Gigantic market

Hydrogen is a central factor in plans for the energy transition and achieving climate targets. Unlike fossil fuels, the use of hydrogen does not cause CO2 emissions and is, therefore, a more environmentally friendly alternative. The German government published a "National Hydrogen Strategy" in 2020 to promote the use of hydrogen in Germany. The market volume of this future industry is gigantic. According to the Fuel Cells and Hydrogen Joint Undertaking of the European Commission, more than one million jobs and a market volume of around EUR 150 billion can be created worldwide by 2030 through an expansion of the technology.

Battle for market share

Yet the battle for dominance in the renewable energy industry, especially in the hydrogen sector, has been gathering pace for years. With massive economic aid of USD 370 billion, US President Joe Biden wants to boost the climate-friendly industry in the United States and is also enticing foreign companies to relocate to North America. In addition, the world's second-largest economy, China, has already announced plans to promote green technologies at a similar level. Europe is challenged to maintain the competitiveness of the old continent.

Industrial plan as counter

Clear signals were already coming from Brussels at the beginning of February. For example, the European Commission's new "Green Deal Industrial Plan" plans to mobilize a total of EUR 380 billion for investments in the transition to renewable energies by 2030. Much of the money is to be financed by the Corona Reconstruction Fund RRF, which will provide EUR 250 billion for the transition to renewables. It is estimated that more than EUR 170 billion will need to be invested by 2030 in areas such as solar, wind, batteries, heat pumps and hydrogen alone in order to drive the energy transition and achieve the climate goals set of becoming the first continent on earth to become climate neutral by 2050.

The subsidies are to include tax breaks for companies that invest in green technologies. It also aims to ensure faster permitting for projects and a relaxation of state aid rules that would allow EU member states to double the aid offered by a third country for initial investments in sectors relevant to net zero.

First Hydrogen benefits multiple times

Balraj Mann, Chairman and CEO of First Hydrogen Corp, welcomed the EU's plans: "The European Union needs to catch up with the United States and China in terms of subsidies. The proposed Green Deal Industrial Plan will provide greater support for the production of carbon-neutral products such as our light-duty vehicles and a green hydrogen service through faster access to finance and a simpler regulatory framework."*

The new subsidy program for Europe comes at an opportune time for the hydrogen specialist, as the Canadian company with headquarters in Vancouver and London recently expanded its operations to identify and acquire fleets for future testing of its two light commercial vehicles in Europe. Testing is expected to begin in Germany and France in early 2024. In addition, market development is to take place in Eastern Europe, France, Spain, Portugal and the Benelux countries. In the US, the course has already been set with the establishment of the companies First Hydrogen Energy (USA) Inc. and First Hydrogen Automotive (USA) Inc.

In addition, First Hydrogen intends to establish its "Hydrogen-as-a-Service" model in Europe. In addition to series production of light commercial vehicles, the Group intends to cover the entire value chain in the hydrogen sector. For example, a joint venture has been established with EV Consulting GmbH, based in Aachen, Germany, to develop a prototype for a customized refueling system for the hydrogen mobility market. Furthermore, the own production and distribution of green hydrogen is to be launched in Europe in the future, in addition to the UK and North America. Here, opportunities for production and procurement will be identified and developed to support the core and comprehensive networks within the trans-European transport network for the widespread use of zero-emission LCVs.

Taking unique design to mass production

With the development of the utility vans, First Hydrogen is already on its way to series production in the UK. The two prototypes, developed using a "best-of strategy", will soon be tested with customers in real-world use on the road. The vans, for which the MAN eTGE served as a so-called "donor vehicle," are equipped with the latest generation Ballard FCgen LCS fuel cell, which gives the vehicles a range of over 500km.

The customers are at least 13 UK fleet operators from various industries, including telecommunications, utilities, infrastructure, delivery services, grocery and healthcare. Approval by the Vehicle Certification Agency, the UK's vehicle licensing authority for road transport in the UK, was already obtained last fiscal year.

Another market leader on board

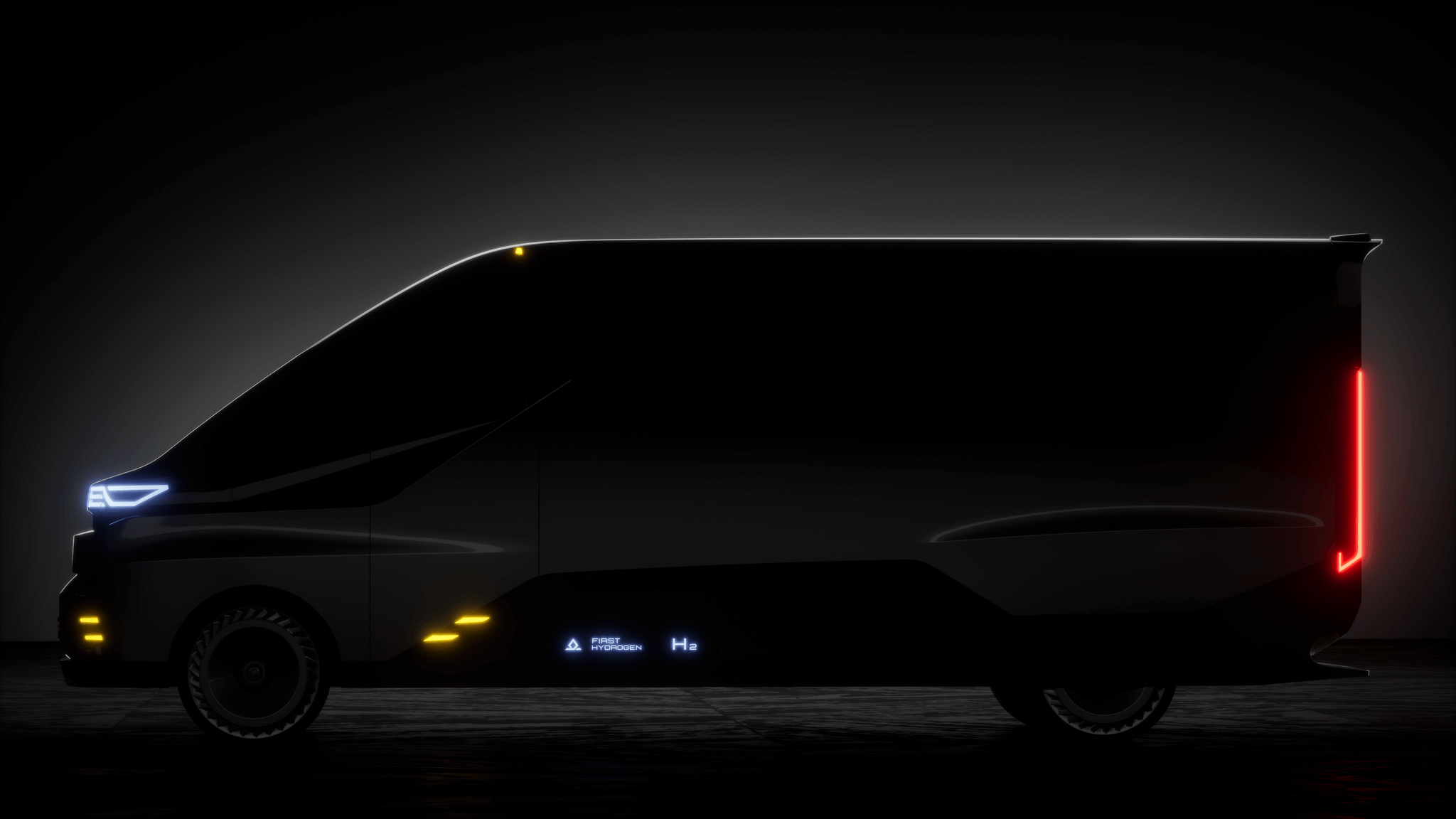

In addition to the partnerships with Ballard Power and AVL, another market leader has been acquired in the form of the EDAG Group as a design partner. EDAG is the world's largest independent service provider for the international mobility industry and provides engineering services in the areas of vehicle technology, electrics/electronics and production solutions. First Hydrogen will receive support in commercial vehicle development, with the goal of making zero-emission vehicles accessible to fleet managers, thus opening the door to volume production. Recently, images of the second generation zero-emission light-duty vehicles were released.

The vehicles are modular and can be optimized for flexible large box trucks suitable for fleets in the delivery, roadside assistance, food, construction and utility, and healthcare sectors. The front features a smart digital panel that displays the daytime running light configuration and gives the vehicle an identifiable look, while the rear includes vertical taillights and the main charging port. Moreover, the design is functional as it can accommodate different types of doors, such as tailgates, gates and shutters. The silhouette, in turn, highlights the clean, aerodynamic image.

Interim Conclusion

With the "Green Deal Industrial Plan", the European Commission aims to ensure competitiveness in the hydrogen industry. First Hydrogen should benefit from this in several ways. For one, the light commercial vehicle developer plans to expand into Europe. For another, the Company plans to expand the production and distribution of green hydrogen. Thus, the global hydrogen specialist is diversified by its "Hydrogen-as-a-Service" strategy to benefit significantly from global policy support programs. Testing of the two prototypes under real-world conditions is expected to start soon, which would mark a new milestone in the development of the fledgling company.

First Hydrogen Energy's CEO, Robert Campbell, will present the Company at the 6th IIF - International Investment Forum on February 15, 2023. Registration for the virtual event is free.

The update is based on the initial report 07/2022