No need to hurry

Two Asian heavyweights were on the selling list of Warren Buffett, although he was still fundamentally convinced of them. In addition to the "extraordinary company" BYD, the "Oracle of Omaha" also parted with company shares of chip manufacturer Taiwan Semiconductor, which he also classified as "fabulous". "We are going to do something with the money that makes me feel better," the chairman and chief executive officer of Berkshire Hathaway Inc. said Wednesday in an interview with CNBC in Tokyo about BYD. Berkshire Hathaway is in no hurry to further reduce its stake in BYD. By selling 2.48 million H-shares for a consideration of USD 68.78 million, the US company's stake fell from 11.19% to now 10.90%.

Share falls significantly

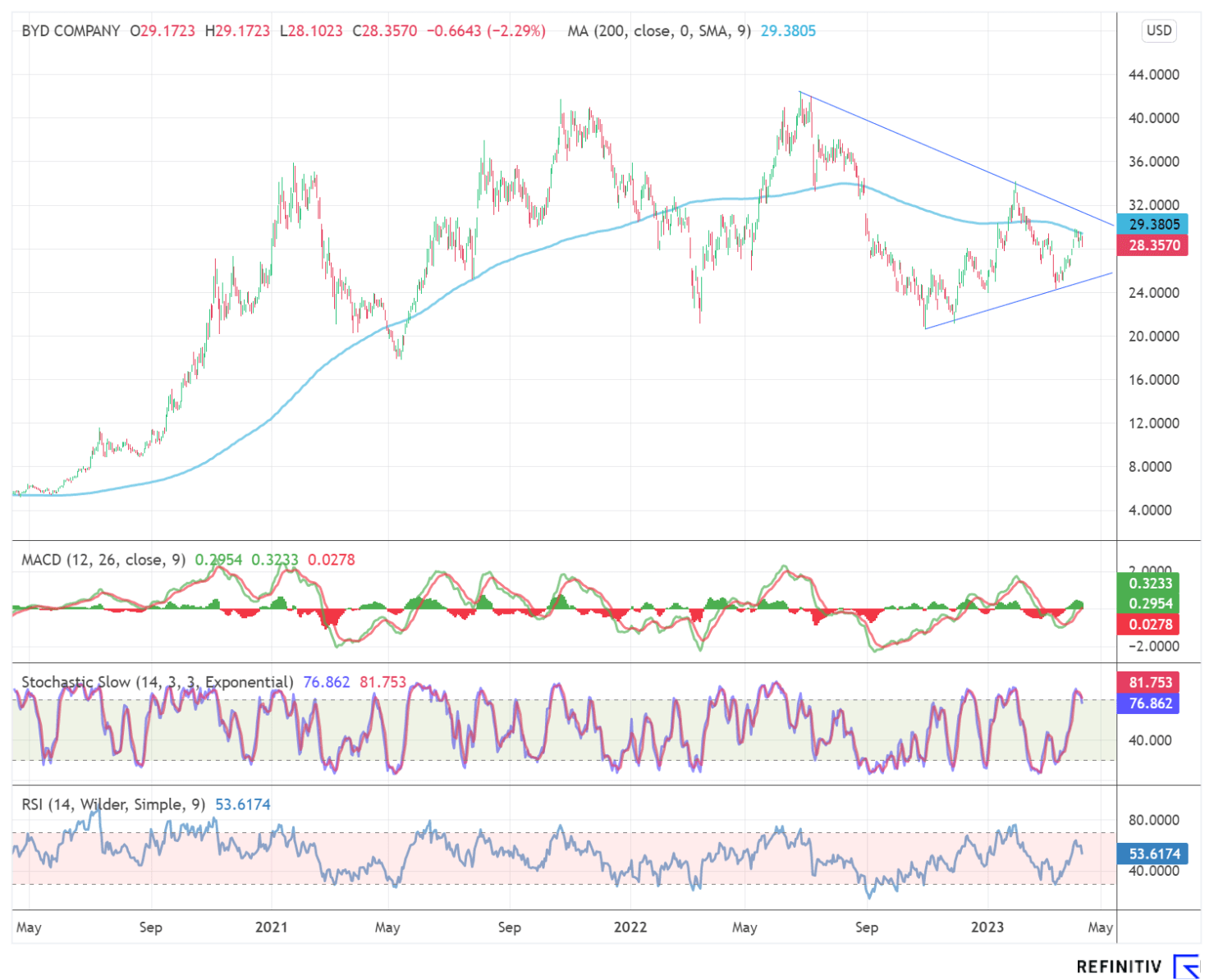

The news about the reduction triggered a sell-off of around 5% in the stock, bringing it down to USD 27.72 on the Nasdaq exchange. As a result, the chart has been severely damaged since the rebound in February 2023. The price bounced off the important 200-day moving average at USD 29.38, turning south with high volume. The Slow Stochastic and the Relative Strength Index already gave sell signals, and the trend-following indicator MACD is expected to follow soon. The next broader support is the uptrend formed since the end of October, currently at USD 25.03. On the upside, breaking the downtrend formed since July 2022 at USD 31.26 would significantly brighten the chart.

Positive trend remains intact

In purely fundamental terms, however, BYD is still on a growth course. In March alone, the Shenzhen-based company sold 207,100 units, a whopping increase of around 97.4% year-on-year. In the first quarter of 2023, NEV sales and production volume rose 92.8% and 97.3% year-on-year to 552,100 and 567,000 units, respectively. By comparison, the main rival Tesla came in at just 422,875 electric cars.

Analysts positive

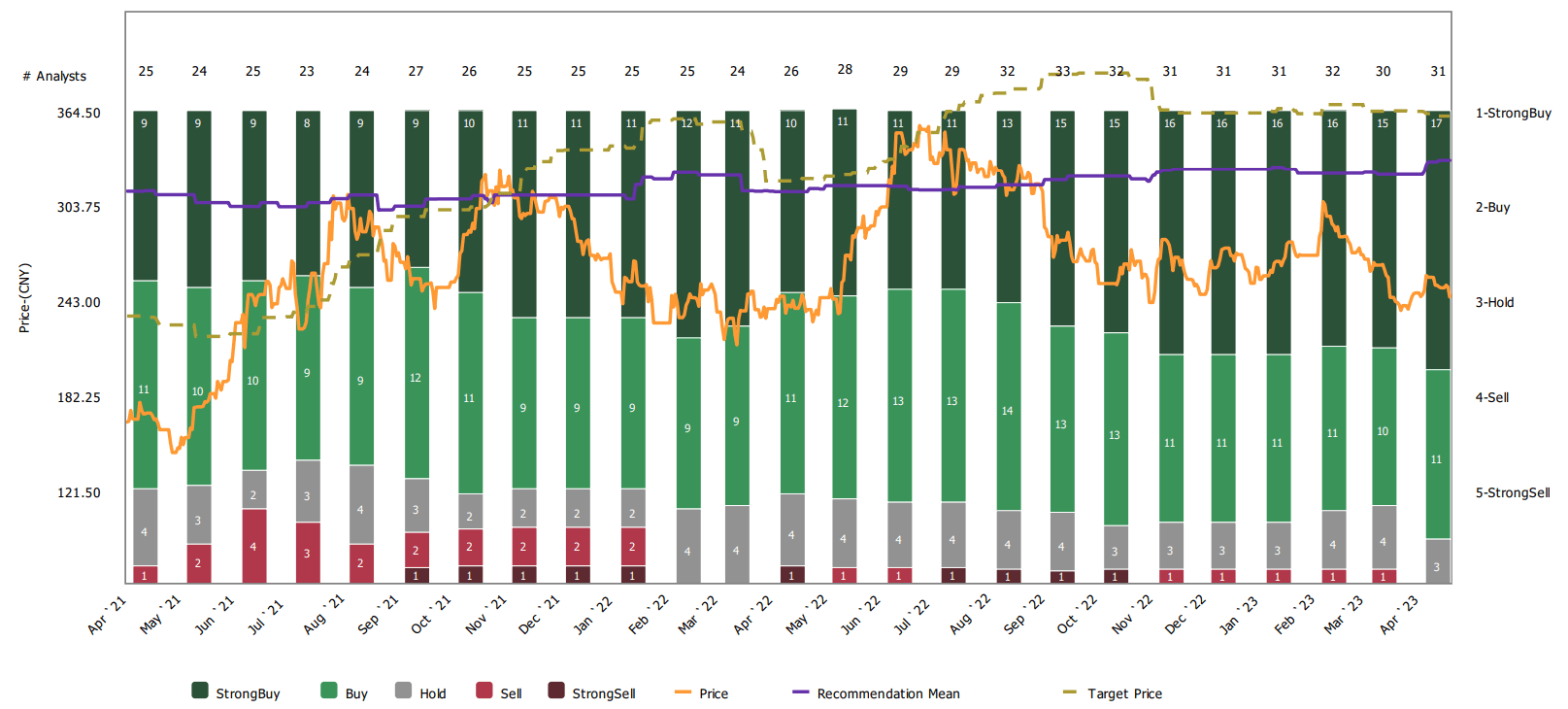

The Japanese analyst firm DAIWA is positive on the Shenzhen-based company. In addition to the price target of HKD 326 to currently HKD 349, the equivalent of USD 44.46, the profit forecasts for the current year were also raised by up to 8%, and the buy rating was also confirmed. At a recent analyst conference, BYD management expressed optimism about surpassing the 3 million unit sales threshold this year, giving them a market share of 40-50% in China. Expanding into other markets, such as Southeast Asia, Europe and South America, is also expected to boost sales outside of China significantly. The highest price target came from the Chinese investment bank CITIC Securities, with a price target equivalent to USD 69.98.

According to Reuters Refinitiv, a total of 31 analysts analyzed the Chinese market leader. They issued 17 "strong buy" ratings, 11 "buy" ratings and 3 "hold" ratings. The average target price is therefore CNY 359.57, equivalent to USD 52.30.

Interim conclusion

The sale by investment legend Warren Buffett caused the chart image of BYD to show some initial cracks. From a fundamental perspective, the Company was able to further increase its sales in March and is likely to further expand its market share in 2023. The consensus among analysts still sees BYD as a buy candidate with a potential price increase of 90% at current levels.

The update is based on the initial report 07/2022