So-called recurrent pericarditis is most common in 16- to 65-year-old men, but this inflammation of the heart can affect anyone at any age. In the Western world, the incidence of acute pericarditis is estimated to be around 28 sufferers per 100,000 people per year. Prevalence indicates existing cases, while incidence provides information about new cases. Statistically, 3.32 cases of recurrent pericarditis are hospitalized.1 According to the European Medicines Agency, pericarditis affects approximately 2.5 in 10,000 people in the European Union (EU), or 130,000 people. In the US, a national health issue surveillance database estimate found an average of 125,000 patients per year with pericarditis and an estimated annual prevalence of 40 in 100,000.

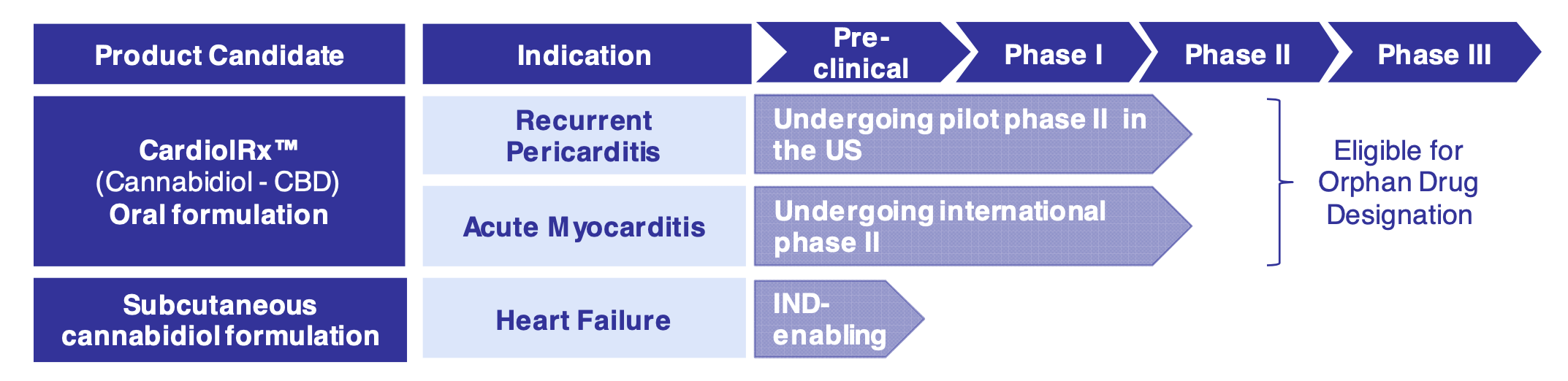

Cardiol Therapeutics product portfolio

The non-intoxicating active ingredient cannabidiol, derived from the female hemp plant, is used in medicine to relieve pain symptoms, such as those associated with seizures.2 This is where the known anti-inflammatory properties of cannabidiol come into play, motivating researchers to investigate cannabidiol's effect against myocarditis. In doing so, they found in a study initiated in 2016 that cannabidiol can dampen inflammatory processes in the heart by preventing the spread of 3 inflammatory cells. At the same time, the blockade extends to risky immune responses of the defense system and thus supports its calming. Likewise, cannabidiol contributes to lowering blood pressure due to its stress-relieving properties, partly due to its interaction with the opioid system. The same is true for cannabidiol's promotion of serotonin balance, which favors calming, relaxation, serenity, and sleep promotion. These effects also counteract elevated blood pressure. So those who take cannabidiol for anxiety and stress are doing something for their cardiovascular system at the same time.

The Company's lead drug candidate, CardiolRx™, will use cannabidiol as a pharmaceutically manufactured oral solution. The therapeutic is currently in clinical development for the treatment of heart disease. Currently, CardiolRx™ is being evaluated in a Phase II US multi-center study in 25 patients for recurrent pericarditis and a Phase II multi-national study in 100 patients for acute myocarditis.

Seven years of market exclusivity as an orphan drug

Both indications, recurrent pericarditis and acute myocarditis, would qualify CardiolRx™ for orphan drug designation in the US and EU. This would give CardiolRx™ 7 years of market exclusivity if approved. In the pharmaceutical industry, an orphan drug is a drug for which the disease conditions are so rare that no, or inadequate therapies are available. Only a small part of the population is affected by these diseases (mostly since birth or early childhood). This affects less than 1/2000 people in Europe. In Europe, 25-30 million people are affected by such a rare disease. For Cardiol Therapeutics, the recognition of CardiolRx™ as an orphan drug means market exclusivity of 7 years.

Triple-digit sales targets possible in the US and Europe

As previous treatment options for patients in the US are more poor than good, Cardiol Therapeutics has an opportunity to achieve sales of approximately EUR 423.8 million for the treatment of recurrent pericarditis (WP) in the United States if approved - Source: First Berlin report. For acute myocarditis therapy, the Company can generate over EUR 874.7 million in sales in the US and Europe. By comparison, the only approved therapy in this condition, rilonacept (Arcalyst), is used primarily as a third-line therapy and generated EUR 110.4 million in sales in 2022, 12 months after launch, targeting the approximately 14,000 WP patients with ≥ 2 relapses. Arcalyst is administered as an injection. Thus the chances for CardiolRx™ as an oral solution are far better in terms of prescription.

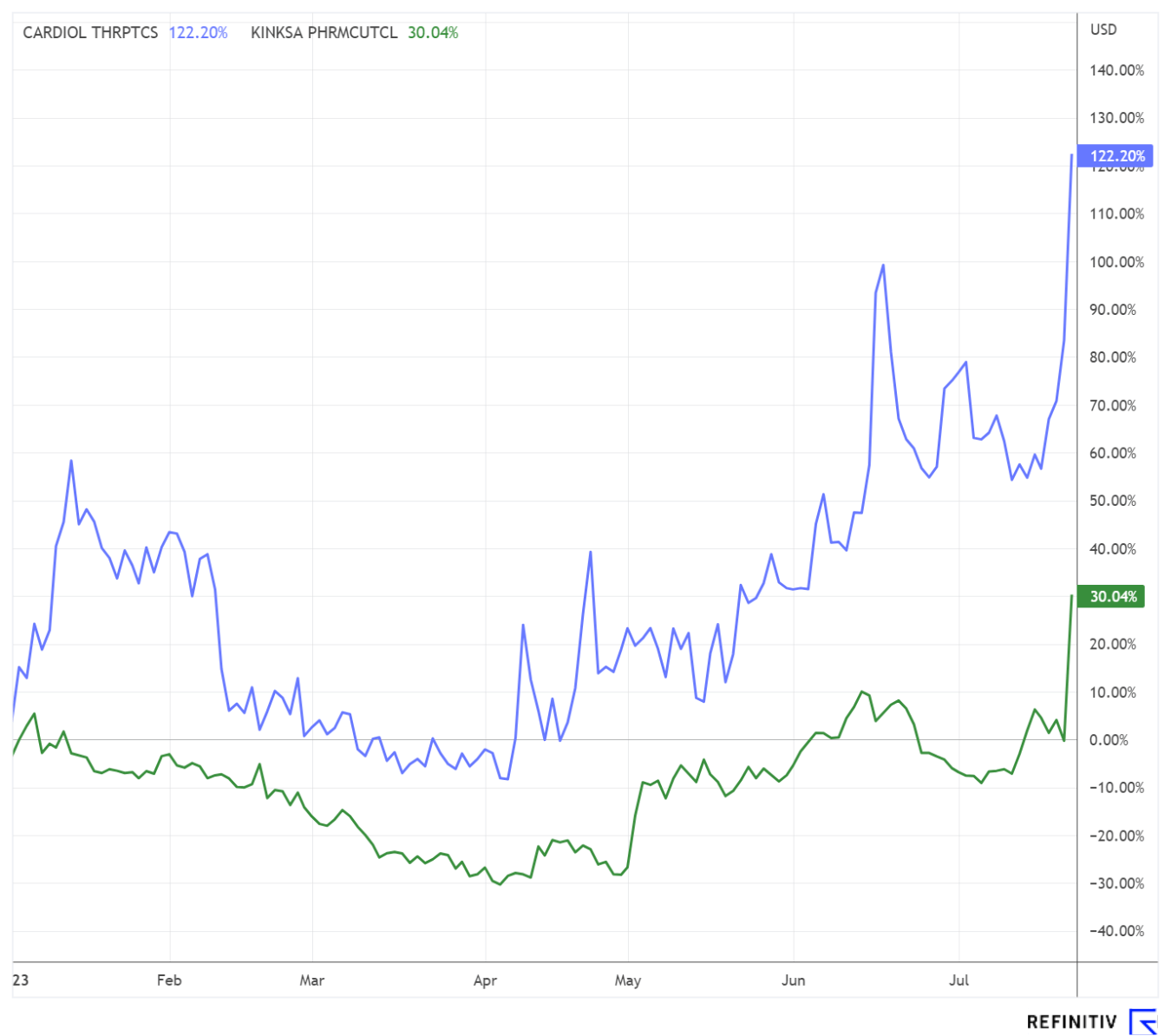

An open-label Phase II pilot study of CardiolRx™ in 25 patients with recurrent pericarditis was initiated in the US in December 2022. Results are expected in early 2024. Analysts at First Berlin Equity Research believe that the positive results of the Phase II data on CardiolRx™ treatment for recurrent pericarditis will be a concise value accretion for the Company and consequently lead to a strong increase in the share price. 4 They conclude coverage on Cardiol Therapeutics with a Buy rating and a price target of EUR 3.30.

Cardiol Therapeutics' shares clearly undervalued

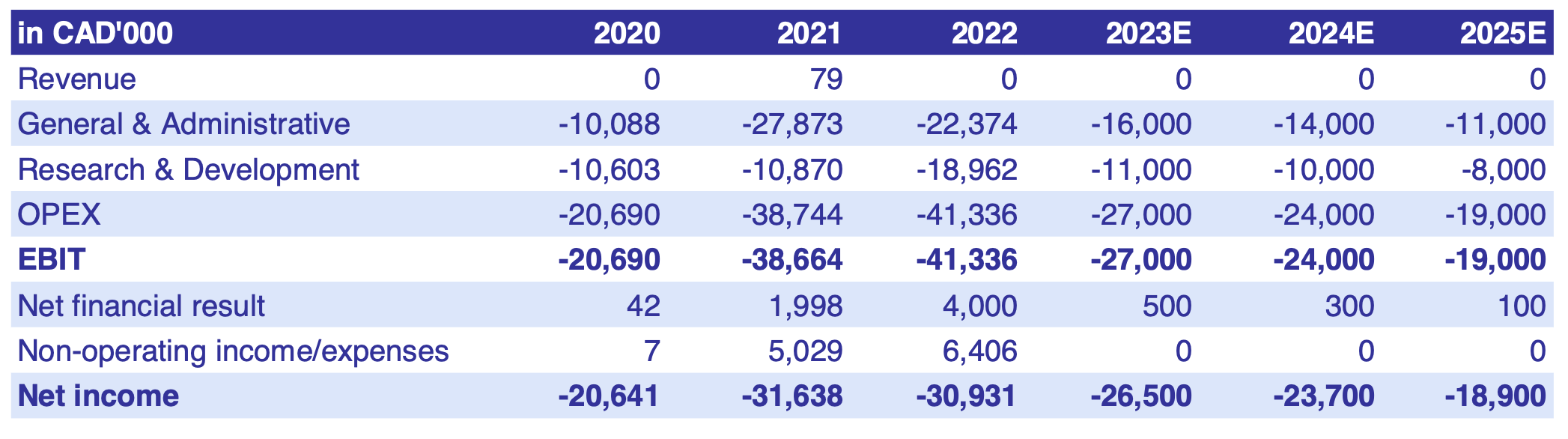

Based on these aspects, the launch as an orphan drug and the associated market exclusivity, Cardiol’s shares appear significantly undervalued. The Company is financially well positioned, with a solid cash position of EUR 33.6 million at Q1 2023, which is expected to last into 2026 thanks to excellent management. The positive sentiment surrounding the expected news on the current Phase II study of CardiolRx™ for recurrent pericarditis reveals the potential of Cardiol's pipeline.

'Sum-of-the-parts' valuation method for biotech

The 'sum-of-the-parts' (SOTP) valuation method is an approach to valuing a company in which the value of each business segment or subsidiary is assessed separately and added to the Company's total value. Biotechnology companies are notoriously difficult to value5 , as the development of the R&D pipeline involves a high degree of risk and makes the forecast of cash flows uncertain.

The SOTP method is suitable for biotech company valuations because it reflects the implied, risk-adjusted value of each drug candidate in the R&D pipeline and takes into account development risks, including clinical and regulatory risks, as well as the market size and expected timing of post-approval cash flows for each project. According to DiMaso et al, "the estimated average out-of-pocket costs per approved new drug are EUR 1,258 million. Capitalizing the out-of-pocket costs up to the time of marketing approval with a real discount rate of 10.5% yields an estimate of total pre-approval costs of EUR 2,308 million."

Interim Conclusion:

Cardiol Therapeutics is an equity candidate for long-term value growth. The global pericarditis market is an attractive niche worth approximately EUR 1.4 billion globally in 2021. It is expected to grow at a compound annual growth rate (CAGR) of 6.2% to reach EUR 2.3 billion by 2029. Growth will be driven by the development and introduction of new therapies, increasing prevalence, and the potential impact of the SARS-CoV-2 virus on prevalence.6

The update is on the initial report of 01/22