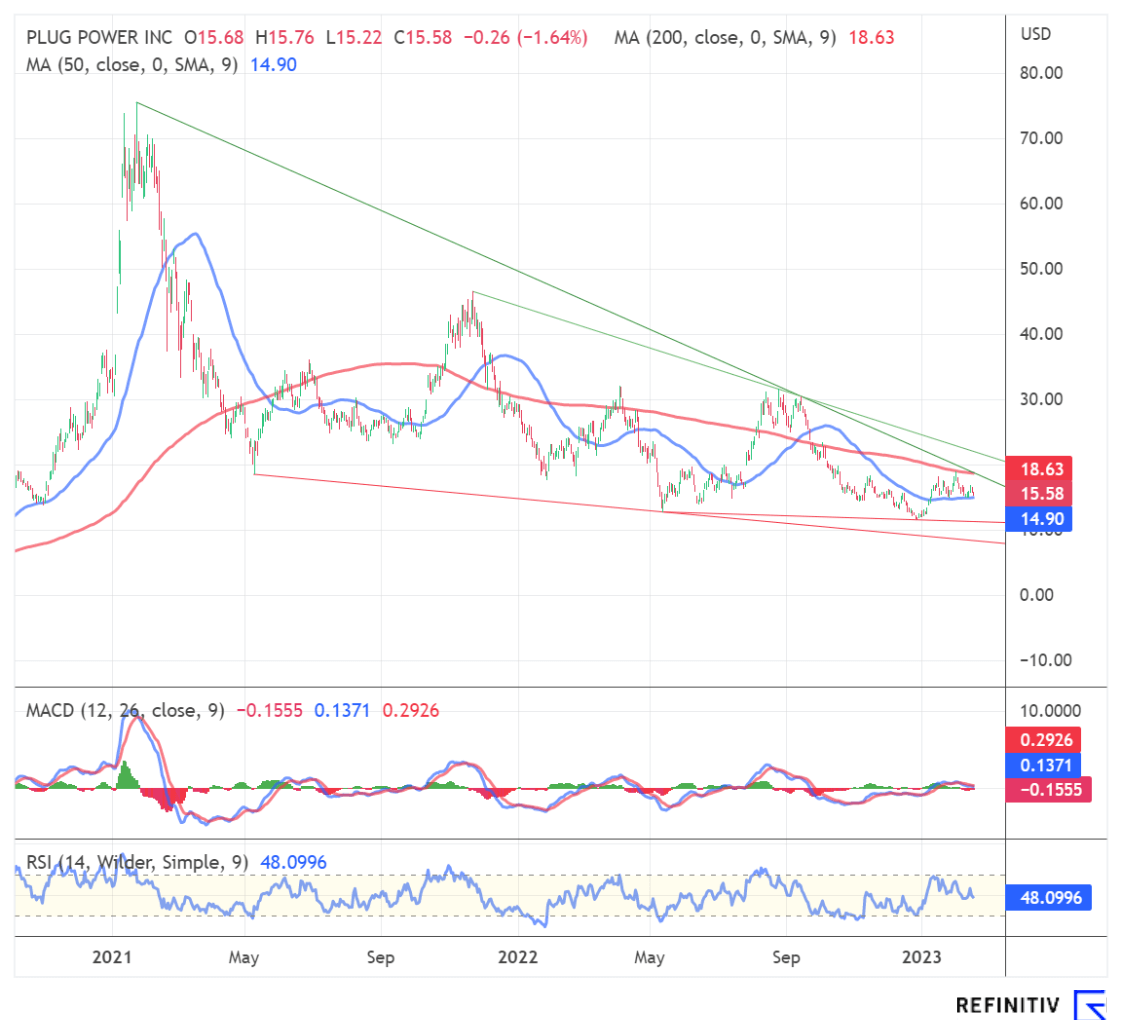

Plug Power's stock remains in the overarching downtrend formed since January 2021, currently at USD 21.85. The falling 200-day line is located at USD 18.63. In the area of the current quotation at USD 15.58, in addition to the 50-day line, there is a support area that has existed for weeks. Should this area be breached downwards due to further misses of the annual figures or disappointments with regard to the expectations for the current year, a sell signal would be generated down to the area of USD 11.14. With the possible break of this support, we see the support area formed since May 2021 at single-digit USD 8.41 as the target point.

Interim conclusion

Plug Power's long-term goals of becoming one of the largest global energy companies focused on displacing diesel with green hydrogen are ambitious. The four building blocks for the vertical integration of green hydrogen that Plug Power plans to offer in a closed value chain to take advantage of broad economies of scale are hydrogen generation, liquefaction, logistics, and "material handling," the originating business of providing hydrogen-powered equipment such as forklifts for Walmart, BMW, or Amazon. In 2021, this sector generated about 90% of revenues and is expected to be outpaced in the next few years with new businesses still being developed. This is to be achieved through partnerships with global market leaders such as Renault, Johnson Matthey, SK or Acciona. Plug Power is well positioned, but estimates for the coming years appear ambitious. In addition, building up the individual sections is capital-intensive, so further capital increases are likely to be needed.

The update is based on the initial report 02/2022