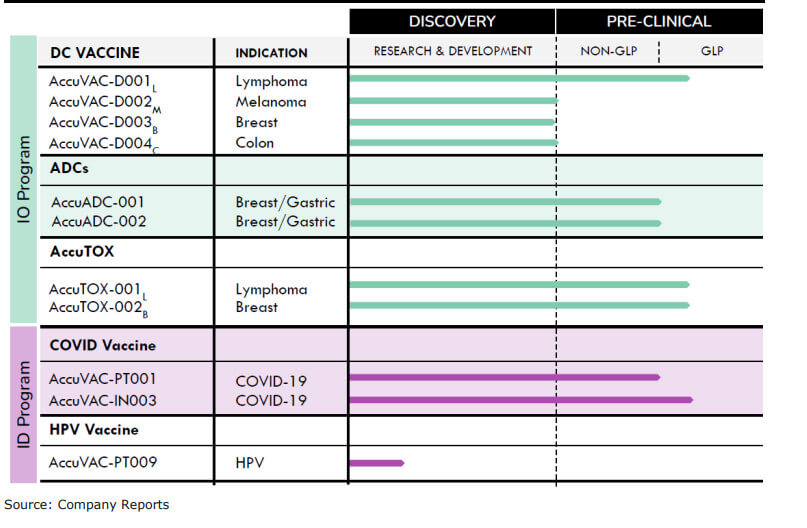

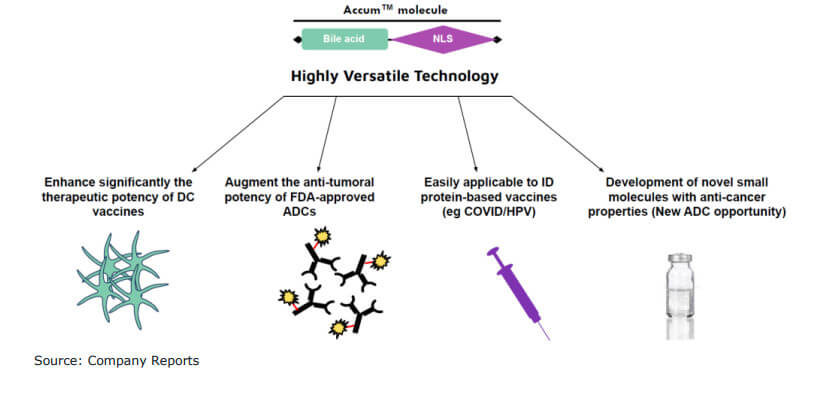

Analysts Tania Armstrong-Whitworth and Greg Beaman explain Defence Therapeutics' business model and provide insight into the technology behind it in their analysis: "Defence Therapeutics is a Canadian biotechnology company developing solutions to improve intracellular delivery of biological therapeutics. Based on its patented Accum™ platform, DTC has built a pipeline of therapeutic candidates that include cancer, HPV and COVID-19 vaccines, antibody-drug conjugates (ADC) and novel small molecules. All programs are currently in the preclinical stage, but management expects three Phase 1 trials to be initiated by early 2023" analysts write.

Accum™ for greater drug and vaccine efficacy

The unique selling point of the patented Accum™ platform is to be able to circumvent challenges in drug delivery, they say. Protein-based drugs, in particular, typically could not passively diffuse through the cell membrane to reach the nucleus. Instead, these drugs enter the cell enclosed in a so-called endosome. This endosome is subject to a natural acidification process in which enzymes act non-specifically and also damage peptide fragments, which can negatively affect active ingredients. The Accum™ drug enhancer now ensures that this acidification process has a significantly less negative impact on the efficacy of drugs or vaccines. The US patent for Accum™ runs until 2037, while that for the associated vaccine platform runs until 2041.

Flexible platform, many solutions

In vaccine development, while all programs are in the preclinical stage, Canaccord Genuity analysts point to the wide range of applications: "lymphoma, skin cancer, breast cancer, colon cancer, glioblastoma, a prophylactic and therapeutic cervical cancer vaccine, two Accum-linked ADCs for breast and gastric cancer, a "free" Accum small molecule program to fight multiple cancers, and an intranasal COVID-19 vaccine. " However, in early 2023, Defence Therapeutics plans to launch three Phase 1 clinical trials, according to analysts:

- an investigation around a vaccine for skin cancer

- an investigation around a vaccine against cervical cancer

- an investigation around the efficacy of Accum™ as a non-bound ("free") agent against various cancers

Completing these studies will require further capital, according to an analysis by Armstrong-Whitworth and Beaman. Capital actions could follow as early as the coming weeks. Defence Therapeutics' fiscal year ends June 30.

Intellectual property and market opportunities

In the further course of their study, the analysts refer to the great flexibility of the Accum™ technology in the production of various vaccines, as a drug enhancer or as a sole active agent against tumors. For Defence Therapeutics, the portfolio of valid patents is all the more important in order to protect the Company's intellectual property. With the help of the patents and the technology protected thereby, Defence Therapeutics could be successful in several markets. Canaccord Genuity analysts see growth opportunities both in the market for active substance enhancers (ADCs), therapeutic vaccines against cancer, HPV and COVID-19. However, the market for vaccines against COVID-19 in particular is already very competitive. Here, Defence Therapeutics itself expects to face major competition.

Conclusion: Clear investment case and capital requirements

Canaccord Genuity's analysis soundly ranks Defence Therapeutics' prospects and gives the market a clear outlook into 2023, when the Company plans to launch three clinical trials at once. The focus on cancer seems wisely chosen: The competition is less fierce here, and a successful outcome would also contribute to the awareness of the Company's own Accum™ platform. On the Accum™ side, there is an additional opportunity to generate royalties - the drug enhancer could potentially give "new life" even to drugs that have failed in clinical trials, as the technology seems fundamentally suited to reduce drug doses, which can increase safety. Investors should also keep in mind the capital requirements of Defence Therapeutics, especially for professional investors or companies from the industry, the time could be favorable now to get involved in a company with perspective.

The update is following our initial report 12/21.