Ready for roll-out

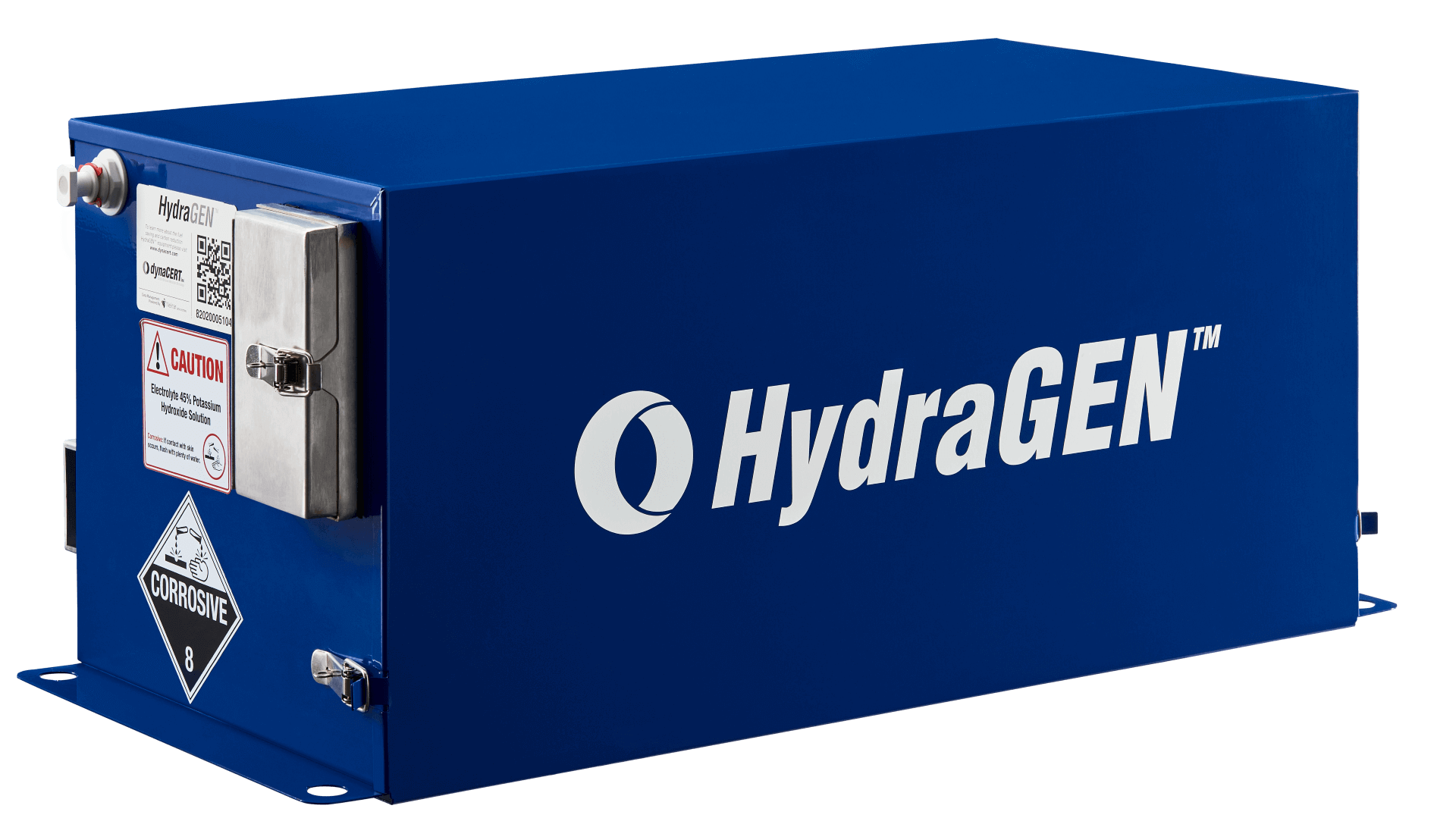

Unlike the billion-dollar companies mentioned above, the Canadian company dynaCERT, which achieves significant emissions reductions with its HydraGEN technology, has a clear competitive advantage. That is because while the hydrogen ecosystem is still visionary among the big players, the Canadians have had a patented and multi-certified product for years. The advantages of HydraGEN have been proven in several test series. In addition to reducing fuel consumption and CO2 emissions, it also significantly lowers nitrogen oxide emissions as well as CO and THC emissions. In addition, engine power and torque are increased, which can lead to an extension of engine and oil life.

Major order in the double-digit million range

Around CAD 90 million and 18 years of research went into the development of the HydraGEN technology, whose product line consists of four series used for various engine sizes and installation specifications in diverse industries, such as mining, transportation, construction, and agriculture. Currently, the HG2R series holds the highest sales potential, with its engine ranging from 1 to 8 litres, used in various vehicles, including small and heavy-duty commercial vehicles. The global sales potential is around 135 million units, according to company estimates.

With a large order totaling 3,000 units, the roll-out, which was originally scheduled to take place in 2020 before the outbreak of the Corona pandemic, has been initiated. According to our calculations, the order volume for HG-2 units amounts to CAD 12 million. On a positive note, the first 93 HydraGEN HG-2 units have already been paid in full with an equivalent value of approximately CAD 370,000. A further 140 units are expected to be delivered by July 30, 2023, and 750 by September 30, 2023. The remaining order is then to be settled step by step.

The shipper of the large order is Bristol & Bristol Incorporated, an oil and gas logistics company based in Georgetown, Guyana. According to industry experts, the South American nation has one of the world's largest newly discovered and undeveloped oil reserves and only began producing its offshore deposits a few years ago.

Rising demand from the mining industry

During our last update in March, on the occasion of PDAC, the world's largest mining conference, CEO Jim Payne expressed optimism due to the increasing interest from the mining industry. Promising discussions were held with major mining producers concerning the HG-4C series, which have since been further intensified. The HG-4C series is used for diesel engines with displacements of between 40 and 60 litres, which are used in particular in heavy commercial vehicles in the mining industry. For months, as observed during a personal visit to the dynaCERT headquarters, the production of the various series has been running at full speed.

The wait for Verra

By June 29, 2023 at the latest, when the ordinary and extraordinary shareholders' meeting in Toronto takes place, the long-awaited admission to Verra's Verified Carbon Standard program, the most widespread greenhouse gas crediting program in the world, should also have already crossed the stock exchange tickers. As early as the end of August last year, it was reported that the Company was in final review. At that time, as the final step in the permitting process, Verra engaged an approved validator to provide services related to method validation in accordance with the terms and conditions set forth in the Agreement and VCS regulations.

By managing emission credits for its HydraGEN customers, dynaCERT could generate significant special revenues. In this regard, dynaCERT's business model calls for revenue generated from the sale of carbon credits to be shared. The plan is that about 50% of the revenues from carbon credits will remain with dynaCERT, and the other half will be passed on to the customer.

Interim conclusion

The large order placed is tantamount to a breakthrough for dynaCERT. In addition, according to management's plans, larger orders for various product series are likely to follow. The approval for emissions trading, which is expected to be finalized shortly, should also provide further potential. Through the announced cooperation with Cipher Neutron, dynaCERT is also aiming to further develop, produce and market a state-of-the-art hydrogen technology, which is expected to significantly lower green hydrogen prices and could thus mutate into a game changer in the sector. On June 15, 2023, both dynaCERT and Cipher Neutron will present at the 1st Hydrogen Day to introduce investors to their technological innovation. Registration for the virtual event is free

The update is based on the initial report 11/2022