Transformation for climate change

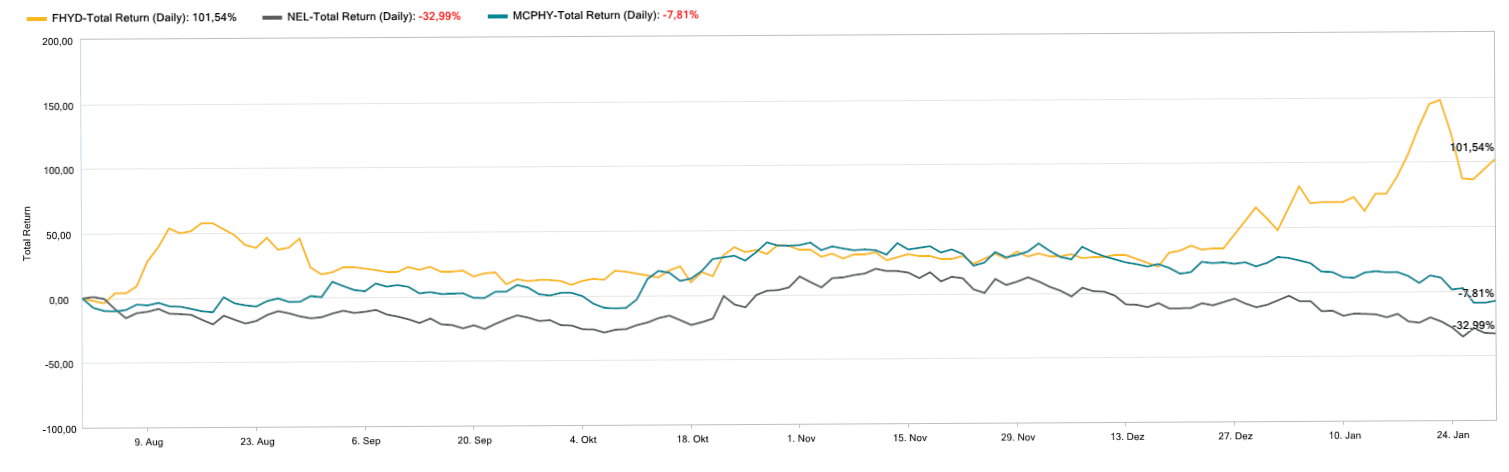

Until the middle of last year, companies identified with technologies for climate change knew only one direction - up. Shares related to electromobility, hydrogen or fuel cell technology were able to multiply in this wake. Then, since mid-2021, partly due to inflated, exaggerated valuations, a market-wide correction set in, which to date has probably not yet been fully completed.

One thing is certain, however, the transformation of the transport sector is in full swing and is supported globally by both politics and business. For example, road transport will fall under the emissions trading scheme from 2026, placing a burden on the cost of pollution and thereby providing an incentive to switch to cleaner fuels and invest in clean technologies. While battery-powered vehicles should prevail in passenger cars, the trend in the transport sector is toward hydrogen and the fuel cell due to range advantages and shorter charging times.

Best-of strategy offers advantages

Joining the light commercial vehicle incumbents is First Hydrogen, a new player in the market that aims to become the leading developer and manufacturer of zero-emission, long-range hydrogen-powered commercial vehicles in the UK, EU and North America by combining the best technologies. Already in the second quarter of 2021, the collaboration between First Hydrogen Corp's wholly-owned subsidiary, First Hydrogen Limited UK, and Ballard Power and AVL Powertrain UK was sealed. Two utility vans, for which the MAN eTGE is intended as a donor vehicle, are to be delivered as prototypes as early as the third quarter of the current year.

Entering the hydrogen fueling station market

In order to enrich their automotive strategy that will benefit their mobility customers throughout the lifetime of their First Hydrogen vehicles, an agreement was reached last year with FEV Consulting GmbH of Aachen, Germany, to design and build a prototype of a customized hydrogen refueling station for the hydrogen mobility market. The wholly-owned subsidiary NetZeroH2 has now been founded for this purpose.

Personnel build-up for ambitious goals

In terms of personnel, there has been a real shake-up around the experienced CEO Balraj Mann in recent weeks. Steve Gill has been appointed as Director of First Hydrogen UK Limited and Chief Executive Officer of the Automotive Division. Gill has extensive experience as an executive, board member and consultant to the automotive industry. His areas of expertise include powertrain technology and decarbonization of transport. Previously, Gill held the position of Director, Power Engineering at Ford of Europe and served on the Board of Ford Technologies Ltd.

In addition, Robert Campbell has been appointed as a non-executive director of First Hydrogen UK Limited, the Company's wholly-owned subsidiary. Mr. Campbell has been senior vice-president and chief commercial officer at Ballard Power Systems since 2017. His responsibilities include global business development, sales, marketing, product line management and customer service activities in Ballard's key power product markets such as heavy-duty vehicles, material handling and stationary power.

One of the key positions going forward will be held by Nicholas Wrigley. He has been appointed chairman and director of First Hydrogen UK Limited, according to the announcement, and will oversee the global development of First Hydrogen's hydrogen fuel cell light and medium duty commercial vehicle business and, in collaboration with AVL Powertrain UK and Ballard Power Systems, the construction of the Company's two road-legal hydrogen fuel cell demonstration vehicles. In addition, the new hire will be responsible for overseeing the construction of hydrogen refueling stations in collaboration with FEV Consulting GmbH.

Interim conclusion: At First Hydrogen, things are currently going well, and not just on the stock market. CEO Balraj Mann's ambitious goal of delivering at least 10,000 utility vans in the year 2025 is in place. Should the two prototypes be delivered in cooperation with Ballard Power and AVL, First Hydrogen would have a significant lead over comparable US companies, which have much higher stock market valuations. Entering the hydrogen fueling station market could also leverage cross-selling effects. The new managers have years of experience in the market and should significantly advance the targets. More details on First Hydrogen in our Report 12/2021.