The best is good enough

First Hydrogen's management remains committed to its "best of" strategy. The alliance of global leaders with decades of experience in renewable energy, hydrogen and fuel cell technology, whose vision is to become the leading designer and manufacturer of zero-emission, long-range hydrogen-powered vehicles in the UK, EU and North America, continues to cultivate collaborations with global industry leaders. For example, it relied on the technology and expertise of AVL Powertrain and Ballard Power to develop and design its two Generation I commercial vehicles.

a vehicle developed by First Hydrogen can travel far on a single fuel tank filled at 700 bar, taking about five minutes to fill.

The vans, which the MAN eTGE serves as a donor vehicle, are equipped with the latest generation Ballard FCgen LCS fuel cell, which gives the vehicles a range of more than 500 km. AVL Powertrain Limited, in turn, is the world's largest independent automotive engineering, simulation and testing company and was responsible for the concept, architecture and production of the hydrogen-powered fuel cell vehicles.

Through EDAG Group, the world's largest independent service provider to the international mobility industry, another heavyweight also came on board to help First Hydrogen make zero-emission vehicles accessible to fleet managers, thus designing the Generation II vehicles for mass production and the mass market. Initial images have already been released, showing the potential of the modular vehicles offering customization for operational use and can be used for a variety of applications, including express delivery, grocery stores, construction, utilities and emergency services.

The next stage ignited

Approval by the Vehicle Certification Agency, the British vehicle approval authority, paved the way for further commercialization and represents another milestone in the still-young history of the hydrogen innovator. As a result, test drives can now be carried out with customers in real-life use on the road. The interest is huge. Fifteen major fleet operators from various sectors, such as food and express delivery companies, utilities and breakdown services, have already applied as part of the British "Aggregated Hydrogen Freight Consortium" AHFC. This consortium aims to bring together operators of the UK's largest van and truck fleets and key members of the hydrogen industry, including hydrogen producers, hydrogen suppliers and vehicle manufacturers. The Generation I zero-emission light-duty vehicle test program is scheduled to run between 12 and 18 months and is coordinated by AHFC, which is led by Element Energy and involves the global industrial members of UK H2Mobility. The program will allow operators to compare different vehicle technologies in the field.

The launch of the deployment tests will be supported by Rivus, an award-winning fleet management provider. Based in the UK, the Company employs over 1,300 people across 78 workshops. As a workshop partner to 500 customers, including some of the country's largest and most important fleets, Rivus manages over 120,000 light commercial vehicles and trucks annually.

Commercial vehicles First Hydrogen aims to deliver between 2025 and 2026.

The first test phase will run for one month and will take place in the Birmingham and Sheffield regions, where hydrogen infrastructure is also available. To test driving performance under different conditions, Rivus plans to operate First Hydrogen's vehicle on pre-planned routes. Meanwhile, telematics and onboard instruments will collect data on vehicle performance, efficiency and fuel consumption. These results will then be fed into First Hydrogen's overall vehicle evaluation and performance tracking program, which aims to support vehicle optimization and determine the total cost of ownership. Once testing is complete, Rivus will produce its own report analyzing the performance of the hydrogen-powered LCVs. This report will be made available to fleet managers and customers to provide insights into the benefits and practicality of adopting hydrogen-powered mobility solutions.

Closed value chain as the goal

In addition to the goal of bringing zero-emission commercial vehicles into volume production to sell between 10,000 and 20,000 units in 2025/2026, First Hydrogen's plans go much further. For example, the business plan is based on generating revenue from monetizing the vehicle lifecycle. This is to be achieved by establishing a closed value chain to earn multiple times with the "Hydrogen-as-a-Service model". In order to solve the still current problem of the lack of infrastructure with far too few filling stations, an agreement was already signed last year with FEV Consulting GmbH from Aachen, according to which the partners will design and build a prototype for a customized hydrogen filling station for the hydrogen mobility market. First Hydrogen's goal is to sell hydrogen-related technology to its customers in the future, accelerating the adoption of hydrogen as the primary fuel for the light to heavy mobility sector.

It also plans to produce and sell green hydrogen in-house in North America, Europe and the United Kingdom. For the latter alone, the Canadian company plans to have up to four sites, each of which will have a refueling station for commercial vehicles and passenger cars. Initial production capacity estimates for the four sites range from 80 MW to 160 MW.

Significant premiums in peer group comparison

There is no question that the future belongs to hydrogen fuel cell technology, and it is considered a key element in the transportation revolution. Politicians around the globe are subsidizing alternative energies with programs worth billions. In 2022, the US put forward the "Inflation Reduction Act" to the tune of USD 370 billion, on the one hand, to support domestic industry and, on the other, to lure foreign corporations overseas. China also announced support of a similar amount to promote green energy. With the "Green Deal Industrial Plan", the European Union has now followed suit in order to secure Europe as a business location in the long term. First Hydrogen is expected to participate in these programs in several ways, firstly through its established sites in North America, the UK and Europe, and secondly through its various business areas of commercial vehicles, infrastructure and the production and distribution of green hydrogen.

First Hydrogen currently has a market cap of USD 125.45 million, relatively modest compared to its peer group. There is no doubt that companies like Plug Power, with a market capitalization of USD 6.19 billion, have been established for longer, but the fuel cell pioneer is not in the black.

The business model is more comparable to that of heavy hybrid truck maker Nikola. The US-based company also plans a closed-loop value chain and, according to CEO Michael Lohscheller,"is the only company that succeeds in uniting a revolutionary new product, the hydrogen fuel cell truck, and the entire supply chain for the H2 energy infrastructure under one roof."

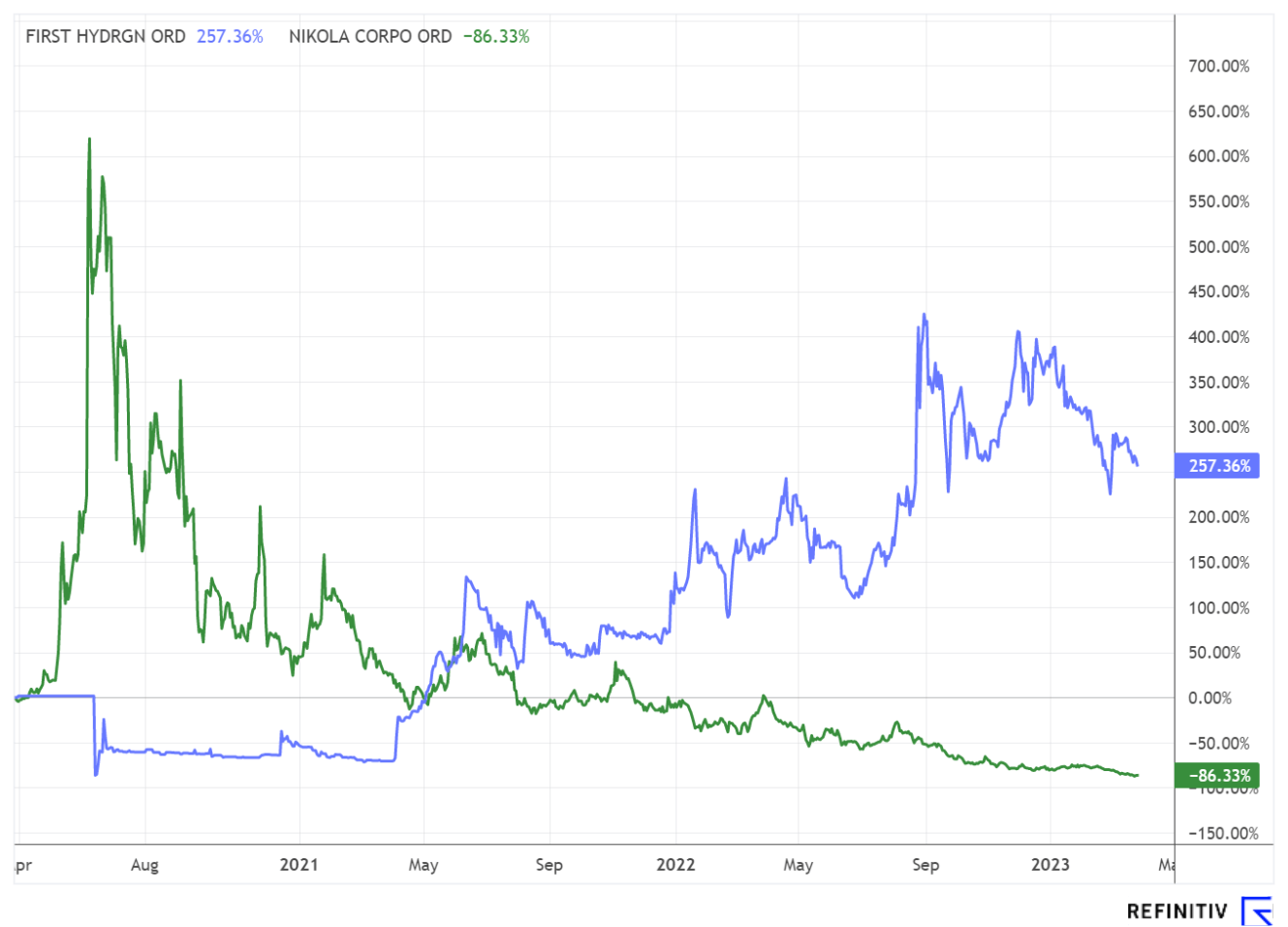

By 2026, the plan calls for at least 60 company-owned hydrogen fueling stations. In addition, Nikola also intends to produce green hydrogen itself and with partners. The Company's 2022 revenue was just USD 6.5 million after delivering only 20 battery-electric trucks, and its loss was minus USD 784.2 million. With a market value of USD 841.65 million, Nikola is thus valued 6.7 times higher than First Hydrogen, despite a sharp correction of around 85%.

Interim conclusion

First Hydrogen achieved another milestone in the Company's history with the commencement of test drives under real-world road conditions. The program, which involves at least 15 major fleet companies, was launched through Rivus, a fleet management provider that serves about 500 partners, including some of the largest fleet operators. In addition, First Hydrogen is working with EDAG Group on the design of Generation II to reach volume production. By building a closed-loop value chain and expanding its businesses to Europe and North America, the Company is expected to benefit from various subsidy programs from policymakers several times over. Compared to the peer group, we believe there is a clear discrepancy in the Company's valuation based on similar business models.

The update is based on the initial report 07/2022