Unlimited market potential

We reported on the successful transformation of the venerable publishing house with a combined brand history of 560 years into a next-generation digital media platform in previous reports. After a tight 5-year plan, the unchallenged leader of digital business-to-business media in the mining, energy and agriculture sectors stands today. At the end of September, there were around 4 million users on the Anything-as-a-Service platform.

Due to the Company's long history, there are 8 million contacts of board members and executives from key industries in the database, which will still be converted to paying digital customers in the future. The market potential that Aspermont possesses is admittedly much larger. For example, the Mediatech company serves sectors that employ 22% of the world's population, equivalent to around one-fifth of global gross domestic product.

Impressive development

The Australians continued an impressive streak with their full-year 2022 report. Thus, Aspermont has continuously increased its revenues in the last 25 quarters. Accordingly, total revenues amounted to AUD 18.7 million, an increase of 17% year-on-year. In terms of normalized EBITDA growth, the increase was as high as 41% at AUD 2.8 million. The key metric of recurring income grew to 75% from 70% in the previous year, and the gross margin was 64% on a gross profit of AUD 12 million. A key driver, the "Live Events" division, was reactivated after the interruption due to the Corona pandemic and contributed over AUD 2 million to total revenue. Although Aspermont increased staff by 10% and invested in various projects such as Skywave and Blu Horseshoe, cash on hand grew to AUD 6.6 million, and net cash at the debt-free company rose to AUD 4.7 million.

Blu Horseshoe with a rocket launch

Speaking of Blu Horseshoe, a merger of high-profile partners International Pacific Capital, Spark Plus and Aspermont, which holds the lion's share at 58%, created the digital financing platform to help qualified clients access the lucrative secondary issuance market on the ASX. The launch was in June last year. In mid-October, CEO Antony Tolfts announced the execution of a total of 118 transactions. He commented after the successful launch: "When we opened the platform in June, our goal was to execute 60 transactions in the first year. In a little over 4 months, we have almost doubled that goal, and our pipeline continues to grow. Seeing the enthusiasm from both brokers and investors as we prove our model in the Australian market is very exciting."

From a strategic perspective, the successful proof-of-concept is likely to be leveraged to transfer the model to other sectors of the economy and other countries. The global target groups and the required media channels are, in any case, available.

Trimmed for growth

Increasing margins, the quality of revenues, and organic growth are still on the agenda of the Company's leader Alex Kent. Nevertheless, the Company's strategy is likely to change in 2023. Investing in the future is the magic word to transform the linear growth curve into an exponential one. However, this is not to be financed by raising new equity and debt capital but exclusively from the cash flow generated and the cash reserves built up. In addition to increasing the workforce by around 10%, Aspermont aims to enter new markets. North America is the next target. In conjunction with this, a Nasdaq listing is likely to be envisaged in order to address a significantly broader capital market audience. In addition, the launch of the Skywave, Esperanto and Archive platforms is to be driven forward.

Interim conclusion

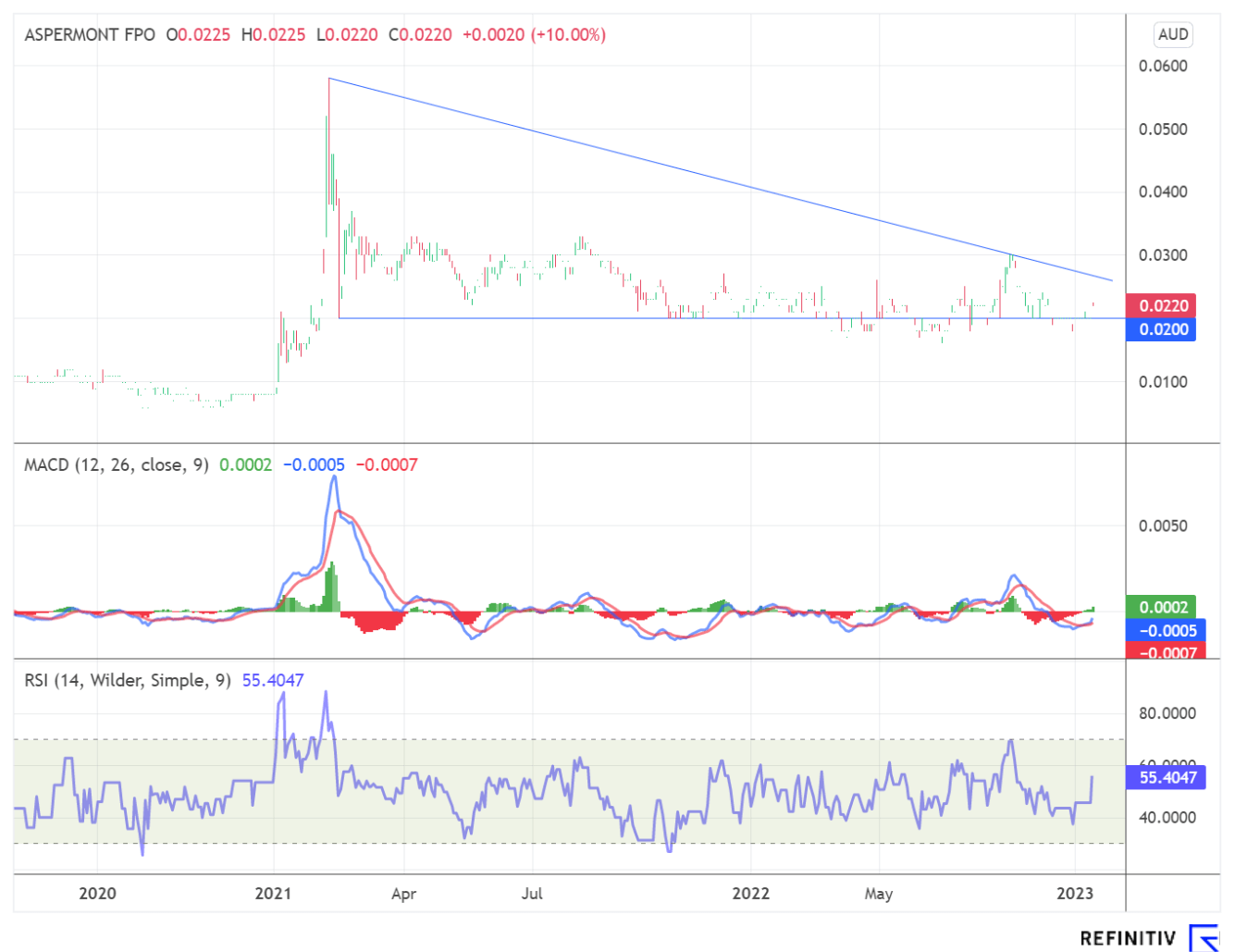

Aspermont's three integrated business models - content, data and services are highly scalable and can be extended to new sectors, new countries and new languages. In addition, the foundation has been laid in recent years for a possible docking external platforms to move from linear to exponential growth. The price-to-sales ratio of three with organic sales growth of 20% and margins of over 50% compares favourably with the peer group. In a recent report, analysts at GBC AG reiterated their "buy" rating with a price target of AUD 0.11, which equates to a potential of around 450% relative to the current share price.

The update is based on the initial report 01/2022