The new strike rate: 38,000 to 40,000 BOE per day

With a firm hand: The next deal is sealed! Yesterday, Saturn Oil & Gas Inc. announced that it has entered into another purchase agreement to strategically acquire two oil and gas asset packages in southern Saskatchewan, adjacent to the Company's existing asset base in Saskatchewan. A transformative investment of CAD 525 million will be made, and the acquisition is expected to be completed around June 14, 2024. The effective date has been set as January 1, 2024, meaning the financials for 2024 will scale up by approximately 30%. All agreements are subject to customary approvals and closing conditions.

barrels of oil equivalent/day is the new mark

The acquisition consists of two distinct asset packages that directly offset the existing core properties, including the Battrum area assets in southwest Saskatchewan and the Flat Lake area properties in southeast Saskatchewan. With this acquisition, Saturn takes the next step towards becoming a midsize producer and catapults itself overnight to a CAD 1.5 billion oil and gas company. This further adjustment to the Company's size will allow synergy effects to be leveraged at the operational level, in addition to the improved logistical conditions in the exploration and development of production points.

The financial details create new flexibility

On the financial side, Saturn is demonstrating its current strength in addressing and attracting larger lenders to its growth model. This transformation replaces a relatively expensive loan with lower cost and more flexible debt. The total cost of the acquisition, net of customary closing adjustments, is expected to be CAD 525 million. The transaction is underpinned by a USD 625 million loan commitment from Goldman Sachs and secured equity financing with total proceeds of approximately USD 100 million with a placement price of CAD 2.35.

Saturn has also entered into an agreement with the National Bank of Canada to provide a CAD 150 million reserve-based line of credit, further enhancing Saturn's liquidity and increasing flexibility in the operational integration of the new assets. All transaction details are subject to customary closing conditions. The introduction of the new Canadian and US institutions as capital market partners represents the next phase in Saturn's development as a growing mid-cap oil producer in the Canadian energy sector. To date, no foreign investment banks have been on board.

The perfect fit: Highlights of the acquisition

Production from the acquired assets is expected to be approximately 13,000 BOE/d at closing and is 96% oil and NGLs with a very low 16% average decline. More than 90% of the acquired acreage is located on public lands, which increases the value of future development sites due to provincial royalty incentives. Saturn's established infrastructure in the area underpins an attractive cost structure and increases operational efficiencies. The acquired assets provide multi-zone development opportunities and significant operational synergies and further advance Saturn's growth strategy by adding approximately 950 identified gross drilling locations. The Company's existing drilling inventory secures development targets over the next 20 years with ample future reserve potential.

The new properties promise high netbacks as they can be operated with existing infrastructure and are located in close proximity to existing pumping stations. Additional cost benefits are realized through the Company's high quality infrastructure and existing marketing agreements. Saturn's previous experience in the development of the Viking and Bakken deposits will serve it well in the development of the Lower Shauna and Flat Lake assets. Due to the high quality of the drilling inventory, the current production level can be maintained at a drilling rate of 20 to 30 wells per year for more than 20 years. Further optimization exists through the use of active waterfloods.

The acquired assets are expected to generate a net operating profit of approximately CAD 251 million over the next 12 months, which is approximately half of the acquisition price paid. The payback before development costs can be realized within 2-3 years in an optimized view. Based on proven, developed and producing reserves, the total production potential on a net present value basis (discount rate 10%) is 44.1 million BOE with future net revenues of CAD 926 million. If the probable reserves are added, the discounted present value is calculated at around CAD 1.4 billion. Overall, the acquisition is expected to be significantly accretive to key financial metrics.

An overview of the new guidance for the current financial year:

Interim conclusion: The leap into the next league

Saturn Oil & Gas is making another evolutionary leap. The ratio of net debt to adjusted EBITDA is rising slightly and is expected to be 1.2 to 1.3 after the takeover is completed. Due to the high cash flow, the much-noticed ratio will fall to around 1.0 to 0.9 on an annualized basis by June 30, 2025.

"The acquired assets perfectly fit Saturn's existing operations in Saskatchewan and offer significant synergies. The acquisition is of great value to our shareholders and is consistent with our strategy of acquiring high-quality assets where we can apply our strategic operating approach to improve margins, grow adjusted EBITDA and increase free funds flow," said John Jeffrey, Chief Executive Officer.* ‘The financial flexibility provided by our modified capital structure puts Saturn in an ideal position to efficiently develop our expansive light oil-focused assets, optimize our cost structure, and create value for our shareholders*.’

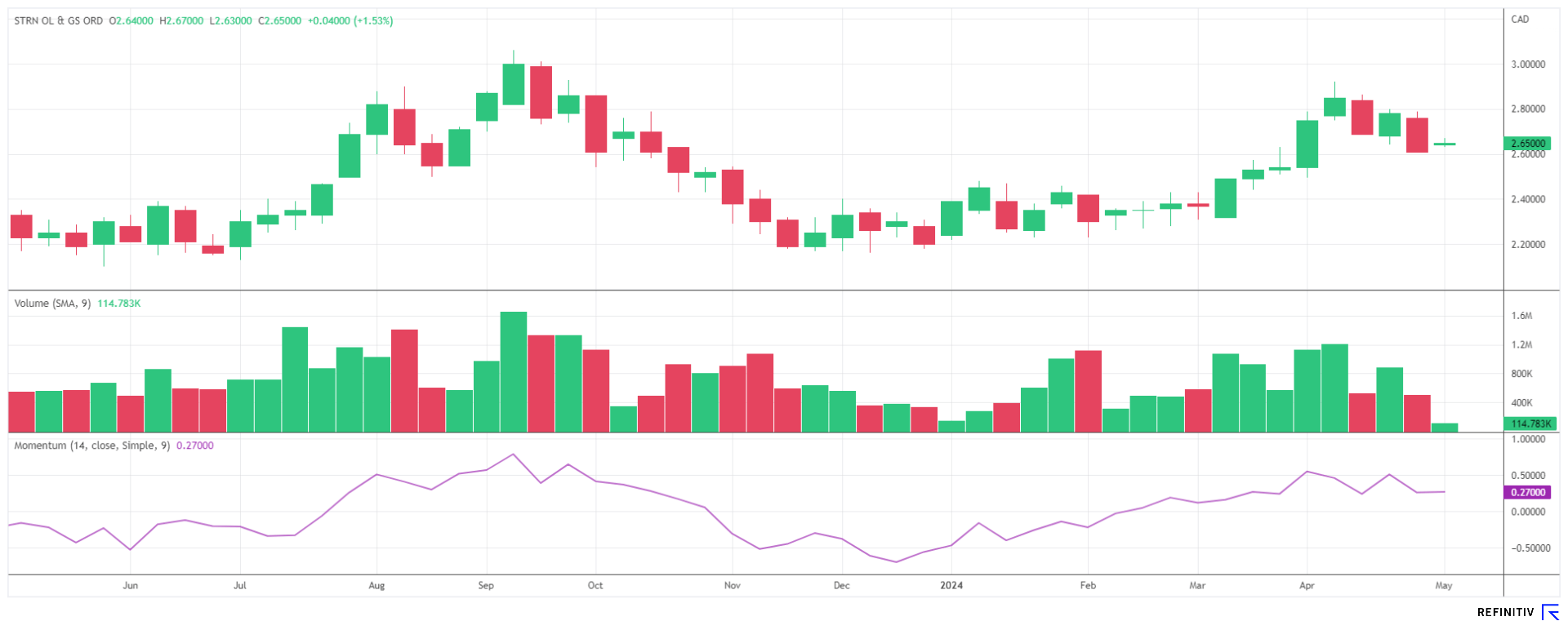

The price expectations of analysts on the Refinitiv Eikon platform recently ranged between CAD 4.45 and CAD 6.30 on a 12-month horizon. On average, five analyst firms expect a price of CAD 5.15 on a 12-month basis. The experts must now be given time to assess the available figures in light of the new number of shares of around 204 million and the current debt of CAD 792 million at the time of the merger. However, with an annual adjusted EBITDA of almost CAD 700 million, debt will already fall to around CAD 620 million by the end of the year. This will also reduce the prospective EV/EBITDA to around 1.5. Within the “mid-tier producers” of North America, this factor is around 3.8. Minor disappointments due to the new debt should only be temporary.

In the updated guidance, management continues to assume an average WTI oil price of around USD 80. At USD 78.50, this is currently slightly below this expectation. However, Saturn will maintain its recent hedging strategy and sell forward large parts of its production to meet financing requirements. This will ensure the healthy development of the balance sheet in the near future. Given the undervaluation relative to the sector, the share should set off for new shores once the current capital increase has been priced in. A medium-term adjustment of the share's value to the new proportions is very likely for this reason alone, as the institutional share of investors will continue to increase due to the renewed commitment of the major investor, GMT Capital. Yesterday, the market reacted with a discount of 5% to approximately CAD 2.50. Taking the average target of analysts as a benchmark, there is a potential of 100% from today's perspective.

The update is based on our initial report 11/21