The restructuring plan is ambitious

Cost pressure and problems with major customers are forcing the Ellwangen-based battery manufacturer Varta to take drastic measures. The former flagship company has to cut costs due to pressure from the financing banks and also wants to cut many jobs in the process. The Austrian major shareholder Michael Tojner is already stepping up and has taken over the entire 50 million in the "rescue capital increase." The creditor banks had previously demanded a restructuring report to check the Company's viability. The KPMG auditors concluded that the traditional company can be restructured and has real growth prospects. As a prerequisite, however, the consultants named major cost reductions in procurement, internal processes and personnel. Due to the high dependence on blockbuster customers, a rapid broadening of the customer base is recommended.

Varta still employed around 4,700 people at the end of 2022. The tough talks with employee representatives started in the first quarter. Due to falling demand for button cells for headphones - e.g. Apple's "AirPods" - around 500 employees in Nördlingen have been on short-time working hours since December. Plans to build a new factory for battery cells for electric cars have been halted for lack of acceptance commitments. However, the Swabians are continuing to produce a small series of the V4Drive round cell for Porsche in a pilot plant.

Q1 2023 performed in line with lowered expectations

Sales fell from EUR 185.3 million to EUR 164.2 million in the 1st quarter. Adjusted EBITDA also decreased from EUR 38.1 million to EUR -2.0 million. Contrary to the trend, the Energy Storage Systems segment expanded its revenues by a factor of 2.7 and became the second-largest group segment. A high order backlog into Q4 2023 ensures good predictability of Energy Storage Systems revenue potential in 2023. Consumer Batteries revenues declined by 8.9%. The "Microbatteries" business was very disappointing, with a 20.9% drop in revenue. In addition to a decline in demand, the drop in earnings resulted from increased manufacturing costs, particularly due to the negative development of energy and raw material prices for VARTA.

Dr. Markus Hackstein, Spokesman of the Board of Directors of VARTA AG: "2023 is a year of change for VARTA AG. Restrained customer demand in most segments requires a rigorous cost-cutting course. We are currently implementing the measures of our restructuring program. Unfortunately, this also means painful cuts in personnel. Our customers' business is generally focused on the second half of the year. Only the home storage business is running evenly strong throughout the year. In the second half of 2023, we expect higher utilization of our production capacity for our lithium-ion cells, but also in the Consumer Batteries segment, based on the forecasts of our customers."

The outlook is still vague

The VARTA Group is operating in a challenging market environment. However, indications from customers so far, especially the high order backlog for energy storage, give reason for some optimism. To meet current and future challenges, the Executive Board has launched a comprehensive package of measures to reduce costs. The restructuring program adopted in March includes cost savings in all areas and reductions in working capital, in particular through a reduction in inventories. Savings in personnel amount to around 800 positions worldwide. More than half of these will come from planned departures and attrition. A further 240 jobs will be cut at the German sites this year. Around 150 more jobs are to be relocated abroad next year. For the fiscal year 2023, the management board of Varta AG expects a reduced turnover between EUR 820 and 870 million. It assumes an adjusted EBITDA of at least the previous year's level of approximately EUR 62 million. The management's forecast assumes that the challenging economic situation and the existing global crises will continue in 2023, with corresponding negative consequences for manufacturing costs and consumer demand. Nevertheless, the Management Board is convinced it will return to profitability with the adopted restructuring program, the successfully implemented capital increase and targeted investments in growth markets.

the consensus sales forecast for 2023 is only 5% higher than the previous year

Analysts surveyed at Refintiv Eikon estimate 2023 revenues of EUR 848 million and EBITDA of EUR 62.9 million, following management's cautious statements. Thus, the consensus estimates are very close to the management's cautious outlook. The 2021 revenues of around EUR 900 million are not expected to be exceeded again until 2024. Due to ongoing restructuring and consulting expenses, consensus estimates call for a net loss of EUR 1.63m or EUR 0.17 per share in 2023/24. The financing position has improved since the beginning of the year: On the one hand, the Company received almost EUR 51 million from a capital increase. On the other hand, the syndicate banks finally agreed on April 17, 2023, to extend the debt financing until the end of 2026. In addition to implementing the restructuring concept, which will result in operational adjustments to production and administrative costs, the Company plans to make targeted investments in growth areas such as the energy transition and e-mobility.

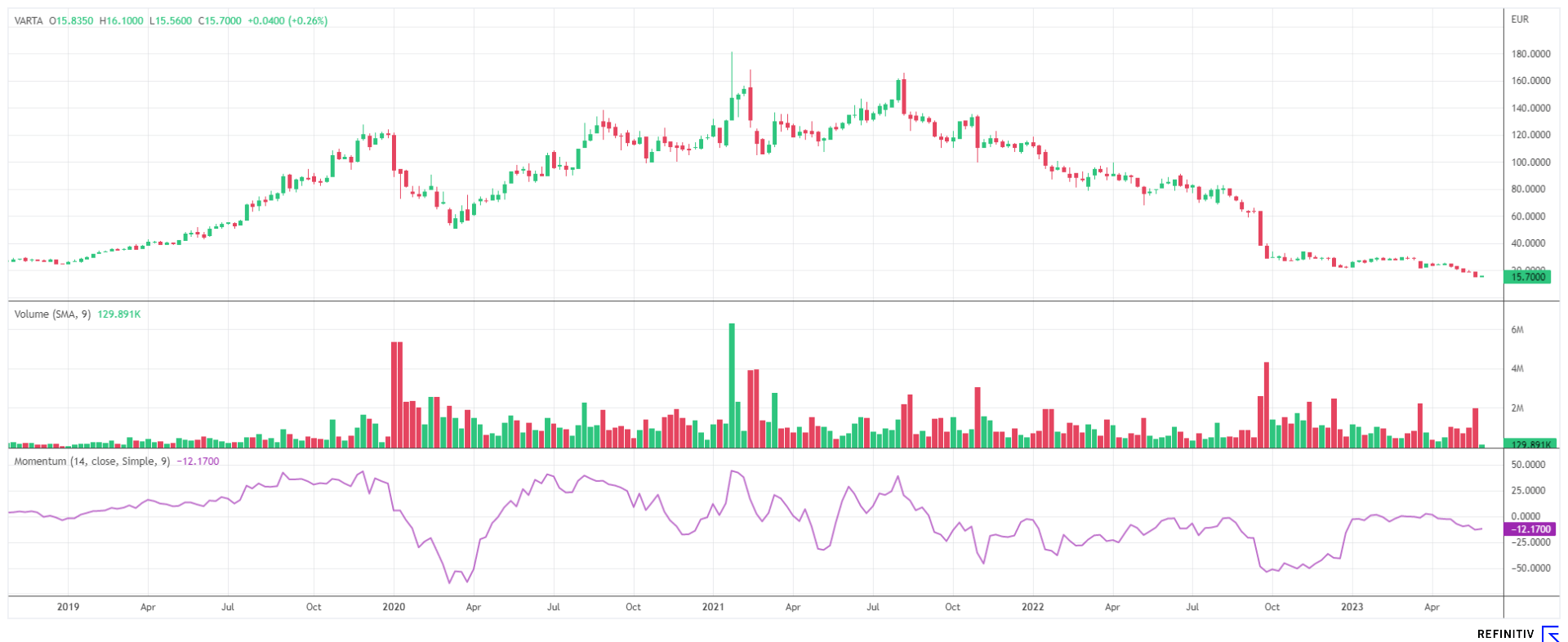

Chart technology strongly negative, short sellers jump on the bandwagon

At the IPO in October 2017, the issue price of the share was EUR 17.50. Until the beginning of 2019, things went uphill at a comparatively leisurely pace. Then the fabulous flight of fancy began, catapulting the share to a record high of around EUR 181 at the beginning of 2021. Investors from the very beginning were thus able to enjoy a tenfold increase in value.

Now we are on the downside of the possible in the chart. Daily reports about new short positions in the Varta share pile up, and the price is steadily sinking to new annual lows. This trend will only be broken once the share can initiate a trend reversal with high momentum. However, this also requires initial fundamental progress.

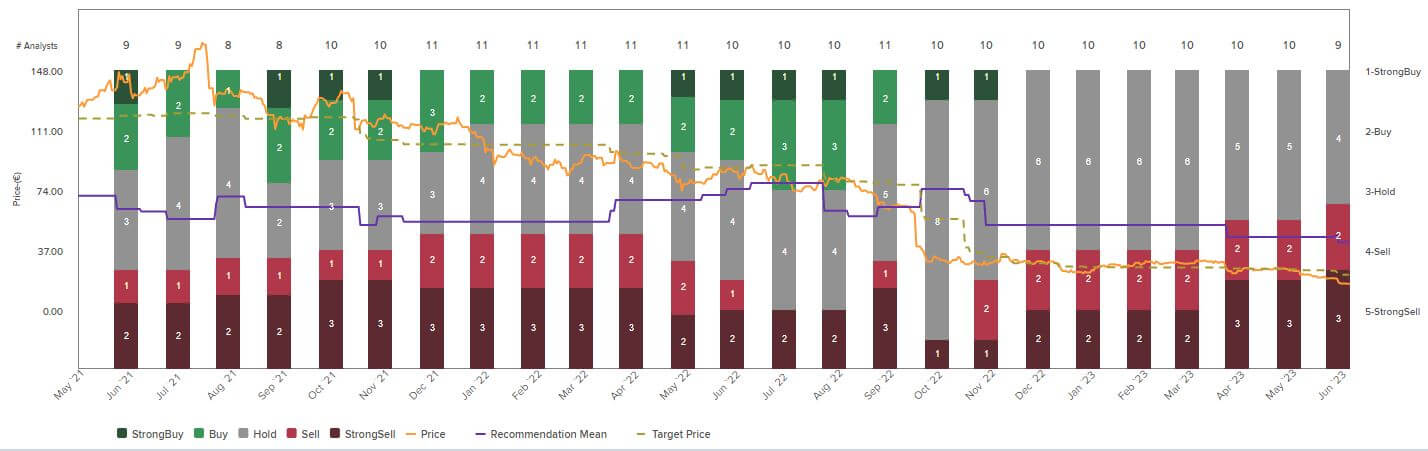

Analysts strongly revise their forecasts

After several revisions of expectations, it has become difficult for analysts to derive a fair valuation. While Berenberg can still settle on a "hold" vote after several revisions of the price target from EUR 45 to EUR 25, Goldman Sachs halved its price target from EUR 30 to EUR 15 at the end of May. The analysts continue to see large over-capacities for Varta's most important product, lithium-ion button cells, wrote analyst Philipp Konig. There is also a risk that the Company could miss its targets in the current year. His estimates for sales and adjusted operating profit (EBITDA) are, therefore, well below the consensus forecasts of other experts. The analysts at M.M. Warburg also threw in the towel in mid-May, voting "Sell" and setting the price target at EUR 15.50. The share reached this price level on May 26, 2023.

After strong adjustments of the analysts' discounting models, it should still take a few months until upward revisions are possible again due to slightly better figures. For this, cost measures would finally have to take effect, and a proper forward vision would have to become visible in new market areas.

Interim conclusion: The principle of hope

Among all analysts surveyed, there is currently no active buy recommendation for Varta AG. The average price expectation of the 9 experts of Refinitv Eikon is EUR 20.65 on a 12-month view. This promises a potential of about 33% if the turnaround really happens this time. For newcomers, the current level of EUR 15.60 offers a comfortable situation because the next quarterly releases will deliver successive, positive restructuring results that will revive the principle of hope. But they are not safe in the current economic downturn.

We had secured an exit price of over EUR 100 in our estimates through recommended technical stops. Based on the chart, the price would first have to climb back up to the EUR 25 and later to the EUR 33 or EUR 58 mark, which from today's perspective, cannot be expected very quickly. Remain in a waiting position with a small buyback investment. It will probably not go much lower unless the restructuring plans fail entirely. If the share price picks up due to good news, there is still enough time to jump on the bandwagon.

Upcoming dates: VARTA AG's annual general meeting will take place on July 11, 2023. Half-year figures will be available one month later, on August 11, 2023.

The update is based on the initial Report 11/2021