Continued strength in a challenging environment

"Saturn has reached a new milestone in achieving its goal of generating sustainable free cash flow. The Company set a new record with an adjusted EBITDA of over CAD 100 million. This achievement was driven by increased production in the third quarter of 2023 but was also aided by our commitment to operational efficiencies," commented John Jeffrey, CEO of Saturn Oil & Gas.

Saturn Oil & Gas continues to further improve its figures. Following the integration of the latest acquisition, "Ridgeback", the quarterly production is at its best, even though the oil price had to take a hit due to economic factors and severe wildfires in Alberta forced the temporary shutdown of some properties. As published on November 7, 2023, current production reached a new dimension with over 26,000 BOE per day (BOE = Barrel of Oil Equivalent, including gas). Consequently, the Canadian oil producer's 9-month revenue of CAD 508.5 million almost exactly doubled compared to the previous year (CAD 201.1 million) and set a new record for the third quarter.

Barrel of Oil Equivalent per day is the new production mark for an average day

Some key figures have changed less due to the significant increase in the number of shares to 139.31 million. As a result, the adjusted cash flow per share is almost unchanged at CAD 1.62 after CAD 1.72 in the previous year. Assuming a good 4th quarter, this means that a good CAD 2.10 per share is currently backed by solid liquid earnings. Saturn Oil & Gas shares (symbol: SOIL) are currently trading at CAD 2.45. The price-to-cash flow ratio is an unusually low 1.2, while the North American oil sector calls for values of 4 to 5. The undervaluation of Saturn Oil & Gas remains clear.

Operationally, everything is running like clockwork

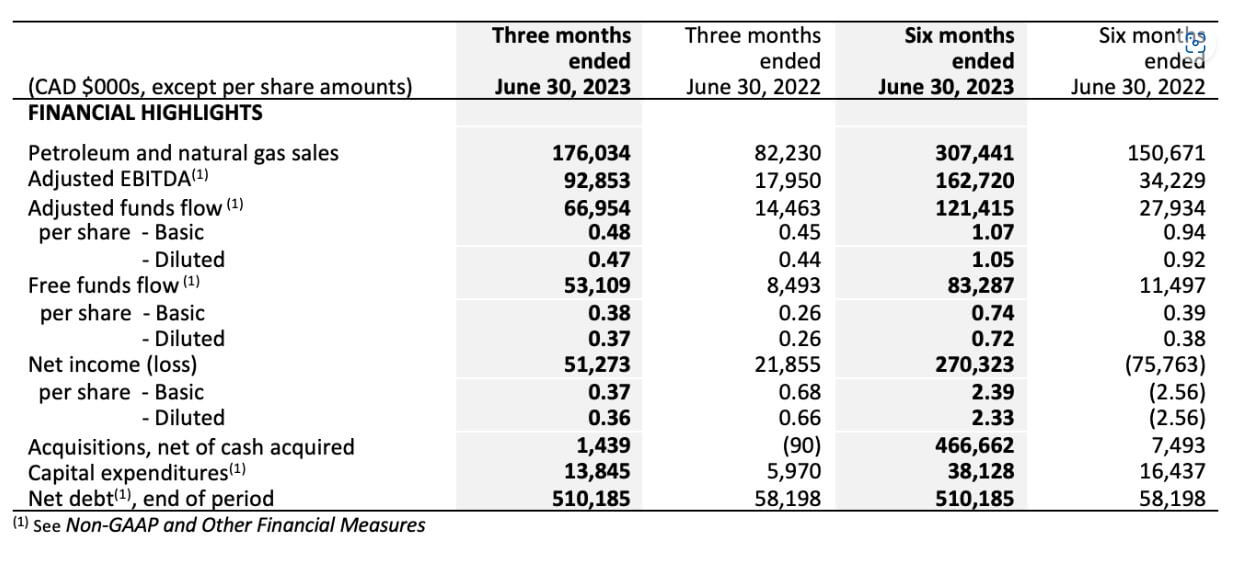

An overview of the Q3 and 9-month financial figures:

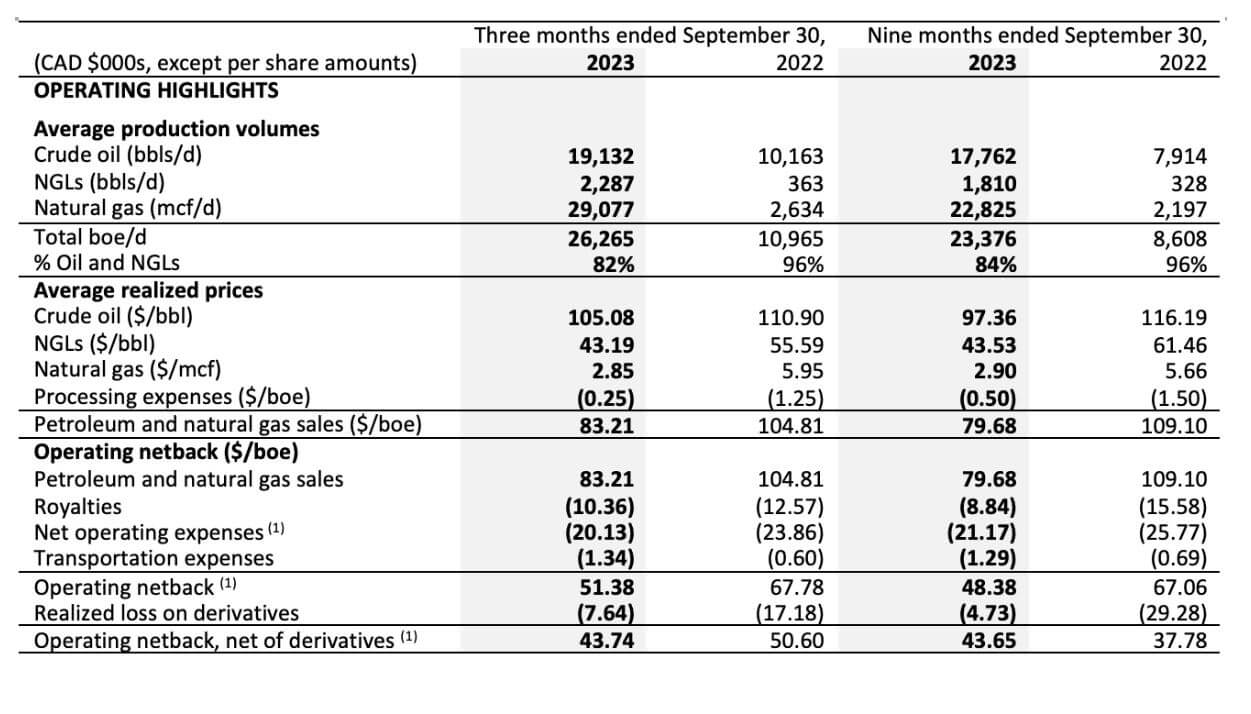

Saturn continues to make significant progress in the integration of Ridgeback Resources Inc. and is thus becoming a major energy producer in Western Canada. In the first 9 months of 2023, average production increased from 8,608 to 23,376 BOE/day. It is already clear today that annual production is expected to increase by more than 250% compared to the previous year. Overall, investments increased to a record level of CAD 73.4 million. Compared to the previous year, this is an increase of 37%. The realized oil price fell from USD 109.1 to USD 79.7 due to the crisis, and the cash flow-effective net income was CAD 43.7 per BOE, slightly below the Q2 figure of CAD 50.60. With an unchanged high adjusted cash flow of over CAD 124 million after 9 months, CAD 50.7 million was again repaid on the debt side following record investments. Debt reached CAD 473.8 million at the end of the quarter, with the scheduled repayment of debt expected in the course of 2025. Overall, the operating picture is stable, with no major surprises.

Overview of the production figures for Q3 and the first 9 months:

Outlook: Exploration is where the profit lies

Saturn has performed well in the development of new drilling fields in recent months. New technology and an outstanding exploration team have led to excellent follow-up figures. A total of 18 drilling fields were developed in the third quarter. But that is not all: Saturn is once again accelerating its expansion activities in Alberta and Saskatchewan. Management expects Q4 2023 to be the most active development period for the Company to date. Currently, for the first time in the Company's history, 3 drilling programs are being carried out simultaneously. In Alberta, 2 Cardium light oil targets are being developed with a 100% working interest, expected to come on stream in early Q1 2024. The current investments should significantly increase production by the turn of the year. We therefore expect a sequentially strong fourth quarter in 2023 and further growth in 2024.

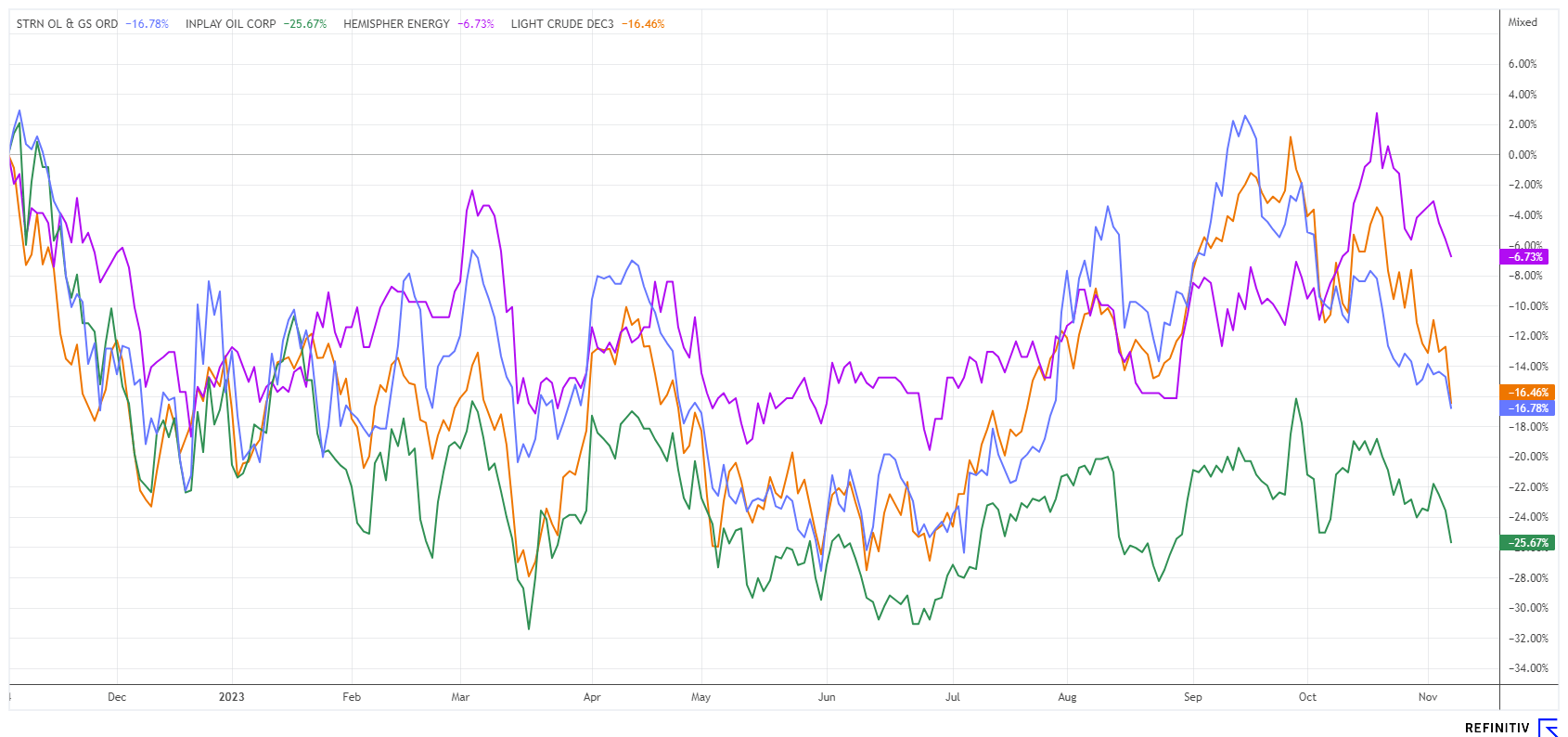

Interim conclusion: Hand in hand with the oil price

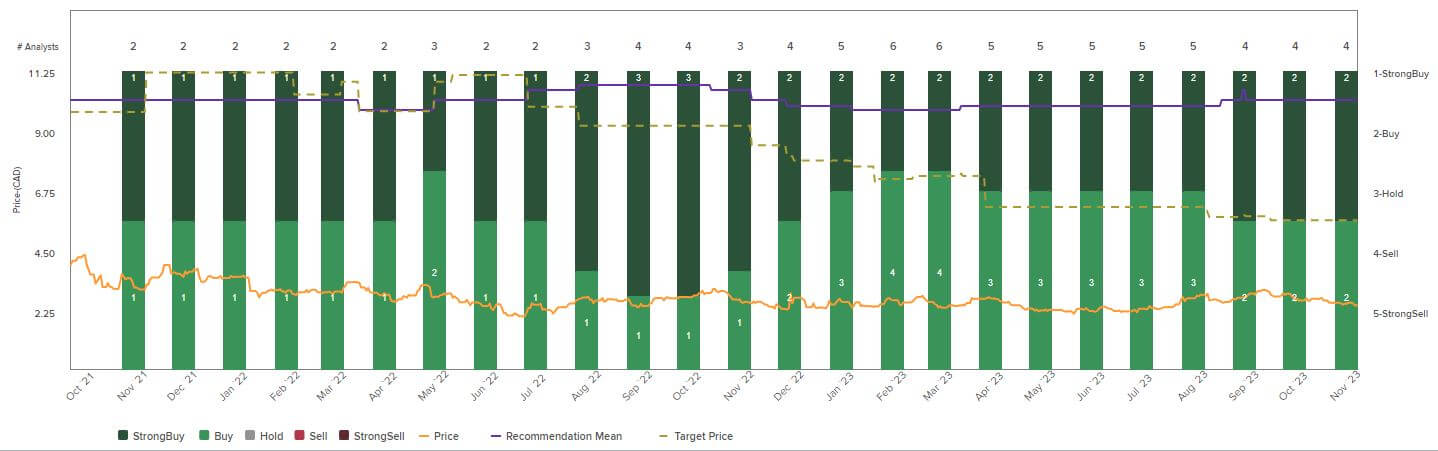

The chart shows a synchronization between the selected Saturn peer group and the WTI oil price. Due to the sharp decline in spot prices for light oil, the peer companies came under heavy pressure and have given up their positive development in 2023. Nevertheless, Saturn Oil & Gas is still in the upper midfield with a loss of just under 17% over the past 12 months. From an analytical point of view, the strong synchronization with traded oil prices is still incomprehensible, as Saturn's management achieved good hedging successes in the past quarter. Given the geopolitical conflicts in Ukraine and the Middle East, commodity prices will likely continue to fluctuate considerably. Fundamentally, Saturn is currently trading at an estimated 2024 EV/adj EBITDA ratio of around 0.8. With an average industry valuation of 4.3, a fair value per share of around CAD 8.50 to CAD 11.00 can be expected from today's perspective. The significant acquisitions by the major investor GMT Capital, holding a 24.91% stake, indicate such undervaluation. Other institutional investors should also become active at this level because, with an enterprise value of over CAD 800 million, the Company could achieve a billion-dollar valuation as early as next year.

The price expectations of analysts on the Refinitiv Eikon platform currently range between CAD 4.75 and CAD 6.30 over a 12-month horizon. This is somewhat perplexing because Saturn Oil & Gas showed in the past quarter that it is making rapid progress with the integration of the new properties. The increase in sales indicates a good exploration performance and confirms the value of the acquired properties. In a normalized economic environment, the Company's low-risk parameters should lead to increased investor interest. We anticipate a further sequential improvement in the operating figures in 2024 in the usual range. Due to the historically low sector valuation, M&A transactions are quite likely.

Note: A detailed presentation on the financial results for the third quarter and the first 9 months of 2023 can be found here. On November 8, 2023, Saturn Oil & Gas presented its results to investors in a webcast. Further information can be found at www.saturnoil.com.

The update is based on our initial report 11/21