Nel ASA - On the way to a new league

In early May, Nel ASA announced plans to build a new gigawatt automated electrolyzer plant in Michigan. When completed, the plant will be one of the largest electrolyzer factories in the world, creating more than 500 new jobs. CEO Håkon Volldal added the USA to his investment list in January. Now the announcement was made at the SelectUSA investment summit in Washington. Michigan had recently shown itself to be a state with good framework conditions.

The Nel Michigan project is one of the largest H2 projects in the world

Financial grants, access to a highly skilled workforce, and close collaboration with universities, research institutions, and strategic partners. These factors were critical for the Norwegians to launch one of the world's largest H2 projects. Michigan is considered one of the pioneering states in the US for new energy technology. In the future, Nel will build on its fully automated alkaline electrolyzer manufacturing concept developed in Herøya, Norway. Similarly, the expansion of the Wallingford plant will play a critical role in creating a blueprint for expanding the production of PEM electrolyzers.

In early January, German energy company HH2E initiated the purchase of electrolyzer capacity from Norwegian hydrogen specialist Nel. Nel Hydrogen Electrolyser AS, a subsidiary of Nel ASA, has agreed with HH2E on a Front-End Engineering Design (FEED) study and a letter of intent for two 60 MW electrolysis plants in Germany. The FEED study will be launched once the contract is awarded, and the parties intend to conclude a contract for the supply of the electrolyzers in the first half of 2023. Both are major steps into the H2 future for Germany and Norway.

"These projects are important for the energy transition in Germany and Europe, and we are pleased to support our partner HH2E in its efforts towards a greener society," says Håkon Volldal, CEO of Nel.

HH2E's two proposed 60 MW plants will be among the largest green hydrogen production systems announced to date in Europe. Both plants are in the first phase and can be significantly expanded if needed. The hydrogen produced will be used for industrial applications, transportation & logistics and local heat supply. HH2E aims to reach an electrolyzer capacity of 4 GW by 2030, making it one of Germany's most important H2 companies.

First quarter figures were above expectations

Nel surprised positively with the figures it presented. Compared to the same period last year, revenues increased by 68% to NOK 359 million. Order intake increased by an impressive 105% YOY to NOK 580 million. A record order backlog of NOK 2.9 billion at the end of the quarter was even 126% higher than in the first quarter of 2022. All segments reported strong year-on-year growth, including Fueling, PEM Electrolyzers and Alkaline Electrolyzers. EBITDA of NOK -121 million resulted from high losses in Fueling and low margins on electrolyzer projects completed in 2020/2021. Increased personnel costs due to preparations for major projects also weighed on the cost side. Net loss reached NOK 192 million, up from NOK 84 million, mainly due to losses from operations and a fair value adjustment of equity investments of NOK -76 million.

An auspicious outlook

Nel had a good start to 2023 with robust growth for its Electrolyser Division compared to the same quarter last year. Production volumes at the Company's Herøya manufacturing facility are increasing, and the Company continues to receive large orders for its alkaline electrolyzer equipment. This makes them a technology pioneer, and they will continue to invest in the organization, technology development and scaling of production capacity. The Company is in a solid financial position following a successful private placement in the first quarter of 2023, which raised NOK 1.6 billion in new funds. Nel is building a second production line in Herøya to increase total production capacity to 1 GW. At the same time, Nel plans to automate the production technology of its PEM electrolyzers and increase production capacity to approximately 500 MW at its Wallingford, Connecticut facility.

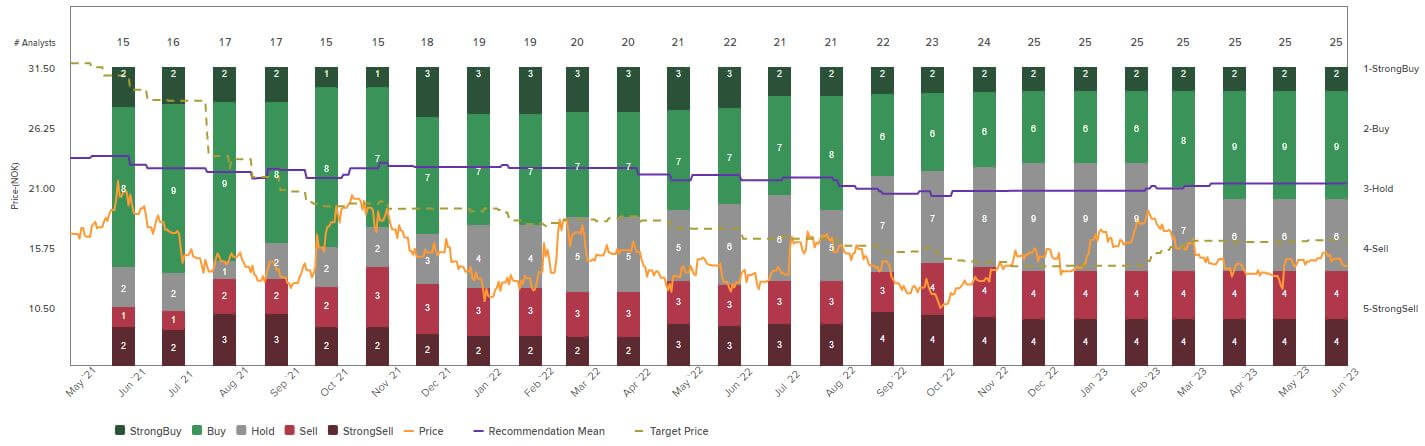

Analysts react with upgrades

Nel expects continued significant growth from European projects. US investment bank Goldman Sachs raised its price target for Nel ASA slightly from NOK 20.60 to NOK 21.00 after the quarterly figures and left its rating at "Buy". The hydrogen group exceeded expectations, analyst Michele della Vigna wrote in a research note issued Friday. The new record level of orders on hand and the recent significant increase in margins are striking. German private bank Berenberg also raised its price target for Nel ASA from NOK 18 to NOK 19 and left its rating at "Buy". According to analyst James Carmichael, Nel's good start to the new year is convincing. The analysts at Refinitiv Eikon estimate that the group's sales will increase by 69% in 2023, or NOK 1.5 billion, and by a further 55% in 2024, to NOK 2.4 billion. However, the Norwegians are not expected to become profitable until the transition to 2027. The order book stands at over NOK 2.9 billion (+125% YOY). The war chest contains a full NOK 4.6 billion. This means that Nel is well-equipped for the next round.

The analysts' assessments nevertheless show a mixed picture on the Refinitiv Eikon platform. Out of 25 experts, only 11 advise a buy. The average price target of the recommendations is NOK 16.55, corresponding to a premium of 22% to the current price at NOK 13.53.

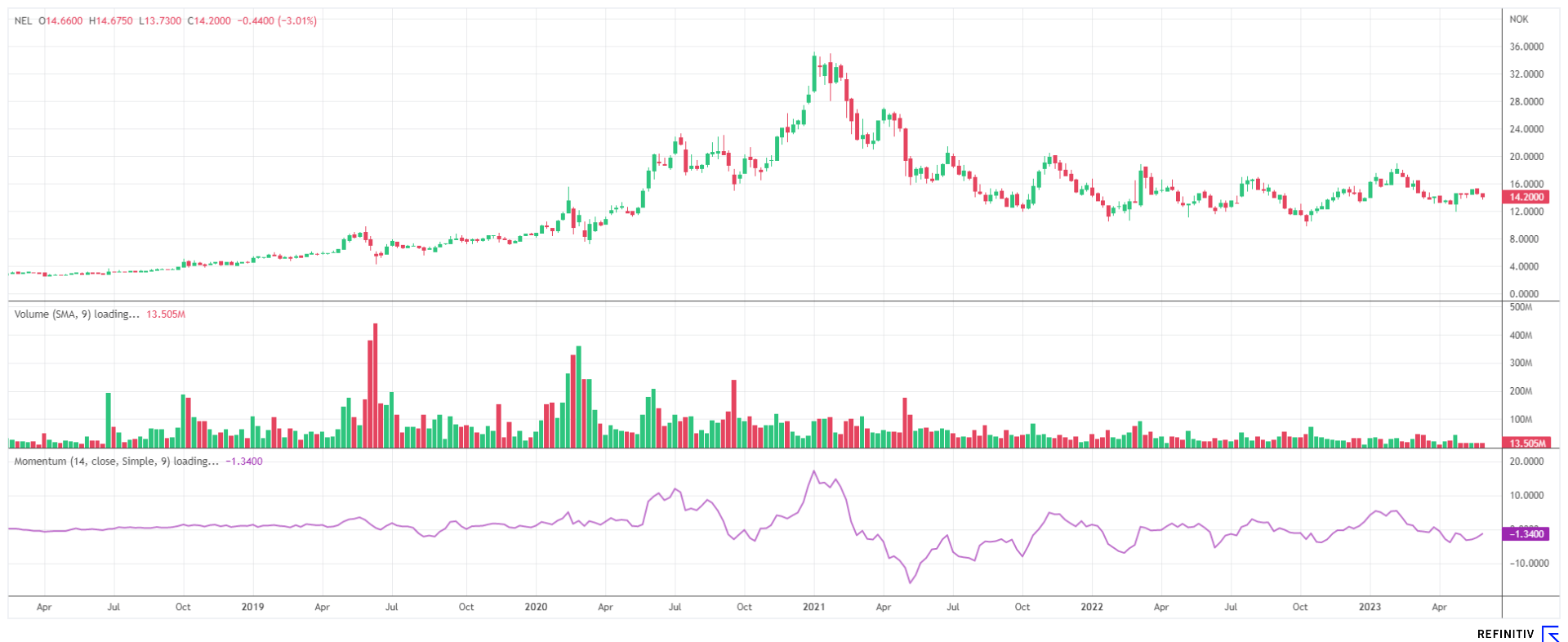

Interim conclusion: Is the next upward movement starting now?

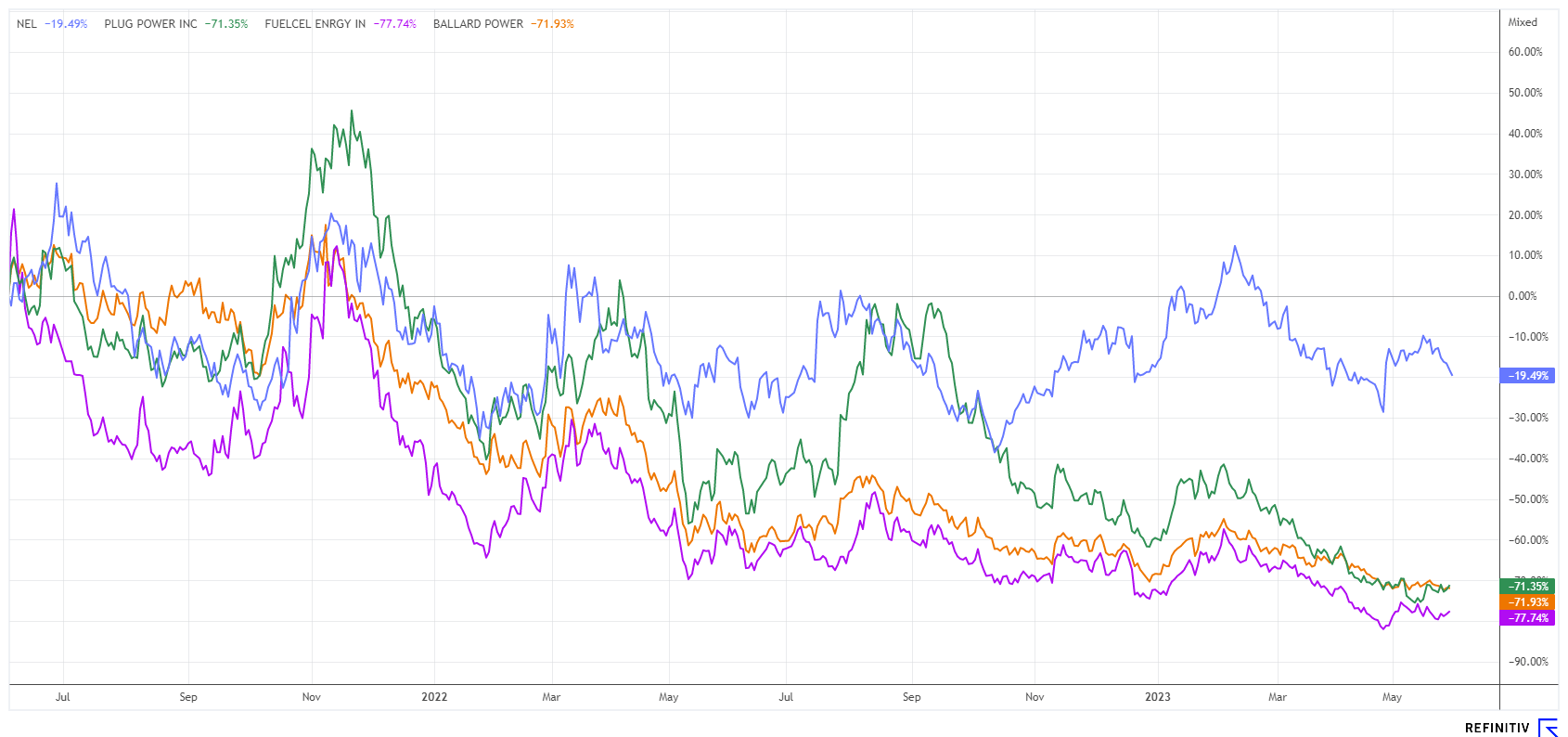

Compared to the H2 sector, the Nel share has clearly outperformed by more than 50% for two years, as the peer group companies FuelCell Energy, Plug Power and Ballard Power lag with more than -70% in the observation period. The depressing balance sheets have a striking effect. The hope for new investor capital must now be placed at a significantly lower level. Nel ASA is a notable exception with its high cash position.

Nel ASA can convince with a high order backlog and a good financing position. Fundamentally, the stock is a standard value in the H2 sector. Due to the problems at Plug Power, the focus has recently turned more towards Nel ASA. Compared to its competitor from the US, Nel's share has already outperformed by 48% in 2023. Nel, as the European market leader, is benefiting from increasing investment budgets from EU governments, but other European countries are also gaining traction. Fundamentally, Nel is still very ambitiously valued with a 2023 P/S ratio of 14.8. In our opinion, the current share price development reflects investors' indifferent attitude towards the valuation of Nel's stock, which is partly due to the high valuation. Recently, investors in the hydrogen sector also faced a sell-off of over 75%.

Note: Q2 2023 financials are expected to be released on July 18.

Also, follow selected hydrogen technology companies on our next International Investment Forum "1st Hydrogen Day " on June 15, 2023 - start: 13:25 CET. Attendance is free - here for registration.

The update is on our initial report 01/22.