Biotech company Defence Therapeutics enters the market for radiopharmaceuticals. To this end, the Canadians have entered into an agreement with Orano Med, a subsidiary of the French Orano Group. Orano is an industrial group around nuclear applications, which includes nuclear medicine. Specifically, the agreement is to use Defence Therapeutics' patented Accum™ technology as a radionuclide-antibody conjugate. It involves a carrier technology, such as Accum™, delivering a radioactive emitter near the nucleus of tumour cells instead of a drug. The more reliably this is done, the higher the chance that the radioactive emitter will damage the cell nucleus of the cancer cell and thus induce cell death.

New mainstay for Defence Therapeutics

"We have many years of knowledge and experience in the development of our Accum™ platform technology, including the field of antibody-conjugate therapeutics, and strongly believe that Orano, with its international expertise, is a strong partner for the development of the next generation of radio-immuno-conjugates to increase the efficacy of therapies targeting tumoral cancer cells using our intracellular targeting technology," said Sebastien Plouffe, CEO of Defence Therapeutics.

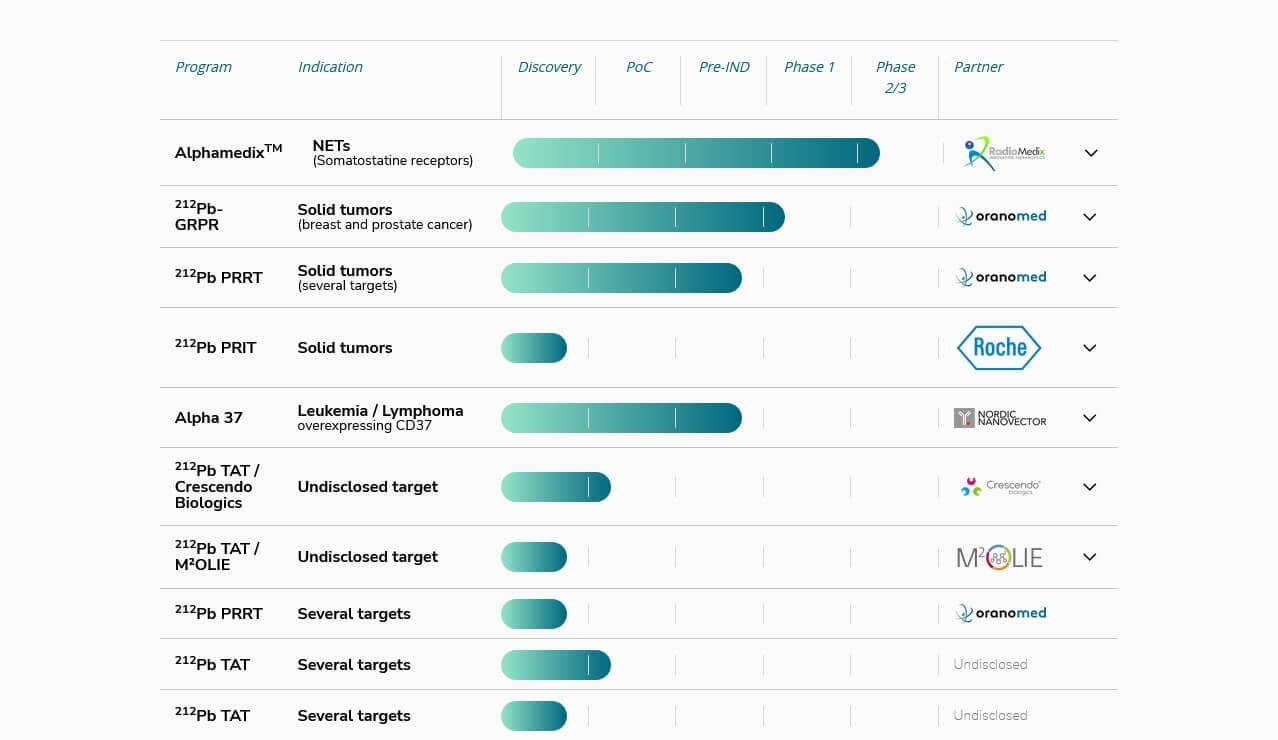

With the agreement now concluded, Defence Therapeutics once again underlines the versatility of its comprehensive portfolio: based on Accum™, Defence Therapeutics has already conceived plans around therapeutic vaccines against cancer, a vaccine against infections with the HP virus, which also has potential for acute therapeutic use, and the chemotherapeutic AccuTOX. Almost all of these projects have already completed preparatory GLP studies; some are about to enter Phase I clinical trials. Because of the versatility of its proprietary technology and the numerous possibilities for its use, Defence Therapeutics is considered a kind of biotech multitool - six projects have a combined market potential in the triple-digit billion range.

Market potential in the billions

With the cooperation in the field of radiopharmaceuticals, Defence Therapeutics is now adding a seventh pillar to its activities. Even before this, Head of Research Moutih Rafei had repeatedly emphasized that Accum™ could help in many areas to effectively channel active ingredients into affected cells and thus reduce the drug dose requirement. Many biotech projects fail in Phase I clinical trials due to safety requirements. If a substance is too toxic, the approval process ends. However, if potentially toxic substances can be targeted so that their concentration can be reduced, even once-discarded projects could be revived.

the radiopharmaceutical market could be huge by 2028.

With radioimmunoconjugates, their efficacy depends on how close each agent can get to the target cell. Since Defence Therapeutics' Accum™ technology transports active ingredients to cancer cells with pinpoint accuracy, Orana and Defence expect major progress. Specifically, the two companies want to work together to increase the efficacy of Orano's radiopharmaceuticals while minimizing side effects. Positioned like this, the new generation radiopharmaceuticals could play a significant role in a market that, according to market researchers at The Insight Partners, was worth USD 7.55 billion in 2021 and is expected to grow at a compound annual growth rate of 7.2% to USD 13.8 billion by 2028.

Orano Med - A global leader in nuclear medicine

Orano emerged from the French nuclear group Areva in 2001 and has made a name for itself in nuclear medicine. In 2005, the Company developed a process to produce the radioisotope Lead-212. The substance is essential for innovative cancer therapies and plays a central role around Targeted Alpha Therapy (TAT). Following several clinical trials around Lead-212 as a therapeutic, Orano invested in manufacturing facilities for the rare substance and also has a subsidiary in the United States. "Orano Med aims to develop a robust portfolio of cancer therapies that combine the properties of Lead-212 with those of targeting vectors. To this end, a dozen developments are underway, either 100% owned by Orano Med or in partnership with other biotechnology or pharmaceutical companies in France and internationally," Orano writes on its website. Orano's partners include Roche.

Cooperation as a leap of faith - Will Defence become a takeover target?

The now-announced partnership between Orano and Defence Therapeutics shows that the Canadian biotech has a promising technology that convinces companies in the industry even before Phase I trials are completed. Typically, investors and collaborators await positive study results for new developments. Since Accum™ as a drug booster is apparently not suspected of failing during the upcoming proof-of-concept phase I trials, Orano is likely to have entered into the collaboration and also did not insist on keeping the collaboration quiet.

Defence Therapeutics gains another potential application for its technology with the latest announcement and enters a new billion-dollar market. At the same time, the Company is likely to gain even more attention within the pharmaceutical industry. This could further fuel the latent takeover fever around biotech stocks, which has been rampant since early 2023 - the prospect of several billion-dollar pipelines at once for the price of a low triple-digit million amount should be tempting for many pharma companies, the majority of which are sitting on high cash reserves.

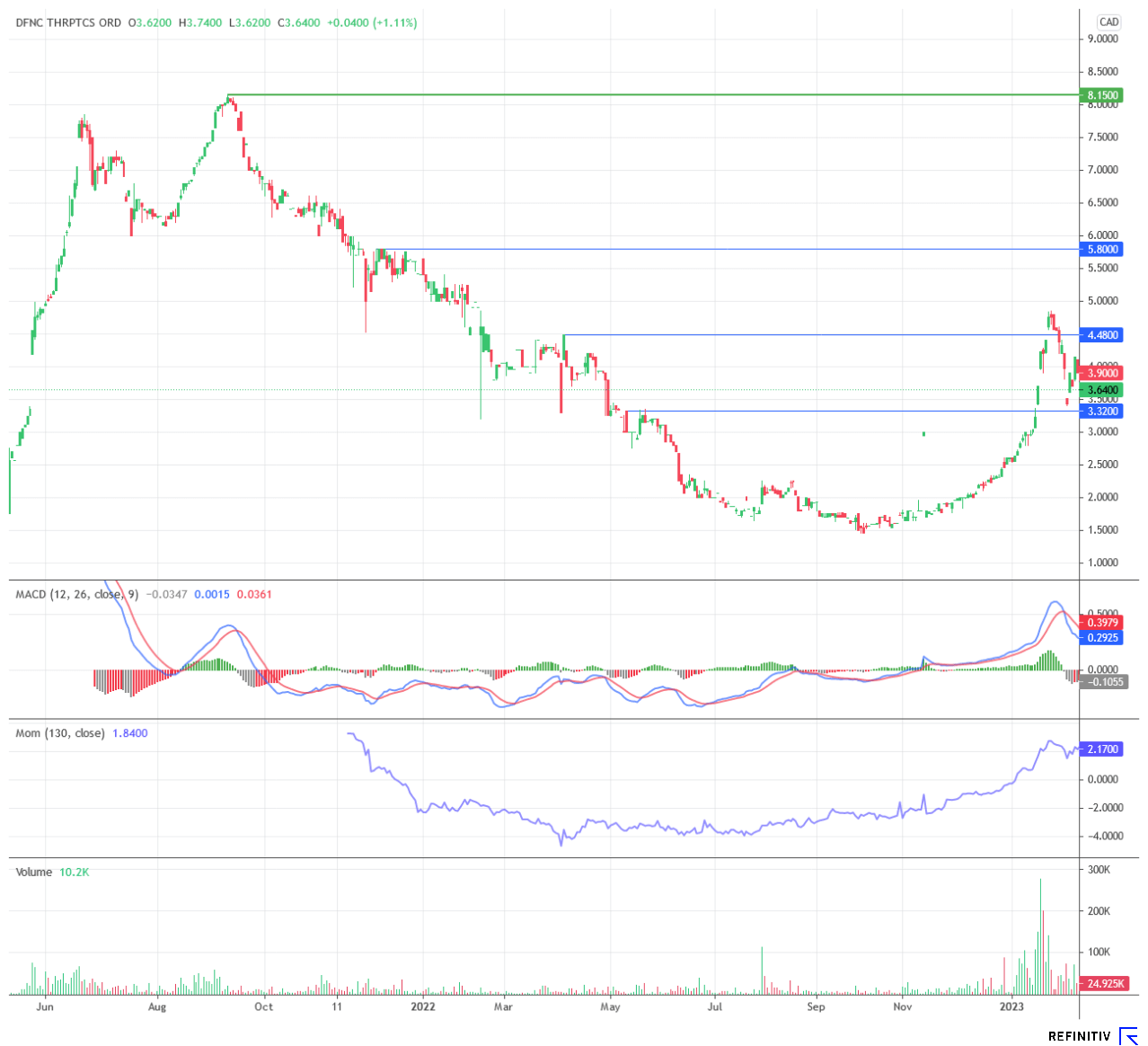

Conclusion: Operational progress hits the mark

The Orano collaboration is an accolade for Defence Therapeutics. While the agreement details are unknown, the Company has likely left all options open concerning further projects. The share has come under a little pressure in the wake of the general market turmoil. However, the news about the cooperation with Orano immediately led to a recovery. The share also remained extremely stable in the weeks before, despite the price gains in January. This consolidation could soon pay off. Defence Therapeutics is an exciting stock not only because of its versatile portfolio but also because the stock has recently gained technical strength. The takeover candidate Defence Therapeutics has great upside potential in the medium term.

The update is based on the initial report 12/2021