Reserves have now reached 145 million barrels

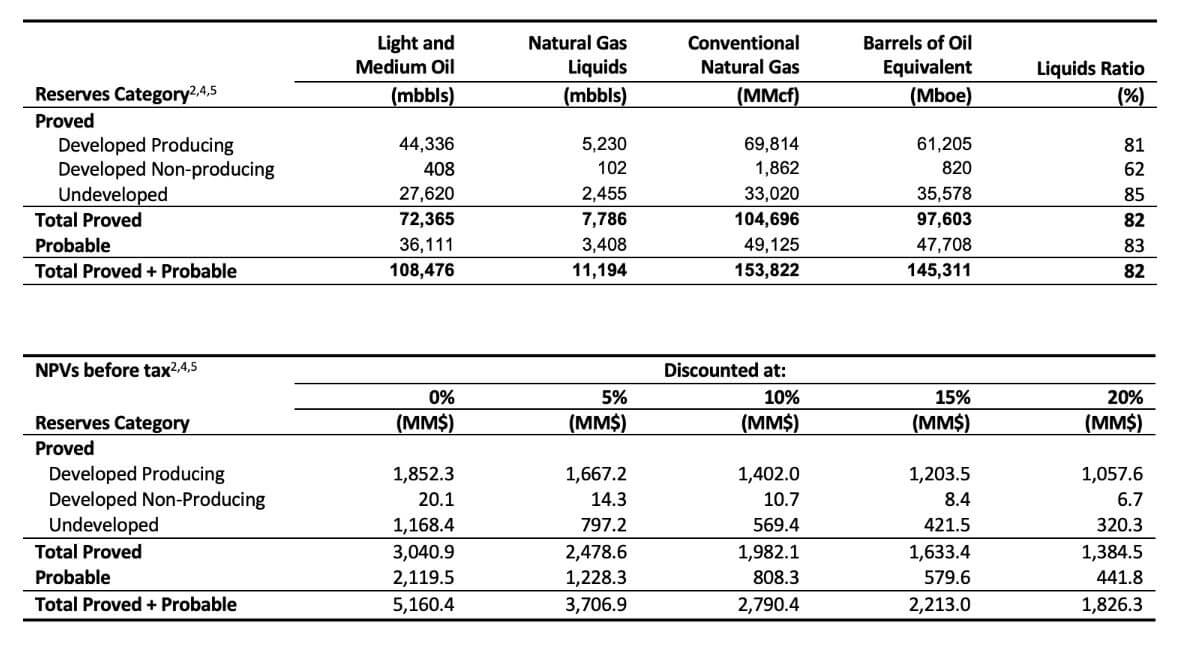

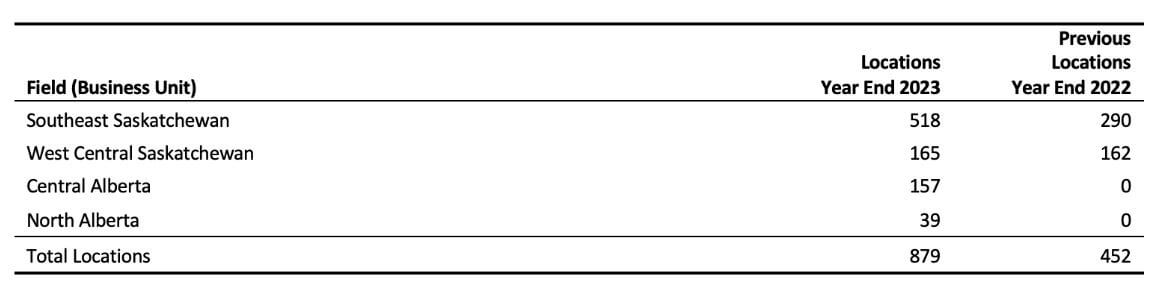

Saturn Oil & Gas is coming up with a new reserve estimate as the new year begins. The NI 51-101 reserve report was prepared by Ryder Scott and evaluated the Company's oil and gas assets in Saskatchewan and Alberta. Proven and probable reserves were confirmed at 145.3 million barrels of oil equivalent (BOE), representing an increase of 131% over the prior year and a net present value of future net revenue of the Proved Developed Producing ("PDP") reserves of CAD 1.4 billion. A discount rate of 10% (NPV10%) was used to calculate the present value. As a result of the integration of the Ridgeback properties and the consistent expansion of drilling, the number of gross drilling locations now stands at 879, with 78% in Saskatchewan and 22% in Alberta. The oil component of light and medium crude oil is 82%, with the remainder consisting of natural gas liquids ("NGL"). The life of the directly proven reserves is 6.2 years (PDP) and 14.8 years for the probable reserves (TP+P1). Based on the current share count of 139.38 million shares, net present values (NPVs) are CAD 6.72 (proven, developed and producing) or CAD 10.89 (in the overall view) and an impressive CAD 16.69 if the probable reserves are also included.

Below is an overview of the current resource estimate and its calculation:

"We are proud of our development programs and strategic acquisitions that have added more than 150 MMBOE of TP+P reserves over the past three years at an attractive average finding, development and acquisition cost of $14.35 per BOE, taking into account expected future development costs," commented Justin Kaufmann, Chief Development Officer.

barrels of oil equivalent per day is the new production mark for an average day

As a result of the successful 2023 drilling program and the acquisition of Ridgeback, Saturn's average oil and gas production in the fourth quarter of 2023 was approximately 26,890 BOE/day, and average production reached approximately 28,000 BOE/day in December 2023. The reserve report includes 680 gross drilling locations (576.6 net) in Saskatchewan and 199 gross drilling locations (150.6 net) in Alberta. The Company has an internally estimated additional 550 gross drilling locations (450 net) in Alberta and Saskatchewan, which, when combined with the booked locations in the reserve report, represent over 20 years of drilling inventory.

Below is an overview of the properties:

Saturn Oil & Gas surprises with this consistent and rapid expansion of resources. Following the integration of the latest acquisition, "Ridgeback", the ongoing quarterly production is showcasing its best performance. This is despite the fact that the oil price has fallen due to the economic situation and fierce forest fires in Alberta, which have forced some properties to shut down temporarily. The daily production volume has now reached over 28,000 BOE, and the oil price is also playing its part. In the fourth quarter, it averaged USD 83.5 (WTI), marginally exceeding Saturn's current plans.

Cash flow ensures rapid debt reduction

For the full year 2025, the Company plans an adjusted fund flow (AFF) of USD 2.25 per share, of which CAD 1.15 could go towards repayment. In order to be more flexible, Saturn renegotiated its credit facility for exploration in December. The amendment allowed the Company more financial flexibility to finalize its robust development plans for the fourth quarter of 2023. This enabled another OHML well to be drilled at the end of the year. Borrowings at the end of September reached approximately CAD 473.8 million at the end of the quarter, with the scheduled debt payout expected to occur throughout 2025 at an oil price of USD 80. An ongoing increase in production volumes could positively impact the repayment schedule.

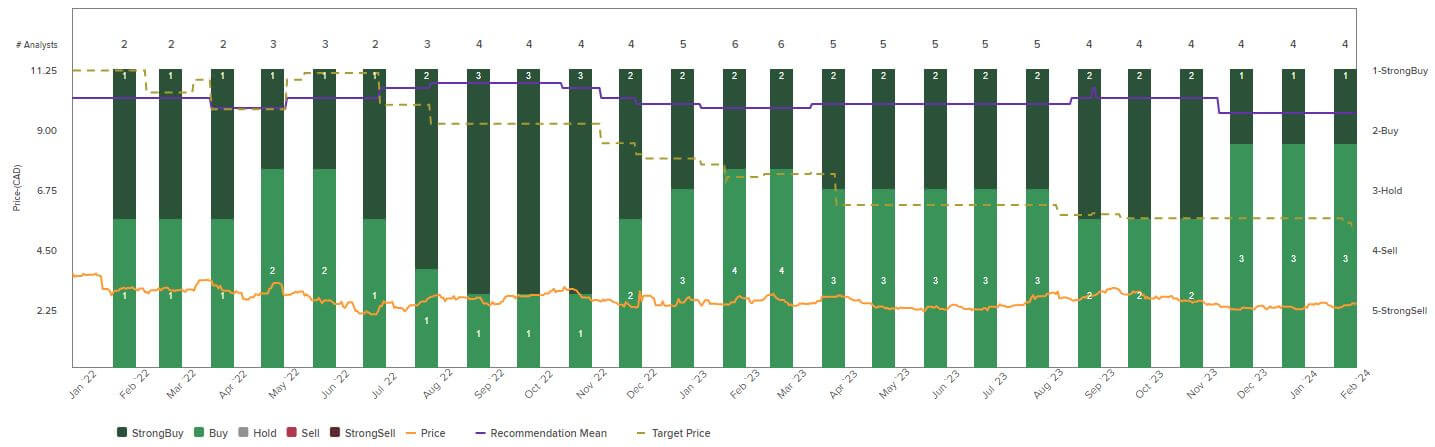

Interim conclusion: Attention is increasing

The price expectations of analysts on the Refinitiv Eikon platform are still between CAD 4.75 and CAD 5.65 over a 12-month horizon. Due to the surprising expansion of reserves, a number of upgrades are likely to occur soon. At the end of 2023, the net present value of the audited reserves amounted to CAD 6.72 per share (NPV/share). The Company suffered a slight dip in 2023 due to the horrendous forest fires in Alberta. For the current year, however, production volumes should reach the original expectation of 30,000 BOE/day. The low valuation of the share is unique in North America but could rise sharply as oil prices increase.

Saturn Oil shares have attracted more and more institutional shareholders in recent months, who are betting on the long-term appreciation cycle and have taken advantage of the extensive capital measures to enter the Company. With an enterprise value of over CAD 800 million, the Company is expected to break the 1 billion mark in 2024. The largest single shareholder is the primary investor GMT Capital with 24.77%, followed by Mackenzie Financial with 3.35% and Pender Fund Capital Management with 2.73%. The free float currently amounts to around 64% of the outstanding shares, and the future dilution will only be around 15% due to the expiry of a large number of warrants.

Fundamentally, Saturn is trading at an estimated 2024 EV/adj EBITDA ratio of around 1.0. Looking at the average industry valuation of approx. 4.5, a fair value per share of around CAD 8.00 to 10.00 would be expected from today's perspective. Due to the high number of M&A deals, investors have recently been diluted several times. In the course of several operational improvements and the exploitation of synergy effects, costs should also fall slightly. This means that with the regular adjustment of production volumes, an ever-widening gap can be observed between the share price and the corresponding cash value. We do not expect the share price to continue to adjust in value; a sliding adjustment of the Company's value to the new proportions is more likely.**

Note: A webinar on the Financial results for Q4 and the full fiscal year 2023 will take place on March 13, 2024, at 18:00 CET. Click here to register. Before this, on February 21, 2024, Saturn Oil & Gas will present at the 10th International Investment Forum. Kevin Smith, VP Corporate Development, will appear on camera at 17:00 CET and answer questions live. Further information can be found at www.saturnoil.com

The update is based on our initial report 11/21